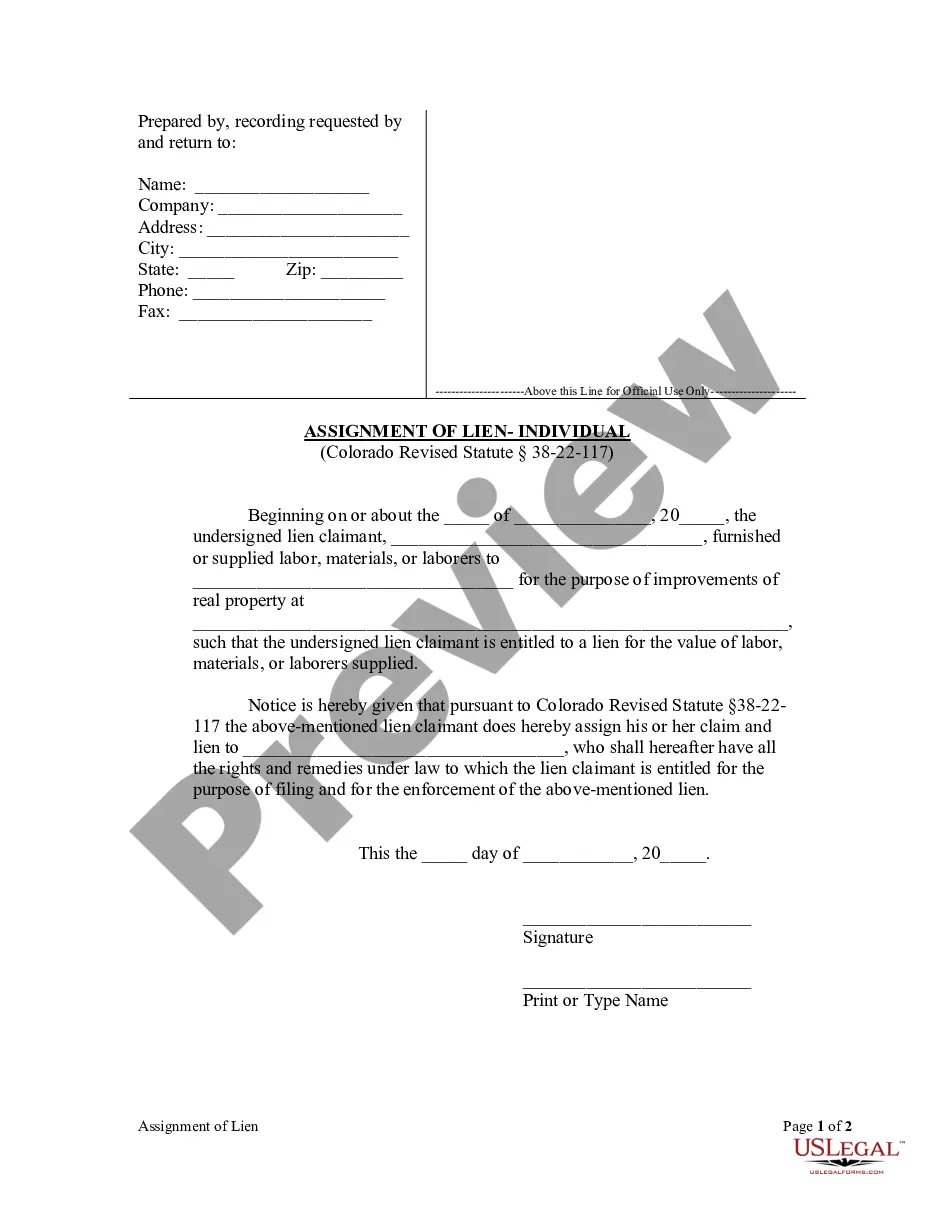

Colorado Revised Statute section 38-22-117 permits a lien claimant to assign his claim and lien to another party who will have all the rights and remedies of the assignor. This assignment may be made before or after the filing of a statement of lien.

