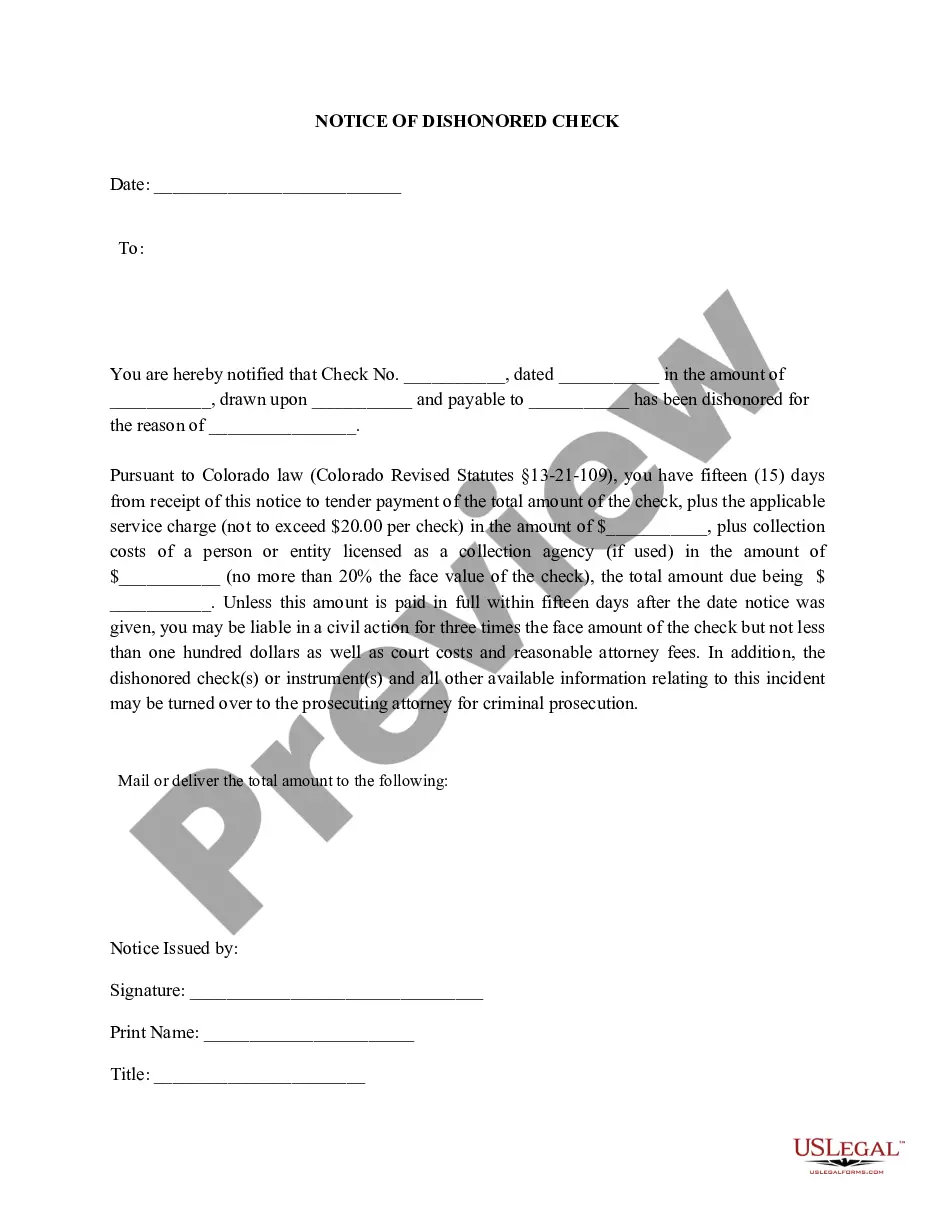

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Arvada Colorado Notice of Dishonored Check — Civil: A Comprehensive Overview Keywords: bad check, bounced check, dishonored check, insufficient funds, check fraud, check bouncing, check payment failure. Introduction: The Arvada Colorado Notice of Dishonored Check — Civil serves as a legal communication to individuals or businesses who have issued a check that has been returned by the bank due to insufficient funds or other reasons. This notice is an essential tool for seeking payment, addressing check fraud, and emphasizing the consequences of writing a bad check in Arvada, Colorado. Here, we provide a detailed description to shed light on the different aspects of this document. Types and Reasons for a Dishonored Check: 1. Insufficient Funds: The most common reason for a dishonored check in Arvada is insufficient funds. This occurs when the issuer's bank account balance is not enough to cover the amount stated on the check. 2. Frozen/Blocked Account: Sometimes, an account may be temporarily frozen or blocked by the bank, resulting in a dishonored check. This situation can arise due to various reasons, such as suspected fraudulent activity, account disputes, or court orders. 3. Account Closure: If the account from which the check was drawn has been closed, the check will be dishonored. It is crucial for individuals to ensure their account remains active to avoid complications. 4. Forgery or Alteration: In cases where a check has been forged or altered, often resulting in an unauthorized change of the payee or amount, the bank may reject the check and issue a dishonored check notice. 5. Technological Issues: Occasionally, a dishonored check might occur due to technological issues within the banking system, such as system outages, errors in scanning or processing, or software glitches. Purpose of Arvada Colorado Notice of Dishonored Check — Civil: The primary purpose of this notice is to inform the check issuer about the dishonored status of their payment. By highlighting the dishonored check, it aims to draw attention to the financial and legal consequences associated with this offense. The notice indicates that the recipient (the person or entity to whom the check was issued) has the option to take legal action to recover the funds owed, including potential civil penalties, fees, and additional charges. Consequences of Writing a Bad Check: 1. Civil Penalties: Depending on the amount stated on the check, Colorado law permits the recipient to seek three times the amount of the check or $100, whichever is greater, plus reasonable attorney's fees and damages. 2. Stain on Credit History: Issuing a bad check can damage an individual's credit score and history, making it difficult to obtain credit facilities or loans in the future. 3. Criminal Charges: In some cases, repeated instances of issuing bad checks can lead to criminal charges of check fraud, a serious offense punishable by fines and even incarceration. Conclusion: The Arvada Colorado Notice of Dishonored Check — Civil serves as a formal communication to inform the check issuer about the dishonored status of their payment. Through this legal document, individuals are informed about the consequences of writing a bad check, including the potential for civil penalties, credit damage, and even criminal charges. Understanding these implications can help individuals navigate financial transactions responsibly and avoid the complications associated