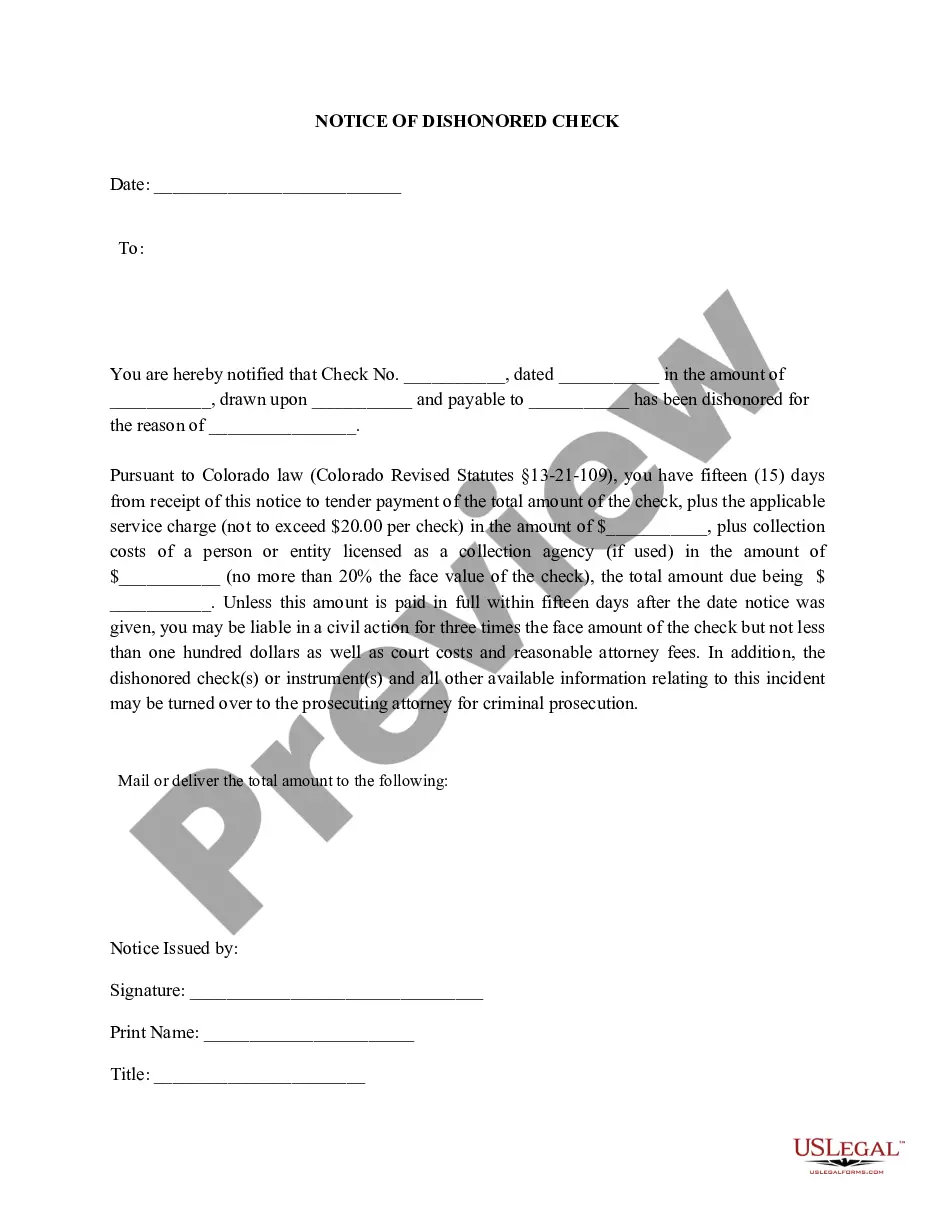

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Lakewood Colorado Notice of Dishonored Check — Civil: Keywords: bad check, bounced check Overview: A Notice of Dishonored Check is a legal document issued by the City of Lakewood in Colorado when a check has been returned unpaid by the bank due to insufficient funds or another reason. This notice is sent to the individual or business who presented the check, informing them of the dishonored transaction and outlining the necessary actions to resolve the matter. It serves as a means of alerting the check issuer about the consequences of writing a bad or bounced check and allows them an opportunity to rectify the situation. Types of Notice of Dishonored Check — Civil: 1. Bad Check Notice: A Bad Check Notice is typically issued when a check is returned unpaid due to insufficient funds in the issuer's bank account. It informs the check writer of the dishonored check, the amount owed, any associated fees or penalties, and provides instructions on how to resolve the matter to avoid further legal action. 2. Bounced Check Notice: A Bounced Check Notice is similar to a Bad Check Notice and is issued when a check is dishonored for reasons such as closed bank accounts, stop payment instructions, or other factors that prevent the check from being cleared. This notice serves as an official communication, alerting the check writer of the transaction's failure and the need for prompt resolution. Key Components of a Notice of Dishonored Check — Civil: 1. Date and Contact Information: The notice should include the date it is issued and contact information for the City of Lakewood, clearly providing individuals or businesses a means of communication for resolving the matter. 2. Check Details: The notice must include the check's relevant details, such as the check number, date of issue, the name of the payee, and the amount of the check. Providing this information helps the check writer to identify the specific transaction in question. 3. Reason for Dishonored Check: The notice should state the reason for the dishonored check, whether it be due to insufficient funds, closed accounts, or another applicable reason. Clear communication of the cause behind the dishonored check helps the check writer understand the issue at hand. 4. Outstanding Amount and Associated Fees: The notice must specify the total amount owed by the check writer, which includes the original check amount and any associated fees or penalties resulting from the dishonored transaction. This information helps the check writer understand the financial consequences of their actions. 5. Remedial Steps: Instructions should be provided on how the check writer can rectify the situation. This may involve making immediate payment to the City of Lakewood, submitting a cashier's check or money order, or arranging a payment plan to settle the debt. Clear guidelines ensure that the check writer understands the necessary actions and the potential consequences if not resolved promptly. It is important for those who receive a Lakewood Colorado Notice of Dishonored Check — Civil to take it seriously and promptly address the situation to avoid further legal complications or damage to their reputation. Resolving the matter in a timely manner helps to maintain financial integrity and prevent the escalation of consequences