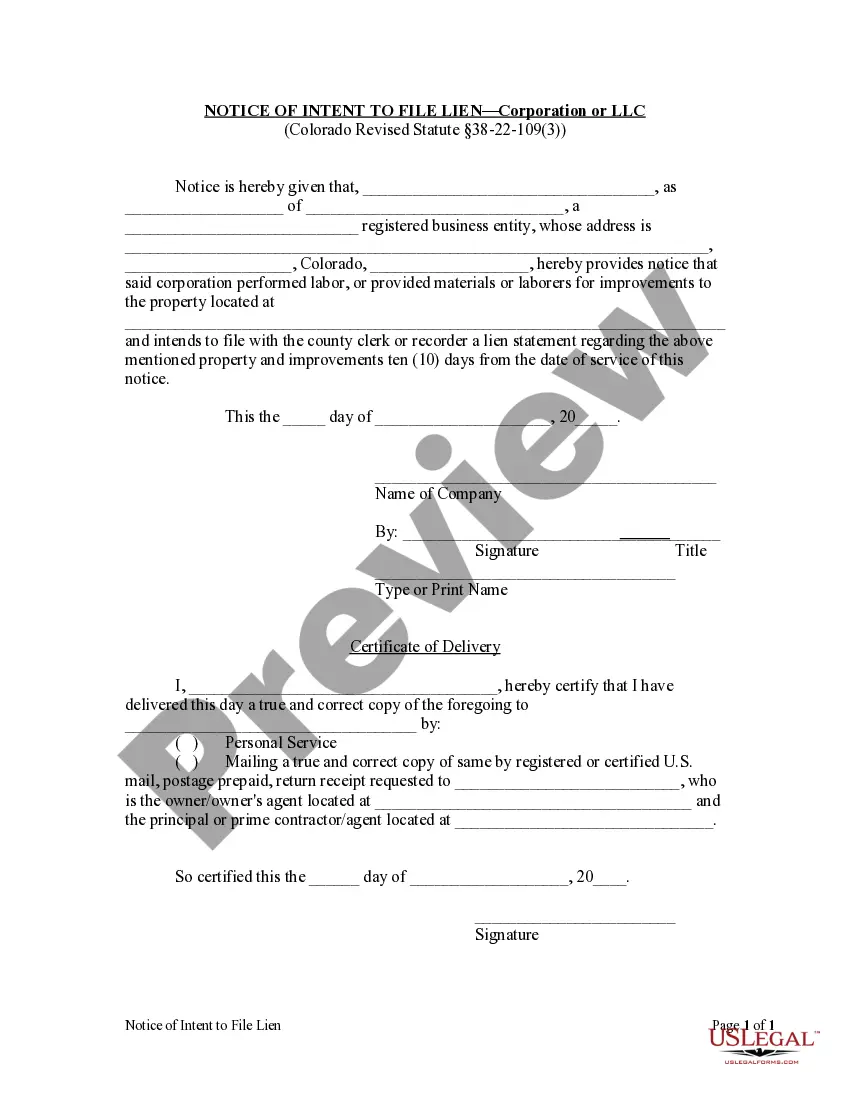

In order to preserve a lien for work performed, or materials or laborers supplied, a notice of intent to file a lien must be served personally on the owner, reputed owner, or agent of the owner, AND the principal or prime contractor or his or her agent at least ten days prior to the filing of a lien statement.

Centennial Colorado Notice of Intent to File Lien by Corporation or LLC is a legal document that serves as a formal notice to inform a property owner of a pending lien filing by a corporation or limited liability company (LLC). This form is crucial in protecting the rights of the corporation or LLC against non-payment for services or materials provided. The purpose of the Centennial Colorado Notice of Intent to File Lien is to make the property owner aware of the outstanding debt and give them an opportunity to address it before the lien is actually filed. By providing this notice, the corporation or LLC is asserting their legal claim to the property in question and the right to file a lien if the debt remains unpaid. This notice is typically sent after efforts to collect payment have been exhausted or when the property owner has consistently failed to fulfill their payment obligations. It is important for the corporation or LLC to follow the specific legal procedures required by the state of Colorado when filing a Notice of Intent to File Lien. Some relevant keywords associated with Centennial Colorado Notice of Intent to File Lien by Corporation or LLC include: — Centennial Colorado: This specifies the geographical location where the lien is being filed. — Notice of Intent to File Lien: This highlights the purpose of the document, emphasizing that it serves as a warning to the property owner. — Corporation or LLC: This specifies the type of entity filing the lien, emphasizing that it is a legally recognized business entity. — Liens: This keyword refers to the legal claim being asserted by the corporation or LLC. — Property Owner: This refers to the recipient of the notice, who is being informed of the pending lien filing. — Debt: This keyword highlights the reason for the lien and the unpaid amount owed to the corporation or LLC. — Legal Procedures: This emphasizes the importance of adhering to the specific legal requirements when filing the notice, ensuring its validity and enforceability. Some potential types of Centennial Colorado Notice of Intent to File Lien by Corporation or LLC may include: 1. Construction Lien: If the corporation or LLC is providing construction-related services or materials and has not received appropriate payment, they may file a Notice of Intent to File a Construction Lien. 2. Mechanics Lien: This type of notice is relevant when a corporation or LLC's services or materials have been provided for the improvement or repair of a property, and payment is still outstanding. 3. Service Lien: In cases where a corporation or LLC provides specific services, such as maintenance, consulting, or professional services, and the payment remains unpaid, they may file a Notice of Intent to File a Service Lien. It is important to consult with legal professionals and refer to the specific laws and regulations in Centennial, Colorado to ensure compliance when filing a Notice of Intent to File Lien by Corporation or LLC.