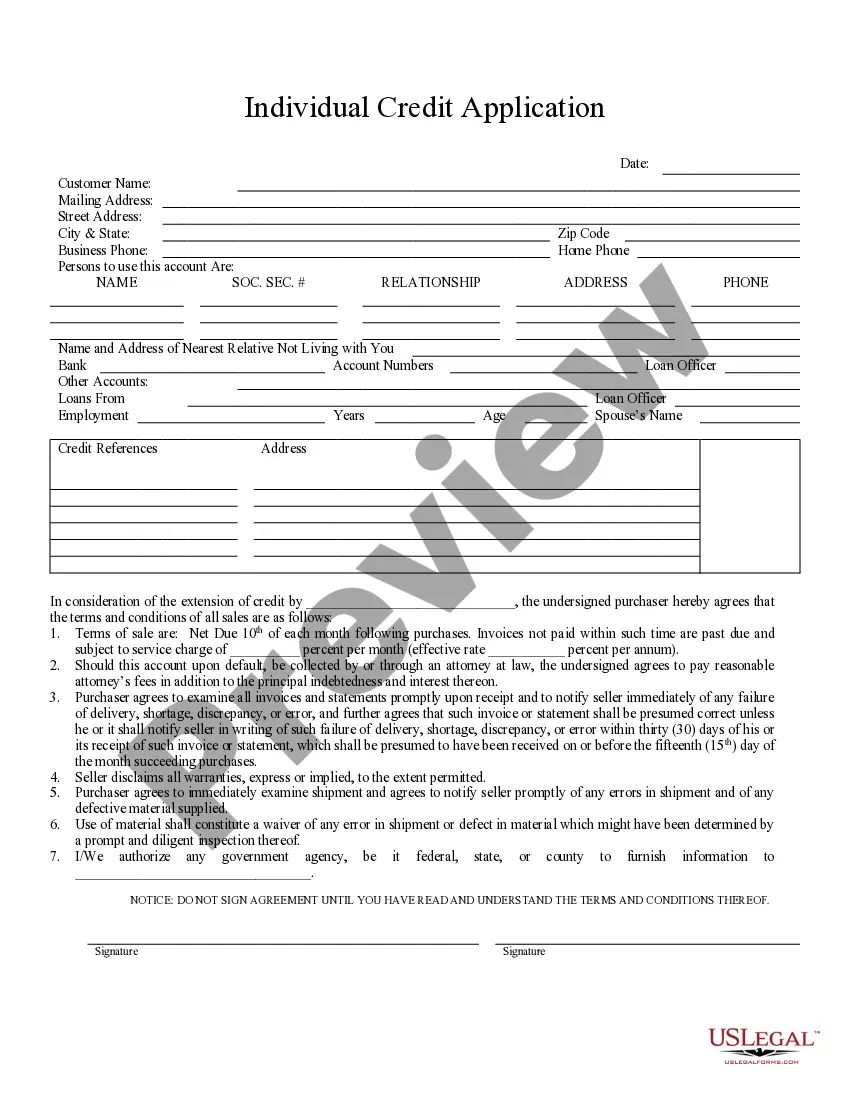

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Title: Exploring the Thornton Colorado Individual Credit Application Process and its Types Introduction: The Thornton Colorado Individual Credit Application serves as an integral tool for individuals seeking financial assistance, allowing them to access various credit facilities. This comprehensive guide will delve into the specifics of the credit application process, highlighting the key features, requirements, and different types available to residents of Thornton, Colorado. 1. Understanding the Thornton Colorado Individual Credit Application Process: The Thornton Colorado Individual Credit Application process facilitates individuals in applying for credit-based services or loans. It involves the collection, evaluation, and verification of personal and financial information, enabling creditors to assess an applicant's creditworthiness and determine the appropriate terms for loan approval. 2. Key Features and Components of a Thornton Colorado Individual Credit Application: a. Personal Information: Applicants are required to provide their name, address, contact details, social security number, date of birth, and other identifying information. b. Employment and Income Details: The application typically requests employment history, salary, and any additional sources of income. c. Financial Information: Involves disclosing existing debts, monthly expenses, assets, and liabilities to provide a complete financial snapshot. d. Credit History: Applicants must disclose their previous credit obligations, payment patterns, and any instances of bankruptcy. 3. Different Types of Thornton Colorado Individual Credit Applications: a. Mortgage Loan Application: Specifically designed for individuals seeking financing for real estate purchases, refinancing, or home equity loans. b. Auto Loan Application: Tailored for those seeking to finance the purchase of a vehicle or refinancing existing auto loans. c. Personal Loan Application: Applicable for individuals requiring funds for personal expenses, debt consolidation, or emergencies. d. Credit Card Application: Ideal for those looking to obtain a credit card, allowing for convenient and flexible access to credit. e. Student Loan Application: Targeted at students or parents seeking financial assistance to cover educational expenses. 4. Credit Application Approval Process: Once the Thornton Colorado Individual Credit Application is submitted, lenders typically evaluate the provided information based on their designated eligibility criteria. They consider factors such as credit score, income, employment stability, and existing debt-to-income ratio. The evaluation process can involve credit checks, income verification, and contacting references. Upon thorough assessment, the lender decides to approve, decline, or offer modified credit terms based on the applicant's creditworthiness. Conclusion: The Thornton Colorado Individual Credit Application serves as an important gateway for individuals seeking financial assistance across various credit products. By understanding the application process and the different types available, residency in Thornton, Colorado becomes an opportunity to access credit services tailored to specific needs. Prospective applicants should thoroughly understand the requirements and ensure accurate and complete information