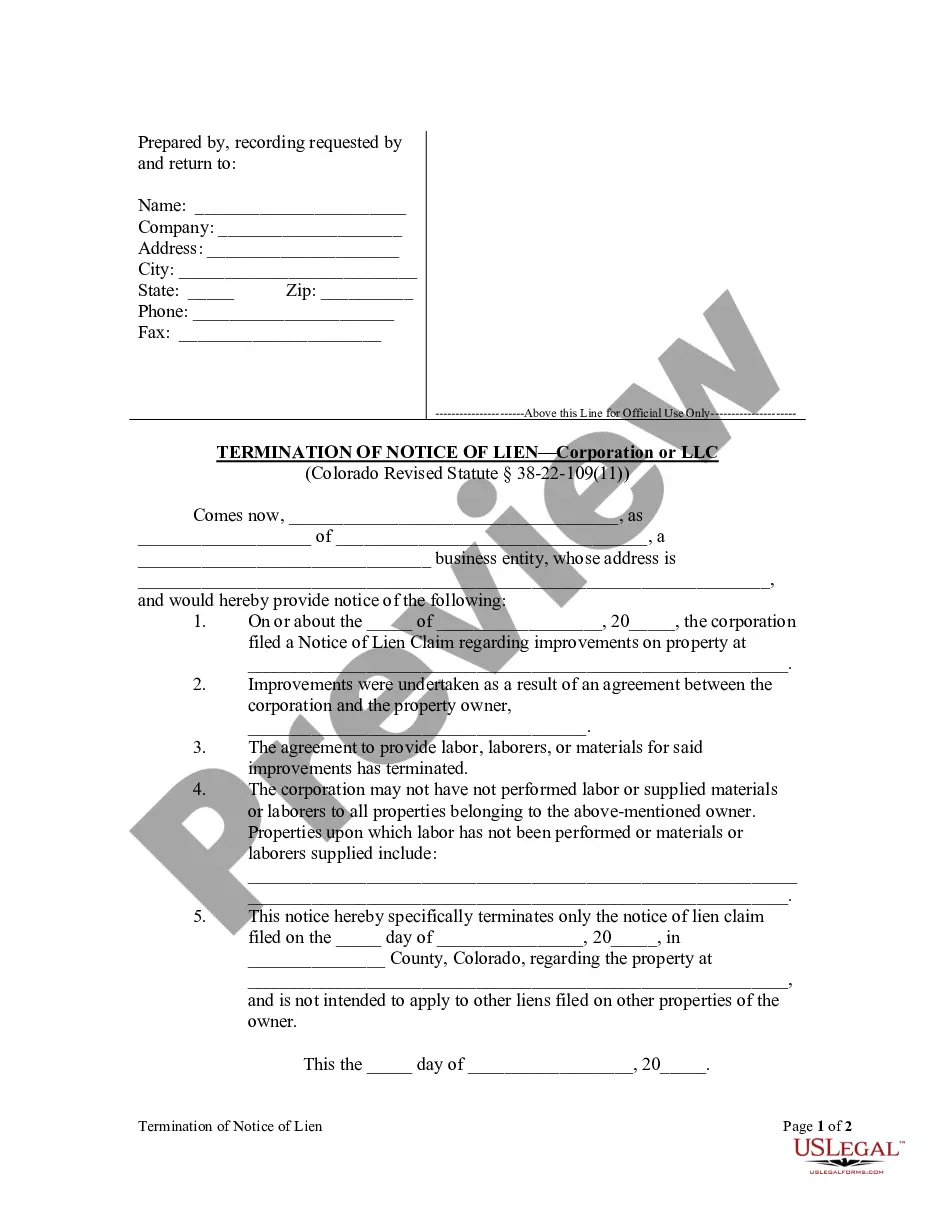

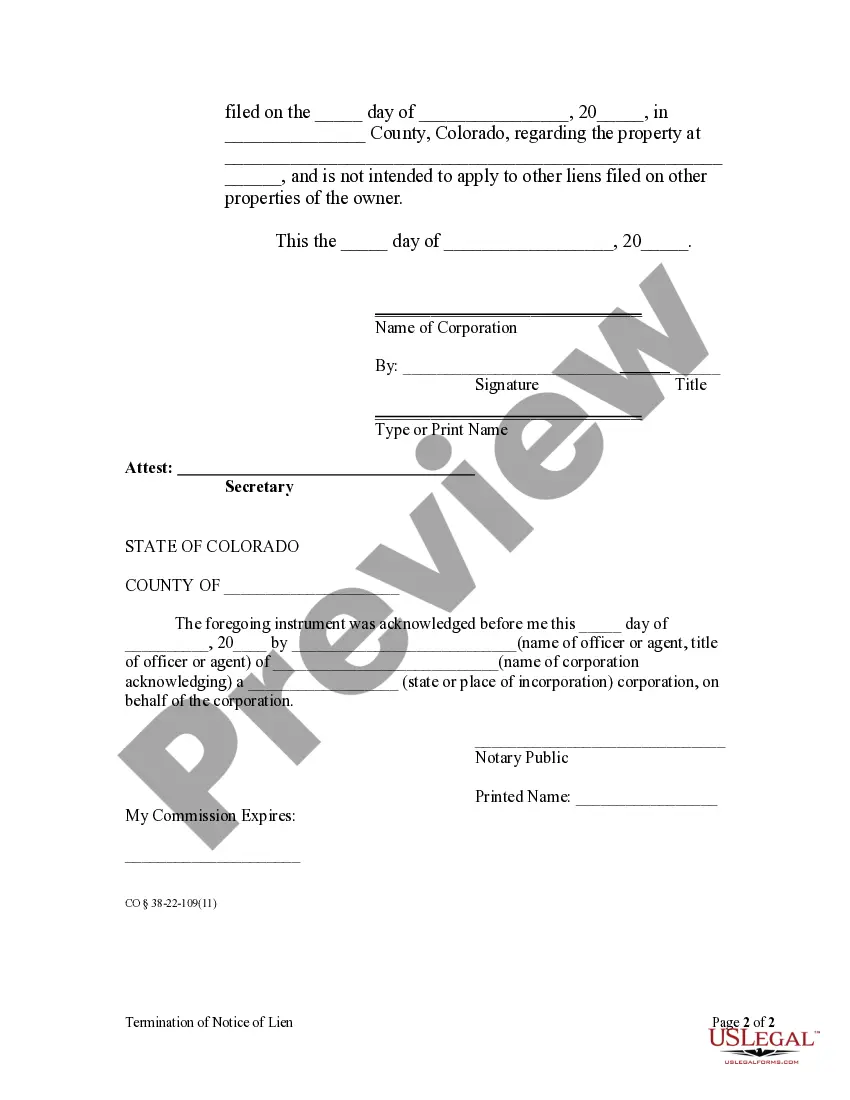

Colorado Revised Statute section 38-22-109(10) allows a potential lien claimant to file a Notice of Lien Claim. Upon the termination of an agreement to provide labor, materials, or laborers, an owner may demand pursuant to section 38-22-109(11) that the party filing the Notice of Lien Claim file a termination of that notice. The termination should be filed in the office of the county clerk or recorder where the original notice was recorded.

Centennial Colorado Termination of Notice of Lien by Corporation or LLC is a legal process that allows businesses to remove a filed notice of lien from public record. This termination is crucial for corporations and LCS seeking to clear their property or assets from any encumbrances that may hinder future transactions or financing opportunities. Here are some relevant keywords related to Centennial Colorado Termination of Notice of Lien by Corporation or LLC: 1. Notice of Lien: A legal claim placed on property or assets by a creditor to enforce payment of a debt. 2. Corporation: A company considered a legal entity that is separate from its owners and shareholders. 3. Limited Liability Company (LLC): A legal structure that combines the flexibility of a partnership with the limited liability protection of a corporation. 4. Termination: The act of ending or canceling something, in this case, the removal of a notice of lien. 5. Centennial Colorado: A city located in Arapahoe County, Colorado, known for its thriving business community and attractive real estate market. Types of Centennial Colorado Termination of Notice of Lien by Corporation or LLC: 1. Voluntary Termination: When a corporation or LLC proactively seeks to terminate a notice of lien by filing the necessary documents with the appropriate state agency or county clerk's office. 2. Satisfaction of Lien: When the corporation or LLC satisfies the debt or obligation that led to the filing of the notice of lien, allowing for its termination. 3. Release of Lien: A legal document released by the creditor, declaring that the debt has been paid in full and officially terminating the notice of lien. 4. Court-Ordered Termination: In certain cases, a court may issue an order to terminate a notice of lien, typically following a successful legal dispute or resolution. 