with dishonored checks in Arvada, Colorado.Arvada Colorado Notice of Dishonored Check — Civil: A Comprehensive Overview Keywords: bad check, bounced check, dishonored check, insufficient funds, check fraud, check bouncing, check payment failure. Introduction: The Arvada Colorado Notice of Dishonored Check — Civil serves as a legal communication to individuals or businesses who have issued a check that has been returned by the bank due to insufficient funds or other reasons. This notice is an essential tool for seeking payment, addressing check fraud, and emphasizing the consequences of writing a bad check in Arvada, Colorado. Here, we provide a detailed description to shed light on the different aspects of this document. Types and Reasons for a Dishonored Check: 1. Insufficient Funds: The most common reason for a dishonored check in Arvada is insufficient funds. This occurs when the issuer's bank account balance is not enough to cover the amount stated on the check. 2. Frozen/Blocked Account: Sometimes, an account may be temporarily frozen or blocked by the bank, resulting in a dishonored check. This situation can arise due to various reasons, such as suspected fraudulent activity, account disputes, or court orders. 3. Account Closure: If the account from which the check was drawn has been closed, the check will be dishonored. It is crucial for individuals to ensure their account remains active to avoid complications. 4. Forgery or Alteration: In cases where a check has been forged or altered, often resulting in an unauthorized change of the payee or amount, the bank may reject the check and issue a dishonored check notice. 5. Technological Issues: Occasionally, a dishonored check might occur due to technological issues within the banking system, such as system outages, errors in scanning or processing, or software glitches. Purpose of Arvada Colorado Notice of Dishonored Check — Civil: The primary purpose of this notice is to inform the check issuer about the dishonored status of their payment. By highlighting the dishonored check, it aims to draw attention to the financial and legal consequences associated with this offense. The notice indicates that the recipient (the person or entity to whom the check was issued) has the option to take legal action to recover the funds owed, including potential civil penalties, fees, and additional charges. Consequences of Writing a Bad Check: 1. Civil Penalties: Depending on the amount stated on the check, Colorado law permits the recipient to seek three times the amount of the check or $100, whichever is greater, plus reasonable attorney's fees and damages. 2. Stain on Credit History: Issuing a bad check can damage an individual's credit score and history, making it difficult to obtain credit facilities or loans in the future. 3. Criminal Charges: In some cases, repeated instances of issuing bad checks can lead to criminal charges of check fraud, a serious offense punishable by fines and even incarceration. Conclusion: The Arvada Colorado Notice of Dishonored Check — Civil serves as a formal communication to inform the check issuer about the dishonored status of their payment. Through this legal document, individuals are informed about the consequences of writing a bad check, including the potential for civil penalties, credit damage, and even criminal charges. Understanding these implications can help individuals navigate financial transactions responsibly and avoid the complications associated with dishonored checks in Arvada, Colorado.