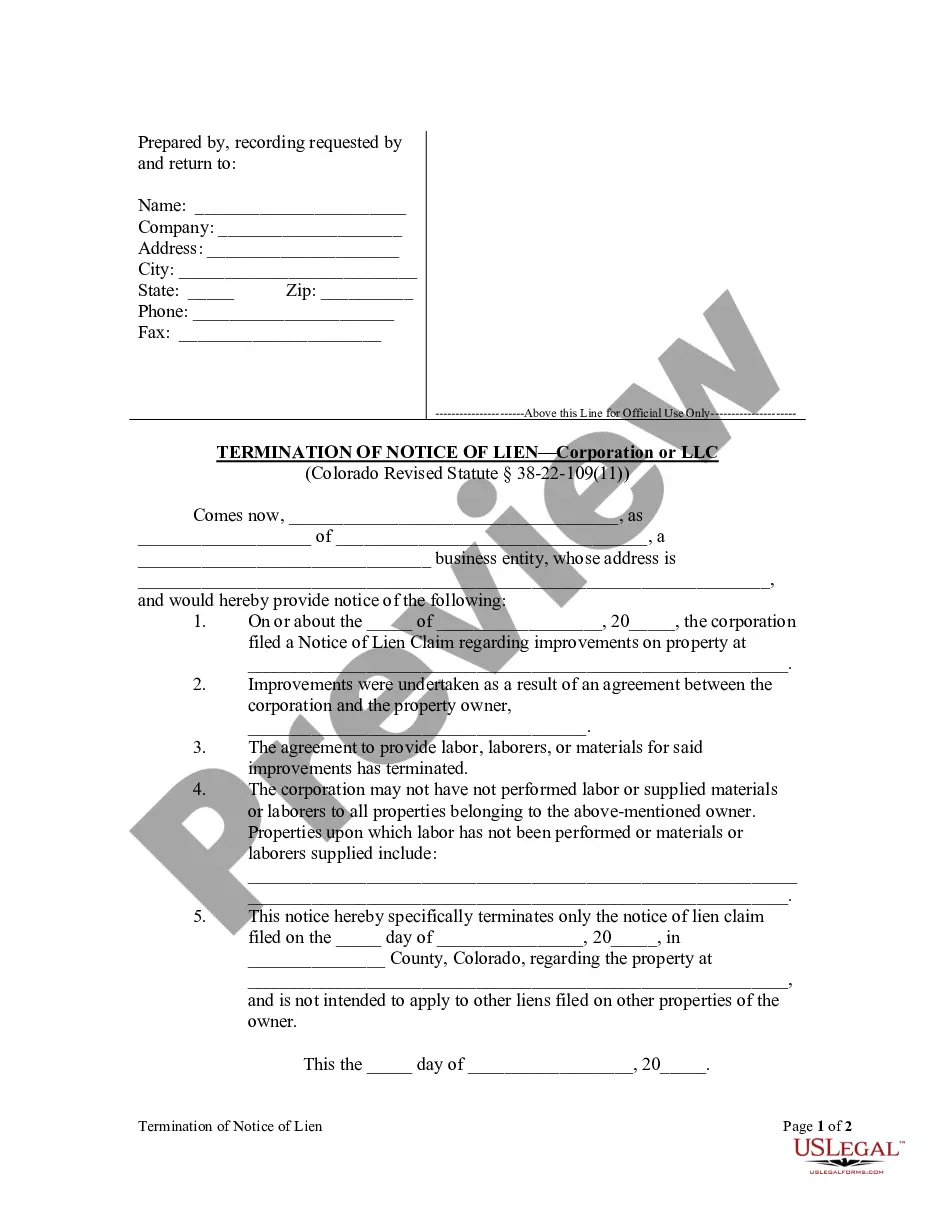

Colorado Revised Statute section 38-22-109(10) allows a potential lien claimant to file a Notice of Lien Claim. Upon the termination of an agreement to provide labor, materials, or laborers, an owner may demand pursuant to section 38-22-109(11) that the party filing the Notice of Lien Claim file a termination of that notice. The termination should be filed in the office of the county clerk or recorder where the original notice was recorded.

