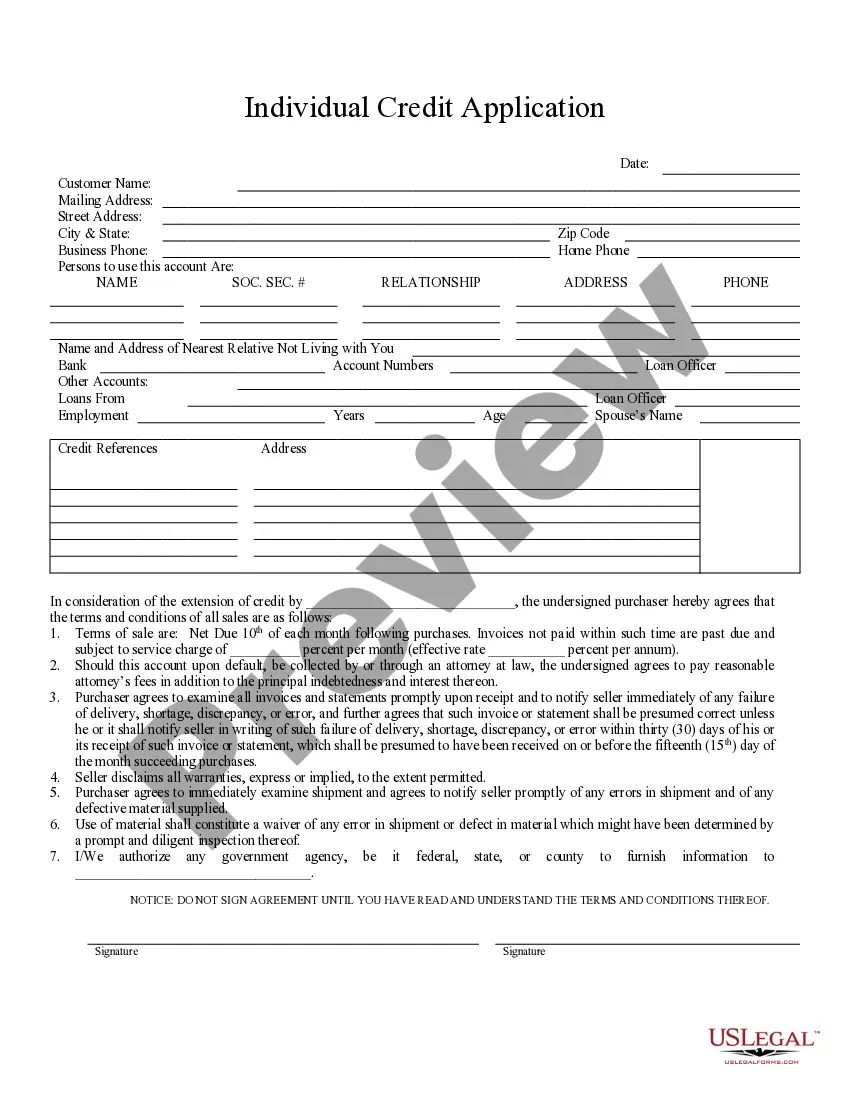

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Colorado Springs, Colorado Individual Credit Application: A Comprehensive Overview The Colorado Springs Individual Credit Application is a crucial document used by individuals residing in the Colorado Springs area when seeking credit approval from financial institutions or lenders. This application enables individuals to apply for various types of credit, such as personal loans, mortgages, credit cards, and lines of credit, based on their specific financial needs. Colorado Springs, Colorado offers several types of individual credit applications to cater to the diverse financial requirements of its residents. These may include: 1. Personal Credit Application: This type of credit application is ideal for individuals seeking financial assistance for personal purposes like debt consolidation, medical expenses, home improvements, or general expenses. The application requires applicants to provide detailed information on their income, employment history, current debts, and assets. 2. Mortgage Credit Application: For those planning to purchase or refinance a home in Colorado Springs, the mortgage credit application is an essential document. It requests comprehensive details about the applicant's financial situation, employment history, income sources, credit score, and the property they intend to finance. This information assists lenders in determining the financial viability of the applicant and their ability to repay the loan. 3. Credit Card Application: Colorado Springs residents can apply for credit cards, either secured or unsecured, through credit card applications. These applications collect critical personal information, including income, employment details, and credit history. Different credit card providers in Colorado Springs may offer unique application processes and requirements. 4. Auto Loan Credit Application: Individuals interested in buying a vehicle in Colorado Springs can apply for an auto loan by submitting an auto loan credit application. This application typically includes information about the applicant's income, employment, credit history, and the desired loan amount. Lenders use this data to assess the applicant's creditworthiness and determine the loan terms. Regardless of the type of credit application, it is essential to provide accurate and up-to-date information to increase the chances of approval. Any false information or incomplete details may lead to delays or even rejection of the application. Additionally, applicants should familiarize themselves with the lending institution's specific requirements and criteria before submitting their application. Colorado Springs, Colorado Individual Credit Applications play a vital role in helping individuals achieve their financial goals, whether it involves purchasing a home, obtaining a credit card, or securing an auto loan. By completing these applications accurately and thoroughly, residents of Colorado Springs can maximize their chances of obtaining the credit they need to achieve their financial objectives.Colorado Springs, Colorado Individual Credit Application: A Comprehensive Overview The Colorado Springs Individual Credit Application is a crucial document used by individuals residing in the Colorado Springs area when seeking credit approval from financial institutions or lenders. This application enables individuals to apply for various types of credit, such as personal loans, mortgages, credit cards, and lines of credit, based on their specific financial needs. Colorado Springs, Colorado offers several types of individual credit applications to cater to the diverse financial requirements of its residents. These may include: 1. Personal Credit Application: This type of credit application is ideal for individuals seeking financial assistance for personal purposes like debt consolidation, medical expenses, home improvements, or general expenses. The application requires applicants to provide detailed information on their income, employment history, current debts, and assets. 2. Mortgage Credit Application: For those planning to purchase or refinance a home in Colorado Springs, the mortgage credit application is an essential document. It requests comprehensive details about the applicant's financial situation, employment history, income sources, credit score, and the property they intend to finance. This information assists lenders in determining the financial viability of the applicant and their ability to repay the loan. 3. Credit Card Application: Colorado Springs residents can apply for credit cards, either secured or unsecured, through credit card applications. These applications collect critical personal information, including income, employment details, and credit history. Different credit card providers in Colorado Springs may offer unique application processes and requirements. 4. Auto Loan Credit Application: Individuals interested in buying a vehicle in Colorado Springs can apply for an auto loan by submitting an auto loan credit application. This application typically includes information about the applicant's income, employment, credit history, and the desired loan amount. Lenders use this data to assess the applicant's creditworthiness and determine the loan terms. Regardless of the type of credit application, it is essential to provide accurate and up-to-date information to increase the chances of approval. Any false information or incomplete details may lead to delays or even rejection of the application. Additionally, applicants should familiarize themselves with the lending institution's specific requirements and criteria before submitting their application. Colorado Springs, Colorado Individual Credit Applications play a vital role in helping individuals achieve their financial goals, whether it involves purchasing a home, obtaining a credit card, or securing an auto loan. By completing these applications accurately and thoroughly, residents of Colorado Springs can maximize their chances of obtaining the credit they need to achieve their financial objectives.