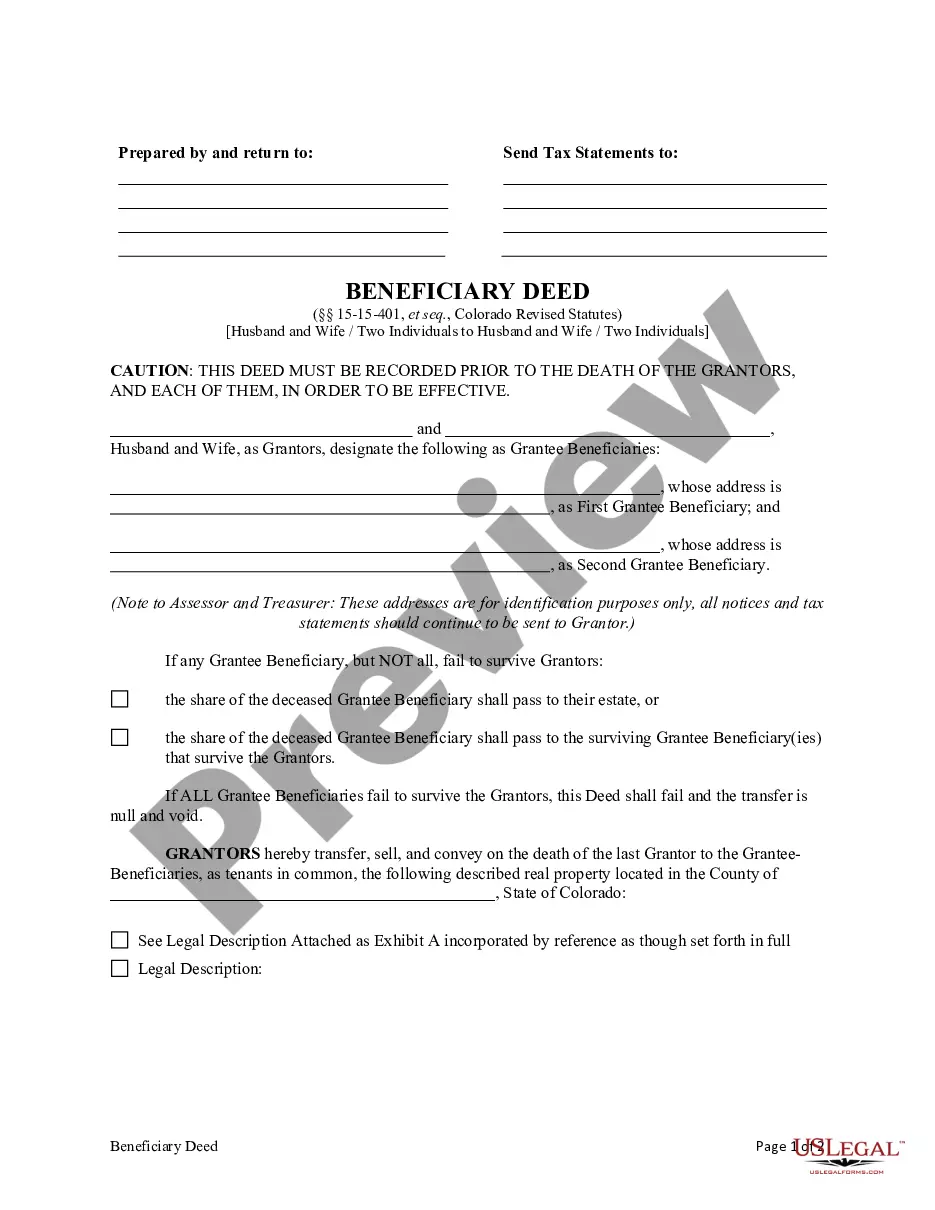

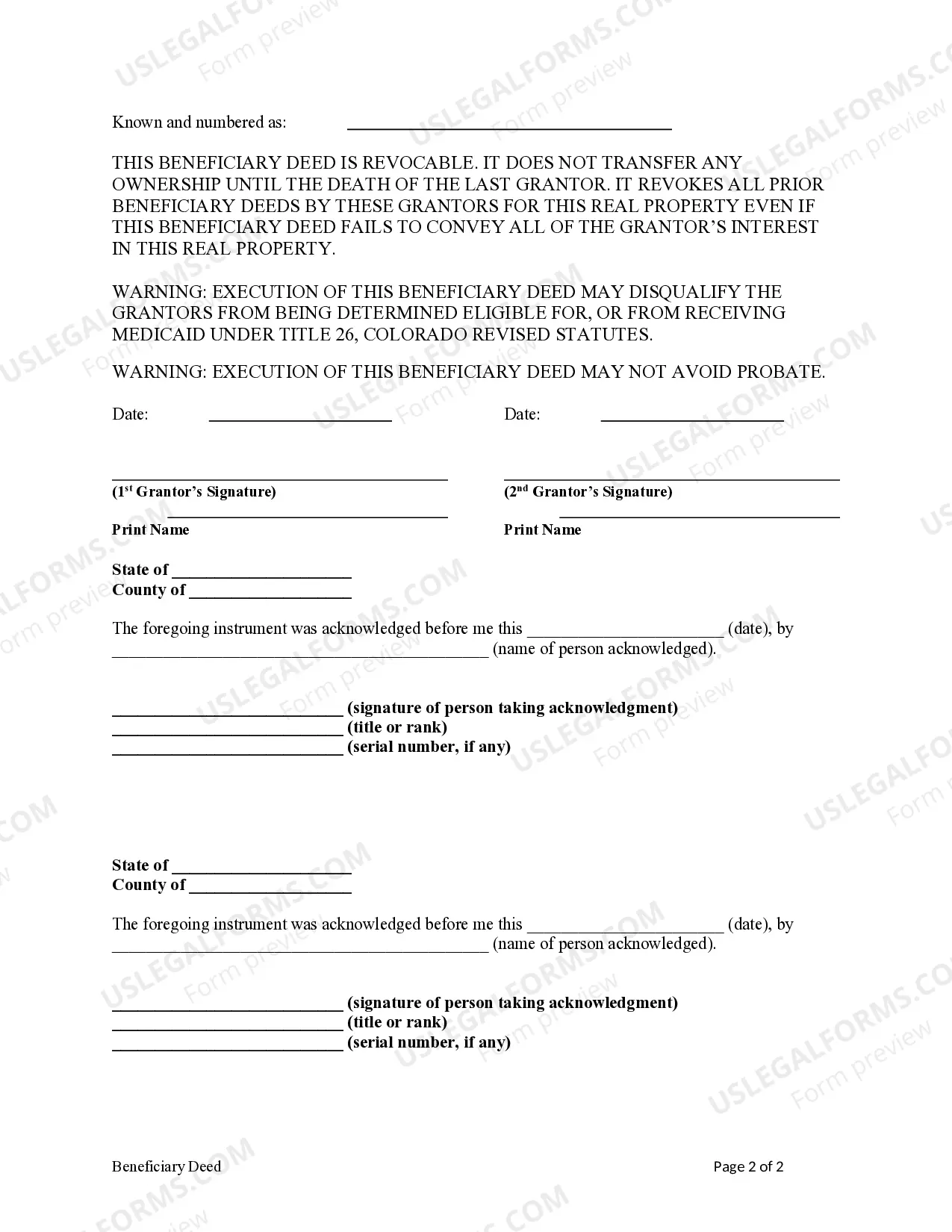

This form is a Beneficiary or Transfer on Death Deed from two individual or husband and wife as Owner Grantors to two individuals or husband and wife as Grantee Beneficiaries. Grantors convey and transfer, upon the death of the last surviving Grantor, to the Grantee Beneficiaries. This Deed is not effective unless recorded prior to the death of either Grantor. This deed complies with all state laws. A Westminster Colorado Beneficiary or Transfer on Death Deed is a legal document that allows two individuals (a husband and wife) to designate the transfer of their property to two other individuals (another husband and wife) upon their death. This type of deed provides a streamlined process for the transfer of real estate assets and ensures that the intended beneficiaries receive the property without the need for probate. There are several types of Westminster Colorado Beneficiary or Transfer on Death Deeds from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife: 1. Joint Tenancy with Right of Survivorship: This type of deed ensures that when one spouse passes away, the other spouse automatically becomes the sole owner of the property. This transfer of ownership happens outside of probate, allowing for a seamless transition of the property. 2. Tenancy by the Entirety: This deed is only available to married couples and provides ownership of the property to both spouses equally. In the event of the death of one spouse, the surviving spouse automatically becomes the sole owner of the property. 3. Community Property with Right of Survivorship: This type of deed is applicable to married couples residing in community property states. It grants joint ownership of the property to both spouses and ensures that the surviving spouse becomes the sole owner upon the death of the other spouse. By utilizing a Westminster Colorado Beneficiary or Transfer on Death Deed, couples can rest assured that their property will easily transfer to the designated individuals without the need for court involvement or the expenses of probate. It provides a cost-effective and efficient method for estate planning while promoting the smooth continuation of the property's ownership after their passing. Discussing this option with an experienced estate planning attorney can help ensure that the deed is correctly executed and tailored to meet the specific needs and wishes of the individuals involved.