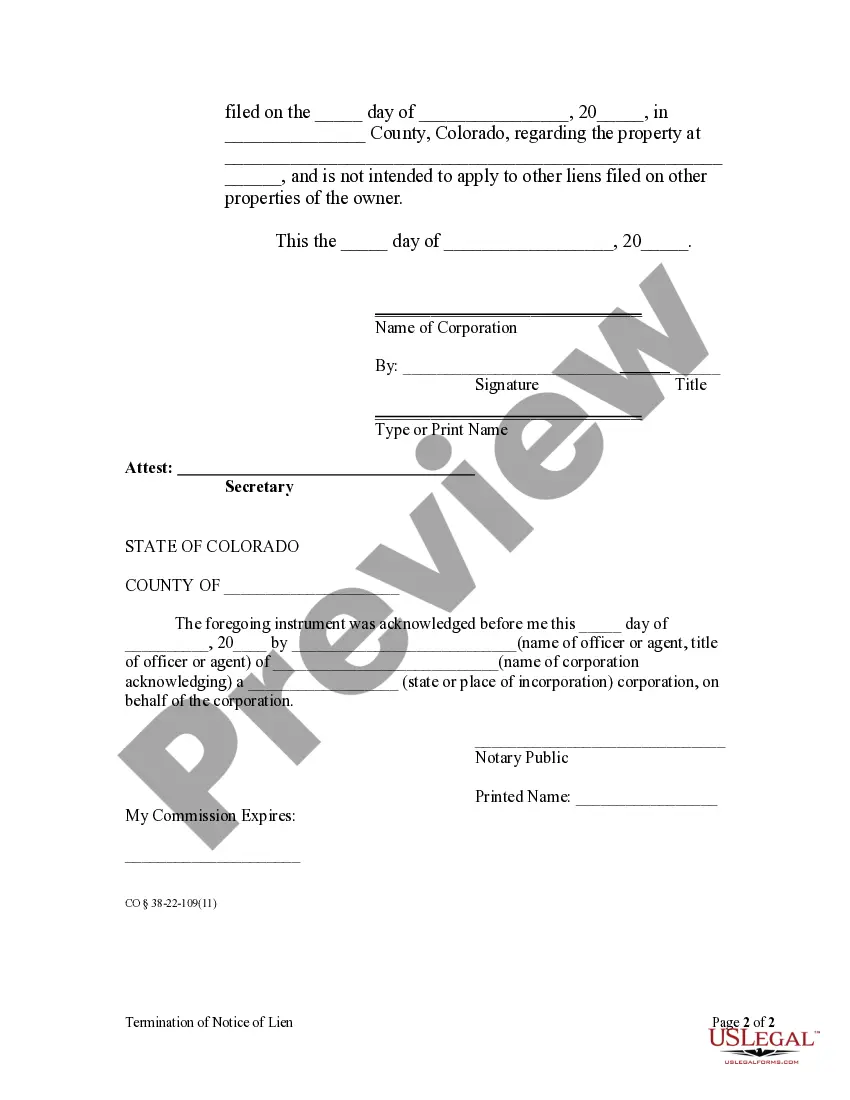

Title: A Comprehensive Guide to Lakewood Colorado Termination of Notice of Lien by Corporation or LLC Description: In Lakewood, Colorado, when a corporation or limited liability company (LLC) wishes to terminate a notice of lien, it is essential to understand the process involved. This guide provides a detailed description of Lakewood Colorado Termination of Notice of Lien by Corporation or LLC, covering all the relevant keywords associated with this topic. 1. Understanding the Termination of Notice of Lien: This article aims to clarify the mechanisms and requirements for terminating a notice of lien filed by a corporation or an LLC in Lakewood, Colorado. We explain the significance of this process and how it releases the property and assets from any encumbrances imposed by the lien. 2. Legal Authority for Termination: Explore the legal provisions and laws governing the dissolution of liens by corporations and LCS in Lakewood, Colorado. Annotations and references to the relevant statutes provide readers with a deeper understanding of the legal framework surrounding this process. 3. Steps for Initiating Termination: — Identification and Verification: We outline the initial steps required to identify the lien and confirm the lien holder's identity, ensuring that the termination is initiated correctly. — Documentation: Discover the necessary forms, documents, and certificates that the corporation or LLC must submit to initiate the termination process. — Notification: Learn about the notification requirements, including serving notice to concerned parties such as the property owner, lien holder, and other interested parties. 4. Different Types of Termination: a) Voluntary Termination: Understand the circumstances under which a corporation or LLC may voluntarily terminate a notice of lien. Compliance with legal obligations and fulfillment of financial settlements are discussed in detail. b) Involuntary Termination: Explore scenarios where a notice of lien may be terminated involuntarily due to certain legal proceedings, bankruptcy, or other circumstances specified by Lakewood, Colorado laws. 5. Effect of Termination: Comprehend the consequences and benefits that follow the successful termination of a notice of lien by a corporation or LLC. This section outlines the removal of the lien's encumbrances on the property, credit reporting implications, and the restoration of the property's reputation. By providing a comprehensive and detailed overview of Lakewood Colorado Termination of Notice of Lien by Corporation or LLC, this resource serves as a reliable reference guide for individuals, attorneys, and business owners navigating this complex process. Understanding the nuanced requirements and procedures is fundamental to ensuring a successful termination, safeguarding the interests of corporations, LCS, and