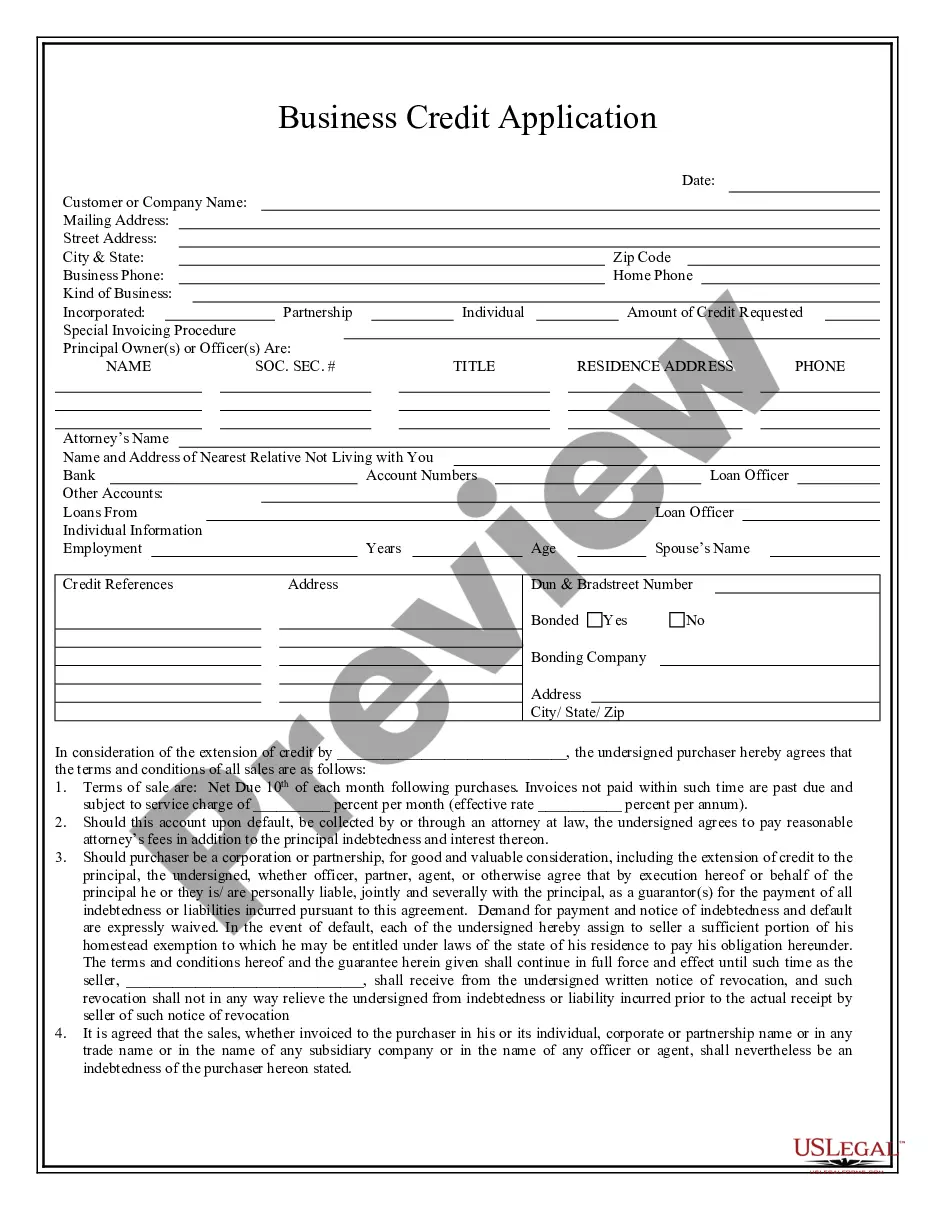

Arvada Colorado Business Credit Application is a formal document used by businesses in Arvada, Colorado, to apply for credit or financing from financial institutions, banks, or lenders. This application enables businesses to request funds for various purposes such as expanding their operations, purchasing inventory, or investing in capital assets. The Arvada Colorado Business Credit Application typically includes detailed information about the business, its owners, and the purpose for which the credit is being sought. The application may vary depending on the financial institution or lender, but it generally contains the following key sections: 1. Business Information: This section includes the legal name of the business, its address, contact details, and the type of business entity (sole proprietorship, partnership, corporation, etc.). It may also require the business's federal tax ID or employer identification number (EIN). 2. Ownership Details: Here, applicants need to provide information about the business owners, including their names, addresses, social security numbers, and percentage of ownership in the company. If the business has multiple owners, each owner's information is typically required. 3. Financial Information: This section focuses on the financial health and history of the business. It may include details such as the business's annual revenue, net income, current debt obligations, and credit history. Applicants might need to provide financial documents like balance sheets, income statements, and tax returns to support the application. 4. Purpose of Credit: In this section, applicants must clearly state the purpose for which they are seeking credit. This might include funding for working capital, equipment purchase, real estate acquisition, or any other specific financial need of the business. Clear and concise explanations help lenders understand how the requested funds will be utilized. 5. Credit Amount and Terms: Here, applicants specify the desired credit amount along with the proposed repayment terms, including repayment duration, interest rate, and any collateral offered as security. Additionally, businesses may mention if they are seeking a renewable line of credit or a one-time loan. Types of Arvada Colorado Business Credit Applications: 1. Small Business Loan Application: Designed for small businesses, this application focuses on short- or long-term loans to finance various aspects of business growth. 2. Business Line of Credit Application: This type of application allows businesses to request a specific credit limit, which they can access as needed. This revolving credit line enables them to manage fluctuations in cash flow and meet ongoing operational expenses. 3. Equipment Financing Application: This application is specific to businesses seeking credit for purchasing or leasing equipment required for their operations. It typically includes details about the equipment, its cost, and the desired financing terms. 4. Commercial Real Estate Loan Application: Geared towards businesses interested in acquiring or refinancing commercial properties, this application may require additional information such as property appraisals, rent rolls, and environmental impact reports. In conclusion, the Arvada Colorado Business Credit Application serves as a vital tool for businesses in Arvada to access credit and financing options. This comprehensive application helps lenders assess the creditworthiness and financial stability of businesses while facilitating their growth and development.

