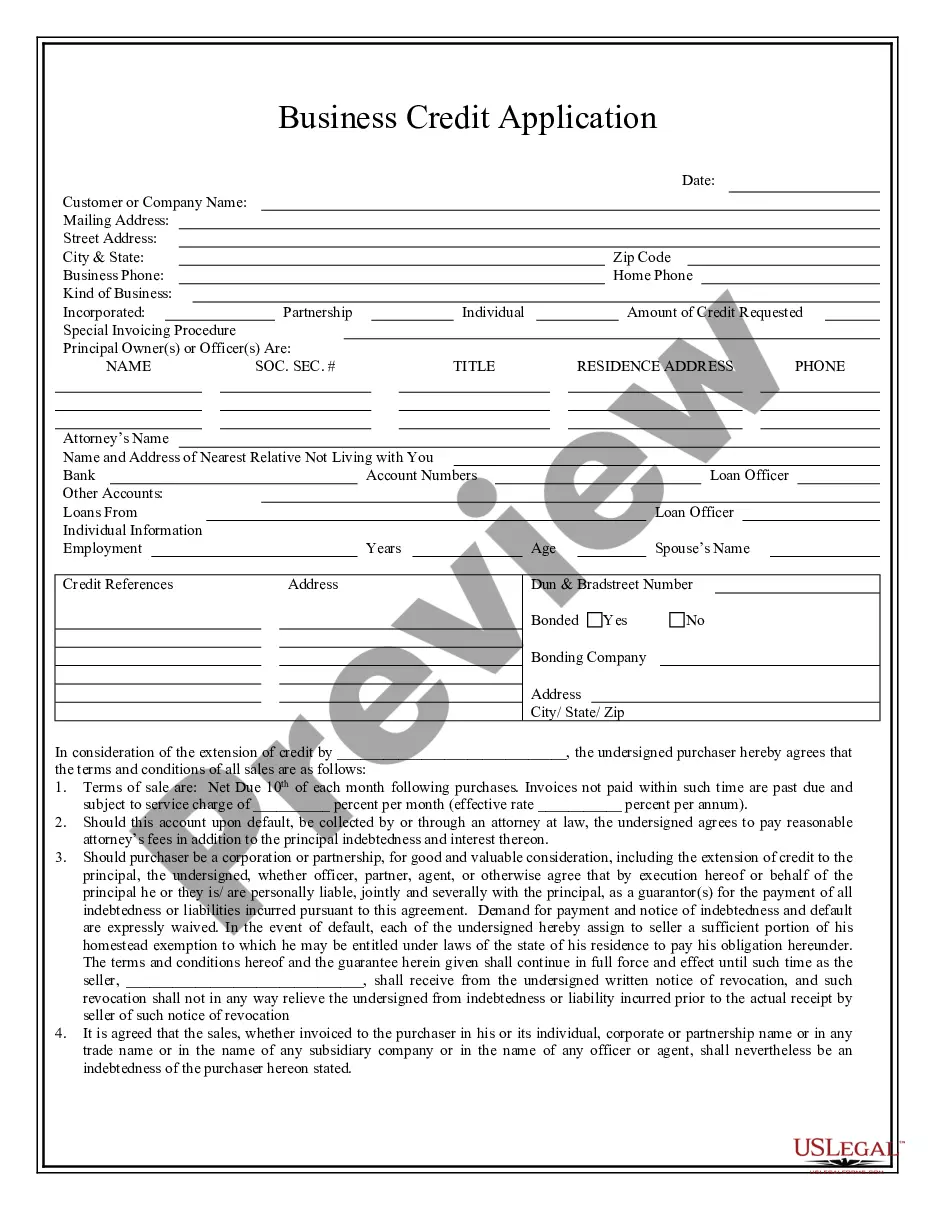

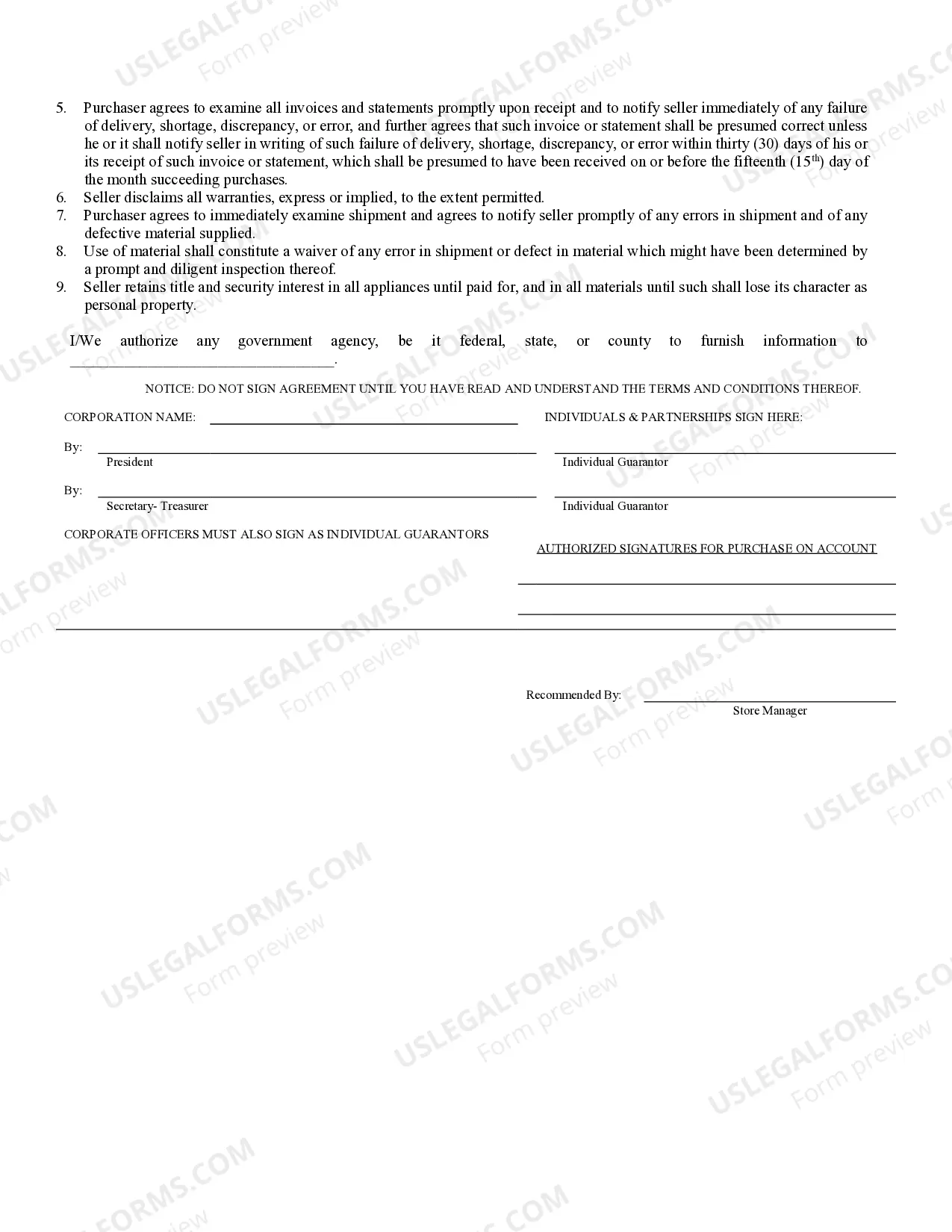

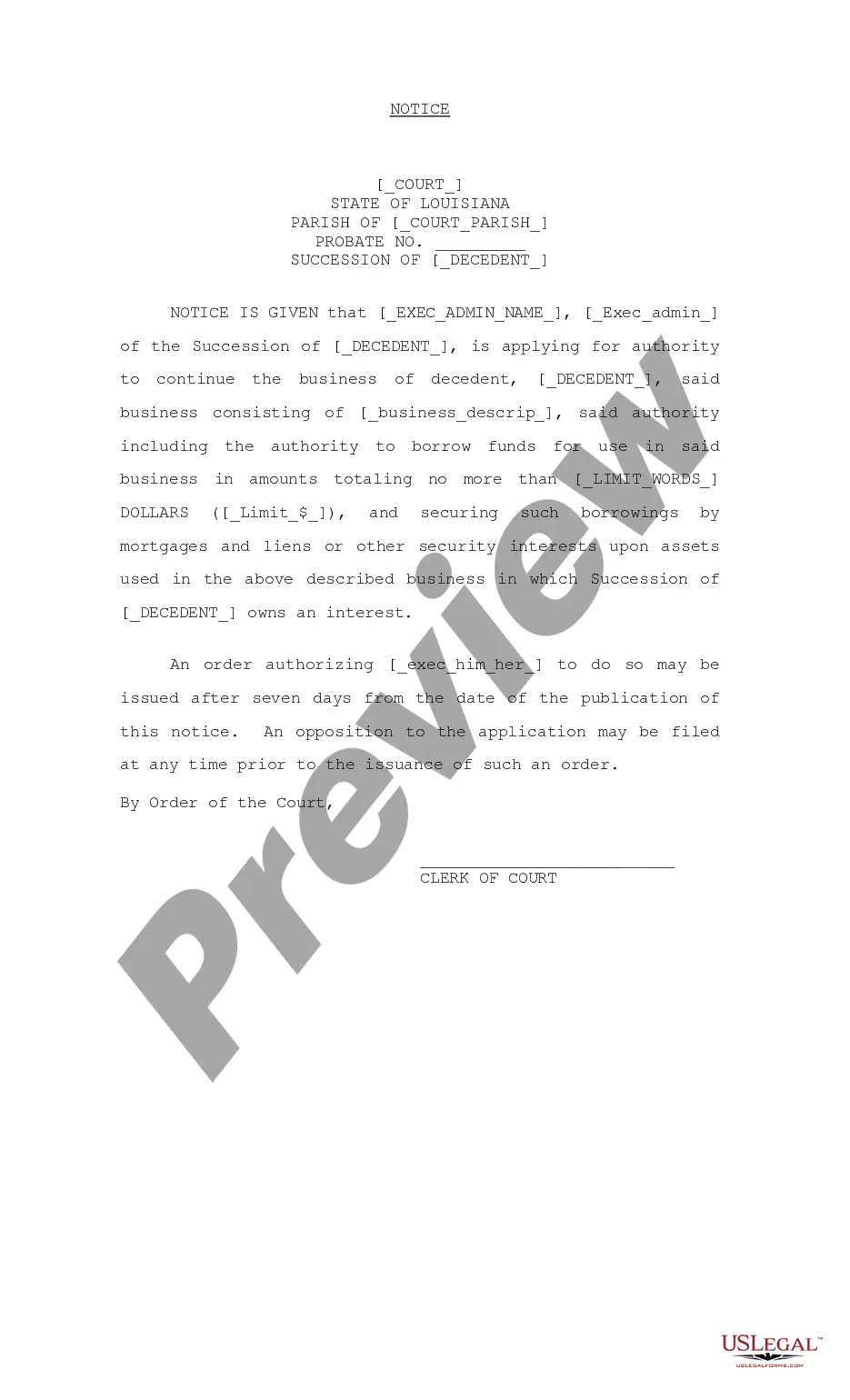

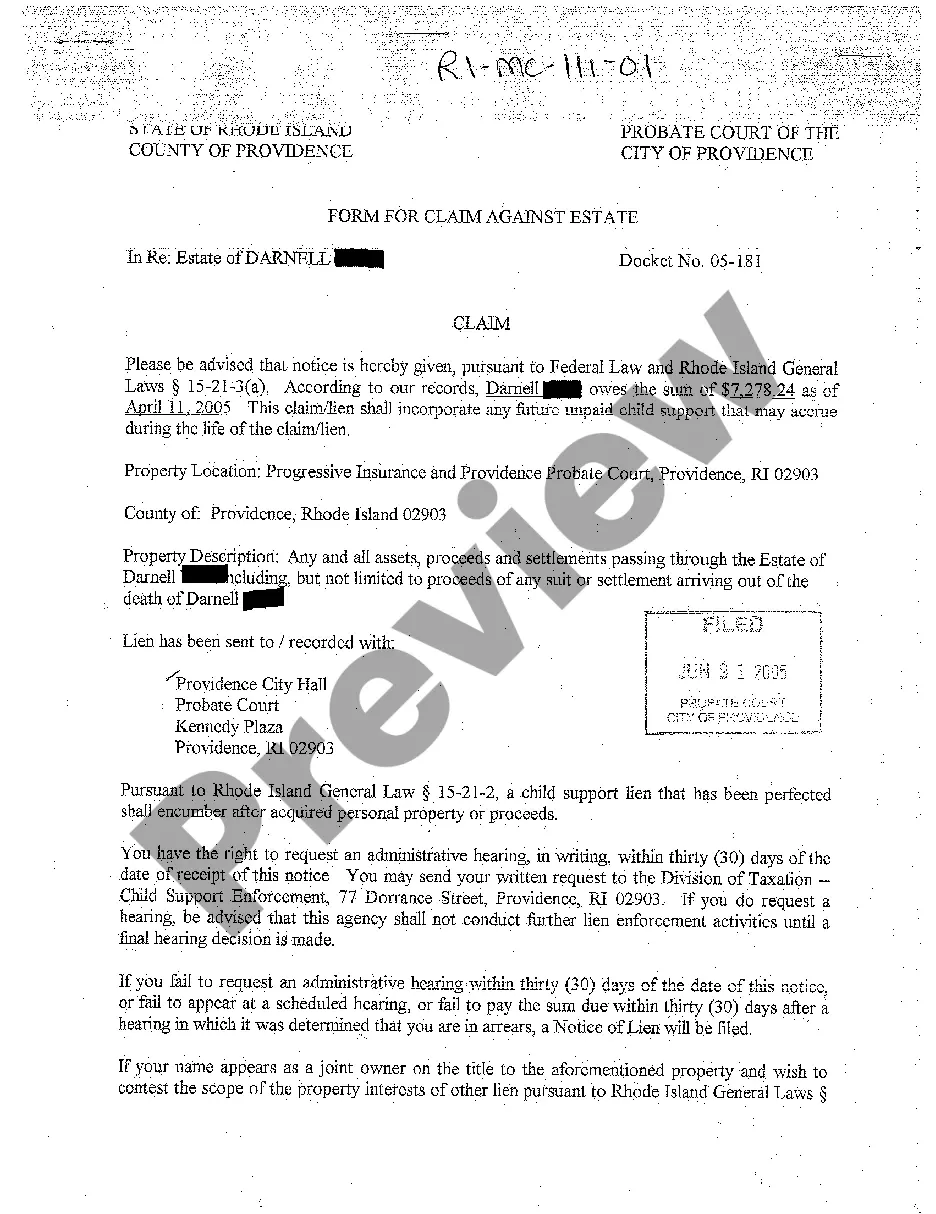

Fort Collins Colorado Business Credit Application is a formal document that local businesses in Fort Collins, Colorado, utilize to apply for credit from financial institutions and other lending entities. The application is designed to gather crucial information about the business, its owner(s), financial status, and creditworthiness, enabling lenders to assess the risk associated with extending credit. Keywords: Fort Collins, Colorado, business credit application, local businesses, credit, financial institutions, lending entities, application process, creditworthiness, risk assessment. Different types of Fort Collins Colorado Business Credit Application: 