This will package contains two wills for a man and woman living together with no children. It is designed for persons that, although not married, desire to execute mutual wills leaving some of their property to the other. State specific instructions are also included.

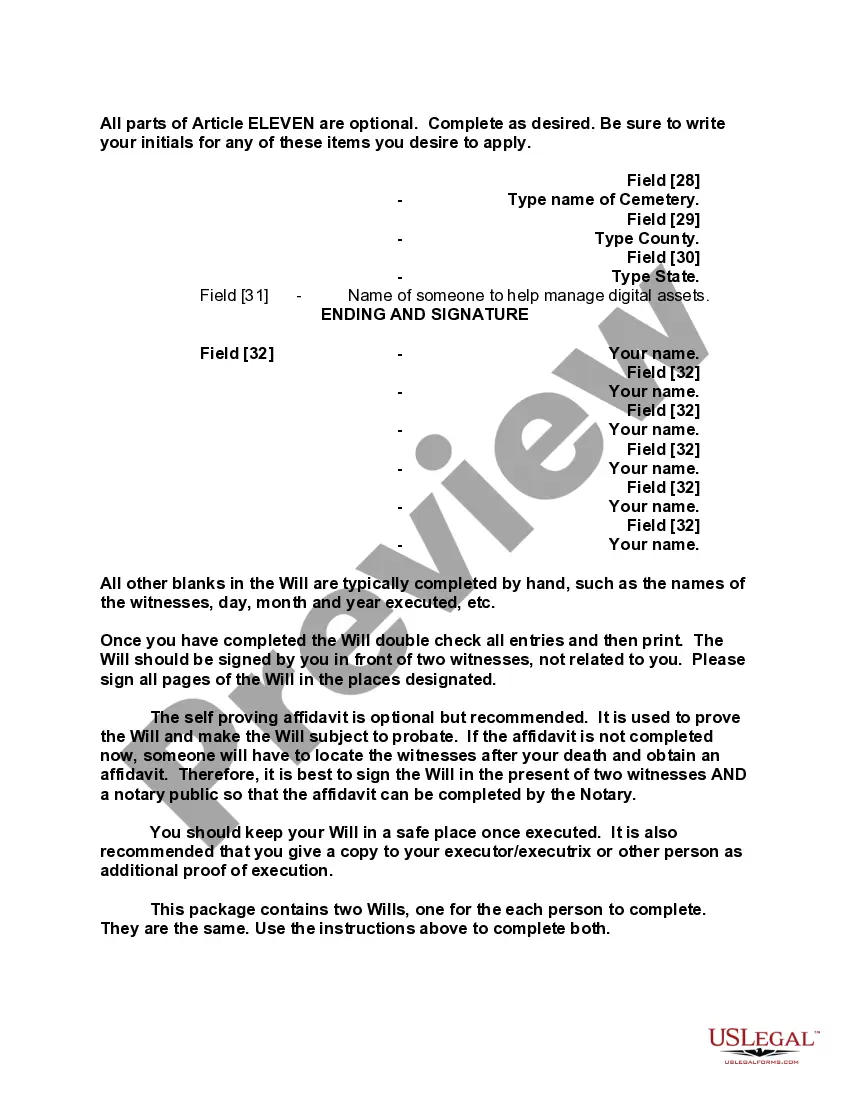

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills.

