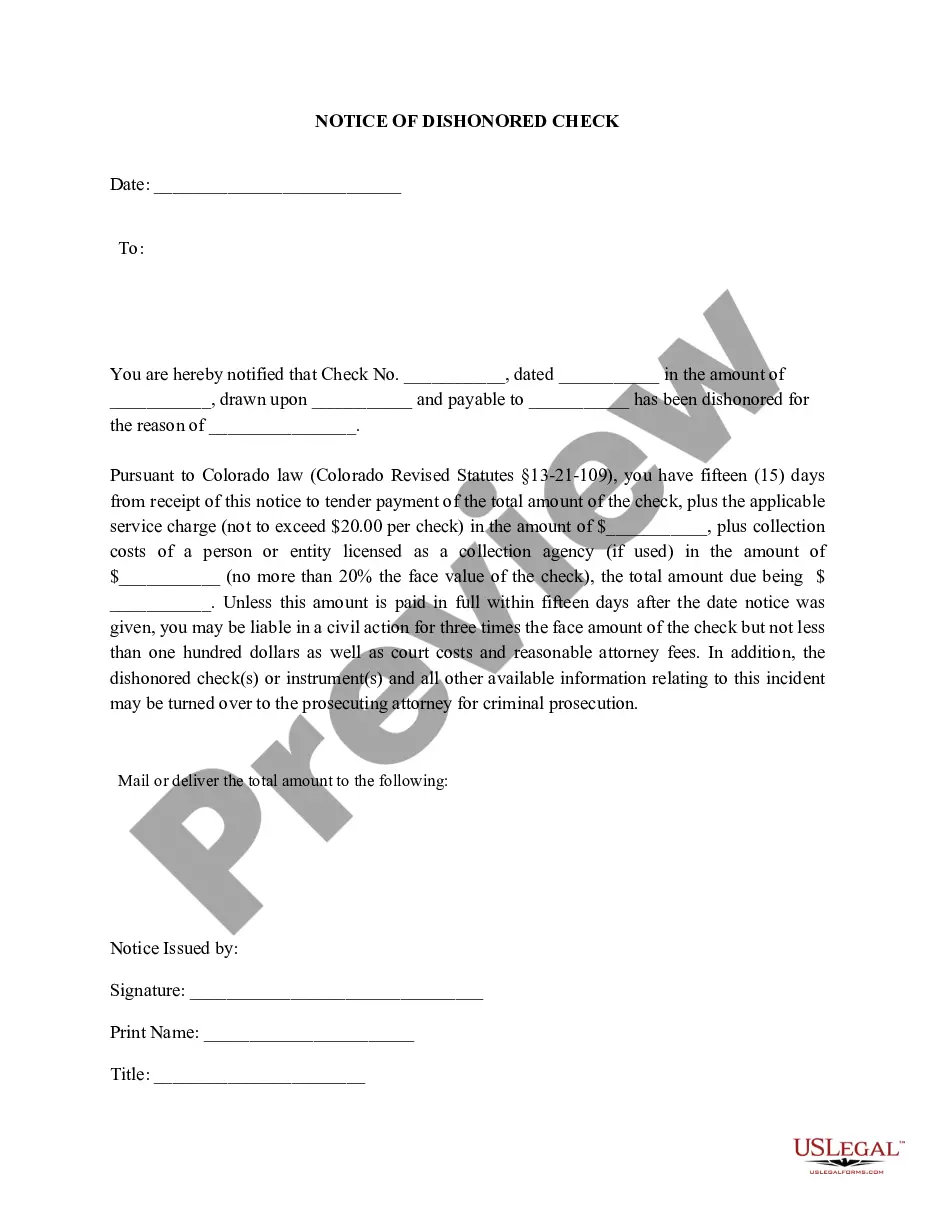

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Aurora Colorado Notice of Dishonored Check — Civil: Handling Issues Relating to Bad Checks and Bounced Payments Introduction: In Aurora, Colorado, the Notice of Dishonored Check — Civil serves as a legal document that addresses the concerns arising from bad checks and bounced payments. This notice is crucial in alerting individuals or businesses of their potential involvement in a matter concerning checks that have been returned unpaid by the bank. In this article, we will provide a comprehensive overview of the Aurora Colorado Notice of Dishonored Check — Civil, covering its purpose, types, and the appropriate actions needed to resolve such issues. 1. Understanding the Aurora Colorado Notice of Dishonored Check: The Aurora Colorado Notice of Dishonored Check — Civil is a legal instrument used by businesses or individuals who have encountered a bounced check or bad check situation. It serves as a formal communication that notifies the check issuer of the dishonored payment and addresses the consequences of the incident. 2. Types of Dishonored Checks: a) Bad Check: A bad check refers to a check that lacks sufficient funds, causing it to be returned unpaid by the bank. It can occur due to an unintentional oversight or a deliberate attempt to deceive the payee. b) Bounced Check: A bounced check is another term used to describe a bad check. When the payer's account doesn't hold sufficient funds, the check bounces, leading to non-payment. 3. Purpose and Importance of the Notice of Dishonored Check: The Notice of Dishonored Check is vital for several reasons: a) Legal Intent: By issuing this notice, the recipient is informed about the existence of a dishonored payment, ensuring they are aware of their involvement in the matter. b) Notification and Deadline: The notice informs the check issuer about the dishonored payment, usually providing a specified time frame to address the situation and rectify the outstanding amount. c) Potential Legal Ramifications: This notice serves as a warning to the (payer) of the legal consequences associated with writing bad checks. It also emphasizes the obligations and liabilities involved. d) Documentation: The Notice of Dishonored Check ensures a formal record of the incident and can be used as evidence for legal proceedings, if necessary. 4. Actions to Take When Receiving a Notice of Dishonored Check: When you receive a Notice of Dishonored Check, it's important to take the following steps to address the issue effectively: a) Respond Promptly: Contact the issuer of the notice and discuss the situation to gain a clear understanding of the problem. b) Rectify the Payment: Address the dishonored payment by paying the outstanding amount or making alternative arrangements with the issuer to settle the debt. c) Maintain Documentation: Keep a record of all communications, receipts, and any additional evidence that can support your actions or provide clarity during the resolution process. 5. Resolution of Dishonored Check Issues: Through open communication and cooperation, dishonored check issues can often be resolved without escalating the matter legally. By acknowledging the problem, establishing a repayment plan or fulfilling payment obligations promptly, both parties can work towards a satisfactory resolution and avoid any further complications. Conclusion: The Aurora Colorado Notice of Dishonored Check — Civil plays a crucial role in addressing issues related to bad checks and bounced payments. Understanding the purpose, types, and appropriate actions to take when encountering such notices is important for avoiding legal consequences and navigating a potentially complex situation. By acting promptly, maintaining open communication, and meeting financial obligations, individuals and businesses can effectively resolve