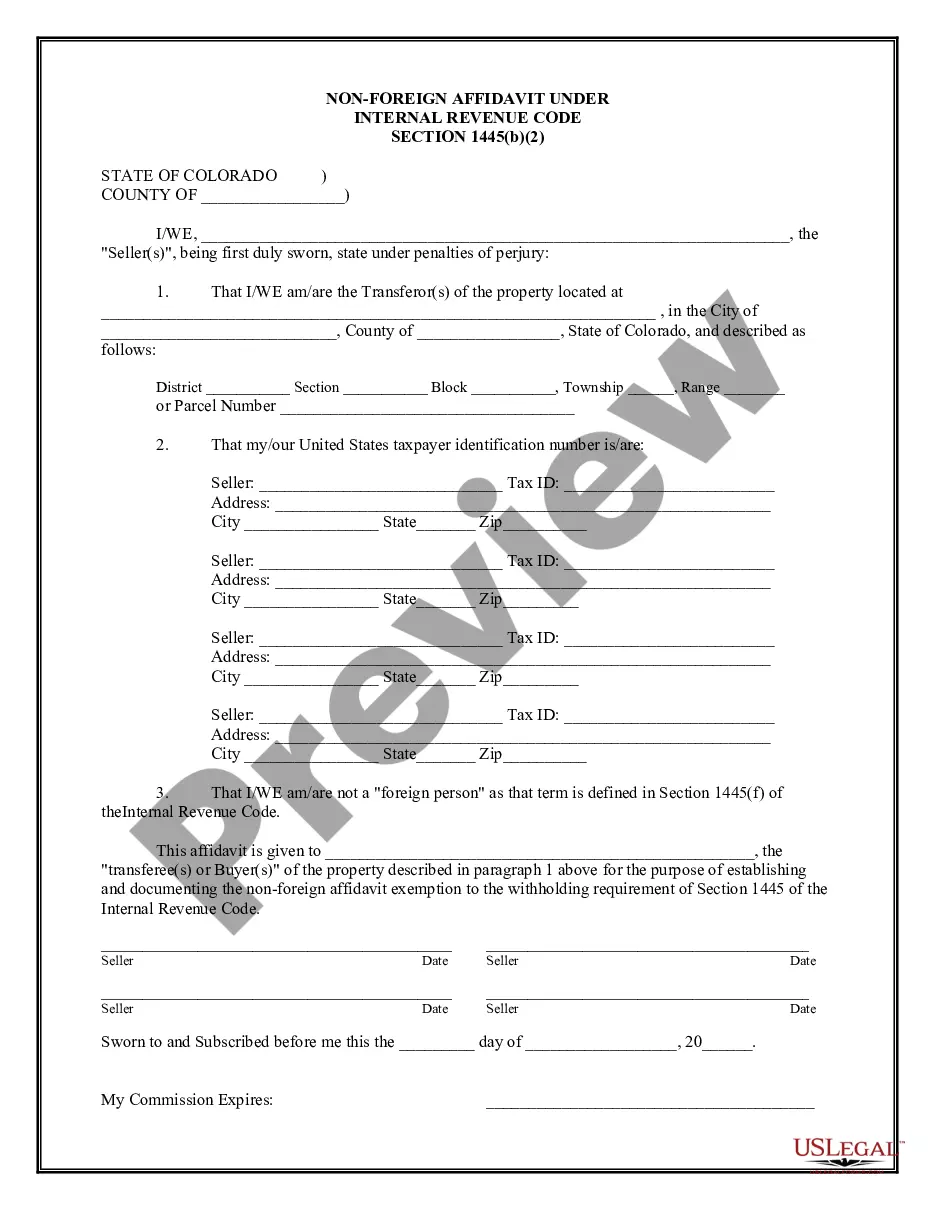

The Fort Collins Colorado Non-Foreign Affidavit Under IRC 1445 is an important document used in real estate transactions involving the sale or transfer of US real property interests. This affidavit helps determine if the transferor of the property is a non-foreign person and ensures compliance with the Internal Revenue Code (IRC) Section 1445. The purpose of this affidavit is to provide the necessary information required by the IRS when conveying or selling a US real property interest. By signing this document, the transferor certifies under penalties of perjury that they are not a foreign person, as defined by the IRC Section 1445. The Fort Collins Colorado Non-Foreign Affidavit Under IRC 1445 is a critical requirement in certain property transactions to ensure that appropriate taxes are withheld and reported to the IRS. Failure to comply with the IRS regulations could lead to significant penalties and legal complications. There are different types of Non-Foreign Affidavits Under IRC 1445 that may be used in Fort Collins, Colorado, depending on the specific circumstances of the real estate transaction. These affidavits include: 1. Non-Foreign Affidavit for Individual Transferors: This affidavit is used when the transferor of the property is an individual who is not a foreign person. The affidavit will require the individual's personal information and certification of their non-foreign status. 2. Non-Foreign Affidavit for Corporate Transferors: This affidavit is utilized when the transferor is a corporation or another entity, such as a limited liability company (LLC), partnership, or trust, that is not considered a foreign person under IRC Section 1445. 3. Non-Foreign Affidavit for Qualified Investment Entities: This affidavit is specifically designed for real estate investment entities, such as Real Estate Investment Trusts (Rests) or foreign pension funds that qualify for certain exemptions or special rules under IRC Section 1445. It is crucial to consult with a qualified real estate attorney or tax professional when dealing with Non-Foreign Affidavits and IRC 1445 compliance. They can provide expert guidance to ensure accurate completion of the affidavit and adherence to the relevant regulations. In summary, the Fort Collins Colorado Non-Foreign Affidavit Under IRC 1445 is a vital document used in real estate transactions to certify that the transferor of the property is not a foreign person. Compliance with this requirement is essential to avoid legal complications and ensure proper tax reporting to the IRS.

Fort Collins Colorado Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Fort Collins Colorado Non-Foreign Affidavit Under IRC 1445?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for legal solutions that, usually, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Fort Collins Colorado Non-Foreign Affidavit Under IRC 1445 or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Fort Collins Colorado Non-Foreign Affidavit Under IRC 1445 adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Fort Collins Colorado Non-Foreign Affidavit Under IRC 1445 is proper for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!