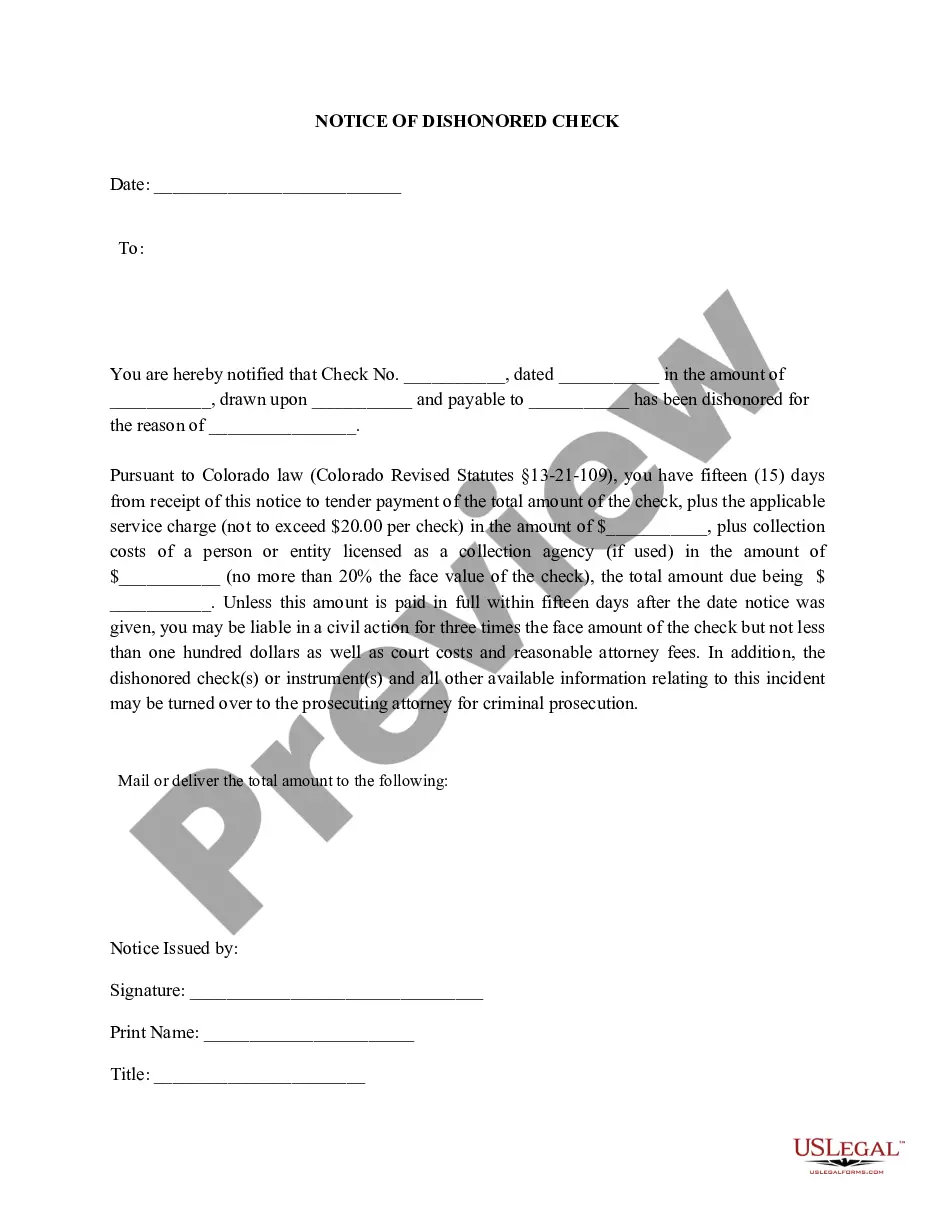

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Thornton Colorado Notice of Dishonored Check — Civil: Understanding Bad Checks and Bounced Checks Introduction: The Thornton Colorado Notice of Dishonored Check — Civil is an important legal document that addresses instances where a check issued within Thornton, Colorado, has been dishonored or bounced. This detailed description aims to provide a comprehensive understanding of what constitutes a bad check and its implications, while incorporating relevant keywords such as "bad check" and "bounced check." Additionally, it will cover various types of bad checks and highlight essential information related to this civil matter. Definition and Explanation: A bad check, also known as a dishonored or bounced check, is a term used when a check is returned unpaid by the financial institution due to insufficient funds, closed accounts, or other invalid reasons. When a check is dishonored, the recipient or payee may take legal action by initiating a civil action against the check-writer or issuing party. In Thornton, Colorado, a Notice of Dishonored Check — Civil serves as the initial step in this legal process. Types of Thornton Colorado Notice of Dishonored Check — Civil: 1. Insufficient Funds: A common type of bounced check occurs when the issuing party does not have sufficient funds to cover the check amount. In such cases, the recipient can file a Notice of Dishonored Check — Civil to begin the collection process. 2. Closed Account: If the issuer closes their bank account before the recipient attempts to cash the check, the check will be deemed dishonored or bounced. This scenario often leads to legal action, resulting in the completion of a Notice of Dishonored Check — Civil. 3. Account Holder Dispute: Sometimes, a dispute arises between the check-writer and their financial institution. If the check issuer contests the charges or transaction, their bank may return the check as dishonored. Subsequently, the recipient can initiate a Notice of Dishonored Check — Civil to address the matter legally. Important Details and Considerations: When dealing with a Thornton Colorado Notice of Dishonored Check — Civil, there are a few crucial points to bear in mind: 1. Timelines: The recipient must file the Notice of Dishonored Check — Civil within a specific time frame, known as the statute of limitations, starting from the date of dishonor. It is advisable to consult an attorney or legal expert to ensure compliance with the applicable timeline. 2. Legal Consequences: The dishonoring of a check is a legal matter that can lead to financial penalties, including payment of the check amount, additional fees, and legal costs. Ignoring or failing to address a bounced check can result in further legal complications. 3. Communication: It is recommended to reach out to the check issuer to discuss the dishonored check and resolve the matter amicably before initiating legal action. In some cases, a resolution can be reached through negotiation or payment arrangements without going through the court process. Conclusion: Understanding the Thornton Colorado Notice of Dishonored Check — Civil and its implications is vital when dealing with dishonored or bounced checks. Recognizing the different types of bad checks, such as those resulting from insufficient funds, closed accounts, or account holder disputes, helps determine the appropriate course of action. By adhering to legal procedures, seeking professional advice when necessary, and communicating with the check-writer, both parties can work towards a