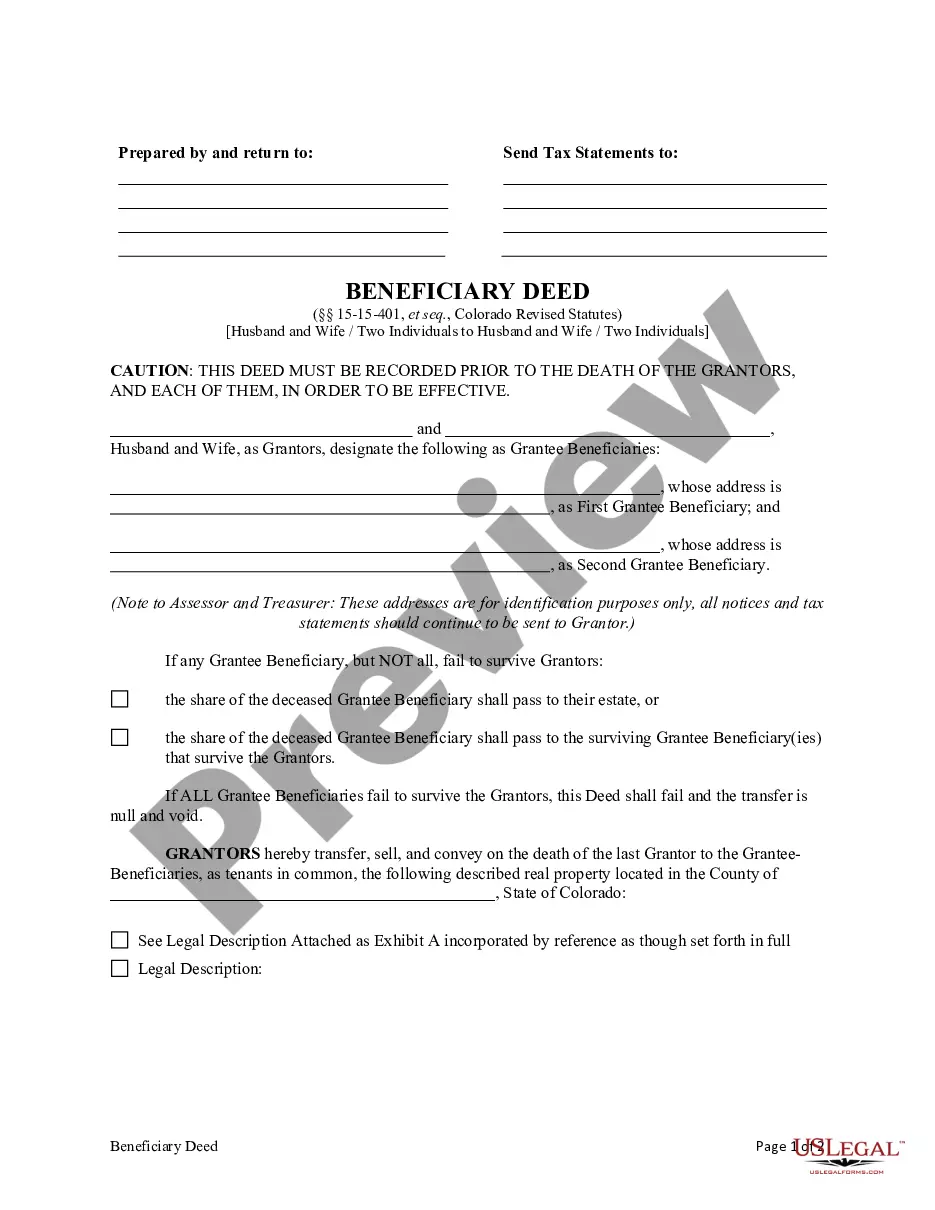

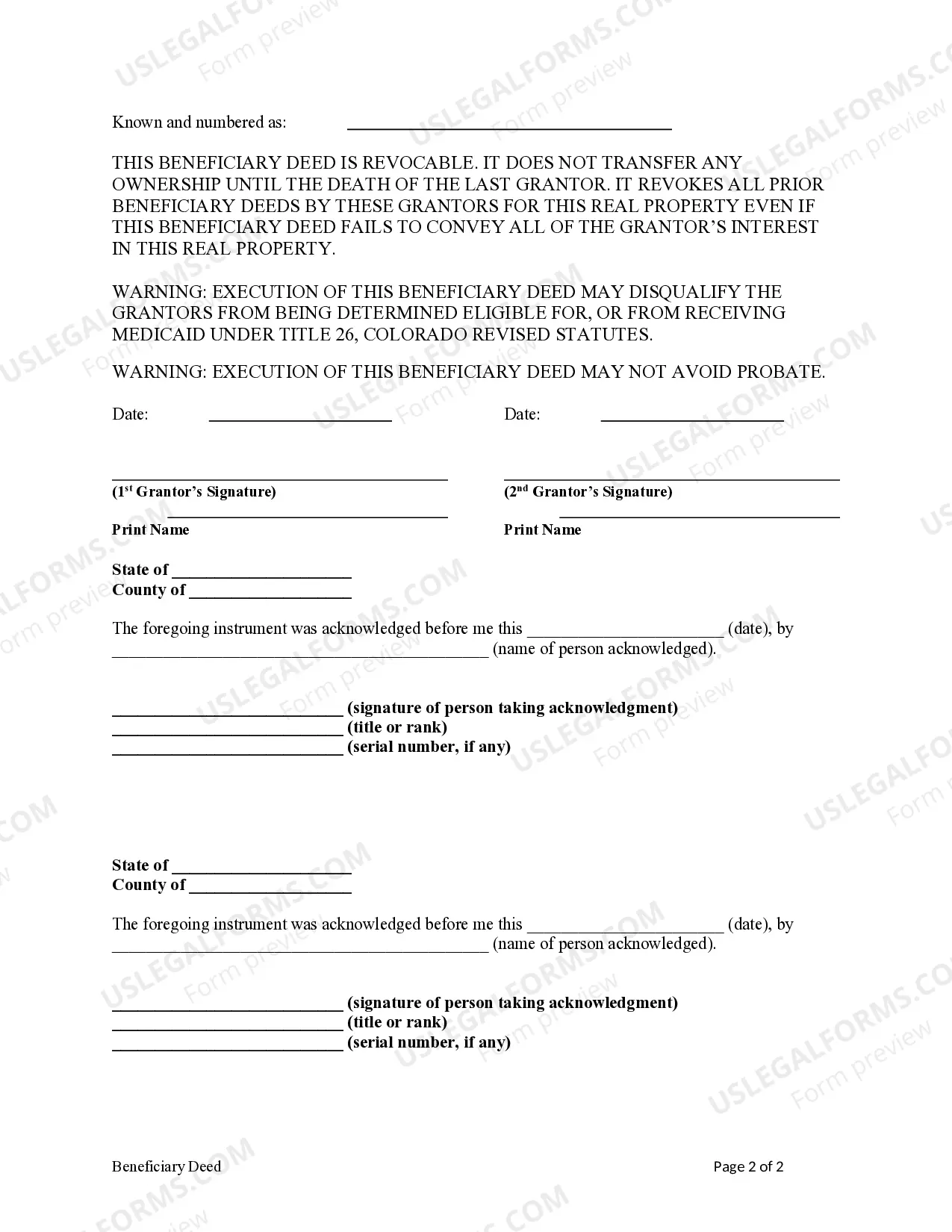

This form is a Beneficiary or Transfer on Death Deed from two individual or husband and wife as Owner Grantors to two individuals or husband and wife as Grantee Beneficiaries. Grantors convey and transfer, upon the death of the last surviving Grantor, to the Grantee Beneficiaries. This Deed is not effective unless recorded prior to the death of either Grantor. This deed complies with all state laws. Fort Collins, Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife: A Beneficiary or Transfer on Death (TOD) Deed is a legal document that allows property owners in Fort Collins, Colorado, who are married, to designate who will inherit their property upon their death. This deed helps ensure a smooth and efficient transfer of property without the need for probate. The Beneficiary or TOD Deed can be used by a married couple in Fort Collins to transfer their property to another married couple. This type of deed enables the property to pass directly to the designated beneficiaries without going through a court process. There are different types of Beneficiary or TOD Deeds available to suit the specific needs of the individuals involved. In Fort Collins, typical variations include joint tenancy with rights of survivorship and tenancy in common. 1. Joint Tenancy with Rights of Survivorship: In this type of deed, both the husband and wife are designated as joint tenants. Upon the death of one spouse, the property automatically passes to the surviving spouse outside of probate. If the surviving spouse is also deceased, the property will be transferred to the designated beneficiaries. 2. Tenancy in Common: With this option, the property is owned jointly by the husband and wife, but each spouse has an individual share. Upon the death of one spouse, their share is transferred according to the terms outlined in the Beneficiary or TOD Deed. This could include passing the share to the surviving spouse or designating other beneficiaries. It's important to consult with a real estate attorney or legal professional in Fort Collins to ensure that the Beneficiary or TOD Deed is prepared correctly and meets all the necessary legal requirements. They can also guide individuals through the process and help determine the most suitable type of deed according to their unique circumstances and wishes. By utilizing a Fort Collins Beneficiary or TOD Deed, married individuals can have peace of mind knowing that their property will be efficiently transferred to their chosen beneficiaries, avoiding probate and potential complications in the future.