is provided during the application process.Title: Exploring the Thornton Colorado Individual Credit Application Process and its Types Introduction: The Thornton Colorado Individual Credit Application serves as an integral tool for individuals seeking financial assistance, allowing them to access various credit facilities. This comprehensive guide will delve into the specifics of the credit application process, highlighting the key features, requirements, and different types available to residents of Thornton, Colorado. 1. Understanding the Thornton Colorado Individual Credit Application Process: The Thornton Colorado Individual Credit Application process facilitates individuals in applying for credit-based services or loans. It involves the collection, evaluation, and verification of personal and financial information, enabling creditors to assess an applicant's creditworthiness and determine the appropriate terms for loan approval. 2. Key Features and Components of a Thornton Colorado Individual Credit Application: a. Personal Information: Applicants are required to provide their name, address, contact details, social security number, date of birth, and other identifying information. b. Employment and Income Details: The application typically requests employment history, salary, and any additional sources of income. c. Financial Information: Involves disclosing existing debts, monthly expenses, assets, and liabilities to provide a complete financial snapshot. d. Credit History: Applicants must disclose their previous credit obligations, payment patterns, and any instances of bankruptcy. 3. Different Types of Thornton Colorado Individual Credit Applications: a. Mortgage Loan Application: Specifically designed for individuals seeking financing for real estate purchases, refinancing, or home equity loans. b. Auto Loan Application: Tailored for those seeking to finance the purchase of a vehicle or refinancing existing auto loans. c. Personal Loan Application: Applicable for individuals requiring funds for personal expenses, debt consolidation, or emergencies. d. Credit Card Application: Ideal for those looking to obtain a credit card, allowing for convenient and flexible access to credit. e. Student Loan Application: Targeted at students or parents seeking financial assistance to cover educational expenses. 4. Credit Application Approval Process: Once the Thornton Colorado Individual Credit Application is submitted, lenders typically evaluate the provided information based on their designated eligibility criteria. They consider factors such as credit score, income, employment stability, and existing debt-to-income ratio. The evaluation process can involve credit checks, income verification, and contacting references. Upon thorough assessment, the lender decides to approve, decline, or offer modified credit terms based on the applicant's creditworthiness. Conclusion: The Thornton Colorado Individual Credit Application serves as an important gateway for individuals seeking financial assistance across various credit products. By understanding the application process and the different types available, residency in Thornton, Colorado becomes an opportunity to access credit services tailored to specific needs. Prospective applicants should thoroughly understand the requirements and ensure accurate and complete information is provided during the application process.