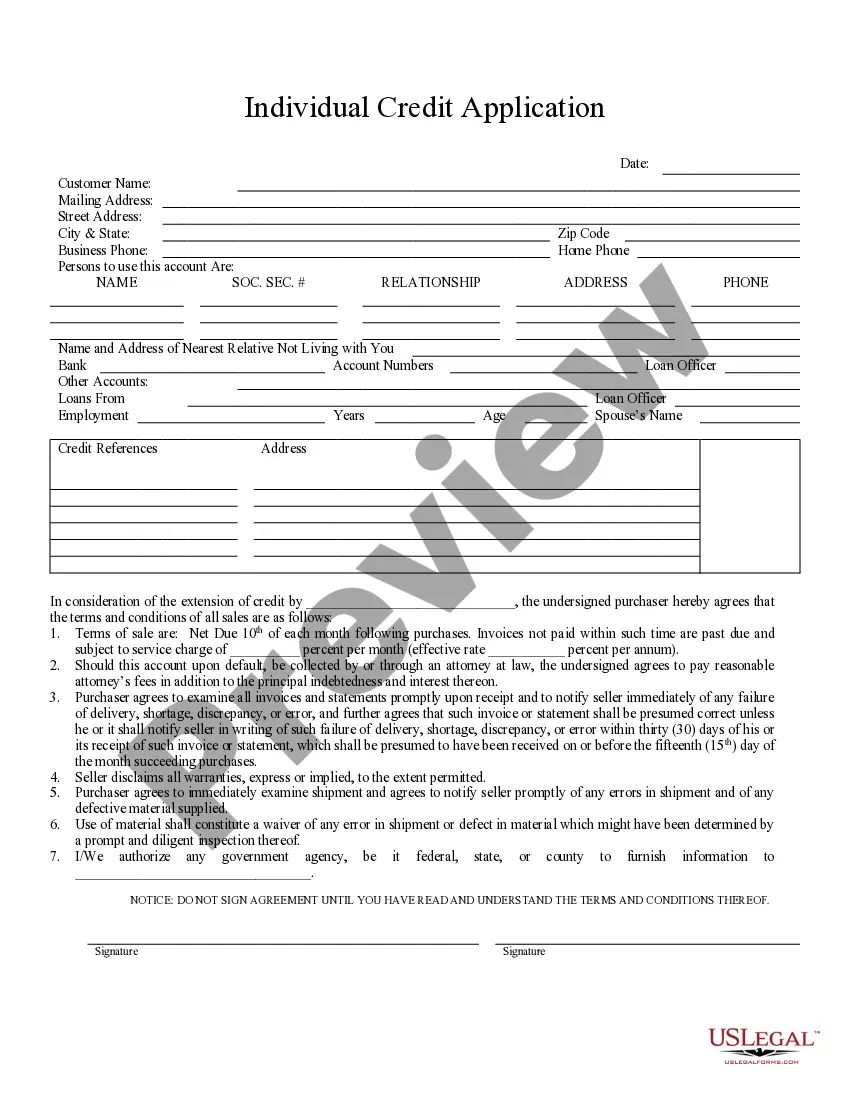

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Lakewood Colorado Individual Credit Application is a comprehensive and standardized form used by financial institutions in Lakewood, Colorado, to gather and assess an individual's creditworthiness when applying for various financial products and services. This application forms an essential part of the loan and credit approval process, allowing lenders to evaluate the applicant's financial stability, income, employment history, and credit history. The Lakewood Colorado Individual Credit Application includes several sections that applicants must complete with accurate and up-to-date information. These sections typically include personal details, such as name, date of birth, social security number, residential address, and contact information. The application also requests comprehensive financial information, including current employment details, income sources, and monthly expenses. Applicants must disclose their employer's name, position held, length of employment, and monthly income. They may also need to provide documentation, such as recent pay stubs or tax returns, to verify their income. Moreover, the credit application requires applicants to disclose their existing debts, such as student loans, credit cards, mortgages, or auto loans. This information assists lenders in determining the applicant's debt-to-income ratio, a key factor in evaluating creditworthiness. Additionally, applicants may be required to provide details about their assets, including real estate, vehicles, investments, and savings accounts. The Lakewood Colorado Individual Credit Application also contains sections dedicated to the applicant's credit history. This includes providing details about prior bankruptcies, foreclosures, or any late payments on loans or credit cards. Additionally, applicants may need to authorize the lender to access their credit reports from major credit bureaus for a thorough analysis. Furthermore, it is essential to note that there may be different types of Lakewood Colorado Individual Credit Applications, depending on the specific financial product or service being applied for. For instance, some common variations may include credit card applications, mortgage applications, auto loan applications, personal loan applications, or business loan applications. Each type of application may have specific sections or questions tailored to the respective financial product. However, all these applications aim to assess an applicant's creditworthiness and determine the level of risk involved in lending money or extending credit.Lakewood Colorado Individual Credit Application is a comprehensive and standardized form used by financial institutions in Lakewood, Colorado, to gather and assess an individual's creditworthiness when applying for various financial products and services. This application forms an essential part of the loan and credit approval process, allowing lenders to evaluate the applicant's financial stability, income, employment history, and credit history. The Lakewood Colorado Individual Credit Application includes several sections that applicants must complete with accurate and up-to-date information. These sections typically include personal details, such as name, date of birth, social security number, residential address, and contact information. The application also requests comprehensive financial information, including current employment details, income sources, and monthly expenses. Applicants must disclose their employer's name, position held, length of employment, and monthly income. They may also need to provide documentation, such as recent pay stubs or tax returns, to verify their income. Moreover, the credit application requires applicants to disclose their existing debts, such as student loans, credit cards, mortgages, or auto loans. This information assists lenders in determining the applicant's debt-to-income ratio, a key factor in evaluating creditworthiness. Additionally, applicants may be required to provide details about their assets, including real estate, vehicles, investments, and savings accounts. The Lakewood Colorado Individual Credit Application also contains sections dedicated to the applicant's credit history. This includes providing details about prior bankruptcies, foreclosures, or any late payments on loans or credit cards. Additionally, applicants may need to authorize the lender to access their credit reports from major credit bureaus for a thorough analysis. Furthermore, it is essential to note that there may be different types of Lakewood Colorado Individual Credit Applications, depending on the specific financial product or service being applied for. For instance, some common variations may include credit card applications, mortgage applications, auto loan applications, personal loan applications, or business loan applications. Each type of application may have specific sections or questions tailored to the respective financial product. However, all these applications aim to assess an applicant's creditworthiness and determine the level of risk involved in lending money or extending credit.