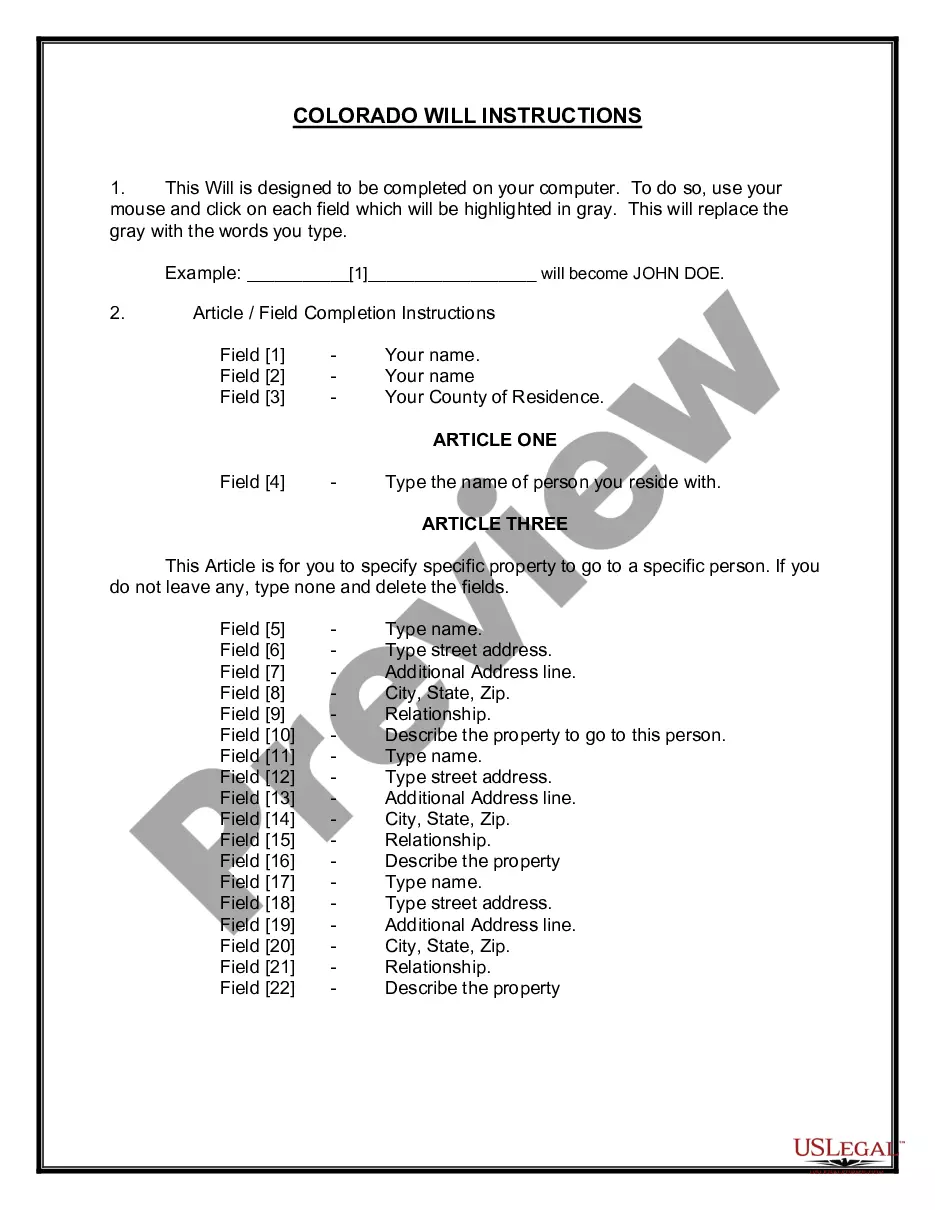

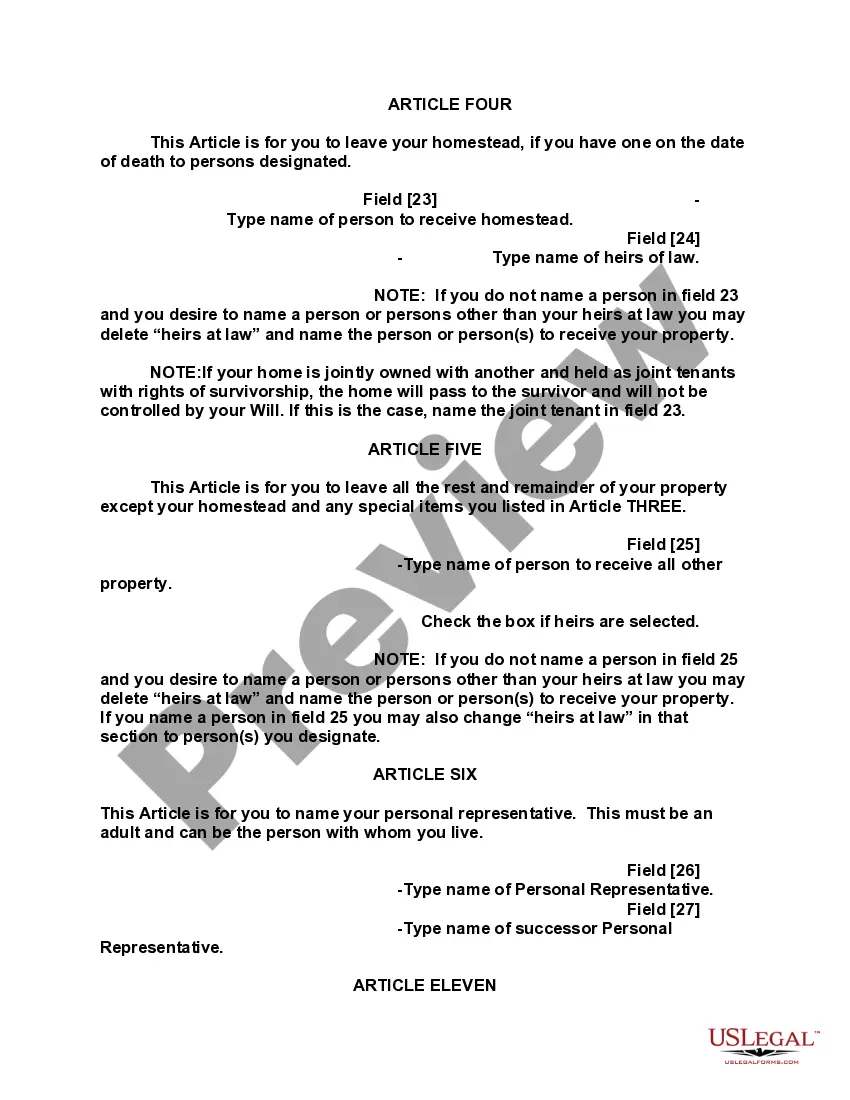

Lakewood Colorado Mutual Wills containing Last Will and Testaments for Unmarried Persons living together with No Children are legal documents that provide comprehensive instructions on how to handle the distribution of assets, properties, and other important matters in the event of the individuals' deaths. 1. Definition: A Lakewood Colorado Mutual Will is a legal agreement between unmarried individuals living together, creating a joint estate plan that outlines their wishes in case of death. 2. Purpose: The purpose of a Mutual Will is to ensure that the assets and properties of unmarried partners are distributed according to their wishes without leaving any room for disputes. 3. Asset Distribution: The Mutual Will specifies how the assets, such as bank accounts, real estate, investments, and personal possessions, will be divided between the partners upon the death of one. 4. Executor: The document designates an executor, a trusted person responsible for carrying out the instructions outlined in the Mutual Will. 5. Funeral Arrangements: Details about funeral preferences, burial or cremation choices, and any specific requests can be included in the Mutual Will, ensuring that the wishes of both partners are respected. 6. Debt and Taxes: The Mutual Will addresses any outstanding debts or taxes and instructs how they should be paid using the estate's funds. 7. Healthcare Decisions: Partners may include provisions for healthcare decisions, granting each other power of attorney for medical purposes, should one partner become incapacitated. 8. Termination Clause: The Mutual Will, can include a termination clause stating that it will no longer be valid if either partner marries or enters into a registered partnership. Types of Lakewood Colorado Mutual Wills containing Last Will and Testaments: 1. Basic Mutual Will: This type of Mutual Will covers the essential elements of asset distribution, executor designation, and funeral arrangements. 2. Advanced Mutual Will: An Advanced Mutual Will includes additional provisions, such as healthcare decisions and instructions on how specific debts and taxes should be handled. 3. Comprehensive Mutual Will: The Comprehensive Mutual Will encompasses all aspects of basic and advanced Mutual Wills, allowing for detailed instructions on asset distribution, healthcare decisions, funeral arrangements, and debt/tax management. 4. Amending Mutual Will: In case any changes need to be made to the original Mutual Will, an amending Mutual Will specifies the alterations made to the document. Creating a Lakewood Colorado Mutual Will is crucial for unmarried partners without children who wish to protect their assets and ensure their wishes are carried out after their passing. It is advisable to consult an experienced attorney to draft the document to address any specific requirements and comply with local laws.Lakewood Colorado Mutual Wills containing Last Will and Testaments for Unmarried Persons living together with No Children are legal documents that provide comprehensive instructions on how to handle the distribution of assets, properties, and other important matters in the event of the individuals' deaths. 