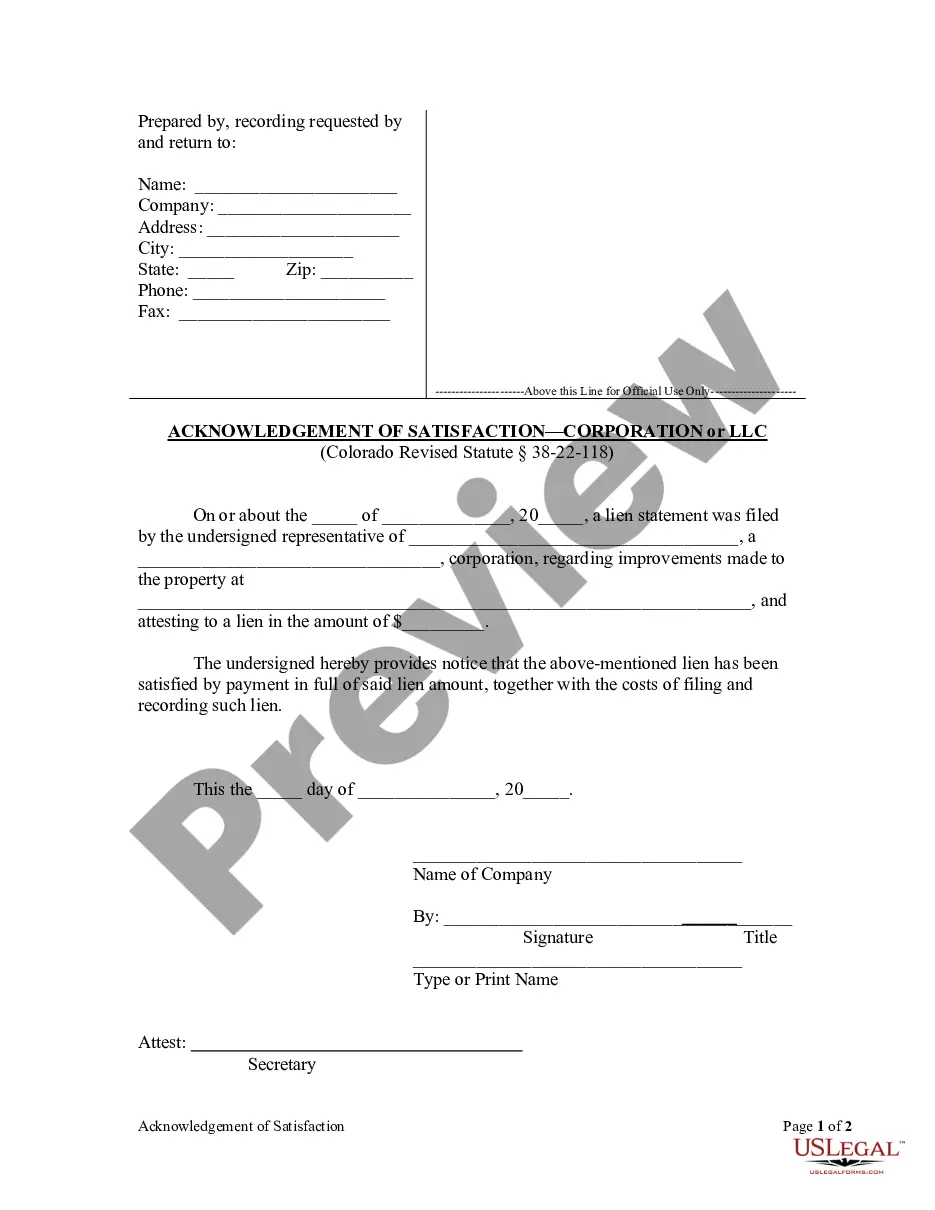

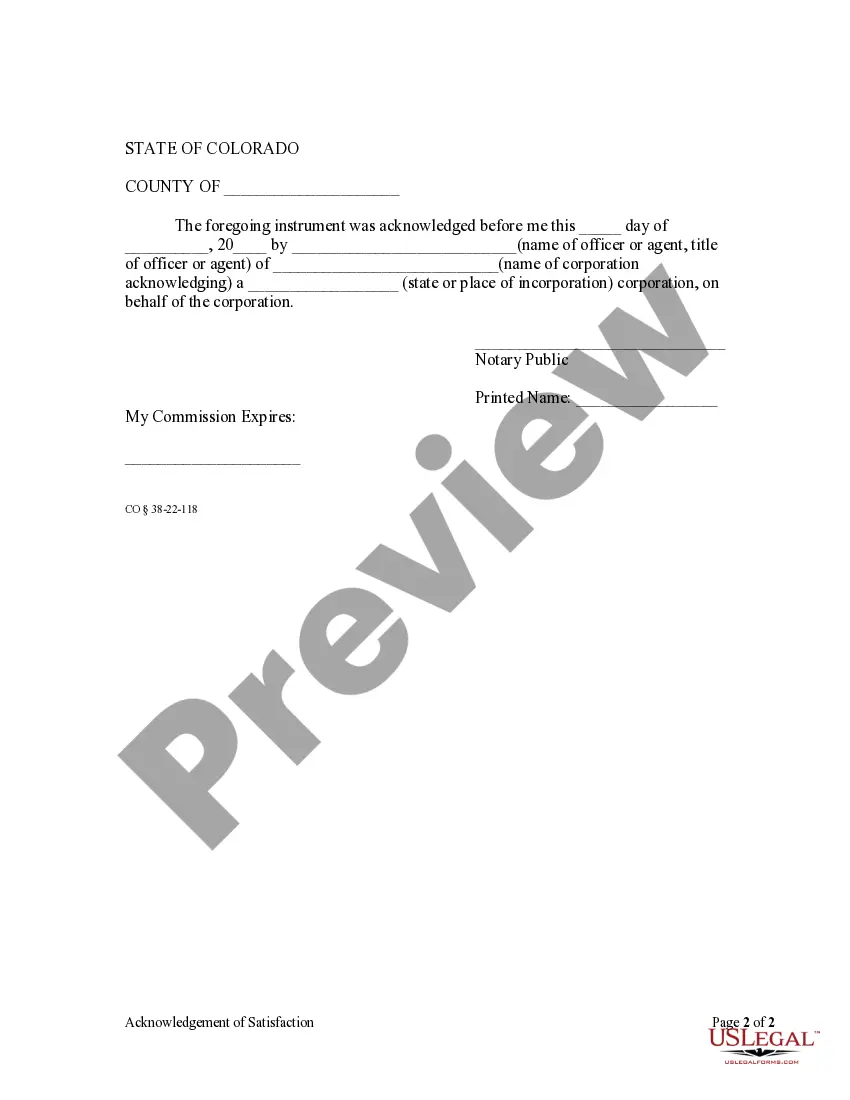

Pursuant to Colorado Revised Statute section 38-22-118, a corporation who has previously filed a lien statement must file an Acknowledgment of Satisfaction after payment in full of the amount attested to in the lien statement, including the cost of filing and recording said lien. Failure to file this acknowledgment within ten (10) days of the request of the property owner to do so may result in a statutory penalty of $10.00 per day being assessed against the lien claimant.

Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation

Description

How to fill out Colorado Acknowledgment Of Satisfaction Of Lien By Corporation?

If you're seeking a legitimate form, it’s hard to discover a superior platform than the US Legal Forms website – likely the most extensive online collections.

With this collection, you can locate thousands of form examples for business and personal reasons by categories and areas, or keywords.

Utilizing our premium search feature, locating the latest Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC is as simple as 1-2-3.

Obtain the document. Select the file format and download it to your device.

Edit as needed. Fill in, modify, print, and sign the acquired Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC is to Log In to your user account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the guidelines below.

- Ensure you have accessed the example you need. Review its details and use the Preview function (if available) to examine its content. If it doesn’t match your needs, use the Search field at the top of the screen to find the necessary document.

- Verify your choice. Click the Buy now button. Then, select the desired subscription plan and provide information to create an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Discharging a lien means officially removing it from public record, indicating that the debt has been satisfied. This process allows property owners to clear their title and regain full ownership rights. The Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation is a critical document in this process, confirming that the lien has been appropriately discharged.

Getting a release of a lien letter involves reaching out to the organization that filed the lien. Provide them with documentation showing the debt is cleared. They will prepare and send you a release document, potentially including the Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation. For convenience, US Legal Forms can assist in drafting this release request.

To find a lien on a property in Colorado, start by checking public records at the county clerk’s office where the property is located. You can also use online databases that list recorded liens. By doing this, you can quickly identify any Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation connected to the property in question, aiding your research.

