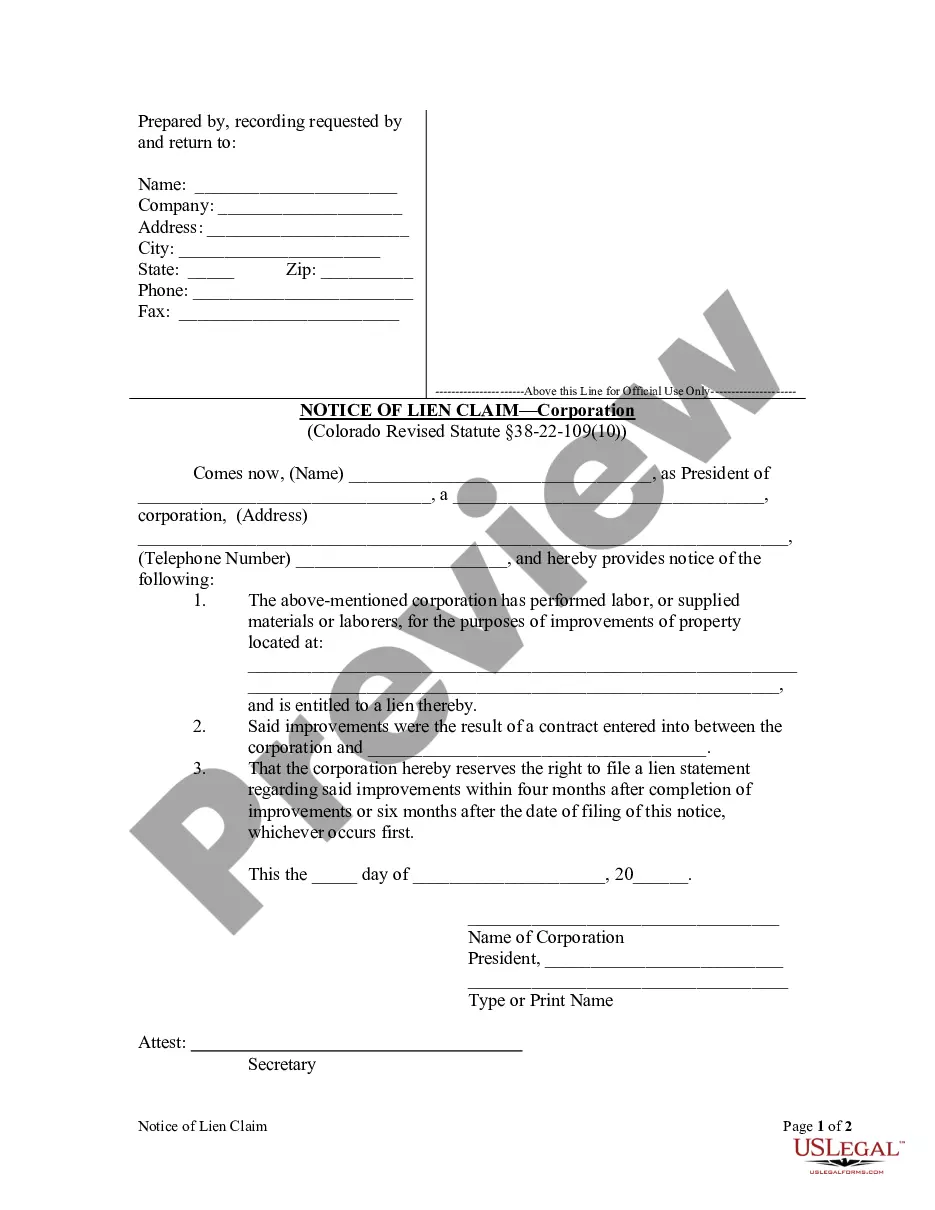

Pursuant to Colorado Revised Statute section 38-22-109(10), a party otherwise entitled to a lien may file with the clerk or county recorder notice that the lien claimant may file a lien statement. This notice properly filed serves to extend the time a lien claimant may file his lien statement to four months after completion of improvements or six months after the filing of this notice whichever comes first.

