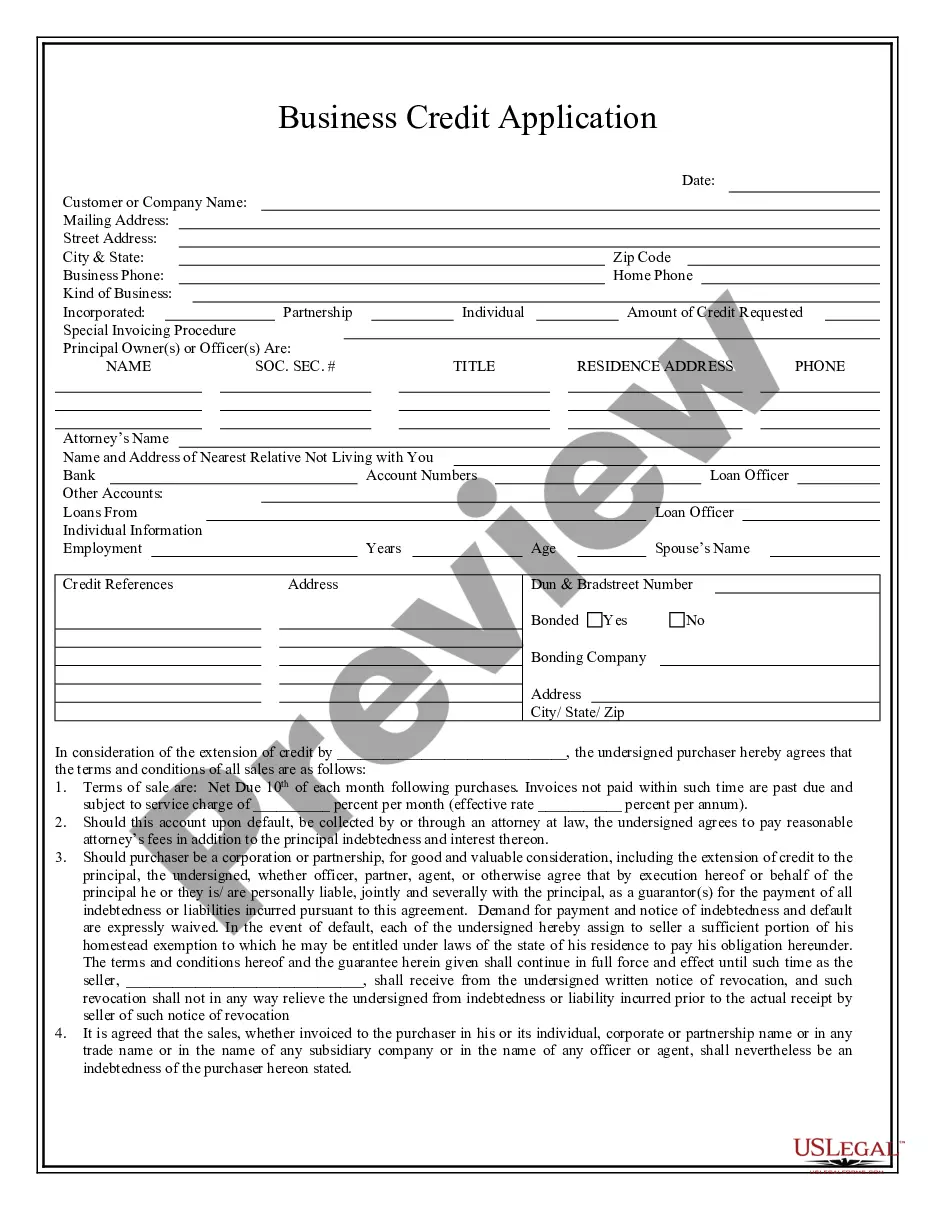

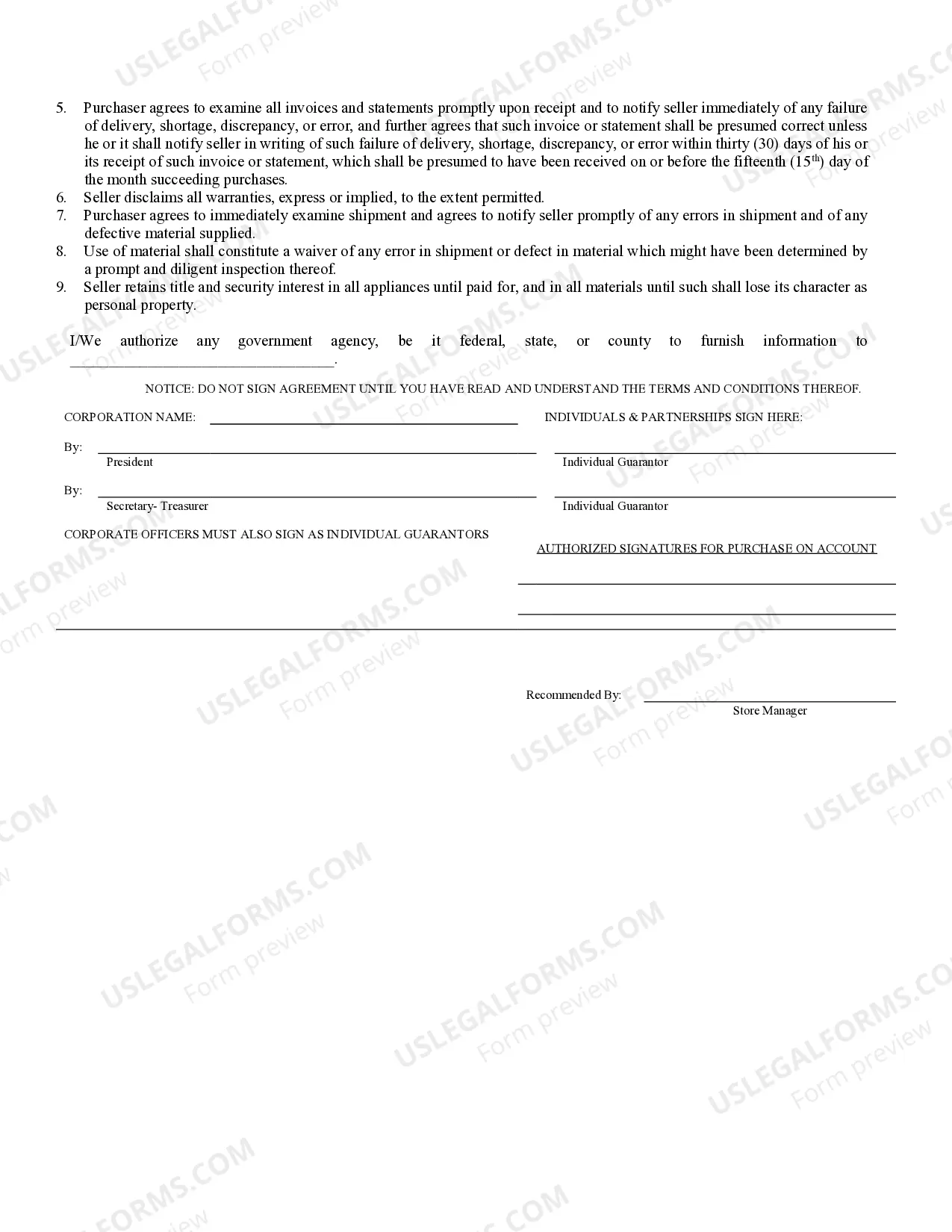

Colorado Springs, Colorado Business Credit Application: A Detailed Description Introduction: In Colorado Springs, Colorado, business owners have access to an array of financial tools to support and grow their enterprises. One such tool is the Colorado Springs Business Credit Application—a vital resource for securing financial assistance to fuel business plans, expansion, or even weather unforeseen challenges. This article offers a comprehensive overview of the characteristics, requirements, and benefits of this credit application. Additionally, it explores the different types of business credit applications available to Colorado Springs entrepreneurs. 1. Features of Colorado Springs Business Credit Application: The Colorado Springs Business Credit Application serves as a formal request for financial assistance from lending institutions, such as banks or credit unions, based in Colorado Springs. By submitting this application, business owners can apply for credit lines, loans, or flexible financing options tailored to their specific needs. The application enables lenders to evaluate the eligibility, credibility, and repayment capacity of the applicant business entity. 2. Key Elements in the Application: a. Business Information: The credit application includes details about the business, such as legal name, address, contact information, and years in operation. This information helps to lend institutions verify the legitimacy and stability of the enterprise. b. Financial History: Providing financial documentation, including income statements, balance sheets, tax returns, and banking records, showcases the business's financial health and repayment capability. Lenders carefully analyze these documents to assess creditworthiness. c. Purpose of Credit: Clarifying how the requested credit will be utilized, whether for working capital, equipment purchase, expansion, or