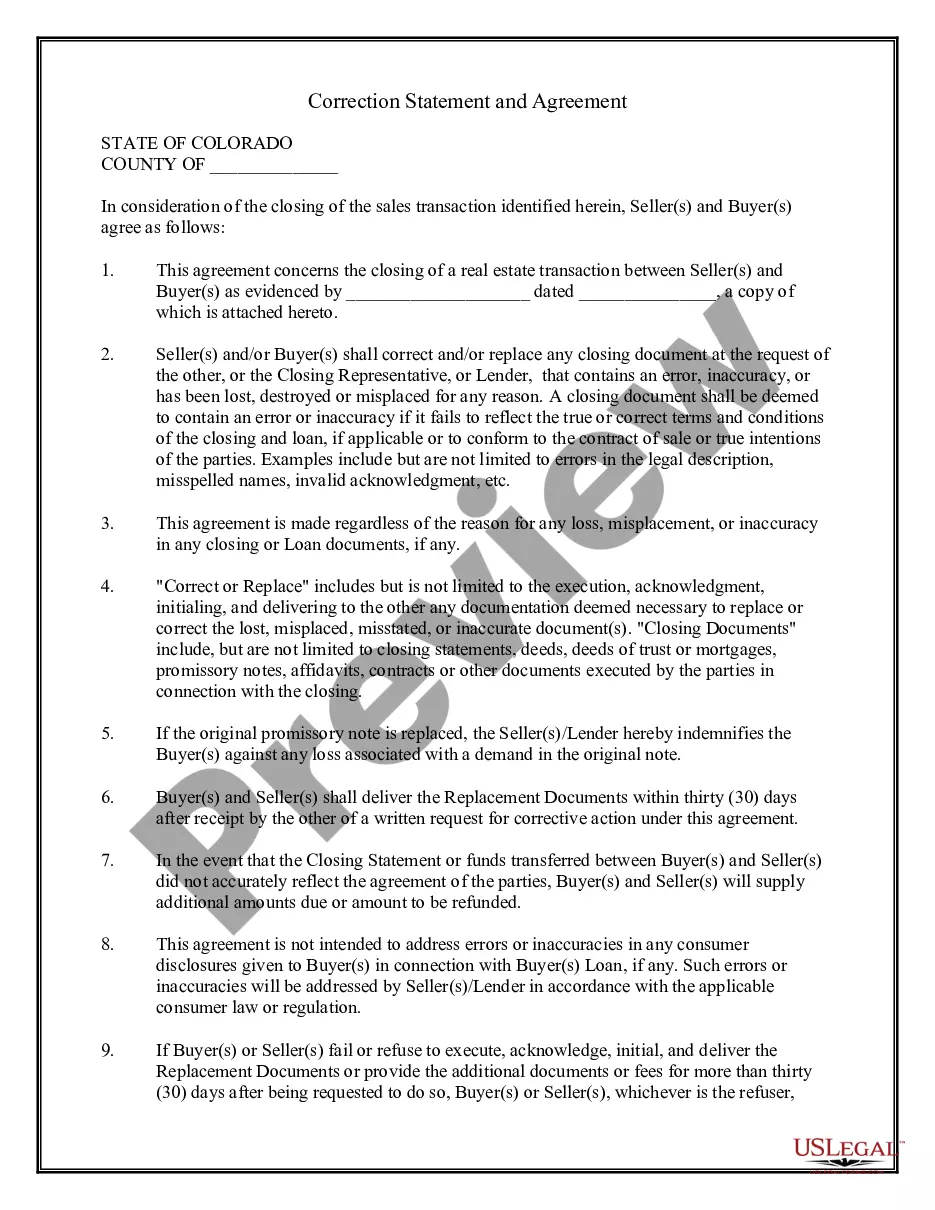

Centennial Colorado Correction Statement and Agreement is a legal document that outlines the terms and conditions for correcting and rectifying any errors, mistakes, or omissions in previously submitted documents or statements in Centennial, Colorado. This agreement ensures that the correct information is provided and any unintentional misinformation or inaccuracies are rectified. The Centennial Colorado Correction Statement and Agreement pertains to various situations, such as incorrect financial or tax statements, misleading marketing materials, erroneous public records, inaccurate business filings, and any other mistake that needs to be addressed and corrected. It serves as a formal agreement between the concerned parties involved in the correction process. This agreement acts as a guideline for individuals, businesses, organizations, or government entities in Centennial, Colorado, to make corrections and ensure the accuracy and reliability of their information. By following the Centennial Colorado Correction Statement and Agreement, parties demonstrate their commitment to upholding transparency, accountability, and the ethical standards expected in the community. Different types of Centennial Colorado Correction Statement and Agreement may exist depending on the specific purpose and context. Some examples include: 1. Financial Correction Statement and Agreement: This type of agreement is used to rectify any mistakes or discrepancies in financial statements, including balance sheets, income statements, and cash flow statements. 2. Tax Correction Statement and Agreement: This agreement is related to the correction of incorrect or misleading tax information, forms, or returns submitted to the Internal Revenue Service (IRS) or the Colorado Department of Revenue. 3. Legal Correction Statement and Agreement: This document is utilized in legal matters to address errors in legal documentation, contracts, court filings, or any other legal records that require correction. 4. Public Record Correction Statement and Agreement: This agreement is designed to correct any erroneous information included in public records, such as property records, court records, or official government documents. 5. Business Filing Correction Statement and Agreement: This type of agreement focuses on correcting inaccuracies in business filings, such as trade names, trademarks, business licenses, or articles of organization, to ensure compliance with state regulations. In summary, the Centennial Colorado Correction Statement and Agreement formulates a framework for rectifying errors, mistakes, or omissions in various types of documents, statements, or records. Adhering to this agreement ensures accuracy, transparency, and compliance with legal and ethical standards in Centennial, Colorado.

Centennial Colorado Correction Statement and Agreement

Description

How to fill out Centennial Colorado Correction Statement And Agreement?

Benefit from the US Legal Forms and obtain instant access to any form you require. Our beneficial website with a large number of documents allows you to find and obtain virtually any document sample you want. You can download, fill, and sign the Centennial Colorado Correction Statement and Agreement in a matter of minutes instead of surfing the Net for hours seeking an appropriate template.

Using our library is a superb strategy to increase the safety of your document submissions. Our professional lawyers on a regular basis review all the documents to ensure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How can you get the Centennial Colorado Correction Statement and Agreement? If you have a profile, just log in to the account. The Download option will appear on all the documents you look at. In addition, you can find all the previously saved files in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Open the page with the template you need. Ensure that it is the form you were seeking: examine its name and description, and make use of the Preview feature if it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the saving process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Download the file. Pick the format to get the Centennial Colorado Correction Statement and Agreement and revise and fill, or sign it for your needs.

US Legal Forms is among the most significant and reliable template libraries on the web. Our company is always happy to help you in virtually any legal process, even if it is just downloading the Centennial Colorado Correction Statement and Agreement.

Feel free to benefit from our service and make your document experience as efficient as possible!