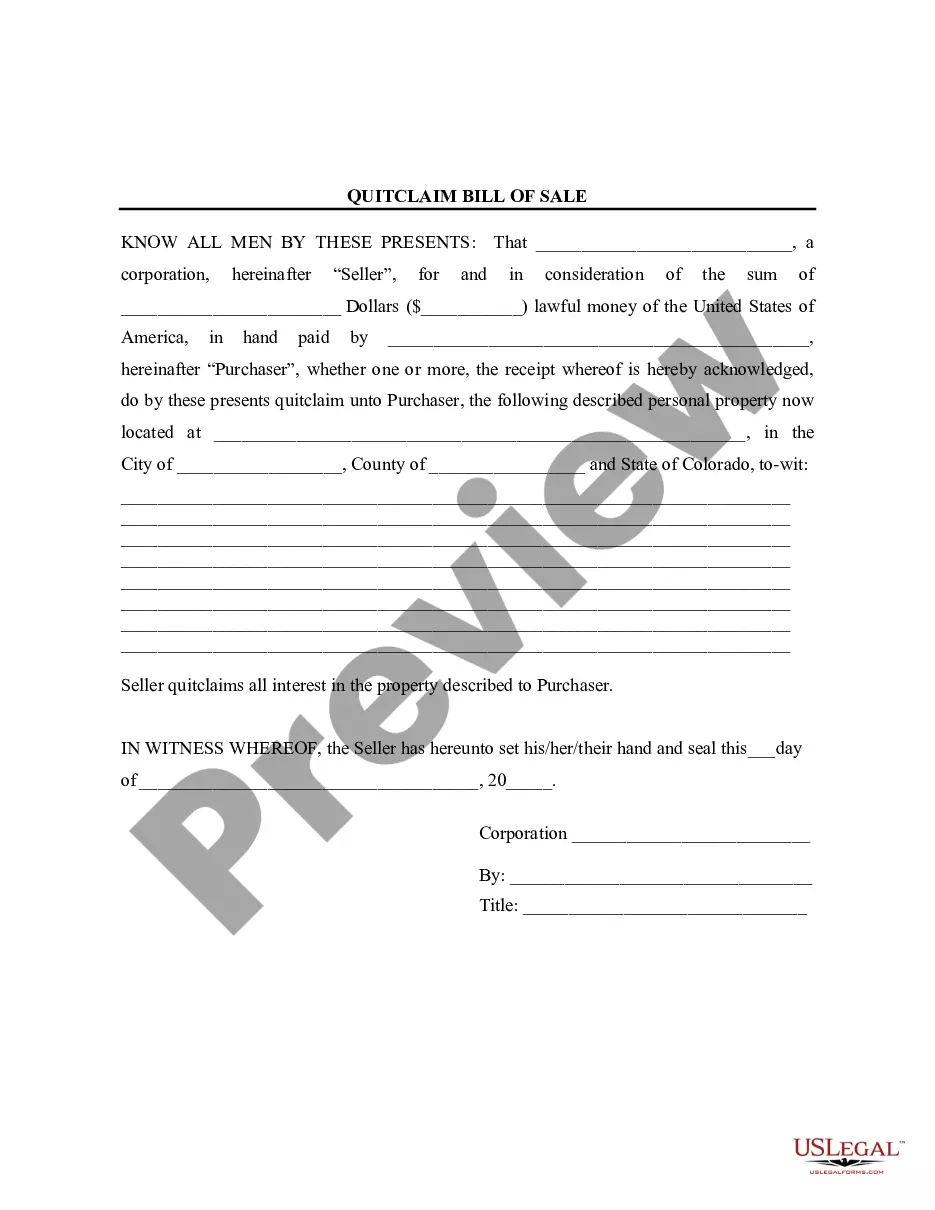

Centennial Colorado Bill of Sale without Warranty by Corporate Seller is a legal document that outlines the sale of goods or property from a corporate entity to an individual, without any guarantee or warranty provided by the seller. This type of bill of sale serves as proof of transfer of ownership and can be used for various transactions such as the sale of vehicles, equipment, or other valuable assets. When creating a Centennial Colorado Bill of Sale without Warranty by Corporate Seller, it is crucial to include specific details that accurately represent the transaction and protect the interests of both parties involved. The document should contain relevant information such as: 1. Identity and Contact Information: Start by stating the full legal name and address of the corporate seller, as well as the buyer. 2. Description of the Asset: Provide a detailed description of the asset being sold, including its make, model, year (if applicable), serial or identification numbers, and any distinguishing features. For vehicles, mention the mileage and Vehicle Identification Number (VIN). 3. Purchase Price and Payment Terms: Clearly state the agreed-upon purchase price, indicating whether it includes any additional fees or taxes. Specify the payment method (cash, check, or any other accepted form) and note if any amount has already been paid. 4. As-Is Condition: Emphasize that the asset is being sold "as-is" without any warranties or guarantees. This means that the seller does not assume responsibility for any defects, damages, or future repairs. 5. Seller's Representation: Include a clause confirming that the seller owns the asset, has the legal authority to sell it, and that there are no liens, claims, or encumbrances against it. 6. Buyer's Acknowledgment: Request the buyer's signature to acknowledge that they have examined the asset, are satisfied with its condition, and accept it in its present state. 7. Governing Law: Mention that the Centennial Colorado laws govern any disputes arising from the bill of sale and specify the jurisdiction for resolving such matters. It is important to note that different types of Centennial Colorado Bill of Sale without Warranty by Corporate Seller may exist, each tailored to specific transactions. For example, there may be separate bill of sale forms for vehicle sales, equipment sales, or other asset categories. However, the common element among them is the absence of any warranties or guarantees provided by the corporate seller, emphasizing the "as-is" nature of the transaction. The Centennial Colorado Bill of Sale without Warranty by Corporate Seller is a legally binding document that should be signed by both the buyer and the corporate seller, and a copy should be retained by each party for future reference. It is recommended to consult with a legal professional or use readily available templates to ensure compliance with the relevant laws and regulations.

Centennial Colorado Bill of Sale without Warranty by Corporate Seller

Description

How to fill out Centennial Colorado Bill Of Sale Without Warranty By Corporate Seller?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no law education to create this sort of paperwork cfrom the ground up, mainly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service provides a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you need the Centennial Colorado Bill of Sale without Warranty by Corporate Seller or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Centennial Colorado Bill of Sale without Warranty by Corporate Seller in minutes using our trustworthy service. If you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

However, in case you are new to our library, ensure that you follow these steps before downloading the Centennial Colorado Bill of Sale without Warranty by Corporate Seller:

- Be sure the template you have found is suitable for your area considering that the regulations of one state or county do not work for another state or county.

- Review the document and read a brief outline (if available) of cases the document can be used for.

- In case the form you picked doesn’t suit your needs, you can start over and look for the necessary document.

- Click Buy now and pick the subscription option that suits you the best.

- with your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Centennial Colorado Bill of Sale without Warranty by Corporate Seller once the payment is completed.

You’re all set! Now you can go ahead and print out the document or fill it out online. If you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.