1. Definition: A Lakewood Colorado Mutual Will is a legal agreement between unmarried individuals living together, creating a joint estate plan that outlines their wishes in case of death. 2. Purpose: The purpose of a Mutual Will is to ensure that the assets and properties of unmarried partners are distributed according to their wishes without leaving any room for disputes. 3. Asset Distribution: The Mutual Will specifies how the assets, such as bank accounts, real estate, investments, and personal possessions, will be divided between the partners upon the death of one. 4. Executor: The document designates an executor, a trusted person responsible for carrying out the instructions outlined in the Mutual Will. 5. Funeral Arrangements: Details about funeral preferences, burial or cremation choices, and any specific requests can be included in the Mutual Will, ensuring that the wishes of both partners are respected. 6. Debt and Taxes: The Mutual Will addresses any outstanding debts or taxes and instructs how they should be paid using the estate's funds. 7. Healthcare Decisions: Partners may include provisions for healthcare decisions, granting each other power of attorney for medical purposes, should one partner become incapacitated. 8. Termination Clause: The Mutual Will, can include a termination clause stating that it will no longer be valid if either partner marries or enters into a registered partnership. Types of Lakewood Colorado Mutual Wills containing Last Will and Testaments: 1. Basic Mutual Will: This type of Mutual Will covers the essential elements of asset distribution, executor designation, and funeral arrangements. 2. Advanced Mutual Will: An Advanced Mutual Will includes additional provisions, such as healthcare decisions and instructions on how specific debts and taxes should be handled. 3. Comprehensive Mutual Will: The Comprehensive Mutual Will encompasses all aspects of basic and advanced Mutual Wills, allowing for detailed instructions on asset distribution, healthcare decisions, funeral arrangements, and debt/tax management. 4. Amending Mutual Will: In case any changes need to be made to the original Mutual Will, an amending Mutual Will specifies the alterations made to the document. Creating a Lakewood Colorado Mutual Will is crucial for unmarried partners without children who wish to protect their assets and ensure their wishes are carried out after their passing. It is advisable to consult an experienced attorney to draft the document to address any specific requirements and comply with local laws.