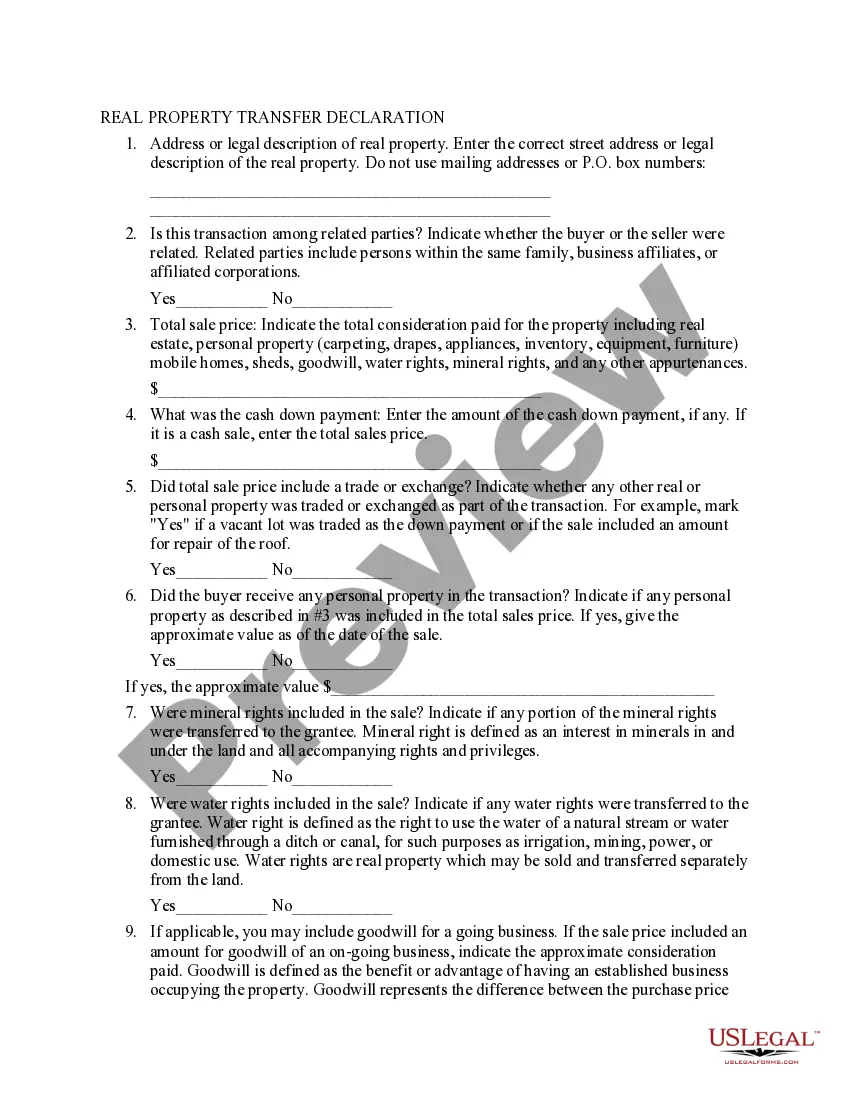

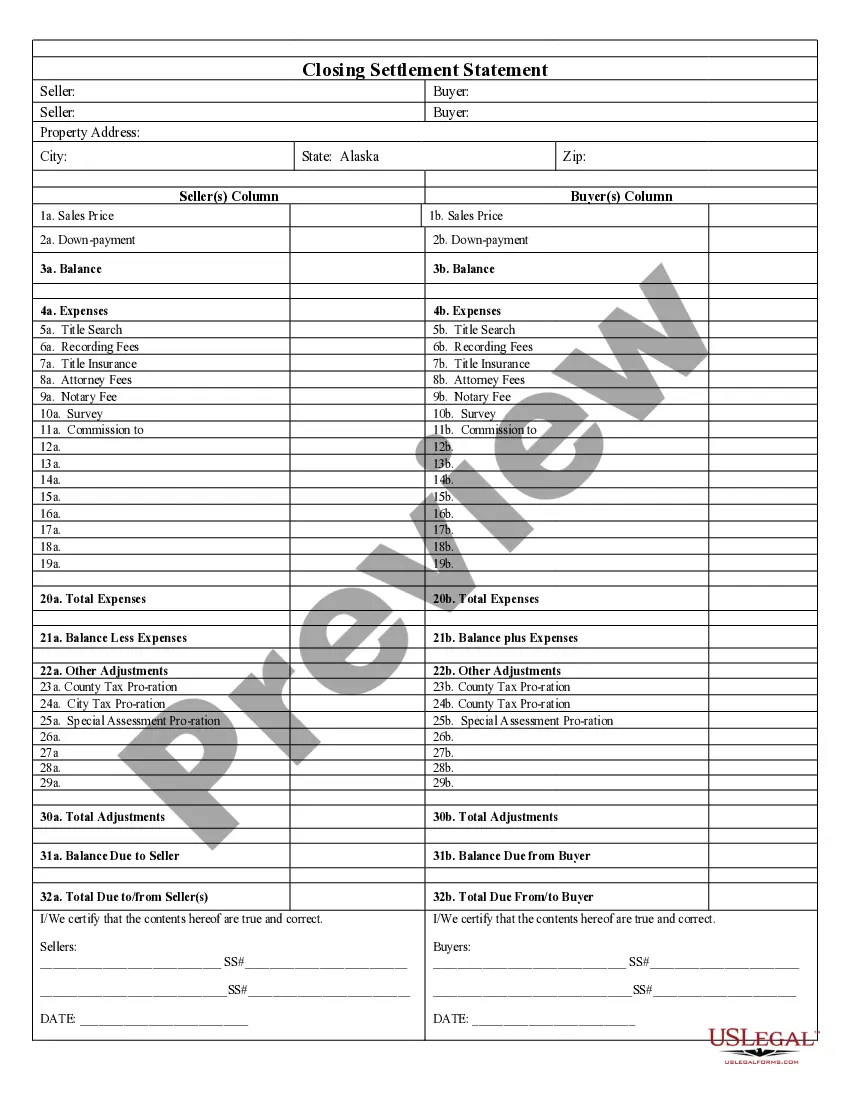

Thornton Colorado Closing Statement is a legal document that essentially serves as a final declaration of the terms and agreements reached between the buyer and seller during a real estate transaction in the city of Thornton, Colorado. It is typically prepared by the escrow or closing agent and helps ensure a smooth closing process. The Thornton Colorado Closing Statement contains extensive details regarding the financial aspects of the transaction, outlining all the costs, fees, and expenses associated with the purchase or sale of a property. It acts as a comprehensive summary of all the financial obligations both parties need to fulfill to successfully complete the transaction. These closing costs may include, but are not limited to, lender fees, appraisal charges, attorney fees, title insurance, property taxes, and more. Moreover, the Thornton Colorado Closing Statement includes specific information about the funds collected from both the buyer and seller. It presents a breakdown of the buyer's down payment, the loan amount (if any), earnest money deposit, and any adjustments made based on prorated taxes, HOA fees, or utility bills. Different types of Closing Statements may exist within the context of Thornton, Colorado, depending on the type of transaction. Some of these types may include residential closing statements (for residential homes), commercial closing statements (for commercial properties), refinance closing statements (pertaining to refinancing existing loans), and foreclosure closing statements (associated with distressed property sales). Each type may have slight variations in the content and requirements. In summary, the Thornton Colorado Closing Statement serves as a crucial legal document that outlines and concludes a real estate transaction in Thornton, Colorado. It provides a comprehensive breakdown of all financial aspects involved, ensuring transparency and facilitating a successful closing process.

Thornton Colorado Closing Statement

Description

How to fill out Thornton Colorado Closing Statement?

