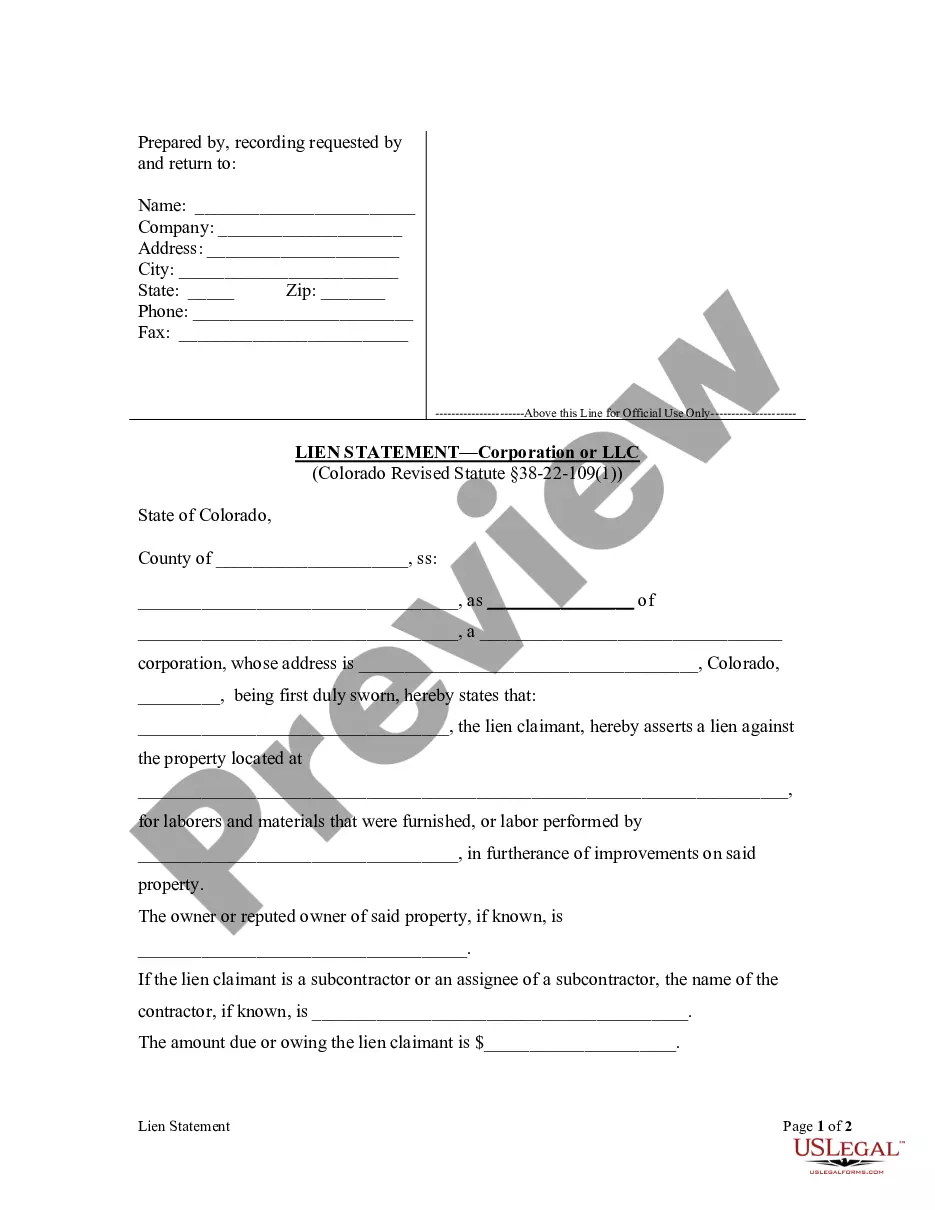

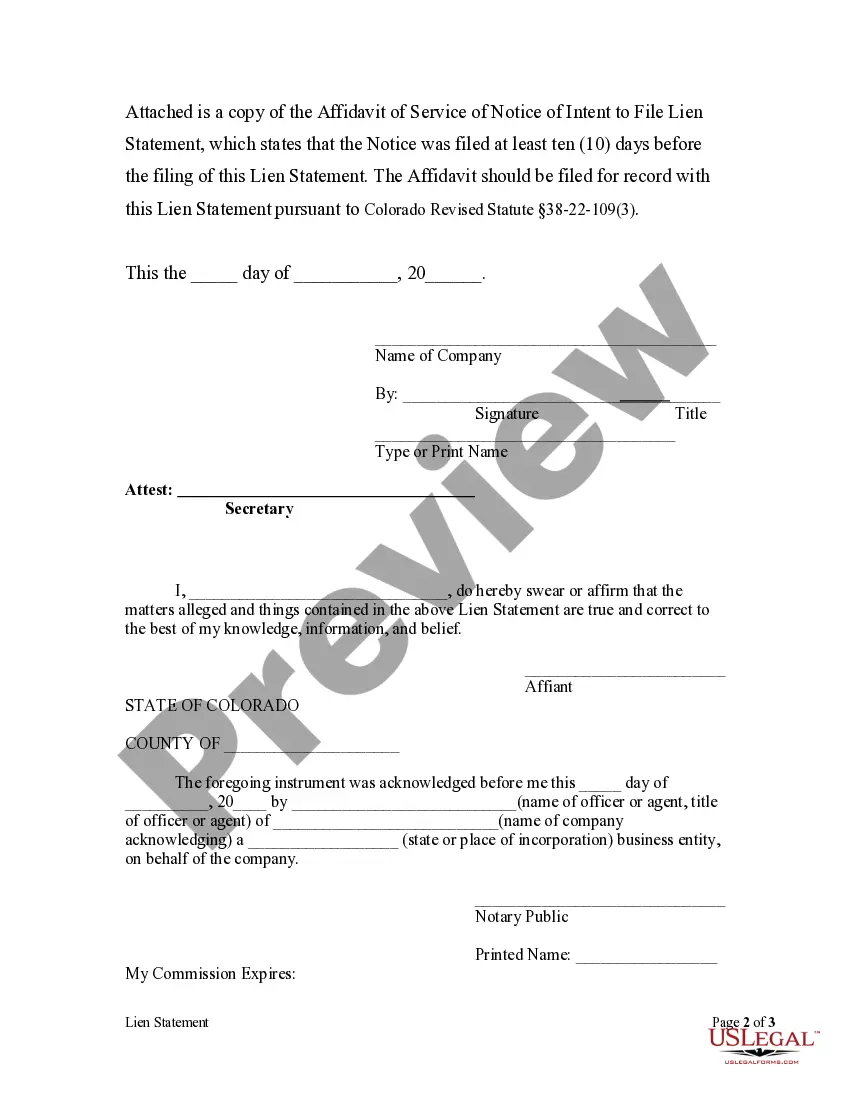

This sworn statement is used by an individual desiring to claim a lien against a piece of property for labor performed or laborers or material furnished. A notice of intent to file a lien must be filed with the county recorder ten days prior to the filing of the lien statement.

Fort Collins Colorado Lien Statement by Corporation

Description

How to fill out Colorado Lien Statement By Corporation?

Do you require a reliable and cost-effective legal forms provider to obtain the Fort Collins Colorado Lien Statement by Corporation or LLC? US Legal Forms is your ideal choice.

Whether you need a straightforward contract to establish guidelines for living with your partner or a collection of documents to advance your divorce case in the court, we've got you covered. Our platform offers over 85,000 current legal document templates for individual and business purposes. All templates that we provide access to are not generic and are structured based on the specific requirements of different states and counties.

To download the document, you must Log In to your account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents section.

Is this your first visit to our website? No need to worry. You can create an account with ease, but before that, ensure you do the following.

Now you can establish your account. Then select the subscription plan and complete the payment. Once the payment is finalized, download the Fort Collins Colorado Lien Statement by Corporation or LLC in any of the offered formats. You can return to the website anytime and redownload the document without any cost.

Acquiring current legal documents has never been simpler. Try US Legal Forms now, and stop wasting your precious time searching for legal papers online indefinitely.

- Check if the Fort Collins Colorado Lien Statement by Corporation or LLC complies with the regulations of your state and locality.

- Review the form’s description (if available) to determine who the document is meant for.

- Reinitiate the search if the form does not fit your particular needs.

Form popularity

FAQ

Writing a letter of intent for a lien involves clearly stating your intention to file a lien against a property due to unpaid debts. Include critical details, such as the amount owed, the nature of the debt, and any relevant timelines. This letter should be sent to the property owner ahead of the formal lien filing. For templates and advice on creating a compliant Fort Collins Colorado Lien Statement by Corporation, consider uslegalforms.

To place a lien on someone's property in Colorado, you need to file a lien statement with the county recorder’s office where the property is located. Ensure that you carefully adhere to local laws and include accurate information regarding the debt. It is essential to follow all required procedures to enforce this claim legally. For expert assistance with the Fort Collins Colorado Lien Statement by Corporation, uslegalforms can guide you through the process.

