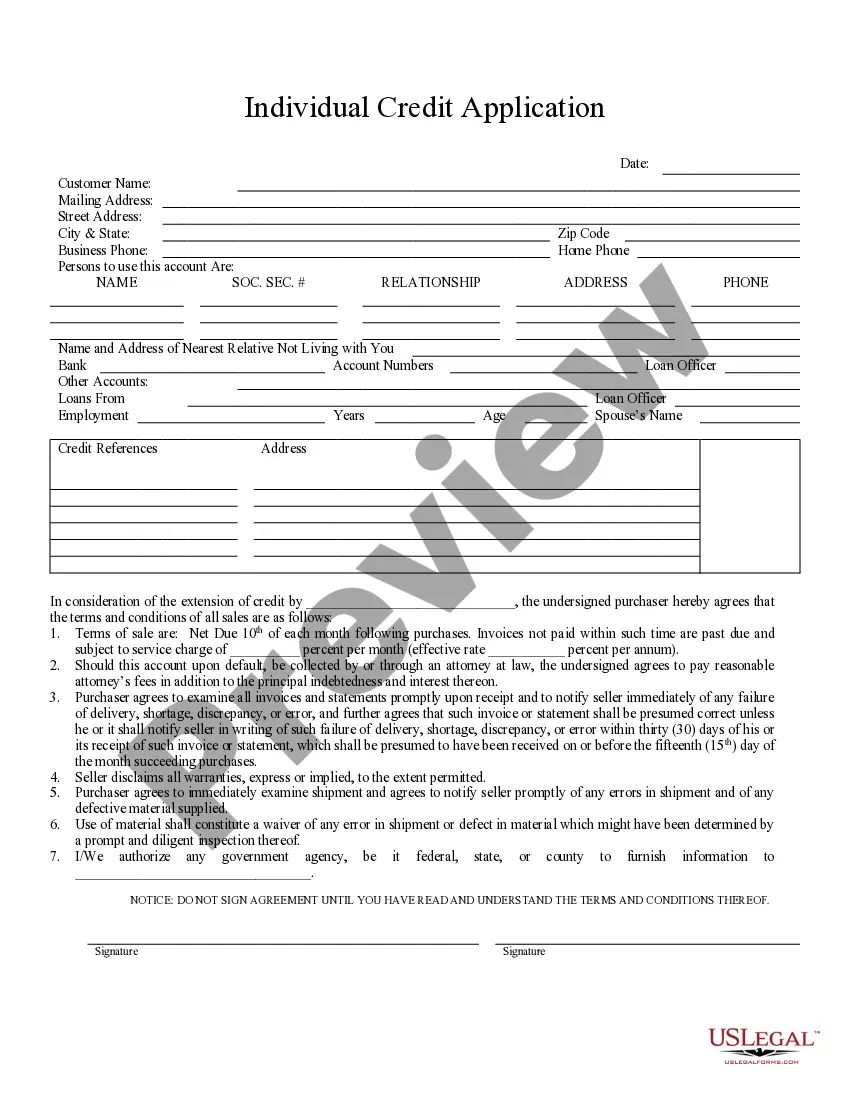

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Arvada Colorado Individual Credit Application is a document used by individuals residing in Arvada, Colorado, to apply for credit or loans from financial institutions or lenders. This application serves as a tool for lenders to assess the creditworthiness of potential borrowers before extending credit facilities to them. The Arvada Colorado Individual Credit Application typically includes various sections and requires applicants to provide personal information, financial details, and employment history. Key information required in this application may encompass: 1. Personal Information: Applicants are typically asked to provide their full name, address, phone number, email address, and social security number. This information helps lenders identify the applicant and verify their identity. 2. Financial Details: This section involves providing details about the applicant's income, including employment details, job stability, and monthly salary. Additionally, applicants may need to disclose other sources of income, such as investments or rental properties. 3. Expenses and Liabilities: It is crucial for applicants to disclose their monthly expenses, including rent/mortgage payments, utilities, car payments, and other outstanding debts like credit card balances, student loans, or existing loans. These details enable lenders to evaluate the borrower's ability to manage their financial obligations. 4. Assets and Collateral: Applicants may need to list their assets, such as real estate, vehicles, investments, or savings accounts. Some lenders may request information about the collateral applicants are willing to provide against the credit facility to secure the loan. 5. Credit History: Lenders usually require applicants to provide details about their current and past credit accounts, including credit cards, loans, and mortgages. This information helps lenders assess the applicant's creditworthiness based on their history of making timely payments. It's worth noting that there are different types of Arvada Colorado Individual Credit Applications available, depending on the specific financial institution or lender. Some variations may include: 1. Arvada Colorado Personal Loan Application: This application is specifically designed for individuals seeking personal loans, usually for purposes like home improvements, debt consolidation, or unexpected expenses. 2. Arvada Colorado Mortgage Loan Application: This application is tailored for individuals looking to obtain a mortgage loan to purchase a property or refinance an existing mortgage. 3. Arvada Colorado Auto Loan Application: This application targets individuals intending to finance the purchase of a vehicle, enabling them to apply for an auto loan. 4. Arvada Colorado Credit Card Application: This application form is utilized when applying for a credit card issued by a financial institution located in Arvada, enabling individuals to access credit with specific terms and benefits. In conclusion, the Arvada Colorado Individual Credit Application is a comprehensive form used by individuals in Arvada to apply for credit or loans from financial institutions or lenders. It encompasses various sections requesting personal information, financial details, employment history, and other relevant information. Different types of credit applications exist, tailored for specific credit facilities, such as personal