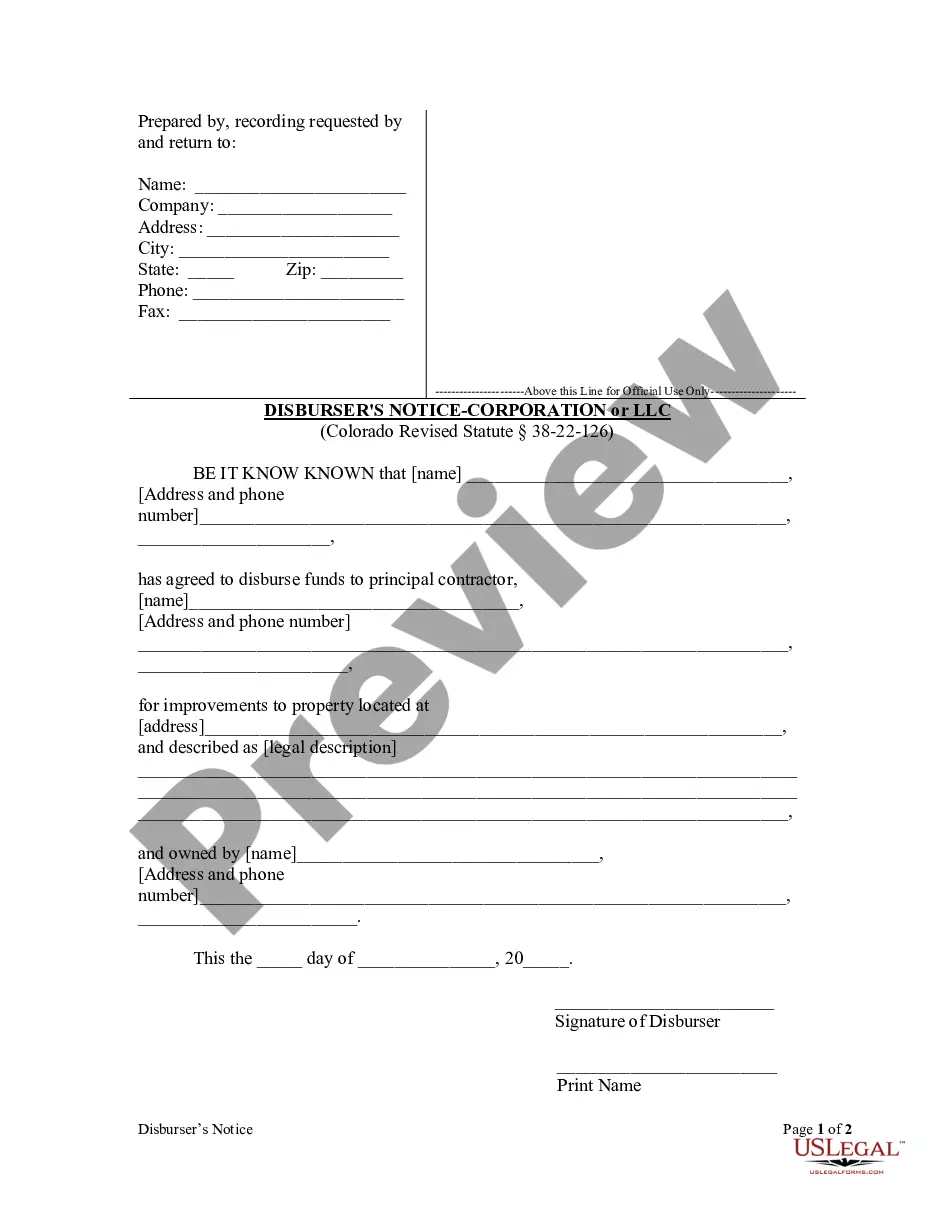

Colorado Revised Statute section 38-22-126 requires lenders who have agreed to make any loan to a contractor to file notice of the disbursement prior to the first disbursement.

