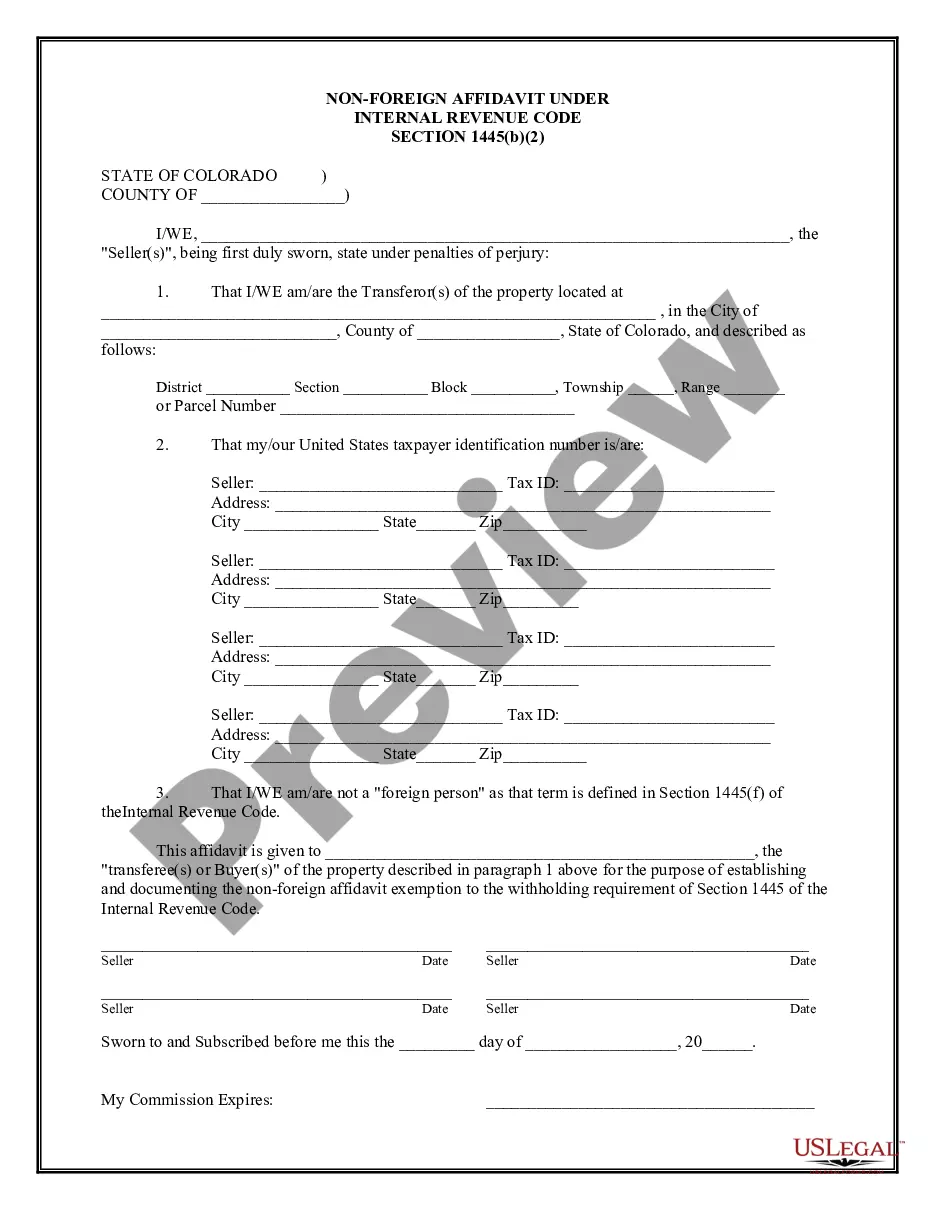

Arvada, Colorado Non-Foreign Affidavit Under IRC 1445 is a legal document that is specifically relevant to the real estate industry. It is required by the Internal Revenue Code (IRC) section 1445, which deals with tax withholding on the sale of U.S. real property interests by foreign persons. The purpose of the Arvada, Colorado Non-Foreign Affidavit Under IRC 1445 is to certify that the seller of the property is not a foreign person. Foreign persons are subject to certain tax withholding provisions to ensure tax compliance on the sale of U.S. real property. However, if the seller is not a foreign person, they can provide this affidavit as proof. Here are a few key points to understand about the Arvada, Colorado Non-Foreign Affidavit Under IRC 1445: 1. Requirements and Contents: The affidavit typically includes the seller's name, contact information, and information about the property being sold. It also requires the seller to declare, under penalty of perjury, that they are not a foreign person for tax purposes. Additionally, the affidavit may require the seller to provide their taxpayer identification number (TIN) or social security number for further verification. 2. Different Types: Generally, there are no specific types or variations of Arvada, Colorado Non-Foreign Affidavit Under IRC 1445. However, the content and format of the affidavit may vary depending on the specific requirements of the title company or the real estate transaction. 3. Importance in Real Estate Transactions: The Arvada, Colorado Non-Foreign Affidavit Under IRC 1445 plays a crucial role in the closing process of real estate transactions involving foreign and non-foreign sellers. It helps fulfill the IRS's withholding tax obligations and provides assurance to the buyer, seller, and other relevant parties that the transaction is conducted in compliance with tax laws. 4. Completing the Affidavit: The affidavit is typically prepared by the seller's attorney, title company, or another authorized party involved in the real estate transaction. The seller must provide accurate and truthful information while signing the affidavit. In some cases, the buyer's attorney or representative may review and validate the affidavit before the transaction proceeds. In conclusion, the Arvada, Colorado Non-Foreign Affidavit Under IRC 1445 is a vital document in real estate transactions to ensure tax compliance and establish the seller's non-foreign status. By providing this affidavit, sellers can navigate the tax withholding provisions associated with the sale of U.S. real property interests.

Arvada Colorado Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Arvada Colorado Non-Foreign Affidavit Under IRC 1445?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Arvada Colorado Non-Foreign Affidavit Under IRC 1445 gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Arvada Colorado Non-Foreign Affidavit Under IRC 1445 takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Arvada Colorado Non-Foreign Affidavit Under IRC 1445. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!