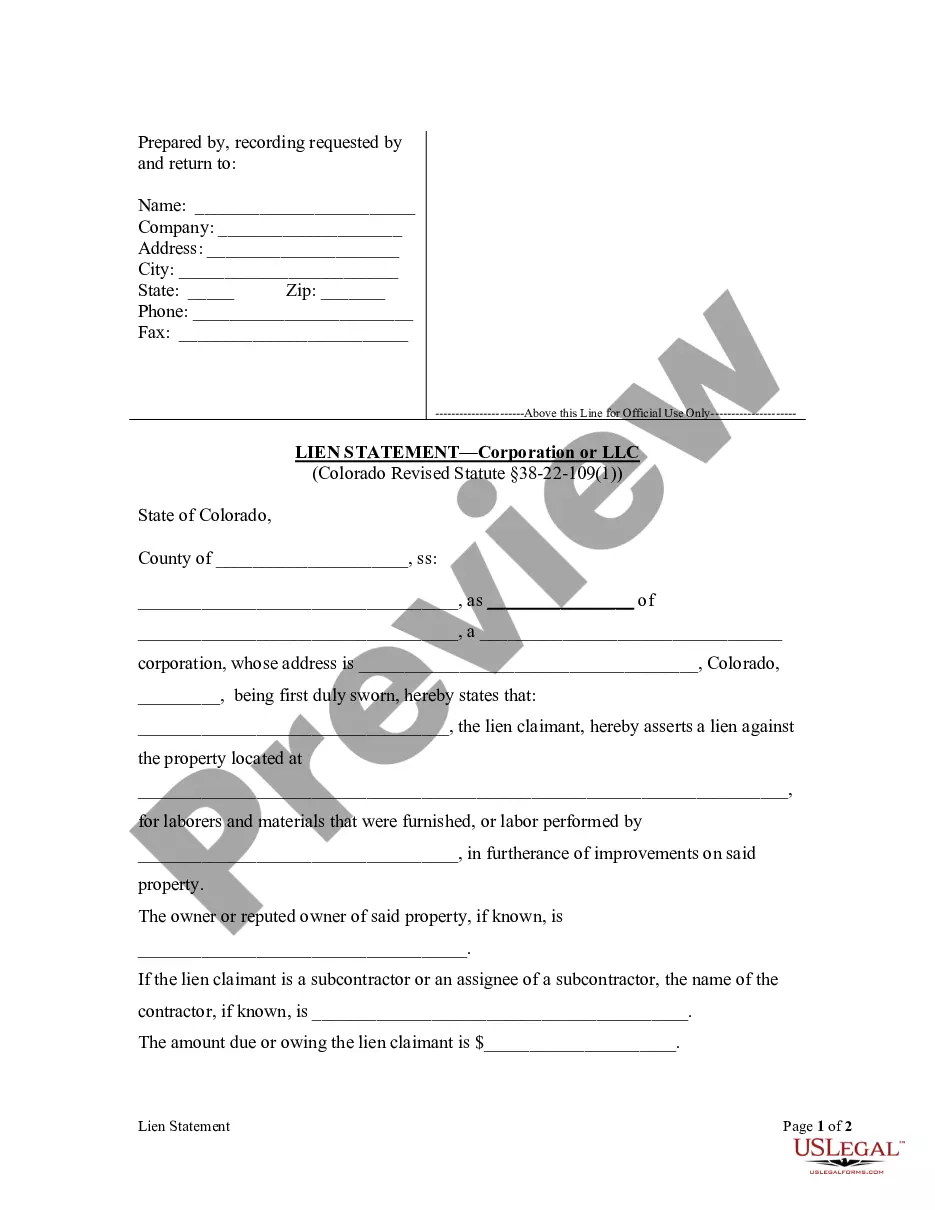

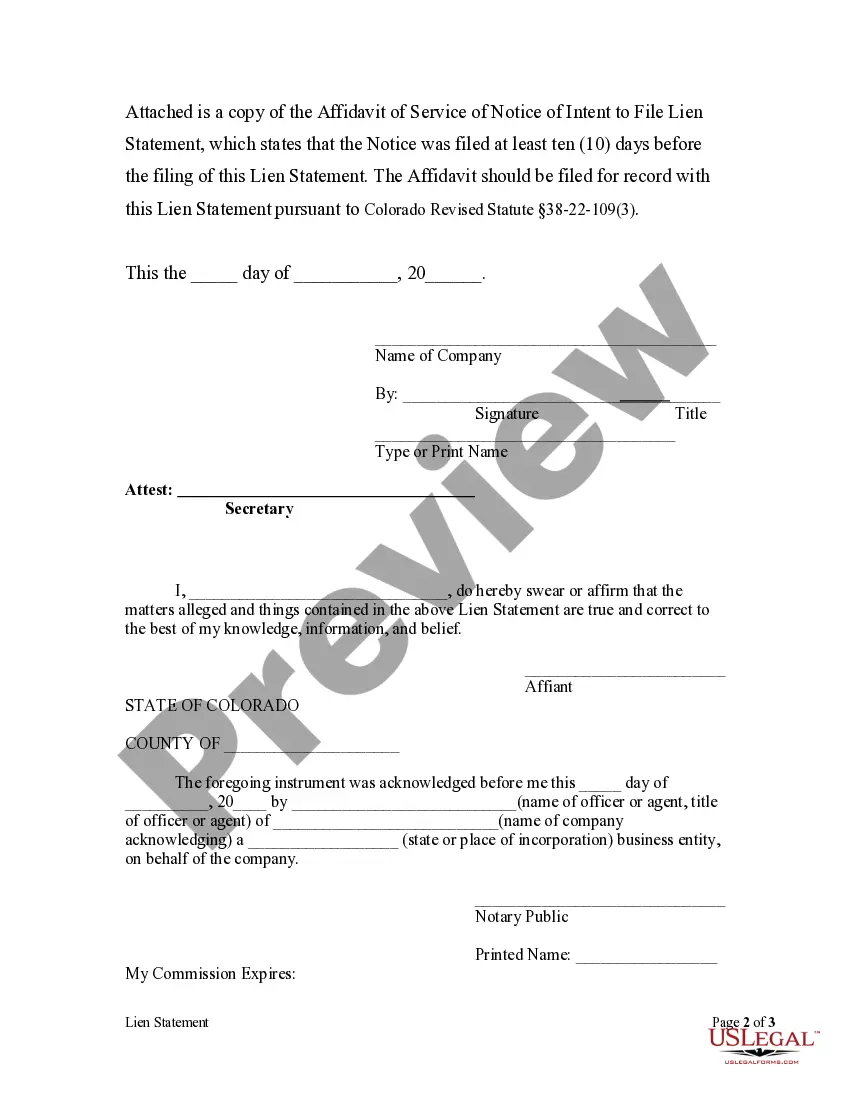

This sworn statement is used by an individual desiring to claim a lien against a piece of property for labor performed or laborers or material furnished. A notice of intent to file a lien must be filed with the county recorder ten days prior to the filing of the lien statement.

Arvada, Colorado Lien Statement by Corporation or LLC is a legal document filed by a corporation or limited liability company (LLC) regarding their claim on a property. This statement is typically used when the corporation or LLC has provided materials, services, or labor to the property and has not received proper compensation. By filing a lien statement, it notifies all parties involved, including property owners, potential buyers, and lenders, that the corporation or LLC has a legal claim against the property. These lien statements, also known as mechanic's liens, serve as a means for corporations and LCS to protect their rights and ensure payment for work done on a property. The statement must be filed with the Arvada County recorder's office, and failure to do so within a specific timeframe and according to the prescribed regulations may result in the loss of lien rights. There are different types of Arvada Colorado Lien Statement by Corporation or LLC, including: 1. Preliminary Lien Statement: This statement is filed before the corporation or LLC begins work on the property. It serves as a notice to the property owner and other potential parties that the corporation or LLC may seek a lien if they do not receive proper payment for their services. 2. Notice of Intent to File Lien: If initial attempts to resolve payment disputes are unsuccessful, a corporation or LLC may choose to send a Notice of Intent to File Lien. This document informs all parties involved that the corporation or LLC intends to file a lien on the property if payment is not received within a specified period. 3. Final Lien Statement: If payment is still not received after sending the Notice of Intent to File Lien, the corporation or LLC can proceed with filing the final lien statement. This statement outlines the amount owed, a detailed description of the services provided, and other relevant information required by Arvada County. By using these different types of Arvada Colorado Lien Statements by Corporation or LLC, these entities can safeguard their interests and ensure proper compensation for the work they have undertaken. It is crucial for corporations and LCS to understand the specific regulations and deadlines associated with filing these statements to protect their rights effectively. In conclusion, Arvada Colorado Lien Statement by Corporation or LLC is a vital legal tool that allows corporations and LCS to assert their right to payment for services rendered on a property. Whether it is a preliminary lien