Centennial Colorado Disbursed's Notice — Corporation or LLC A Centennial Colorado Disbursed's Notice — Corporation or LLC refers to a legal requirement that corporations and limited liability companies (LCS) in Centennial, Colorado must fulfill. This notice serves as a crucial step in the disbursement of funds held by the corporation or LLC, ensuring proper distribution to the rightful recipients. The disbursed's notice is an essential procedure for both types of entities — corporationanalysisCs. While there may not be different variations of the notice specifically tailored to each type, the overall purpose remains the same. The notice aims to prevent fraudulent or unauthorized disbursements, safeguard the financial interests of the company and its stakeholders, and comply with the legal and regulatory framework governing disbursements in Centennial, Colorado. When preparing a Centennial Colorado Disbursed's Notice — Corporation or LLC, certain key elements must be included to satisfy the legal requirements. These typically involve: 1. Entity Information: The notice should clearly state the name and legal structure of the corporation or LLC, along with any relevant identification numbers, such as the Employer Identification Number (EIN) or Colorado Secretary of State registration number. 2. Disbursed’s Details: The notice should provide accurate information about the disbursed or disbursement agent responsible for handling the distribution of funds. This includes the disbursed's name, title, contact details, and any relevant professional licenses or certifications they possess. 3. Disbursement Purpose: A clear description of the reason for the disbursement should be included in the notice. This could range from normal business operations, such as vendor payments or employee salaries, to special circumstances like dividends, capital distributions, or settlements. 4. Authorized Recipients: The notice should specify the individuals or entities who are authorized to receive the disbursements. This could vary based on the situation and may include shareholders, members, directors, employees, or other parties entitled to receive funds from the corporation or LLC. 5. Disbursement Method: The notice should outline the preferred disbursement method, which can include options such as checks, electronic transfers, or any other approved payment methods. By submitting the Centennial Colorado Disbursed's Notice — Corporation or LLC, the company demonstrates its compliance with state laws and regulations pertaining to the disbursement process. It provides transparency, accountability, and legal protection for all parties involved, ensuring that funds are released to the appropriate recipients in a secure and regulated manner. It is important for corporations and LCS in Centennial, Colorado to understand and adhere to the specific requirements outlined by the relevant authorities, such as the Colorado Secretary of State or other governing bodies, to fulfill their obligations regarding disbursements effectively.Centennial Colorado Disbursed's Notice — Corporation or LLC A Centennial Colorado Disbursed's Notice — Corporation or LLC refers to a legal requirement that corporations and limited liability companies (LCS) in Centennial, Colorado must fulfill. This notice serves as a crucial step in the disbursement of funds held by the corporation or LLC, ensuring proper distribution to the rightful recipients. The disbursed's notice is an essential procedure for both types of entities — corporationanalysisCs. While there may not be different variations of the notice specifically tailored to each type, the overall purpose remains the same. The notice aims to prevent fraudulent or unauthorized disbursements, safeguard the financial interests of the company and its stakeholders, and comply with the legal and regulatory framework governing disbursements in Centennial, Colorado. When preparing a Centennial Colorado Disbursed's Notice — Corporation or LLC, certain key elements must be included to satisfy the legal requirements. These typically involve: 1. Entity Information: The notice should clearly state the name and legal structure of the corporation or LLC, along with any relevant identification numbers, such as the Employer Identification Number (EIN) or Colorado Secretary of State registration number. 2. Disbursed’s Details: The notice should provide accurate information about the disbursed or disbursement agent responsible for handling the distribution of funds. This includes the disbursed's name, title, contact details, and any relevant professional licenses or certifications they possess. 3. Disbursement Purpose: A clear description of the reason for the disbursement should be included in the notice. This could range from normal business operations, such as vendor payments or employee salaries, to special circumstances like dividends, capital distributions, or settlements. 4. Authorized Recipients: The notice should specify the individuals or entities who are authorized to receive the disbursements. This could vary based on the situation and may include shareholders, members, directors, employees, or other parties entitled to receive funds from the corporation or LLC. 5. Disbursement Method: The notice should outline the preferred disbursement method, which can include options such as checks, electronic transfers, or any other approved payment methods. By submitting the Centennial Colorado Disbursed's Notice — Corporation or LLC, the company demonstrates its compliance with state laws and regulations pertaining to the disbursement process. It provides transparency, accountability, and legal protection for all parties involved, ensuring that funds are released to the appropriate recipients in a secure and regulated manner. It is important for corporations and LCS in Centennial, Colorado to understand and adhere to the specific requirements outlined by the relevant authorities, such as the Colorado Secretary of State or other governing bodies, to fulfill their obligations regarding disbursements effectively.