5. Expiration of Lien: Notices of lien also have an expiration date, and if the debt remains unpaid within the specified period, the lien may automatically terminate. To initiate the Centennial Colorado Termination of Notice of Lien by Corporation or LLC, it is recommended to consult with an attorney experienced in real estate and business law. They can guide businesses through the necessary steps, including drafting and filing the required documents, and ensuring compliance with the relevant state and local regulations.Centennial Colorado Termination of Notice of Lien by Corporation or LLC is a legal process that allows businesses to remove a filed notice of lien from public record. This termination is crucial for corporations and LCS seeking to clear their property or assets from any encumbrances that may hinder future transactions or financing opportunities. Here are some relevant keywords related to Centennial Colorado Termination of Notice of Lien by Corporation or LLC: 1. Notice of Lien: A legal claim placed on property or assets by a creditor to enforce payment of a debt. 2. Corporation: A company considered a legal entity that is separate from its owners and shareholders. 3. Limited Liability Company (LLC): A legal structure that combines the flexibility of a partnership with the limited liability protection of a corporation. 4. Termination: The act of ending or canceling something, in this case, the removal of a notice of lien. 5. Centennial Colorado: A city located in Arapahoe County, Colorado, known for its thriving business community and attractive real estate market. Types of Centennial Colorado Termination of Notice of Lien by Corporation or LLC: 1. Voluntary Termination: When a corporation or LLC proactively seeks to terminate a notice of lien by filing the necessary documents with the appropriate state agency or county clerk's office. 2. Satisfaction of Lien: When the corporation or LLC satisfies the debt or obligation that led to the filing of the notice of lien, allowing for its termination. 3. Release of Lien: A legal document released by the creditor, declaring that the debt has been paid in full and officially terminating the notice of lien. 4. Court-Ordered Termination: In certain cases, a court may issue an order to terminate a notice of lien, typically following a successful legal dispute or resolution. 5. Expiration of Lien: Notices of lien also have an expiration date, and if the debt remains unpaid within the specified period, the lien may automatically terminate. To initiate the Centennial Colorado Termination of Notice of Lien by Corporation or LLC, it is recommended to consult with an attorney experienced in real estate and business law. They can guide businesses through the necessary steps, including drafting and filing the required documents, and ensuring compliance with the relevant state and local regulations.