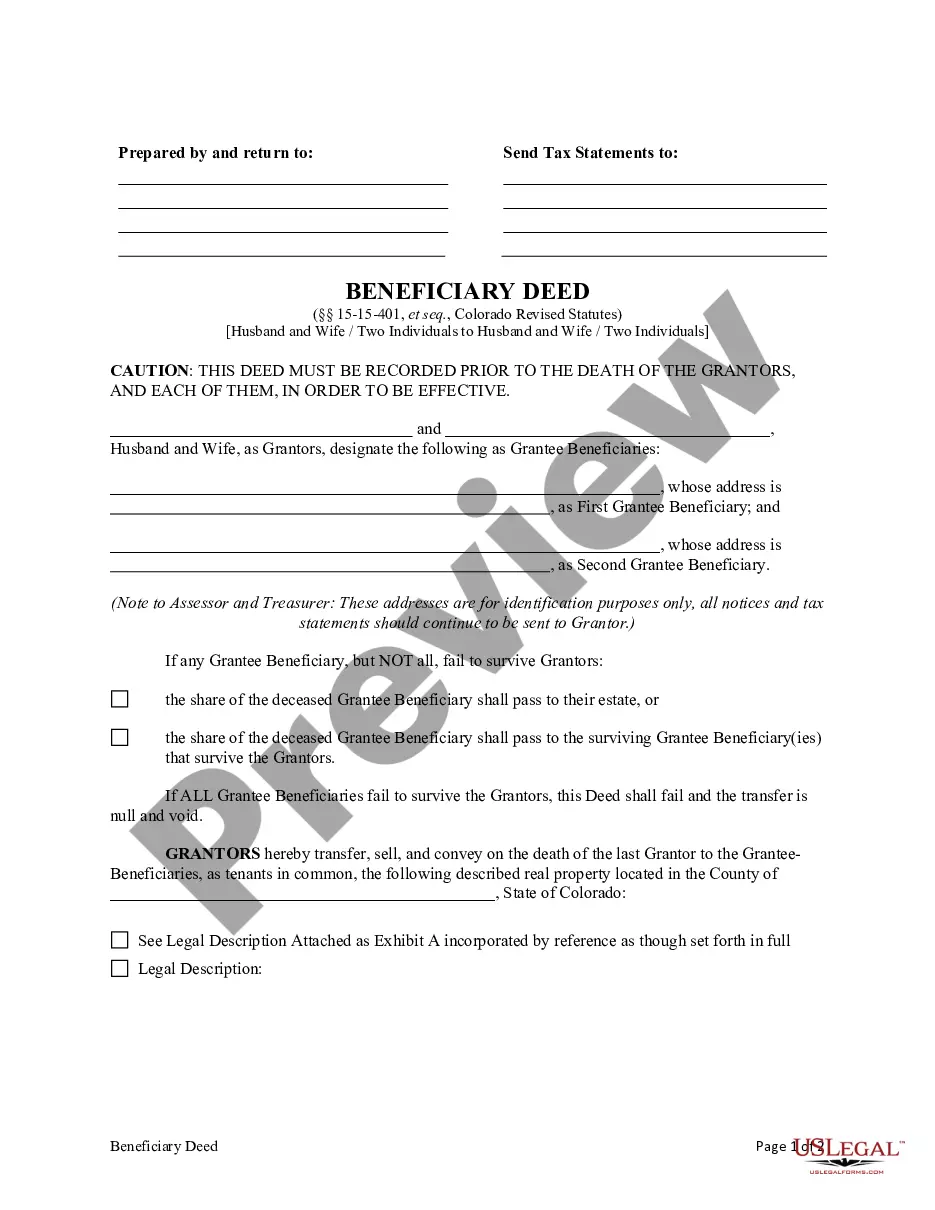

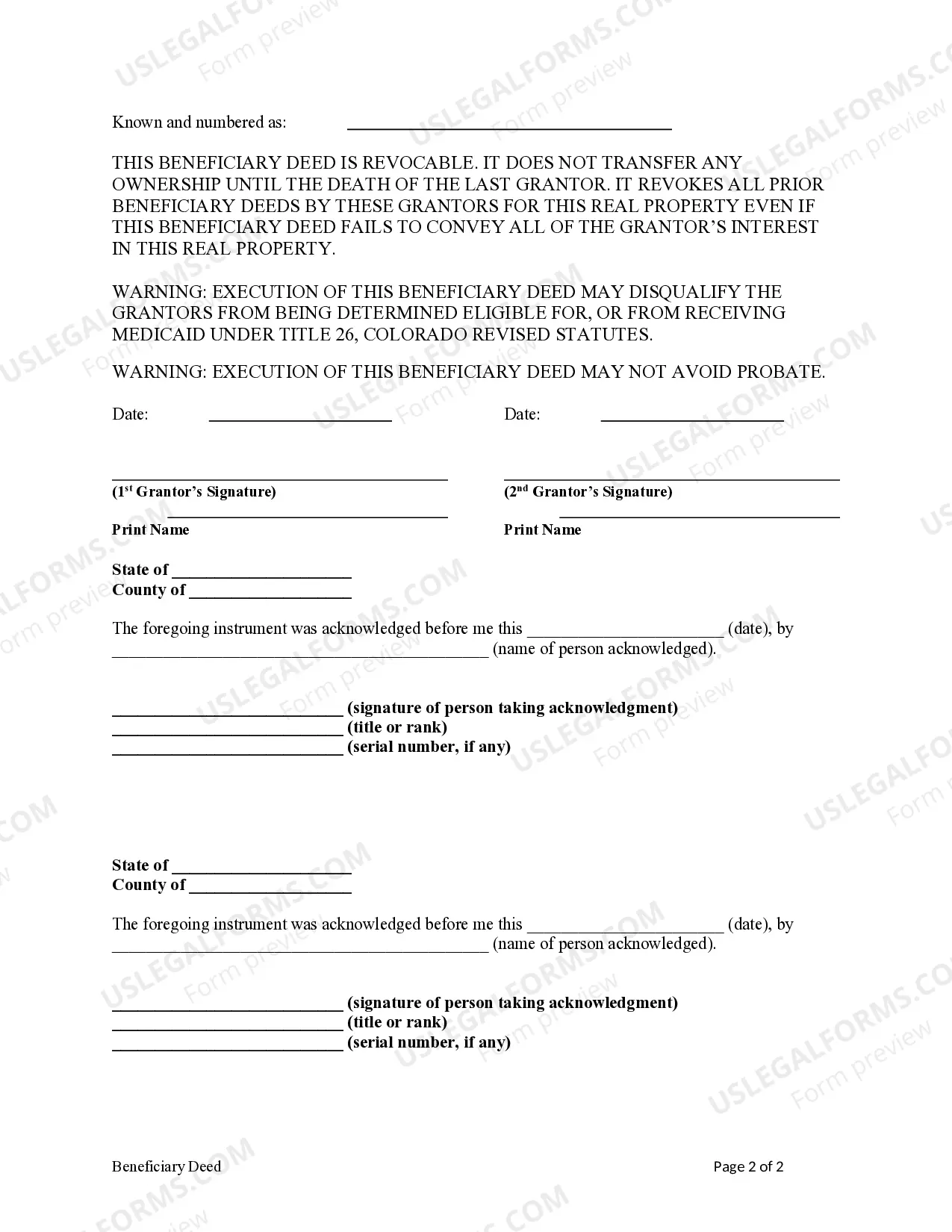

This form is a Beneficiary or Transfer on Death Deed from two individual or husband and wife as Owner Grantors to two individuals or husband and wife as Grantee Beneficiaries. Grantors convey and transfer, upon the death of the last surviving Grantor, to the Grantee Beneficiaries. This Deed is not effective unless recorded prior to the death of either Grantor. This deed complies with all state laws. A Centennial Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife is a legal document that allows property owners to transfer their property to designated beneficiaries upon their death, without the need for probate court involvement. This type of deed is commonly used by married couples who want to ensure a smooth transfer of property ownership between themselves and their chosen beneficiaries. There are different types of Centennial Colorado Beneficiary or Transfer on Death Deeds that can be used depending on the specific circumstances and preferences of the individuals involved: 1. Joint Tenancy with Right of Survivorship: This is a common form of ownership for married couples, where both spouses have equal ownership rights. If one spouse passes away, the surviving spouse automatically inherits the deceased spouse's share of the property, without the need for a transfer on death deed. 2. Tenancy in Common: In this type of ownership, each spouse individually owns a specified percentage or share of the property. Upon the death of one spouse, their share can pass to their designated beneficiaries through a Centennial Colorado Beneficiary or Transfer on Death Deed. 3. Revocable Transfer on Death Deed: This type of deed allows property owners to name specific beneficiaries who will inherit the property after their death. The deed can be revoked or changed during the owner's lifetime if circumstances or preferences change. It is important to consult with an experienced attorney to properly draft and execute a Centennial Colorado Beneficiary or Transfer on Death Deed, ensuring all legal requirements and considerations are met. Additionally, it is crucial to understand the specific laws and regulations governing these types of deeds in Colorado, as they may vary from state to state. Using a Centennial Colorado Beneficiary or Transfer on Death Deed can provide peace of mind for married couples, as it allows for the seamless transfer of property ownership without the complexities and delays often associated with probate proceedings. By clearly stating their intentions and designating beneficiaries, couples can ensure their property is passed on to their loved ones according to their wishes.