other specific business needs, gives lenders insight into the borrower's intentions and overall business strategy. d. Collateral and Guarantees: Depending on the applicant's financial standing, lenders may require collateral, such as real estate, inventory, or other valuable assets, to secure the credit. Personal guarantees from the business owner(s) may also be necessary to provide an additional layer of security. 3. Types of Colorado Springs Business Credit Applications: a. Traditional Business Loans: These commonly involve a fixed term, interest rate, and monthly repayment schedule. Traditional loans are ideal for businesses seeking a one-time influx of capital for a particular purpose, such as expansion or equipment purchase. b. Business Lines of Credit: In this type of credit application, an approved credit limit is extended to the business, allowing owners to borrow funds as needed within that limit. Interest is charged only on the borrowed amount, offering flexibility and convenience for managing ongoing expenses. c. Small Business Administration (SBA) Loans: Entrepreneurs can also choose to apply for SBA loans, backed by the U.S. Small Business Administration. These loans typically offer competitive interest rates, longer terms, and lower down-payment requirements, making them an attractive option for business owners who meet the SBA's eligibility criteria. Conclusion: The Colorado Springs, Colorado Business Credit Application provides a crucial avenue for business owners to access financial assistance and achieve their commercial goals. By completing this application accurately and comprehensively, entrepreneurs increase their chances of obtaining loans, credit lines, or financing options tailored to their specific requirements. Whether applying for traditional loans, business lines of credit, or SBA loans, Colorado Springs entrepreneurs can leverage the available financial resources to drive growth and success in their endeavors.