loans, mortgage loans, auto loans, or credit cards.Arvada Colorado Individual Credit Application is a document used by individuals residing in Arvada, Colorado, to apply for credit or loans from financial institutions or lenders. This application serves as a tool for lenders to assess the creditworthiness of potential borrowers before extending credit facilities to them. The Arvada Colorado Individual Credit Application typically includes various sections and requires applicants to provide personal information, financial details, and employment history. Key information required in this application may encompass: 1. Personal Information: Applicants are typically asked to provide their full name, address, phone number, email address, and social security number. This information helps lenders identify the applicant and verify their identity. 2. Financial Details: This section involves providing details about the applicant's income, including employment details, job stability, and monthly salary. Additionally, applicants may need to disclose other sources of income, such as investments or rental properties. 3. Expenses and Liabilities: It is crucial for applicants to disclose their monthly expenses, including rent/mortgage payments, utilities, car payments, and other outstanding debts like credit card balances, student loans, or existing loans. These details enable lenders to evaluate the borrower's ability to manage their financial obligations. 4. Assets and Collateral: Applicants may need to list their assets, such as real estate, vehicles, investments, or savings accounts. Some lenders may request information about the collateral applicants are willing to provide against the credit facility to secure the loan. 5. Credit History: Lenders usually require applicants to provide details about their current and past credit accounts, including credit cards, loans, and mortgages. This information helps lenders assess the applicant's creditworthiness based on their history of making timely payments. It's worth noting that there are different types of Arvada Colorado Individual Credit Applications available, depending on the specific financial institution or lender. Some variations may include: 1. Arvada Colorado Personal Loan Application: This application is specifically designed for individuals seeking personal loans, usually for purposes like home improvements, debt consolidation, or unexpected expenses. 2. Arvada Colorado Mortgage Loan Application: This application is tailored for individuals looking to obtain a mortgage loan to purchase a property or refinance an existing mortgage. 3. Arvada Colorado Auto Loan Application: This application targets individuals intending to finance the purchase of a vehicle, enabling them to apply for an auto loan. 4. Arvada Colorado Credit Card Application: This application form is utilized when applying for a credit card issued by a financial institution located in Arvada, enabling individuals to access credit with specific terms and benefits. In conclusion, the Arvada Colorado Individual Credit Application is a comprehensive form used by individuals in Arvada to apply for credit or loans from financial institutions or lenders. It encompasses various sections requesting personal information, financial details, employment history, and other relevant information. Different types of credit applications exist, tailored for specific credit facilities, such as personal loans, mortgage loans, auto loans, or credit cards.