Arvada Colorado Business Credit Application

Description

How to fill out Arvada Colorado Business Credit Application?

We consistently aim to minimize or evade legal complications when handling intricate legal or financial issues.

To achieve this, we engage attorney services that are typically very costly.

However, not all legal situations are equally challenging. Many can be managed by ourselves.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the document, you can always re-download it from the My documents section. The procedure is equally simple if you’re new to the site! You can create your account in just a few minutes. Ensure that the Arvada Colorado Business Credit Application aligns with the laws and regulations of your state and area. Additionally, it’s crucial to review the form’s description (if available), and if you find any inconsistencies with what you were initially seeking, look for an alternate template. Once you’ve confirmed that the Arvada Colorado Business Credit Application meets your requirements, you can select a subscription plan and proceed to payment. After that, you can download the document in any compatible format. For over 24 years in the market, we’ve assisted millions by providing ready-to-customize and current legal forms. Take advantage of US Legal Forms now to conserve effort and resources!

- Our library enables you to handle your issues independently without resorting to a lawyer.

- We provide access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, making the search process considerably easier.

- Utilize US Legal Forms whenever you need to obtain and download the Arvada Colorado Business Credit Application or any other document with ease and security.

Form popularity

FAQ

You can form an LLC even if you have bad credit, as the formation process does not consider personal credit scores. The most critical requirement is that you follow the legal steps to register the LLC in your state. When applying for an LLC, you might want to consider using an Arvada Colorado Business Credit Application to explore credit options related to your new business venture.

Yes, you can build business credit even if your personal credit is not strong. By focusing on establishing separate business credit accounts and maintaining prompt payments, you can slowly improve your credit profile. Leveraging tools like the Arvada Colorado Business Credit Application can help you access resources that support your journey towards stronger business credit.

A business credit application is a formal request that a business owner submits to financial institutions to secure credit. This document typically includes detailed information about your business, including financial history and operational plans. When preparing an Arvada Colorado Business Credit Application, make sure to present a clear picture of your business's financial health to increase your chances of approval.

To obtain business credit with a low personal credit score, focus on providing solid business financials and establishing trade lines with suppliers. Many financial institutions may consider your business’s revenue over your personal score. Utilizing an Arvada Colorado Business Credit Application can help you connect with lenders interested in your business's growth, rather than just your history.

Finding the easiest business credit card for those with bad credit often means looking for cards that require fewer requirements. Many cards cater to business owners and focus on your business's potential rather than your personal credit. By applying through platforms like US Legal Forms, you can find options tailored for your needs, especially when submitting an Arvada Colorado Business Credit Application.

With a credit score of 620, you may qualify for secured business credit cards or cards that cater to businesses with lower scores. While options may be limited, some lenders understand the nuances of starting or managing a small business. Consider using tools like the Arvada Colorado Business Credit Application to clearly outline your business financials and explore suitable credit card options.

Yes, personal credit scores can influence business credit decisions, especially for small businesses or startups. Lenders often check personal credit histories to assess risk. Therefore, a strong Arvada Colorado Business Credit Application should reflect both your business's and personal financial responsibilities.

Obtaining business credit with a poor personal credit score is challenging, but it is not impossible. Some lenders may allow you to secure credit based on your business's financial health rather than your personal credit. Using a well-prepared Arvada Colorado Business Credit Application that highlights your business's strengths can improve your chances.

While specific requirements vary, a personal credit score of at least 680 is often recommended when applying for business credit. However, some lenders may consider lower scores depending on the overall strength of your application. Utilizing an Arvada Colorado Business Credit Application can help present your financials clearly, increasing your chances of approval.

Creating a business credit application form involves gathering key information from applicants. You should include sections for personal information, business details, and financial history. Platforms like U.S. Legal Forms provide templates that simplify the process of developing an effective Arvada Colorado Business Credit Application, helping you streamline your review process.