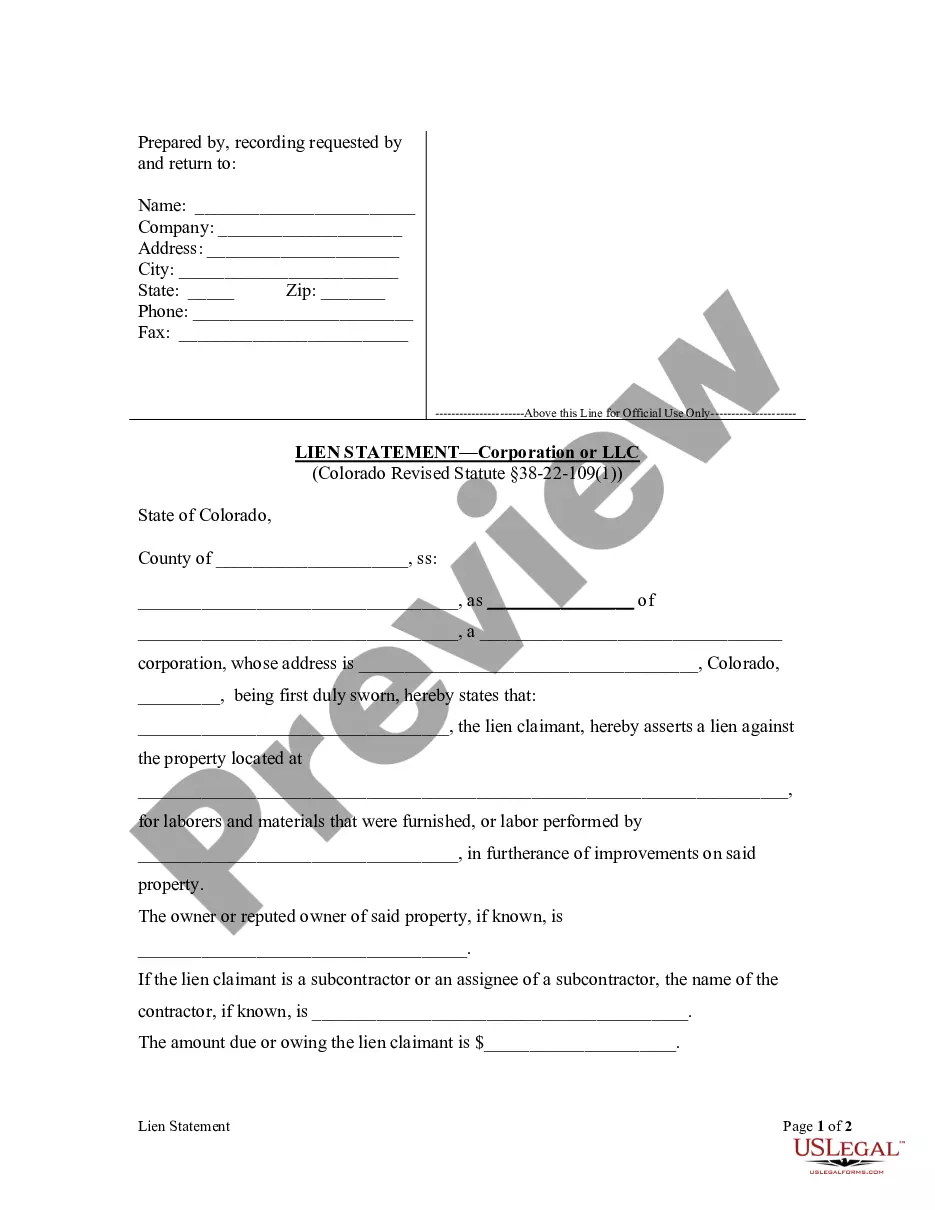

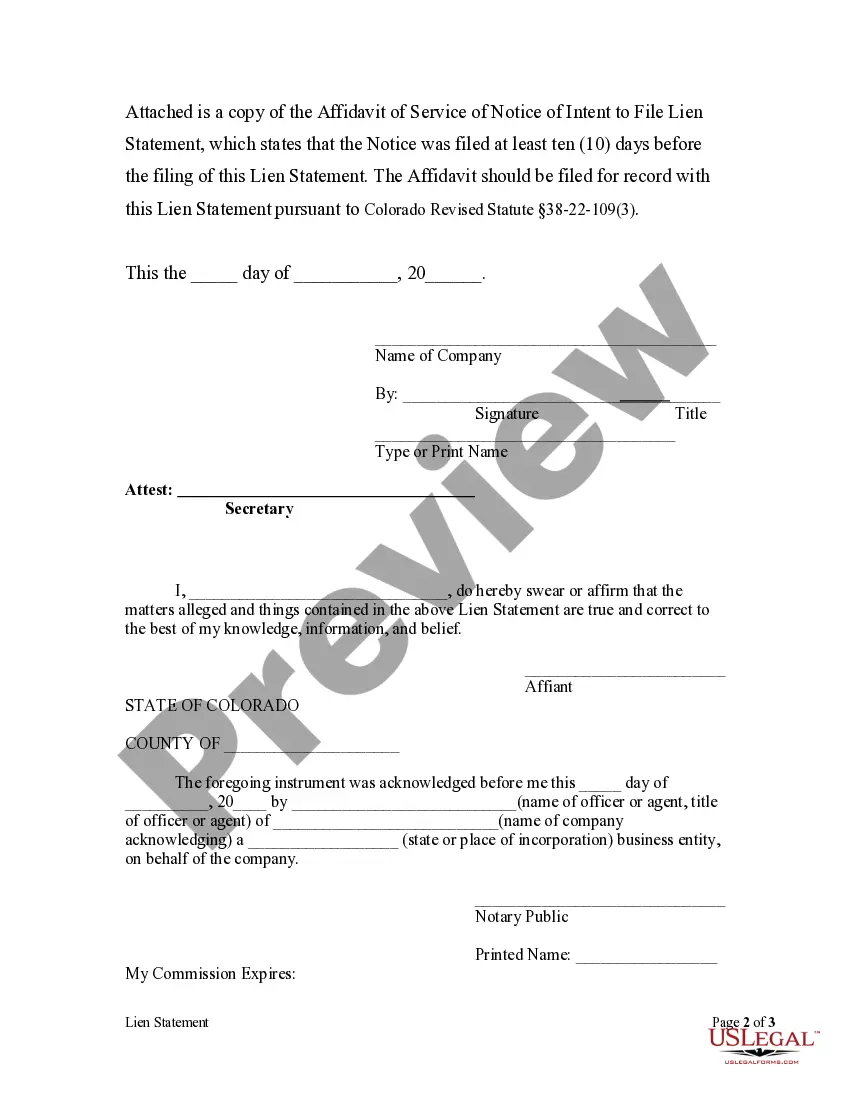

This sworn statement is used by an individual desiring to claim a lien against a piece of property for labor performed or laborers or material furnished. A notice of intent to file a lien must be filed with the county recorder ten days prior to the filing of the lien statement.

Centennial Colorado Lien Statement by Corporation

Description

How to fill out Colorado Lien Statement By Corporation?

Regardless of one's social or occupational position, completing legal documents is an unfortunate requirement in modern society.

Often, it's nearly unfeasible for individuals lacking a legal foundation to create such documents from the ground up, primarily due to the intricate language and legal subtleties they encompass.

This is where US Legal Forms steps in to assist.

Ensure that the template selected is tailored to your area since the laws of one state or county do not apply to another.

Review the document and examine a brief overview (if available) of the instances the form can be utilized for.

- Our service offers an extensive assortment of over 85,000 ready-to-use state-specific templates suitable for nearly any legal circumstance.

- US Legal Forms is also an excellent tool for associates or legal advisors aiming to enhance their time management through our DIY forms.

- Whether you're seeking the Centennial Colorado Lien Statement by Corporation or LLC or any other document acknowledged in your state or county, with US Legal Forms, everything is accessible.

- Here’s how you can quickly acquire the Centennial Colorado Lien Statement by Corporation or LLC utilizing our reliable service.

- If you are currently a subscriber, feel free to Log In to your account to obtain the correct form.

- However, if you are new to our platform, please follow these steps before obtaining the Centennial Colorado Lien Statement by Corporation or LLC.

Form popularity

FAQ

To appeal your property tax assessment in Arapahoe County, you will need to submit a formal appeal to the Assessor's Office, clearly outlining your reasons for the appeal. Ensure you include all necessary documentation to support your claim. If your appeal involves aspects related to the 'Centennial Colorado Lien Statement by Corporation,' presenting thorough evidence can significantly aid your case.

To search for liens in Colorado, you can visit the state’s official online databases or local county clerk's offices. Resources like the Arapahoe County Assessor’s website provide access to public records, which include lien information. Utilizing these tools can be especially helpful when dealing with the 'Centennial Colorado Lien Statement by Corporation' to verify any outstanding claims.

You can send an email to the Arapahoe County Clerk by visiting their official website and finding the appropriate email address. When drafting your email, be sure to clearly state your purpose, especially if it pertains to the 'Centennial Colorado Lien Statement by Corporation.' Providing relevant information will help ensure a prompt response.