dishonored check issues in Aurora, Colorado.Title: Aurora Colorado Notice of Dishonored Check — Civil: Handling Issues Relating to Bad Checks and Bounced Payments Introduction: In Aurora, Colorado, the Notice of Dishonored Check — Civil serves as a legal document that addresses the concerns arising from bad checks and bounced payments. This notice is crucial in alerting individuals or businesses of their potential involvement in a matter concerning checks that have been returned unpaid by the bank. In this article, we will provide a comprehensive overview of the Aurora Colorado Notice of Dishonored Check — Civil, covering its purpose, types, and the appropriate actions needed to resolve such issues. 1. Understanding the Aurora Colorado Notice of Dishonored Check: The Aurora Colorado Notice of Dishonored Check — Civil is a legal instrument used by businesses or individuals who have encountered a bounced check or bad check situation. It serves as a formal communication that notifies the check issuer of the dishonored payment and addresses the consequences of the incident. 2. Types of Dishonored Checks: a) Bad Check: A bad check refers to a check that lacks sufficient funds, causing it to be returned unpaid by the bank. It can occur due to an unintentional oversight or a deliberate attempt to deceive the payee. b) Bounced Check: A bounced check is another term used to describe a bad check. When the payer's account doesn't hold sufficient funds, the check bounces, leading to non-payment. 3. Purpose and Importance of the Notice of Dishonored Check: The Notice of Dishonored Check is vital for several reasons: a) Legal Intent: By issuing this notice, the recipient is informed about the existence of a dishonored payment, ensuring they are aware of their involvement in the matter. b) Notification and Deadline: The notice informs the check issuer about the dishonored payment, usually providing a specified time frame to address the situation and rectify the outstanding amount. c) Potential Legal Ramifications: This notice serves as a warning to the (payer) of the legal consequences associated with writing bad checks. It also emphasizes the obligations and liabilities involved. d) Documentation: The Notice of Dishonored Check ensures a formal record of the incident and can be used as evidence for legal proceedings, if necessary. 4. Actions to Take When Receiving a Notice of Dishonored Check: When you receive a Notice of Dishonored Check, it's important to take the following steps to address the issue effectively: a) Respond Promptly: Contact the issuer of the notice and discuss the situation to gain a clear understanding of the problem. b) Rectify the Payment: Address the dishonored payment by paying the outstanding amount or making alternative arrangements with the issuer to settle the debt. c) Maintain Documentation: Keep a record of all communications, receipts, and any additional evidence that can support your actions or provide clarity during the resolution process. 5. Resolution of Dishonored Check Issues: Through open communication and cooperation, dishonored check issues can often be resolved without escalating the matter legally. By acknowledging the problem, establishing a repayment plan or fulfilling payment obligations promptly, both parties can work towards a satisfactory resolution and avoid any further complications. Conclusion: The Aurora Colorado Notice of Dishonored Check — Civil plays a crucial role in addressing issues related to bad checks and bounced payments. Understanding the purpose, types, and appropriate actions to take when encountering such notices is important for avoiding legal consequences and navigating a potentially complex situation. By acting promptly, maintaining open communication, and meeting financial obligations, individuals and businesses can effectively resolve dishonored check issues in Aurora, Colorado.