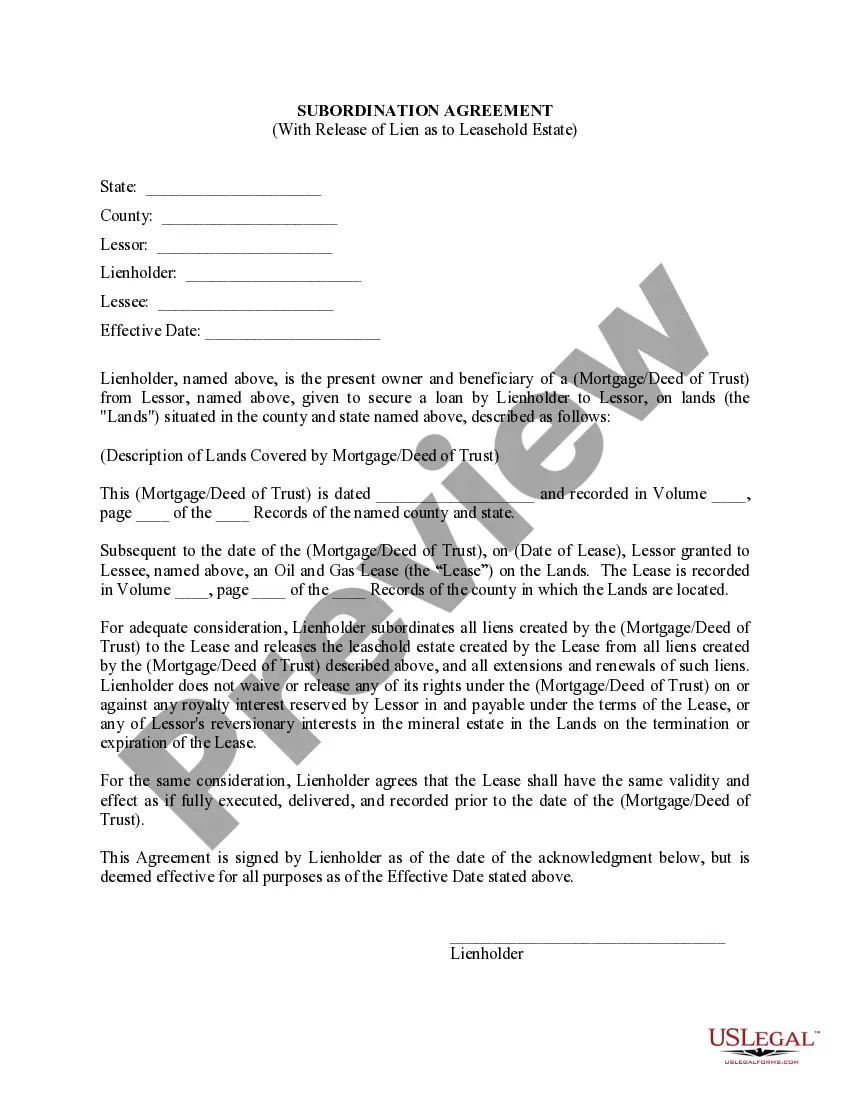

This Lease Subordination Agreement is a lienholder's lien that was created by a (Mortgage/Deed of Trust) and is subordinated to a mineral/oil/gas lease and lienholder releases, said Leasehold from all liens created by said (Mortgage/Deed of Trust), and all extensions and renewals of such liens. Lienholder retains all rights under the (Mortgage/Deed of Trust) against any royalty interest reserved by the lessor in and payable under the terms of the lease, or any of lessor's reversionary interests on the termination or expiration of the lease.

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.

Keywords: Colorado Springs, Colorado, lease subordination agreement, types A Colorado Springs Lease Subordination Agreement is a legal document that outlines the terms and conditions between a property owner (landlord/lessor) and a tenant (lessee) related to the subordination of their lease. It is commonly used in real estate transactions when a tenant wishes to obtain financing against the property and requires the existing lease to be subordinated to the new mortgage or lien. This agreement serves as a crucial document during the process of obtaining financing, as it establishes the priority of liens and encumbrances on the property, ensuring the lender's position in case of default or foreclosure. There are three primary types of Lease Subordination Agreements commonly used in Colorado Springs, Colorado: 1. Lease Subordination Agreement with a Commercial Lender: This type of agreement is used when a tenant wishes to secure financing from a commercial lender. The agreement states that the existing lease is subordinate to the lender's lien, allowing the lender to have a priority claim on the property. 2. Lease Subordination Agreement with a Residential Lender: This agreement is commonly used in residential real estate transactions. It establishes the subordination of the lease to a residential lender's mortgage or lien on the property. 3. Lease Subordination Agreement in a Sale Transaction: This type of agreement is utilized when a property is being sold, and the buyer intends to assume the existing lease. The agreement ensures that the lease is subordinate to any new or existing mortgages or liens on the property, protecting the buyer's position as the new owner. In all types of Lease Subordination Agreements, it is essential to clearly define the rights and obligations of the landlord, tenant, and the lender involved. Key elements that are typically addressed in the agreement include the lease term, rent payments, default provisions, notice requirements, and the rights of the lender in case of default or foreclosure. By entering into a Lease Subordination Agreement, both the tenant and the lender can have a clear understanding of their respective interests and rights in the property. It provides a legal framework that allows the tenant to obtain financing while also ensuring the lender's security in the event of default or foreclosure.Keywords: Colorado Springs, Colorado, lease subordination agreement, types A Colorado Springs Lease Subordination Agreement is a legal document that outlines the terms and conditions between a property owner (landlord/lessor) and a tenant (lessee) related to the subordination of their lease. It is commonly used in real estate transactions when a tenant wishes to obtain financing against the property and requires the existing lease to be subordinated to the new mortgage or lien. This agreement serves as a crucial document during the process of obtaining financing, as it establishes the priority of liens and encumbrances on the property, ensuring the lender's position in case of default or foreclosure. There are three primary types of Lease Subordination Agreements commonly used in Colorado Springs, Colorado: 1. Lease Subordination Agreement with a Commercial Lender: This type of agreement is used when a tenant wishes to secure financing from a commercial lender. The agreement states that the existing lease is subordinate to the lender's lien, allowing the lender to have a priority claim on the property. 2. Lease Subordination Agreement with a Residential Lender: This agreement is commonly used in residential real estate transactions. It establishes the subordination of the lease to a residential lender's mortgage or lien on the property. 3. Lease Subordination Agreement in a Sale Transaction: This type of agreement is utilized when a property is being sold, and the buyer intends to assume the existing lease. The agreement ensures that the lease is subordinate to any new or existing mortgages or liens on the property, protecting the buyer's position as the new owner. In all types of Lease Subordination Agreements, it is essential to clearly define the rights and obligations of the landlord, tenant, and the lender involved. Key elements that are typically addressed in the agreement include the lease term, rent payments, default provisions, notice requirements, and the rights of the lender in case of default or foreclosure. By entering into a Lease Subordination Agreement, both the tenant and the lender can have a clear understanding of their respective interests and rights in the property. It provides a legal framework that allows the tenant to obtain financing while also ensuring the lender's security in the event of default or foreclosure.