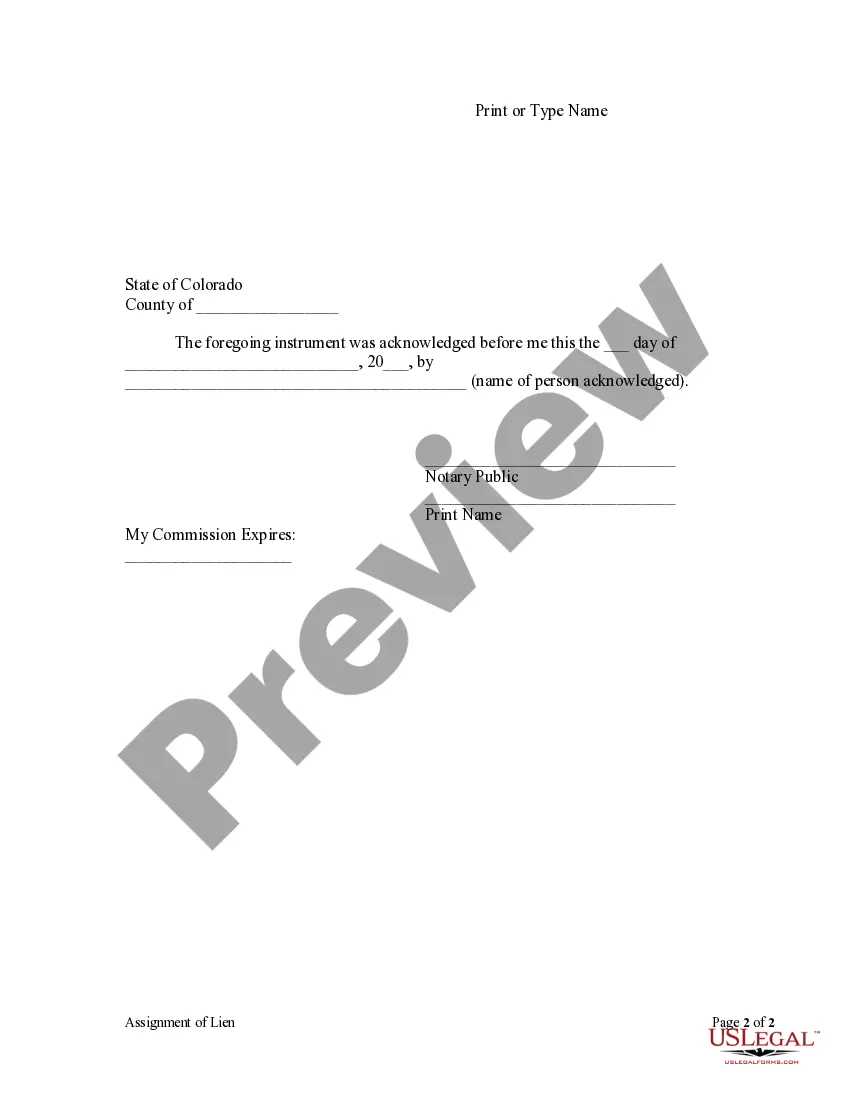

Westminster Colorado Assignment of Lien — Individual is a legal document that transfers the rights and interests of a lien from one individual to another. This assignment typically occurs when an individual, known as the assignor, wants to transfer their lien rights to another individual, known as the assignee. The Westminster Colorado Assignment of Lien — Individual allows for a smooth and legal transfer of a lien, which is a claim against a property to secure payment for a debt or obligation. Liens are often placed on properties when there is unpaid debt, such as unpaid taxes, contractor fees, or mortgage payments. There are different types of Westminster Colorado Assignment of Lien — Individual, each serving a specific purpose. Some common types include: 1. Mechanics' Lien Assignment: This type of assignment refers to the transfer of a mechanics' lien, which is a claim filed by contractors, suppliers, or laborers against a property for unpaid bills related to construction or improvement work. 2. Tax Lien Assignment: In the case of unpaid taxes, the government can place a tax lien on a property. An Assignment of Tax Lien allows the assignor to transfer their rights to the tax lien to the assignee, who then becomes the rightful holder of the lien. 3. Mortgage Lien Assignment: This type of assignment involves the transfer of a mortgage lien, which is a claim against a property used as collateral for a loan. The assignor can transfer their rights and interests in the mortgage lien to the assignee. Completing a Westminster Colorado Assignment of Lien — Individual involves several key components. The document should include the names and addresses of both the assignor and the assignee. It should also clearly state the nature of the lien being assigned and the property on which the lien is attached. Additionally, the assignment should outline any conditions or considerations involved in the transfer, such as payment or other agreements between the parties. By properly executing a Westminster Colorado Assignment of Lien — Individual, both the assignor and the assignee protect their interests and ensure a legal transfer of lien rights. It is crucial to consult with a legal professional experienced in real estate law to draft and review the document to ensure compliance with local laws and regulations. Keywords: Westminster Colorado, Assignment of Lien — Individual, transfer of lien rights, mechanics' lien assignment, tax lien assignment, mortgage lien assignment, unpaid debts, claim against property, unpaid taxes, unpaid bills, collateral, loan, property rights, legal document, real estate law.Westminster Colorado Assignment of Lien — Individual is a legal document that transfers the rights and interests of a lien from one individual to another. This assignment typically occurs when an individual, known as the assignor, wants to transfer their lien rights to another individual, known as the assignee. The Westminster Colorado Assignment of Lien — Individual allows for a smooth and legal transfer of a lien, which is a claim against a property to secure payment for a debt or obligation. Liens are often placed on properties when there is unpaid debt, such as unpaid taxes, contractor fees, or mortgage payments. There are different types of Westminster Colorado Assignment of Lien — Individual, each serving a specific purpose. Some common types include: 1. Mechanics' Lien Assignment: This type of assignment refers to the transfer of a mechanics' lien, which is a claim filed by contractors, suppliers, or laborers against a property for unpaid bills related to construction or improvement work. 2. Tax Lien Assignment: In the case of unpaid taxes, the government can place a tax lien on a property. An Assignment of Tax Lien allows the assignor to transfer their rights to the tax lien to the assignee, who then becomes the rightful holder of the lien. 3. Mortgage Lien Assignment: This type of assignment involves the transfer of a mortgage lien, which is a claim against a property used as collateral for a loan. The assignor can transfer their rights and interests in the mortgage lien to the assignee. Completing a Westminster Colorado Assignment of Lien — Individual involves several key components. The document should include the names and addresses of both the assignor and the assignee. It should also clearly state the nature of the lien being assigned and the property on which the lien is attached. Additionally, the assignment should outline any conditions or considerations involved in the transfer, such as payment or other agreements between the parties. By properly executing a Westminster Colorado Assignment of Lien — Individual, both the assignor and the assignee protect their interests and ensure a legal transfer of lien rights. It is crucial to consult with a legal professional experienced in real estate law to draft and review the document to ensure compliance with local laws and regulations. Keywords: Westminster Colorado, Assignment of Lien — Individual, transfer of lien rights, mechanics' lien assignment, tax lien assignment, mortgage lien assignment, unpaid debts, claim against property, unpaid taxes, unpaid bills, collateral, loan, property rights, legal document, real estate law.