Requesting a lien removal typically involves communicating with the lienholder. You must present proof that the debt has been settled, which could include a payment receipt or a settlement statement. For a smooth process, utilize a template for the Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation found on platforms like US Legal Forms, ensuring all steps are properly followed.

To obtain a lien release letter, you should contact the creditor or the entity that placed the lien against your property. Make sure to provide them with relevant details about the lien, including property information. Once they verify the debt is satisfied, they will issue the Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation. If you need assistance, consider using US Legal Forms to streamline the process.

Filling out a notice of lien in Fort Collins, Colorado, requires specific information. Start by including details about the lien claimant and the property in question. You must also describe the obligation that caused the lien. Consider using US Legal Forms, which provides templates to help you accurately complete the Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation.

In Colorado, you typically have up to six months after completing work or providing materials to file a lien. This timeline emphasizes the importance of acting promptly to secure your financial interests. By correctly assembling documents like the Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation, you ensure your claims are respected and legally binding. Taking these steps can lead to satisfactory conclusions in financial matters.

In Colorado, a notice extending the time to file a lien statement must be served before the expiration of the original timeline. It provides an additional period for claiming a lien, which can significantly impact your rights. The Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation can play a vital role in documenting the completion of obligations after the extension. Proper notices help maintain clarity in property transactions.

In Colorado, lien waivers do not require notarization to be legally valid. However, they must be in written form and signed by the party releasing the lien. This process is crucial when settling debts, particularly related to the Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation. Freeing yourself from lien obligations can create smoother transactions and maintain business relationships.

In Colorado, you generally have to file an intent to lien within 90 days after the last labor or materials were supplied. This document notifies the property owner that you intend to file a lien if payment is not made. Utilizing the Fort Collins Colorado Acknowledgment of Satisfaction of Lien by Corporation can clarify the resolution process once payment is received. Prompt action is key to protecting your interests.