property owners alike.Title: A Comprehensive Guide to Lakewood Colorado Termination of Notice of Lien by Corporation or LLC Description: In Lakewood, Colorado, when a corporation or limited liability company (LLC) wishes to terminate a notice of lien, it is essential to understand the process involved. This guide provides a detailed description of Lakewood Colorado Termination of Notice of Lien by Corporation or LLC, covering all the relevant keywords associated with this topic. 1. Understanding the Termination of Notice of Lien: This article aims to clarify the mechanisms and requirements for terminating a notice of lien filed by a corporation or an LLC in Lakewood, Colorado. We explain the significance of this process and how it releases the property and assets from any encumbrances imposed by the lien. 2. Legal Authority for Termination: Explore the legal provisions and laws governing the dissolution of liens by corporations and LCS in Lakewood, Colorado. Annotations and references to the relevant statutes provide readers with a deeper understanding of the legal framework surrounding this process. 3. Steps for Initiating Termination: — Identification and Verification: We outline the initial steps required to identify the lien and confirm the lien holder's identity, ensuring that the termination is initiated correctly. — Documentation: Discover the necessary forms, documents, and certificates that the corporation or LLC must submit to initiate the termination process. — Notification: Learn about the notification requirements, including serving notice to concerned parties such as the property owner, lien holder, and other interested parties. 4. Different Types of Termination: a) Voluntary Termination: Understand the circumstances under which a corporation or LLC may voluntarily terminate a notice of lien. Compliance with legal obligations and fulfillment of financial settlements are discussed in detail. b) Involuntary Termination: Explore scenarios where a notice of lien may be terminated involuntarily due to certain legal proceedings, bankruptcy, or other circumstances specified by Lakewood, Colorado laws. 5. Effect of Termination: Comprehend the consequences and benefits that follow the successful termination of a notice of lien by a corporation or LLC. This section outlines the removal of the lien's encumbrances on the property, credit reporting implications, and the restoration of the property's reputation. By providing a comprehensive and detailed overview of Lakewood Colorado Termination of Notice of Lien by Corporation or LLC, this resource serves as a reliable reference guide for individuals, attorneys, and business owners navigating this complex process. Understanding the nuanced requirements and procedures is fundamental to ensuring a successful termination, safeguarding the interests of corporations, LCS, and property owners alike.