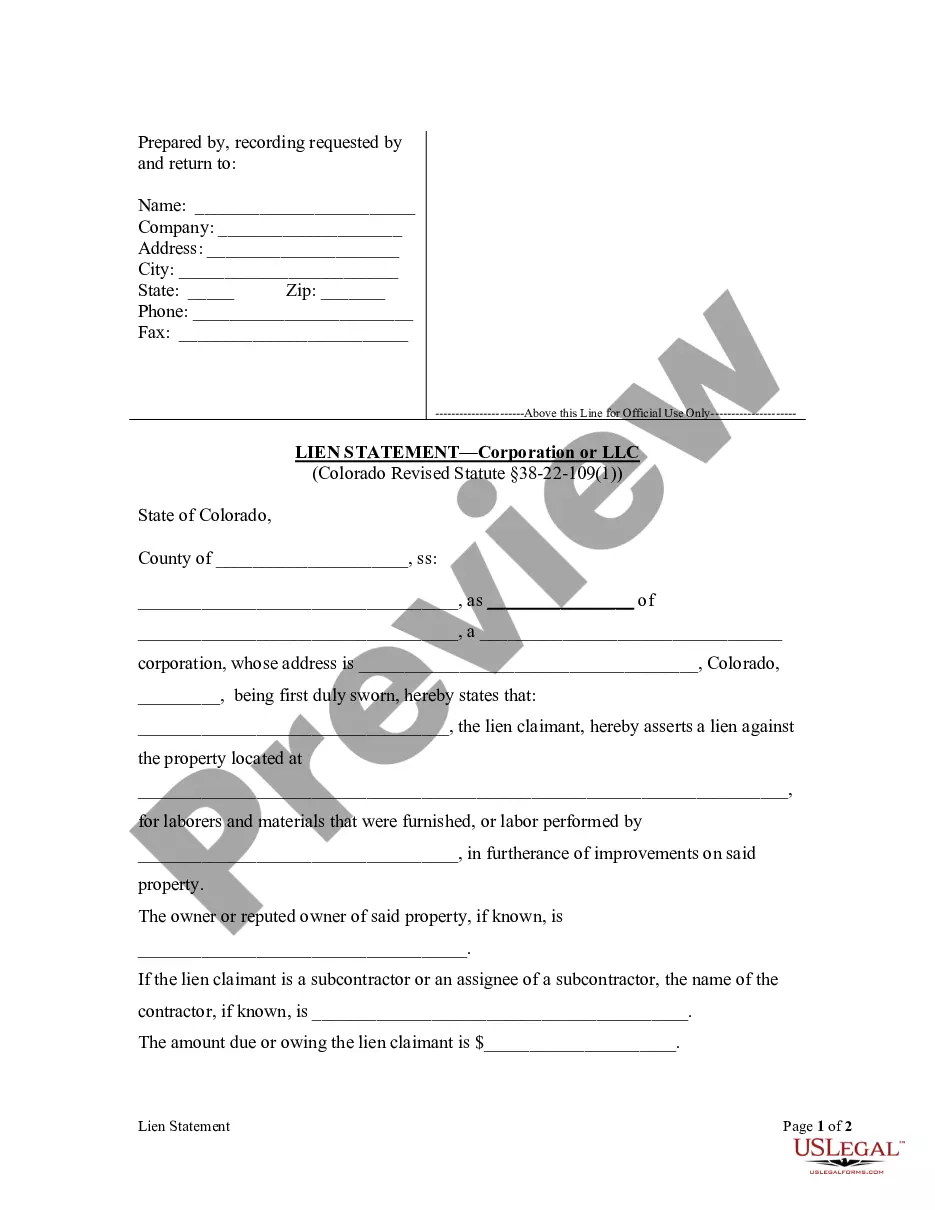

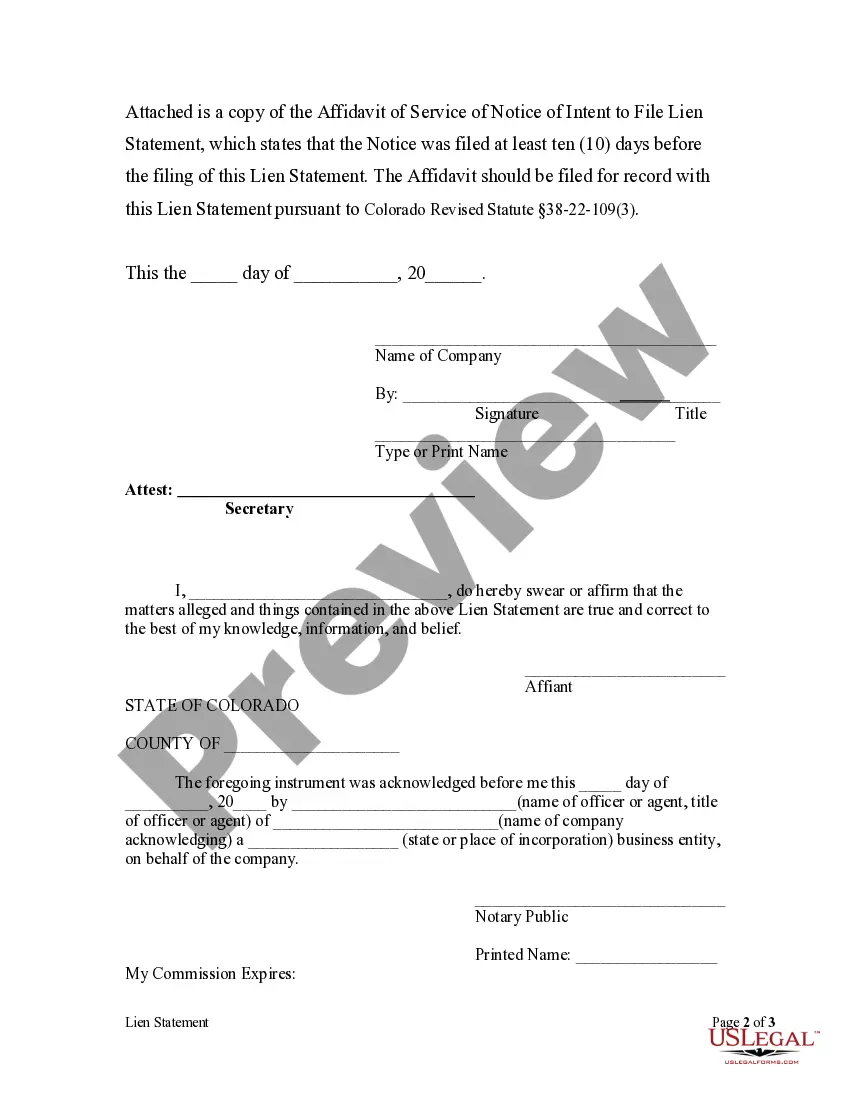

This sworn statement is used by an individual desiring to claim a lien against a piece of property for labor performed or laborers or material furnished. A notice of intent to file a lien must be filed with the county recorder ten days prior to the filing of the lien statement.

Westminster Colorado Lien Statement by Corporation or LLC is a legal document that provides a detailed description of the lien placed on a property by a corporation or Limited Liability Company (LLC) in Westminster, Colorado. Liens are typically placed on properties to secure an outstanding debt or unpaid services or materials provided to the property owner. The Westminster Colorado Lien Statement by Corporation or LLC contains important information such as the name and contact details of the corporation or LLC placing the lien, the name of the property owner, the property's legal description, and the date when the lien was filed. This document serves as an official notification to all parties involved, including lenders, potential buyers, and contractors, that a lien has been imposed on the property. There are several types of liens that can be filed by a corporation or LLC in Westminster, Colorado: 1. Construction Lien: This type of lien is commonly filed by contractors, subcontractors, or suppliers who have not been paid for work done or materials provided on a construction project. It allows them to claim a portion of the property's value to satisfy the unpaid debt. 2. Mechanic's Lien: Similar to a construction lien, a mechanic's lien is filed by individuals or businesses who have provided labor, services, or materials for the improvement, repair, or maintenance of a property but haven't received payment. 3. Judgment Lien: This type of lien is typically filed by a corporation or LLC after winning a lawsuit against the property owner. It allows the creditor to claim a portion of the property's value as compensation for the debt owed. 4. Tax Lien: A corporation or LLC can also file a tax lien on a property if the owner has failed to pay their property taxes. This allows the local or state government to collect the unpaid taxes by selling the property. It is important for property owners, potential buyers, lenders, and contractors to be aware of the presence of a lien on a property. Before purchasing or financing a property, it is advisable to conduct a thorough title search to identify any existing liens. Likewise, contractors should verify if there are any existing liens before entering into agreements with property owners to avoid potential disputes. In summary, Westminster Colorado Lien Statement by Corporation or LLC is a crucial legal document that discloses the imposition of a lien on a property by a corporation or LLC. It outlines essential details, including the lien holder's information, property description, and filing date. Understanding