1. Small Business Credit Application: Designed specifically for small businesses operating in Fort Collins, this application caters to the unique needs of startups, sole proprietors, partnerships, and other small-scale ventures. 2. Corporate Credit Application: Geared towards larger corporations and company structures, this business credit application is suitable for established businesses with a higher credit requirement. It may involve more intricate documentation and financial statements. 3. Real Estate Credit Application: Tailored to meet the credit needs of businesses within the real estate industry, this particular application may focus on the value of real estate assets, property management history, and related financial qualifications. 4. Agricultural Credit Application: This type of application is designed for agricultural businesses or farms in Fort Collins, emphasizing industry-specific criteria such as land value, crop yield, livestock, and other agricultural assets. 5. Construction Credit Application: Targeting construction companies, contractors, and builders, this application may place emphasis on bidding history, project references, and construction-specific financial qualifications. 6. Non-Profit Credit Application: Catering to nonprofit organizations in Fort Collins, this application may differ in its requirements by focusing on the organization's mission, funding sources, and financial stability despite the absence of profit generation. These different types of Fort Collins Colorado Business Credit Application cater to the diverse needs of businesses operating within various industries, allowing lenders to more effectively assess creditworthiness and extend appropriate credit terms.

Fort Collins Colorado Business Credit Application

Description

How to fill out Fort Collins Colorado Business Credit Application?

Do you need a reliable and affordable legal forms provider to buy the Fort Collins Colorado Business Credit Application? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of separate state and county.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Fort Collins Colorado Business Credit Application conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is intended for.

- Restart the search in case the form isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Fort Collins Colorado Business Credit Application in any provided file format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online for good.