A Centennial Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife is a legal document that allows property owners to transfer their property to designated beneficiaries upon their death, without the need for probate court involvement. This type of deed is commonly used by married couples who want to ensure a smooth transfer of property ownership between themselves and their chosen beneficiaries. There are different types of Centennial Colorado Beneficiary or Transfer on Death Deeds that can be used depending on the specific circumstances and preferences of the individuals involved: 1. Joint Tenancy with Right of Survivorship: This is a common form of ownership for married couples, where both spouses have equal ownership rights. If one spouse passes away, the surviving spouse automatically inherits the deceased spouse's share of the property, without the need for a transfer on death deed. 2. Tenancy in Common: In this type of ownership, each spouse individually owns a specified percentage or share of the property. Upon the death of one spouse, their share can pass to their designated beneficiaries through a Centennial Colorado Beneficiary or Transfer on Death Deed. 3. Revocable Transfer on Death Deed: This type of deed allows property owners to name specific beneficiaries who will inherit the property after their death. The deed can be revoked or changed during the owner's lifetime if circumstances or preferences change. It is important to consult with an experienced attorney to properly draft and execute a Centennial Colorado Beneficiary or Transfer on Death Deed, ensuring all legal requirements and considerations are met. Additionally, it is crucial to understand the specific laws and regulations governing these types of deeds in Colorado, as they may vary from state to state. Using a Centennial Colorado Beneficiary or Transfer on Death Deed can provide peace of mind for married couples, as it allows for the seamless transfer of property ownership without the complexities and delays often associated with probate proceedings. By clearly stating their intentions and designating beneficiaries, couples can ensure their property is passed on to their loved ones according to their wishes.