To file a complaint with Arapahoe County, visit the county's website to locate the appropriate department and their contact information. You may need to submit forms detailing your issue and supporting documentation. When addressing matters like the 'Centennial Colorado Lien Statement by Corporation,' clear communication and proper documentation are vital to ensure the resolution of your complaint.

In Colorado, a lien serves as a legal claim against a property, often due to unpaid debts. When a corporation files a lien, it typically guarantees they retain a right to the property until the debt is settled. Understanding this process can be crucial when handling the 'Centennial Colorado Lien Statement by Corporation,' ensuring both compliance and protection of your rights.

You can reach out to the Arapahoe County jury department by using the email address found on their official website. When emailing them, mention the specifics of your situation or questions regarding the 'Centennial Colorado Lien Statement by Corporation' to help them assist you better. Ensure your email includes all essential details to avoid any delays.

To email Arapahoe County records, you can contact the Records Division at their official email address listed on the county website. Typically, providing a clear subject line, such as 'Centennial Colorado Lien Statement by Corporation,' helps ensure your query is directed appropriately. Always include specific details in your message to receive a quicker and more accurate response.

Yes, you can file a lien on your own, but it's important to understand the process thoroughly. Filing a Centennial Colorado Lien Statement by Corporation involves specific steps and documents that must be correctly completed. While many individuals choose to navigate this process independently, using a platform like USLegalForms can offer additional support and streamline the documentation process. This way, you can reduce the chance of errors and ensure your lien is valid and enforceable.

In Oklahoma, a lien generally lasts for five years from the date it is filed. However, it's important to note that this duration can be extended if necessary legal actions are taken. For corporations looking to file a Centennial Colorado Lien Statement, understanding the lifespan of liens in different states can provide valuable context. Resources available on USLegalForms ensure you are well-informed about these timelines and can effectively manage your lien statements.

In Colorado, the notice extending the time to file a lien statement allows a corporation to extend their filing deadline. This is especially useful if you need additional time to gather the necessary documents or information. To ensure compliance with the Centennial Colorado Lien Statement by Corporation, it's crucial to understand how this notice works. Utilizing platforms like USLegalForms can help simplify the process and provide guidance on the necessary steps.