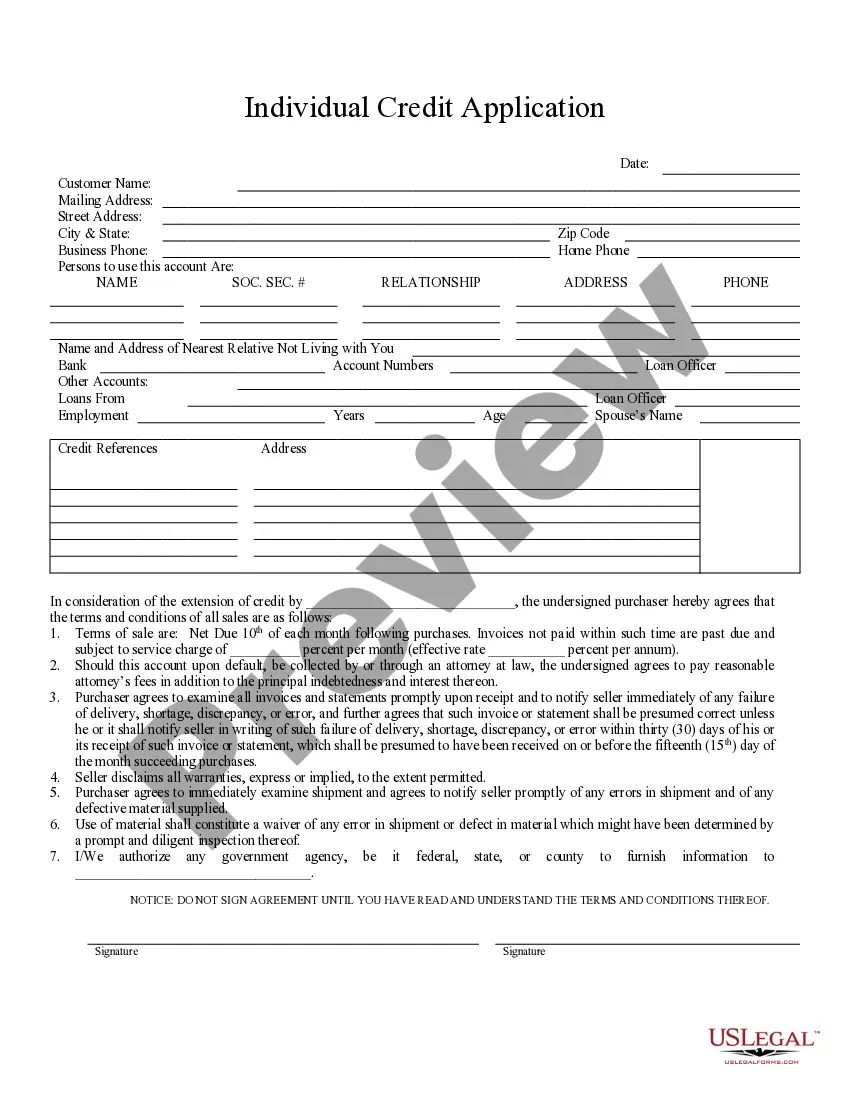

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Fort Collins Colorado Individual Credit Application: Detailed Description and Types A Fort Collins Colorado Individual Credit Application is an essential form used by individuals residing in Fort Collins, Colorado, who are seeking to establish credit with a financial institution or obtain a loan. The application provides crucial information to the lender, allowing them to evaluate the creditworthiness and financial stability of the applicant. This credit application typically requires individuals to provide personal details such as their full name, contact information, social security number, and date of birth. Additionally, applicants are usually asked to include employment details, including current and previous job information, income, and length of employment. These details help the lender assess the applicant's ability to make regular and timely payments. Furthermore, the Fort Collins Colorado Individual Credit Application prompts individuals to disclose their financial assets and liabilities such as bank accounts, investments, outstanding debts, and monthly expenses. This information offers the lender valuable insights into the applicant's financial situation and overall financial responsibility. Additionally, the credit application form may inquire about an applicant's previous credit history, including any past loans, defaults, bankruptcies, or delinquencies. This information allows the lender to determine the individual's creditworthiness and assess the risk associated with extending credit. Different Types of Fort Collins Colorado Individual Credit Applications: 1. Personal Loan Credit Application: This type of credit application is specifically designed for individuals seeking personal loans in Fort Collins, Colorado. It enables individuals to request funds for various purposes such as debt consolidation, home improvements, or educational expenses. 2. Mortgage Loan Credit Application: Primarily used by individuals aiming to secure a mortgage loan, this application form collects specific details related to the purchase or refinancing of a property. It includes additional sections for property value, down payment, and information about the real estate being financed. 3. Auto Loan Credit Application: Automobile financing applications focus on gathering information relevant to purchasing a vehicle. It includes sections for the make, model, year, and VIN (Vehicle Identification Number) of the car, as well as details regarding insurance coverage. 4. Credit Card Application: This type of credit application grants individuals the opportunity to apply for a credit card issued by a financial institution. It typically includes questions about existing credit cards, desired credit limits, and personal references. Keep in mind that the layout and content of the Fort Collins Colorado Individual Credit Application may vary between lenders and financial institutions. However, the main objective remains constant — to provide comprehensive information to assist lenders in making informed decisions regarding credit approval and terms.Fort Collins Colorado Individual Credit Application: Detailed Description and Types A Fort Collins Colorado Individual Credit Application is an essential form used by individuals residing in Fort Collins, Colorado, who are seeking to establish credit with a financial institution or obtain a loan. The application provides crucial information to the lender, allowing them to evaluate the creditworthiness and financial stability of the applicant. This credit application typically requires individuals to provide personal details such as their full name, contact information, social security number, and date of birth. Additionally, applicants are usually asked to include employment details, including current and previous job information, income, and length of employment. These details help the lender assess the applicant's ability to make regular and timely payments. Furthermore, the Fort Collins Colorado Individual Credit Application prompts individuals to disclose their financial assets and liabilities such as bank accounts, investments, outstanding debts, and monthly expenses. This information offers the lender valuable insights into the applicant's financial situation and overall financial responsibility. Additionally, the credit application form may inquire about an applicant's previous credit history, including any past loans, defaults, bankruptcies, or delinquencies. This information allows the lender to determine the individual's creditworthiness and assess the risk associated with extending credit. Different Types of Fort Collins Colorado Individual Credit Applications: 1. Personal Loan Credit Application: This type of credit application is specifically designed for individuals seeking personal loans in Fort Collins, Colorado. It enables individuals to request funds for various purposes such as debt consolidation, home improvements, or educational expenses. 2. Mortgage Loan Credit Application: Primarily used by individuals aiming to secure a mortgage loan, this application form collects specific details related to the purchase or refinancing of a property. It includes additional sections for property value, down payment, and information about the real estate being financed. 3. Auto Loan Credit Application: Automobile financing applications focus on gathering information relevant to purchasing a vehicle. It includes sections for the make, model, year, and VIN (Vehicle Identification Number) of the car, as well as details regarding insurance coverage. 4. Credit Card Application: This type of credit application grants individuals the opportunity to apply for a credit card issued by a financial institution. It typically includes questions about existing credit cards, desired credit limits, and personal references. Keep in mind that the layout and content of the Fort Collins Colorado Individual Credit Application may vary between lenders and financial institutions. However, the main objective remains constant — to provide comprehensive information to assist lenders in making informed decisions regarding credit approval and terms.