Filing a lien with intent in Colorado requires you to complete an intent to lien form and notify the property owner of your intentions. The form must include details such as the amount owed and a description of the services or materials provided. After filing, make sure to adhere to any additional state requirements. To ensure compliance, uslegalforms offers templates for the Fort Collins Colorado Lien Statement by Corporation.

To file a lien against a corporation, you must follow the procedures outlined by your state, which usually involve completing a lien form and submitting it to the appropriate office. Include all necessary details regarding the corporation and the debt owed. It is important to ensure that you provide the correct corporate name and information. Creating a Fort Collins Colorado Lien Statement by Corporation can be simplified using uslegalforms.

Filing an intent to lien in Colorado involves filling out a specific form indicating your intent to claim a lien against a property. You must send this filed intent to the homeowner or property owner. Make sure to follow the state guidelines and timelines to maintain your rights. For accurate documentation, consult uslegalforms to create a proper Fort Collins Colorado Lien Statement by Corporation.

In Colorado, you generally have to file an intent to lien within 90 days after the last date of providing labor or materials. This timeframe is crucial for preserving your rights. If you miss this deadline, you may lose your chance to claim against the property. For guidance specific to the Fort Collins Colorado Lien Statement by Corporation, consider using the services offered by uslegalforms.

To take a lien, you must legally establish a claim against a property due to an unpaid debt. This includes preparing and filing a lien statement that complies with state laws. Using the Fort Collins Colorado Lien Statement by Corporation feature on our platform can help simplify and expedite the process, ensuring your rights are protected.

Placing a lien on a Colorado title involves filing a lien statement with the appropriate county office and providing specific information about the debt and the property. This process ensures that your interest in the title is legally acknowledged and protected. For assistance with your Fort Collins Colorado Lien Statement by Corporation, our tools can guide you through each step.

To file a lien in Larimer County, Colorado, you need to properly prepare your lien statement, including necessary details about the debt and property. Once completed, file the statement with the Larimer County Clerk and Recorder’s office. Our platform facilitates the creation and submission of a Fort Collins Colorado Lien Statement by Corporation, streamlining this process for you.

In Colorado, the timeframe to file a lien generally spans from four to six months after the last labor or materials are provided, depending on the type of project. Timeliness is crucial, so understanding these timelines can prevent claims from being denied. Our Fort Collins Colorado Lien Statement by Corporation option can assist you in navigating these deadlines more efficiently.