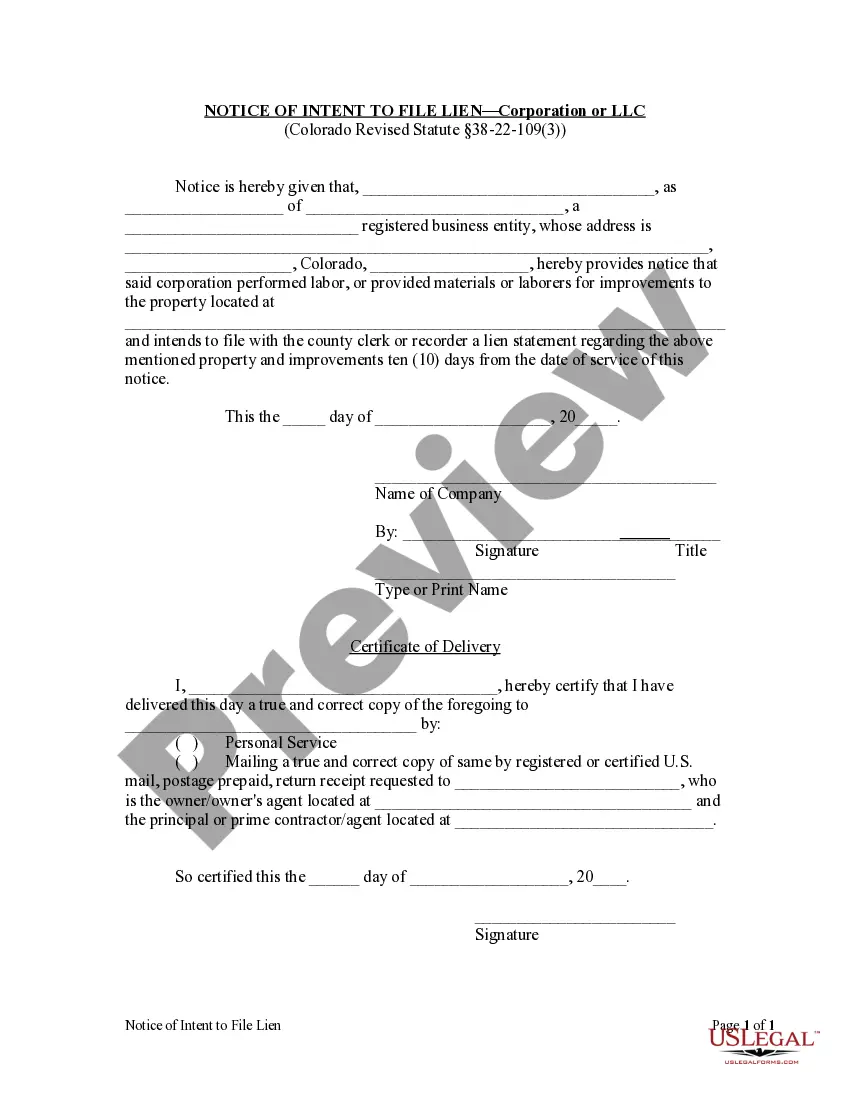

In order to preserve a lien for work performed, or materials or laborers supplied, a notice of intent to file a lien must be served personally on the owner, reputed owner, or agent of the owner, AND the principal or prime contractor or his or her agent at least ten days prior to the filing of a lien statement.

A Lakewood Colorado Notice of Intent to File Lien by Corporation or LLC is a legal document that formally notifies a property owner of an impending lien filing by a corporation or limited liability company (LLC). When an individual or entity fails to make payment for services or materials provided by a corporation or LLC, the unpaid party often resorts to filing a lien to secure their financial interest in the property. This Notice of Intent to File Lien serves as a precursor to the actual filing, providing the property owner with an opportunity to address the outstanding debt before legal action ensues. The Lakewood Colorado Notice of Intent to File Lien by Corporation or LLC typically includes essential information such as the name and contact details of the respective corporation or LLC, as well as the name and address of the property owner or debtor. It also outlines the details of the unpaid services or materials, including the dates, quantities, and associated costs. Additionally, the document usually specifies the timeframe within which the property owner must resolve the outstanding payment, typically 10-30 days from the date of receipt of the notice. It is crucial to note that different types of Lakewood Colorado Notice of Intent to File Lien by Corporation or LLC can exist, depending on the specific nature of the debt. For instance, there may be separate notices for construction-related services, such as contractors or subcontractors seeking payment for labor or materials used in a project. Similarly, a different notice might apply to professional services, such as architects, engineers, or consultants, who seek compensation for their expertise and work rendered. Property owners in Lakewood Colorado should take any Notice of Intent to File Lien by Corporation or LLC seriously, as ignoring such a notice can lead to serious legal consequences. Upon receiving such a notice, property owners are advised to review the details carefully and promptly contact the corporation or LLC to discuss the outstanding debt and potential resolutions. By addressing the matter swiftly, property owners can avoid further escalation, potential litigation, and the subsequent filing of a formal lien on their property. In summary, a Lakewood Colorado Notice of Intent to File Lien by Corporation or LLC is a vital legal document that serves as a warning to property owners regarding an impending lien filing. Property owners should carefully review the notice, promptly communicate with the corporation or LLC, and work towards resolving the outstanding payment to prevent further legal complications.A Lakewood Colorado Notice of Intent to File Lien by Corporation or LLC is a legal document that formally notifies a property owner of an impending lien filing by a corporation or limited liability company (LLC). When an individual or entity fails to make payment for services or materials provided by a corporation or LLC, the unpaid party often resorts to filing a lien to secure their financial interest in the property. This Notice of Intent to File Lien serves as a precursor to the actual filing, providing the property owner with an opportunity to address the outstanding debt before legal action ensues. The Lakewood Colorado Notice of Intent to File Lien by Corporation or LLC typically includes essential information such as the name and contact details of the respective corporation or LLC, as well as the name and address of the property owner or debtor. It also outlines the details of the unpaid services or materials, including the dates, quantities, and associated costs. Additionally, the document usually specifies the timeframe within which the property owner must resolve the outstanding payment, typically 10-30 days from the date of receipt of the notice. It is crucial to note that different types of Lakewood Colorado Notice of Intent to File Lien by Corporation or LLC can exist, depending on the specific nature of the debt. For instance, there may be separate notices for construction-related services, such as contractors or subcontractors seeking payment for labor or materials used in a project. Similarly, a different notice might apply to professional services, such as architects, engineers, or consultants, who seek compensation for their expertise and work rendered. Property owners in Lakewood Colorado should take any Notice of Intent to File Lien by Corporation or LLC seriously, as ignoring such a notice can lead to serious legal consequences. Upon receiving such a notice, property owners are advised to review the details carefully and promptly contact the corporation or LLC to discuss the outstanding debt and potential resolutions. By addressing the matter swiftly, property owners can avoid further escalation, potential litigation, and the subsequent filing of a formal lien on their property. In summary, a Lakewood Colorado Notice of Intent to File Lien by Corporation or LLC is a vital legal document that serves as a warning to property owners regarding an impending lien filing. Property owners should carefully review the notice, promptly communicate with the corporation or LLC, and work towards resolving the outstanding payment to prevent further legal complications.