Colorado Springs Colorado Business Credit Application

Description

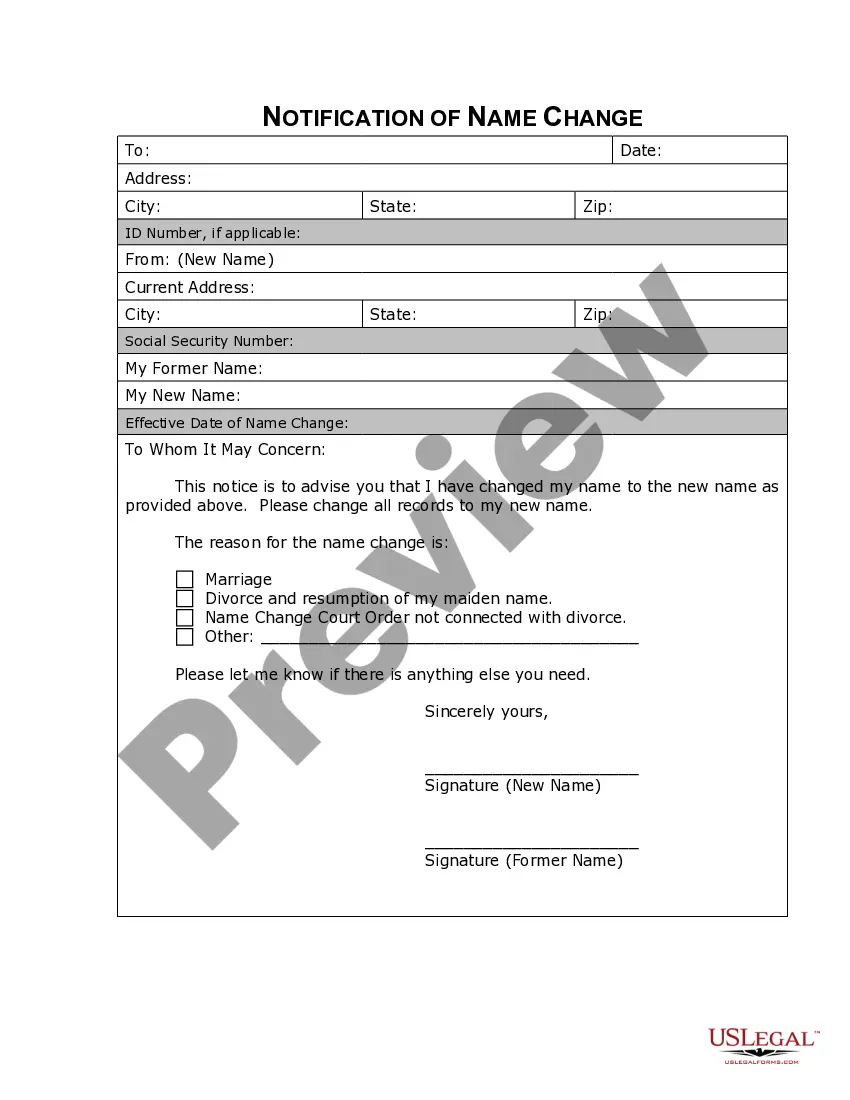

How to fill out Colorado Springs Colorado Business Credit Application?

If you are searching for a relevant form, it’s difficult to find a more convenient service than the US Legal Forms website – one of the most comprehensive libraries on the web. With this library, you can find a large number of form samples for business and individual purposes by categories and states, or keywords. With the high-quality search feature, discovering the most recent Colorado Springs Colorado Business Credit Application is as easy as 1-2-3. Moreover, the relevance of each and every record is verified by a group of skilled attorneys that on a regular basis check the templates on our platform and update them according to the most recent state and county demands.

If you already know about our platform and have an account, all you need to get the Colorado Springs Colorado Business Credit Application is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the sample you want. Check its explanation and make use of the Preview feature to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to discover the appropriate document.

- Affirm your choice. Select the Buy now button. Next, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the template. Indicate the file format and save it to your system.

- Make changes. Fill out, revise, print, and sign the obtained Colorado Springs Colorado Business Credit Application.

Each and every template you add to your user profile does not have an expiry date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you need to get an extra copy for enhancing or printing, you may return and download it again at any time.

Make use of the US Legal Forms professional catalogue to gain access to the Colorado Springs Colorado Business Credit Application you were looking for and a large number of other professional and state-specific samples on a single website!