the different types of liens, such as construction, mechanic's, judgment, and tax liens, is vital for all parties involved in property transactions in Westminster, Colorado.Westminster Colorado Lien Statement by Corporation or LLC is a legal document that provides a detailed description of the lien placed on a property by a corporation or Limited Liability Company (LLC) in Westminster, Colorado. Liens are typically placed on properties to secure an outstanding debt or unpaid services or materials provided to the property owner. The Westminster Colorado Lien Statement by Corporation or LLC contains important information such as the name and contact details of the corporation or LLC placing the lien, the name of the property owner, the property's legal description, and the date when the lien was filed. This document serves as an official notification to all parties involved, including lenders, potential buyers, and contractors, that a lien has been imposed on the property. There are several types of liens that can be filed by a corporation or LLC in Westminster, Colorado: 1. Construction Lien: This type of lien is commonly filed by contractors, subcontractors, or suppliers who have not been paid for work done or materials provided on a construction project. It allows them to claim a portion of the property's value to satisfy the unpaid debt. 2. Mechanic's Lien: Similar to a construction lien, a mechanic's lien is filed by individuals or businesses who have provided labor, services, or materials for the improvement, repair, or maintenance of a property but haven't received payment. 3. Judgment Lien: This type of lien is typically filed by a corporation or LLC after winning a lawsuit against the property owner. It allows the creditor to claim a portion of the property's value as compensation for the debt owed. 4. Tax Lien: A corporation or LLC can also file a tax lien on a property if the owner has failed to pay their property taxes. This allows the local or state government to collect the unpaid taxes by selling the property. It is important for property owners, potential buyers, lenders, and contractors to be aware of the presence of a lien on a property. Before purchasing or financing a property, it is advisable to conduct a thorough title search to identify any existing liens. Likewise, contractors should verify if there are any existing liens before entering into agreements with property owners to avoid potential disputes. In summary, Westminster Colorado Lien Statement by Corporation or LLC is a crucial legal document that discloses the imposition of a lien on a property by a corporation or LLC. It outlines essential details, including the lien holder's information, property description, and filing date. Understanding the different types of liens, such as construction, mechanic's, judgment, and tax liens, is vital for all parties involved in property transactions in Westminster, Colorado.