Fort Collins, Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife: A Beneficiary or Transfer on Death (TOD) Deed is a legal document that allows property owners in Fort Collins, Colorado, who are married, to designate who will inherit their property upon their death. This deed helps ensure a smooth and efficient transfer of property without the need for probate. The Beneficiary or TOD Deed can be used by a married couple in Fort Collins to transfer their property to another married couple. This type of deed enables the property to pass directly to the designated beneficiaries without going through a court process. There are different types of Beneficiary or TOD Deeds available to suit the specific needs of the individuals involved. In Fort Collins, typical variations include joint tenancy with rights of survivorship and tenancy in common. 1. Joint Tenancy with Rights of Survivorship: In this type of deed, both the husband and wife are designated as joint tenants. Upon the death of one spouse, the property automatically passes to the surviving spouse outside of probate. If the surviving spouse is also deceased, the property will be transferred to the designated beneficiaries. 2. Tenancy in Common: With this option, the property is owned jointly by the husband and wife, but each spouse has an individual share. Upon the death of one spouse, their share is transferred according to the terms outlined in the Beneficiary or TOD Deed. This could include passing the share to the surviving spouse or designating other beneficiaries. It's important to consult with a real estate attorney or legal professional in Fort Collins to ensure that the Beneficiary or TOD Deed is prepared correctly and meets all the necessary legal requirements. They can also guide individuals through the process and help determine the most suitable type of deed according to their unique circumstances and wishes. By utilizing a Fort Collins Beneficiary or TOD Deed, married individuals can have peace of mind knowing that their property will be efficiently transferred to their chosen beneficiaries, avoiding probate and potential complications in the future.