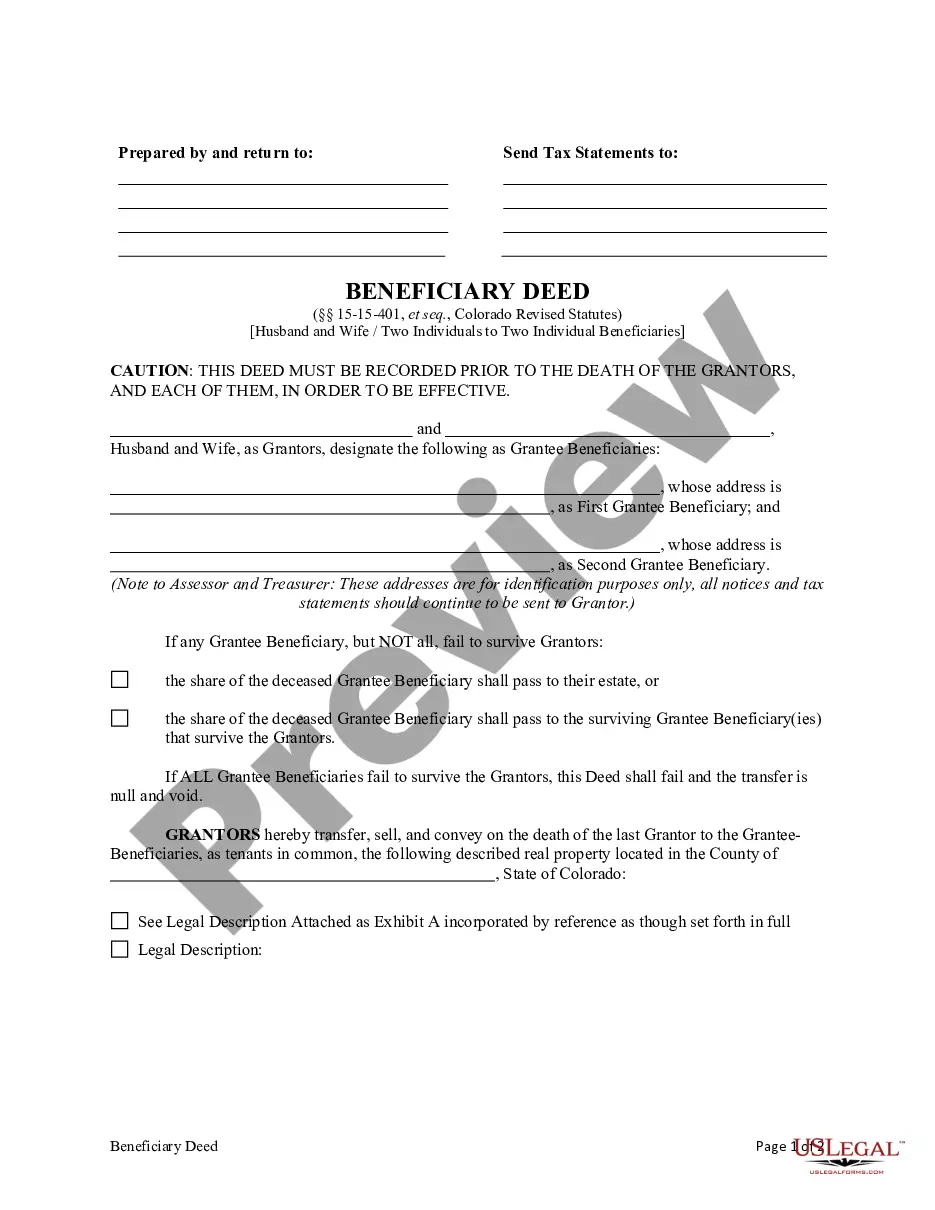

This form is a Beneficiary Deed where the Grantors are two individuals, or husband and wife, and there are two individual Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantors convey and transfer, upon the death of the survivor Grantor, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to either Grantor's death. This deed complies with all state statutory laws.

A Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is a legal document used in estate planning to transfer real estate property to designated beneficiaries after the owner's death. This type of deed allows couples or two individuals to name specific individuals as beneficiaries, without including any successor beneficiaries. This beneficiary deed is a popular option for individuals or couples in Fort Collins, Colorado, who want to ensure a smooth transfer of real estate property, avoiding probate and simplifying the inheritance process. By making use of this deed, the property owner(s) can designate the specific individuals they wish to inherit the property. The Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is a versatile instrument that offers flexibility when it comes to transferring real estate property. It allows the property to be distributed directly to the named beneficiaries, bypassing the need for probate court involvement. While there might not be specific variations of this type of Fort Collins Colorado Beneficiary Deed, it is important to consult with a knowledgeable attorney to ensure the document is drafted accurately and in compliance with Colorado state laws. An attorney can provide guidance on the specific requirements and necessary language to include in the deed, tailoring it to the unique needs and circumstances of the property owner(s). Some relevant keywords related to the Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries could include: estate planning, real estate transfer, inheritance, probate avoidance, beneficiary designation, Fort Collins, Colorado, legal document.A Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is a legal document used in estate planning to transfer real estate property to designated beneficiaries after the owner's death. This type of deed allows couples or two individuals to name specific individuals as beneficiaries, without including any successor beneficiaries. This beneficiary deed is a popular option for individuals or couples in Fort Collins, Colorado, who want to ensure a smooth transfer of real estate property, avoiding probate and simplifying the inheritance process. By making use of this deed, the property owner(s) can designate the specific individuals they wish to inherit the property. The Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is a versatile instrument that offers flexibility when it comes to transferring real estate property. It allows the property to be distributed directly to the named beneficiaries, bypassing the need for probate court involvement. While there might not be specific variations of this type of Fort Collins Colorado Beneficiary Deed, it is important to consult with a knowledgeable attorney to ensure the document is drafted accurately and in compliance with Colorado state laws. An attorney can provide guidance on the specific requirements and necessary language to include in the deed, tailoring it to the unique needs and circumstances of the property owner(s). Some relevant keywords related to the Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries could include: estate planning, real estate transfer, inheritance, probate avoidance, beneficiary designation, Fort Collins, Colorado, legal document.