A Westminster Colorado Notice of Lien Claim by Corporation or LLC is a legal document filed by a corporation or limited liability company to assert its rights over a property or assets in order to secure payment for a debt or claim. This notice acts as a formal warning to individuals or entities that the corporation or LLC has a legal interest in the property, which can affect its ownership or transfer unless the debt is satisfied. The Westminster Colorado Notice of Lien Claim by Corporation or LLC is an essential step for businesses seeking to protect their financial interests, especially when facing non-payment issues or other contractual disputes. By filing this notice, the corporation or LLC establishes its priority position among other potential claimants or creditors in case of any future attempts to sell, mortgage, or transfer the property. Different types of Westminster Colorado Notice of Lien Claim by Corporation or LLC may include: 1. Construction Lien Claim: This type of lien claim is commonly filed by construction companies or contractors who have provided labor, materials, or services for the improvement or construction of a property but have not received full payment for their work. The lien claim allows the corporation or LLC to claim a legal interest in the property until the outstanding debt is settled. 2. Mechanic's Lien Claim: Similar to construction lien claims, mechanic's lien claims are filed when a corporation or LLC in the automotive or mechanical industry has provided goods, services, or repairs to a vehicle or equipment and has not been compensated in full. This type of lien claim secures the business's right to payment and can affect the property's ownership. 3. Tax Lien Claim: In certain cases where businesses fail to pay state taxes, the government may file a tax lien claim against the corporation or LLC's property. This notice establishes the government's right to seize or sell the property if the business fails to fulfill its tax obligations. It is crucial for businesses to resolve tax liens promptly to avoid adverse consequences. 4. Judgment Lien Claim: When a corporation or LLC successfully obtains a court judgment against a debtor, they can file a judgment lien claim to assert their right to the debtor's property. This lien claim ensures that the corporation or LLC is granted priority over other creditors when recovering the outstanding debt. It is essential for corporations and LCS in Westminster, Colorado, to seek legal advice or consult with an attorney experienced in real estate and business law before filing a Notice of Lien Claim. Properly executing and filing the claim is crucial to ensure its validity and effectiveness in protecting the business's financial interests.A Westminster Colorado Notice of Lien Claim by Corporation or LLC is a legal document filed by a corporation or limited liability company to assert its rights over a property or assets in order to secure payment for a debt or claim. This notice acts as a formal warning to individuals or entities that the corporation or LLC has a legal interest in the property, which can affect its ownership or transfer unless the debt is satisfied. The Westminster Colorado Notice of Lien Claim by Corporation or LLC is an essential step for businesses seeking to protect their financial interests, especially when facing non-payment issues or other contractual disputes. By filing this notice, the corporation or LLC establishes its priority position among other potential claimants or creditors in case of any future attempts to sell, mortgage, or transfer the property. Different types of Westminster Colorado Notice of Lien Claim by Corporation or LLC may include: 1. Construction Lien Claim: This type of lien claim is commonly filed by construction companies or contractors who have provided labor, materials, or services for the improvement or construction of a property but have not received full payment for their work. The lien claim allows the corporation or LLC to claim a legal interest in the property until the outstanding debt is settled. 2. Mechanic's Lien Claim: Similar to construction lien claims, mechanic's lien claims are filed when a corporation or LLC in the automotive or mechanical industry has provided goods, services, or repairs to a vehicle or equipment and has not been compensated in full. This type of lien claim secures the business's right to payment and can affect the property's ownership. 3. Tax Lien Claim: In certain cases where businesses fail to pay state taxes, the government may file a tax lien claim against the corporation or LLC's property. This notice establishes the government's right to seize or sell the property if the business fails to fulfill its tax obligations. It is crucial for businesses to resolve tax liens promptly to avoid adverse consequences. 4. Judgment Lien Claim: When a corporation or LLC successfully obtains a court judgment against a debtor, they can file a judgment lien claim to assert their right to the debtor's property. This lien claim ensures that the corporation or LLC is granted priority over other creditors when recovering the outstanding debt. It is essential for corporations and LCS in Westminster, Colorado, to seek legal advice or consult with an attorney experienced in real estate and business law before filing a Notice of Lien Claim. Properly executing and filing the claim is crucial to ensure its validity and effectiveness in protecting the business's financial interests.