statement, notice of intent to file lien, or final lien statement, these document types help preserve the financial integrity of corporations and LCS operating in Arvada, Colorado.Arvada, Colorado Lien Statement by Corporation or LLC is a legal document filed by a corporation or limited liability company (LLC) regarding their claim on a property. This statement is typically used when the corporation or LLC has provided materials, services, or labor to the property and has not received proper compensation. By filing a lien statement, it notifies all parties involved, including property owners, potential buyers, and lenders, that the corporation or LLC has a legal claim against the property. These lien statements, also known as mechanic's liens, serve as a means for corporations and LCS to protect their rights and ensure payment for work done on a property. The statement must be filed with the Arvada County recorder's office, and failure to do so within a specific timeframe and according to the prescribed regulations may result in the loss of lien rights. There are different types of Arvada Colorado Lien Statement by Corporation or LLC, including: 1. Preliminary Lien Statement: This statement is filed before the corporation or LLC begins work on the property. It serves as a notice to the property owner and other potential parties that the corporation or LLC may seek a lien if they do not receive proper payment for their services. 2. Notice of Intent to File Lien: If initial attempts to resolve payment disputes are unsuccessful, a corporation or LLC may choose to send a Notice of Intent to File Lien. This document informs all parties involved that the corporation or LLC intends to file a lien on the property if payment is not received within a specified period. 3. Final Lien Statement: If payment is still not received after sending the Notice of Intent to File Lien, the corporation or LLC can proceed with filing the final lien statement. This statement outlines the amount owed, a detailed description of the services provided, and other relevant information required by Arvada County. By using these different types of Arvada Colorado Lien Statements by Corporation or LLC, these entities can safeguard their interests and ensure proper compensation for the work they have undertaken. It is crucial for corporations and LCS to understand the specific regulations and deadlines associated with filing these statements to protect their rights effectively. In conclusion, Arvada Colorado Lien Statement by Corporation or LLC is a vital legal tool that allows corporations and LCS to assert their right to payment for services rendered on a property. Whether it is a preliminary lien statement, notice of intent to file lien, or final lien statement, these document types help preserve the financial integrity of corporations and LCS operating in Arvada, Colorado.