fair resolution in cases involving bad checks.Title: Thornton Colorado Notice of Dishonored Check — Civil: Understanding Bad Checks and Bounced Checks Introduction: The Thornton Colorado Notice of Dishonored Check — Civil is an important legal document that addresses instances where a check issued within Thornton, Colorado, has been dishonored or bounced. This detailed description aims to provide a comprehensive understanding of what constitutes a bad check and its implications, while incorporating relevant keywords such as "bad check" and "bounced check." Additionally, it will cover various types of bad checks and highlight essential information related to this civil matter. Definition and Explanation: A bad check, also known as a dishonored or bounced check, is a term used when a check is returned unpaid by the financial institution due to insufficient funds, closed accounts, or other invalid reasons. When a check is dishonored, the recipient or payee may take legal action by initiating a civil action against the check-writer or issuing party. In Thornton, Colorado, a Notice of Dishonored Check — Civil serves as the initial step in this legal process. Types of Thornton Colorado Notice of Dishonored Check — Civil: 1. Insufficient Funds: A common type of bounced check occurs when the issuing party does not have sufficient funds to cover the check amount. In such cases, the recipient can file a Notice of Dishonored Check — Civil to begin the collection process. 2. Closed Account: If the issuer closes their bank account before the recipient attempts to cash the check, the check will be deemed dishonored or bounced. This scenario often leads to legal action, resulting in the completion of a Notice of Dishonored Check — Civil. 3. Account Holder Dispute: Sometimes, a dispute arises between the check-writer and their financial institution. If the check issuer contests the charges or transaction, their bank may return the check as dishonored. Subsequently, the recipient can initiate a Notice of Dishonored Check — Civil to address the matter legally. Important Details and Considerations: When dealing with a Thornton Colorado Notice of Dishonored Check — Civil, there are a few crucial points to bear in mind: 1. Timelines: The recipient must file the Notice of Dishonored Check — Civil within a specific time frame, known as the statute of limitations, starting from the date of dishonor. It is advisable to consult an attorney or legal expert to ensure compliance with the applicable timeline. 2. Legal Consequences: The dishonoring of a check is a legal matter that can lead to financial penalties, including payment of the check amount, additional fees, and legal costs. Ignoring or failing to address a bounced check can result in further legal complications. 3. Communication: It is recommended to reach out to the check issuer to discuss the dishonored check and resolve the matter amicably before initiating legal action. In some cases, a resolution can be reached through negotiation or payment arrangements without going through the court process. Conclusion: Understanding the Thornton Colorado Notice of Dishonored Check — Civil and its implications is vital when dealing with dishonored or bounced checks. Recognizing the different types of bad checks, such as those resulting from insufficient funds, closed accounts, or account holder disputes, helps determine the appropriate course of action. By adhering to legal procedures, seeking professional advice when necessary, and communicating with the check-writer, both parties can work towards a fair resolution in cases involving bad checks.