A Westminster Colorado Beneficiary or Transfer on Death Deed is a legal document that allows two individuals (a husband and wife) to designate the transfer of their property to two other individuals (another husband and wife) upon their death. This type of deed provides a streamlined process for the transfer of real estate assets and ensures that the intended beneficiaries receive the property without the need for probate. There are several types of Westminster Colorado Beneficiary or Transfer on Death Deeds from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife: 1. Joint Tenancy with Right of Survivorship: This type of deed ensures that when one spouse passes away, the other spouse automatically becomes the sole owner of the property. This transfer of ownership happens outside of probate, allowing for a seamless transition of the property. 2. Tenancy by the Entirety: This deed is only available to married couples and provides ownership of the property to both spouses equally. In the event of the death of one spouse, the surviving spouse automatically becomes the sole owner of the property. 3. Community Property with Right of Survivorship: This type of deed is applicable to married couples residing in community property states. It grants joint ownership of the property to both spouses and ensures that the surviving spouse becomes the sole owner upon the death of the other spouse. By utilizing a Westminster Colorado Beneficiary or Transfer on Death Deed, couples can rest assured that their property will easily transfer to the designated individuals without the need for court involvement or the expenses of probate. It provides a cost-effective and efficient method for estate planning while promoting the smooth continuation of the property's ownership after their passing. Discussing this option with an experienced estate planning attorney can help ensure that the deed is correctly executed and tailored to meet the specific needs and wishes of the individuals involved.