resulting from writing a bad or bounced check.Lakewood Colorado Notice of Dishonored Check — Civil: Keywords: bad check, bounced check Overview: A Notice of Dishonored Check is a legal document issued by the City of Lakewood in Colorado when a check has been returned unpaid by the bank due to insufficient funds or another reason. This notice is sent to the individual or business who presented the check, informing them of the dishonored transaction and outlining the necessary actions to resolve the matter. It serves as a means of alerting the check issuer about the consequences of writing a bad or bounced check and allows them an opportunity to rectify the situation. Types of Notice of Dishonored Check — Civil: 1. Bad Check Notice: A Bad Check Notice is typically issued when a check is returned unpaid due to insufficient funds in the issuer's bank account. It informs the check writer of the dishonored check, the amount owed, any associated fees or penalties, and provides instructions on how to resolve the matter to avoid further legal action. 2. Bounced Check Notice: A Bounced Check Notice is similar to a Bad Check Notice and is issued when a check is dishonored for reasons such as closed bank accounts, stop payment instructions, or other factors that prevent the check from being cleared. This notice serves as an official communication, alerting the check writer of the transaction's failure and the need for prompt resolution. Key Components of a Notice of Dishonored Check — Civil: 1. Date and Contact Information: The notice should include the date it is issued and contact information for the City of Lakewood, clearly providing individuals or businesses a means of communication for resolving the matter. 2. Check Details: The notice must include the check's relevant details, such as the check number, date of issue, the name of the payee, and the amount of the check. Providing this information helps the check writer to identify the specific transaction in question. 3. Reason for Dishonored Check: The notice should state the reason for the dishonored check, whether it be due to insufficient funds, closed accounts, or another applicable reason. Clear communication of the cause behind the dishonored check helps the check writer understand the issue at hand. 4. Outstanding Amount and Associated Fees: The notice must specify the total amount owed by the check writer, which includes the original check amount and any associated fees or penalties resulting from the dishonored transaction. This information helps the check writer understand the financial consequences of their actions. 5. Remedial Steps: Instructions should be provided on how the check writer can rectify the situation. This may involve making immediate payment to the City of Lakewood, submitting a cashier's check or money order, or arranging a payment plan to settle the debt. Clear guidelines ensure that the check writer understands the necessary actions and the potential consequences if not resolved promptly. It is important for those who receive a Lakewood Colorado Notice of Dishonored Check — Civil to take it seriously and promptly address the situation to avoid further legal complications or damage to their reputation. Resolving the matter in a timely manner helps to maintain financial integrity and prevent the escalation of consequences resulting from writing a bad or bounced check.