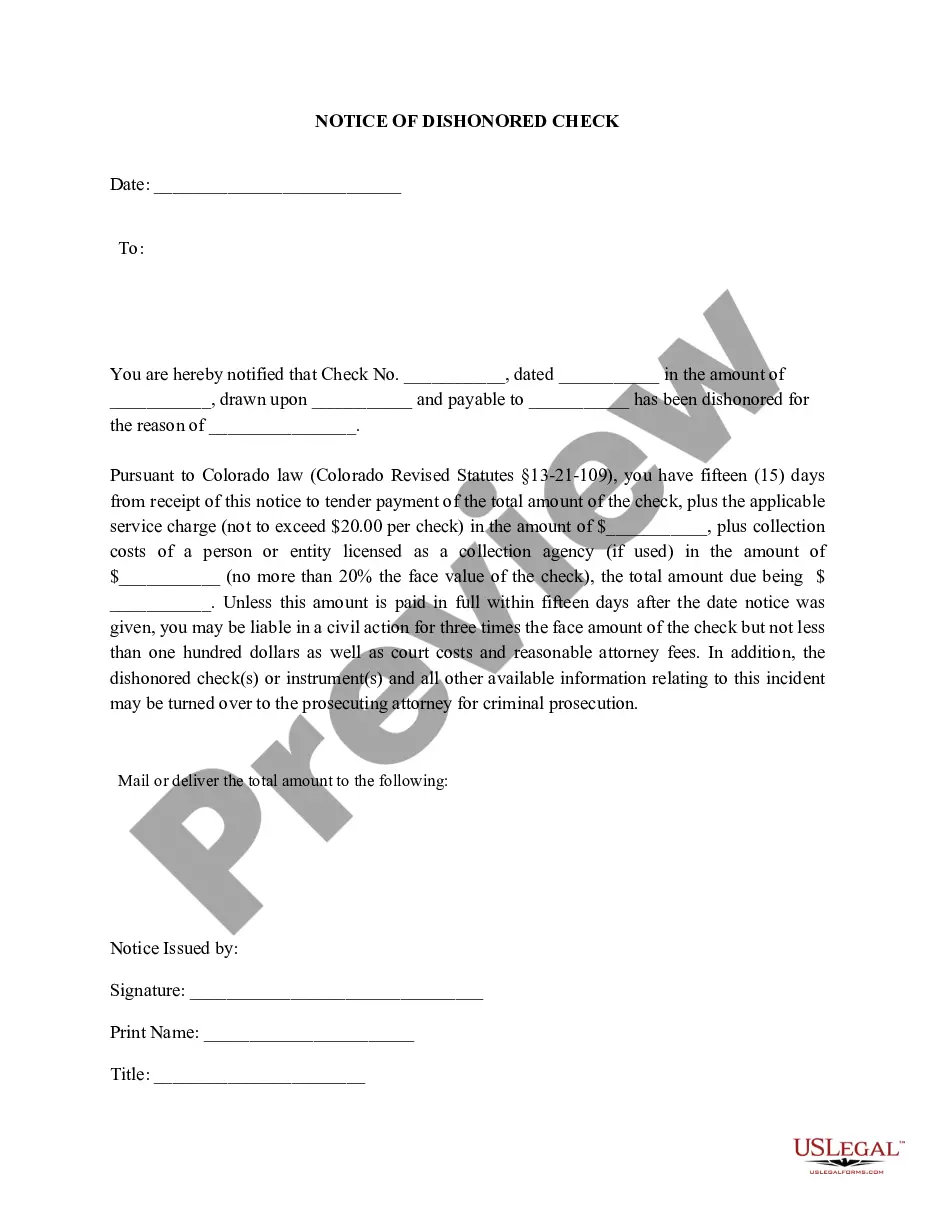

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Westminster Colorado Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check In Westminster, Colorado, a Notice of Dishonored Check is issued when a check is deemed to be bad or bounced. This notice is a legal notification sent to the check issuer, informing them about the dishonored check and the consequences they might face. A bad check, also known as a bounced check, is a check that cannot be processed or honored by the bank due to insufficient funds in the account, an account closure, or other reasons. When a check bounces, it means that the payment intended by the check writer cannot be completed. There are different types or circumstances that can lead to the issuance of a Westminster Colorado Notice of Dishonored Check — Civil: 1. Insufficient funds: This occurs when the check writer does not have enough funds in their account to cover the amount written on the check. 2. Account closed: If the check writer closes their bank account before the check is processed, it will result in a dishonored check. 3. Stop payment: If the check writer requests their bank to stop or cancel the payment of a previously issued check, it will be considered a dishonored check. 4. Forgery or alteration: If the bank discovers that the check has been fraudulently altered or forged, it will be dishonored. 5. Account restrictions: In some cases, the bank may have restricted the account due to suspicious activity or other reasons, leading to the dishonor of a check. When a Westminster Colorado Notice of Dishonored Check is received, the check issuer may face legal consequences. It is crucial for the check writer to rectify the issue by either providing the necessary funds to cover the bounced check or resolving any other underlying issues promptly. Ignoring a Notice of Dishonored Check can result in further legal actions, such as fines, penalties, or even criminal charges. Additionally, the check writer's credit score may be negatively impacted, making it difficult to secure future financial transactions. To avoid such situations, it is crucial to ensure sufficient funds are available before issuing a check, maintain accurate records of payments, and promptly address any issues related to one's bank account. Remember, a Westminster Colorado Notice of Dishonored Check — Civil serves as an official warning and reminder to handle dishonored checks responsibly and address any financial obligations promptly to avoid potential legal consequences.Westminster Colorado Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check In Westminster, Colorado, a Notice of Dishonored Check is issued when a check is deemed to be bad or bounced. This notice is a legal notification sent to the check issuer, informing them about the dishonored check and the consequences they might face. A bad check, also known as a bounced check, is a check that cannot be processed or honored by the bank due to insufficient funds in the account, an account closure, or other reasons. When a check bounces, it means that the payment intended by the check writer cannot be completed. There are different types or circumstances that can lead to the issuance of a Westminster Colorado Notice of Dishonored Check — Civil: 1. Insufficient funds: This occurs when the check writer does not have enough funds in their account to cover the amount written on the check. 2. Account closed: If the check writer closes their bank account before the check is processed, it will result in a dishonored check. 3. Stop payment: If the check writer requests their bank to stop or cancel the payment of a previously issued check, it will be considered a dishonored check. 4. Forgery or alteration: If the bank discovers that the check has been fraudulently altered or forged, it will be dishonored. 5. Account restrictions: In some cases, the bank may have restricted the account due to suspicious activity or other reasons, leading to the dishonor of a check. When a Westminster Colorado Notice of Dishonored Check is received, the check issuer may face legal consequences. It is crucial for the check writer to rectify the issue by either providing the necessary funds to cover the bounced check or resolving any other underlying issues promptly. Ignoring a Notice of Dishonored Check can result in further legal actions, such as fines, penalties, or even criminal charges. Additionally, the check writer's credit score may be negatively impacted, making it difficult to secure future financial transactions. To avoid such situations, it is crucial to ensure sufficient funds are available before issuing a check, maintain accurate records of payments, and promptly address any issues related to one's bank account. Remember, a Westminster Colorado Notice of Dishonored Check — Civil serves as an official warning and reminder to handle dishonored checks responsibly and address any financial obligations promptly to avoid potential legal consequences.