If you are seeking a pertinent document, it’s impossible to discover a superior service than the US Legal Forms website – likely the most exhaustive online collections.

With this collection, you can locate a vast array of form samples for business and personal purposes by categories and regions, or keywords.

With the enhanced search capability, uncovering the most recent Thornton Colorado Closing Statement is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration step.

Acquire the form. Select the file format and download it to your device.

- Furthermore, the applicability of each document is validated by a team of expert lawyers who consistently assess the templates on our site and update them based on the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Thornton Colorado Closing Statement is to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, simply refer to the instructions outlined below.

- Ensure you have located the form you need. Review its details and use the Preview option to examine its content. If it doesn’t fulfill your needs, utilize the Search bar at the top of the page to find the required document.

- Validate your choice. Click the Buy now button. Then, choose the desired subscription plan and enter your information to create an account.

Form popularity

FAQ

Closing an estate in Colorado involves several steps, including finalizing all debts and taxes owed, distributing assets to beneficiaries, and preparing a Thornton Colorado Closing Statement. It is essential to file the necessary documents in court to formally close the estate. By leveraging USLegalForms, you can access valuable templates and information that make the closing process more manageable and compliant with state laws.

In Colorado, a personal representative generally has up to one year to settle an estate. However, this timeline can vary based on the complexity of the estate and any disputes that may arise. Completing a Thornton Colorado Closing Statement accurately can streamline the settling process. To assist with this, USLegalForms provides helpful resources to guide you through the necessary legal documentation.

Yes, closing instructions are required in Colorado to ensure a smooth closing process. These instructions outline the responsibilities of all parties involved, including the closing agent and lenders. A properly prepared Thornton Colorado Closing Statement is crucial to avoid delays and misunderstandings during the closing. Using a resource like USLegalForms can help you find the appropriate templates and guidelines for your closing instructions.

In Colorado, ownership of the property transfers to the buyer on the day of closing. This means that once the closing statement is finalized and funds are exchanged, the buyer becomes the legal owner of the property. It is essential for buyers to understand this transfer process, as it is crucial for their legal rights and responsibilities. Reviewing the Thornton Colorado Closing Statement can help clarify any financial details related to the transaction.

While it is possible to move on the day of closing, it is generally advisable to wait until the transaction is officially complete. This means that all documents are signed, and the Thornton Colorado Closing Statement has been finalized. Delaying your move-in can reduce last-minute stress and ensure everything is settled. Consult your real estate agent for the best strategy tailored to your specific situation.

On the day of closing, all parties involved meet to sign documents and finalize the sale. You will review the Thornton Colorado Closing Statement, which outlines the financial details of your transaction. After signing, the buyer makes payment, and funds are distributed accordingly. Once everything is processed, the keys to your new home are handed over, marking a significant milestone.

The final closing statement is typically prepared by the closing agent or the settlement company handling the transaction. They gather all relevant financial information and calculate the final figures. In some cases, if you are using a real estate agent, they may also assist in preparing this important document. Ensuring an accurate Thornton Colorado Closing Statement helps avoid misunderstandings and facilitates a smoother closing process.

On the day of closing, ownership officially transfers to the buyer. This transfer occurs as you review and sign the closing documents, including the Thornton Colorado Closing Statement. Once the documents are signed and the payment is processed, the title is recorded in the buyer's name. This means you can freely enjoy your new property from that moment.

To obtain a copy of your closing statement, contact your lender or the title company that facilitated your closing. They can provide you with the necessary documents, including the Thornton Colorado Closing Statement, which is essential for your records. If you encounter any challenges, uslegalforms can aid you in navigating the process effectively.

You can find a settlement statement through your lender or the title company that handled your closing. This document, often part of the Thornton Colorado Closing Statement, details the financial transactions of your real estate transaction. If you need help locating it, consider reaching out to uslegalforms for assistance in obtaining these important documents.