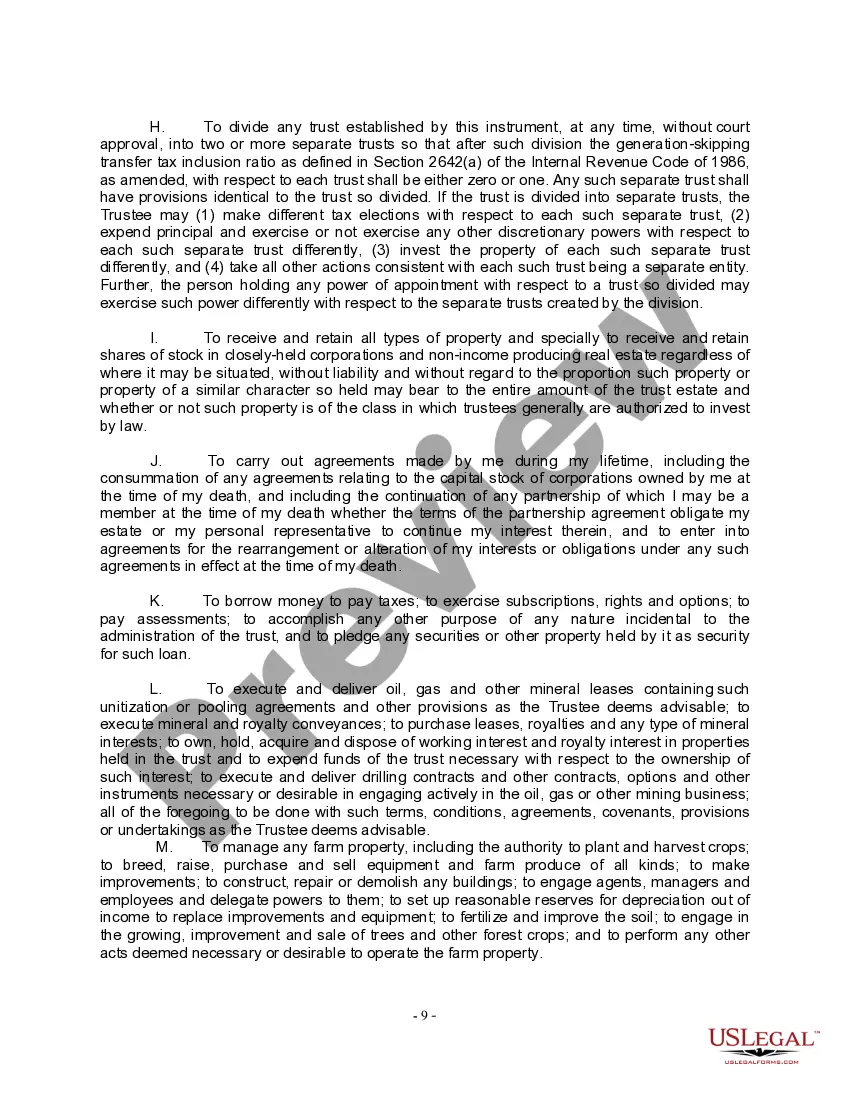

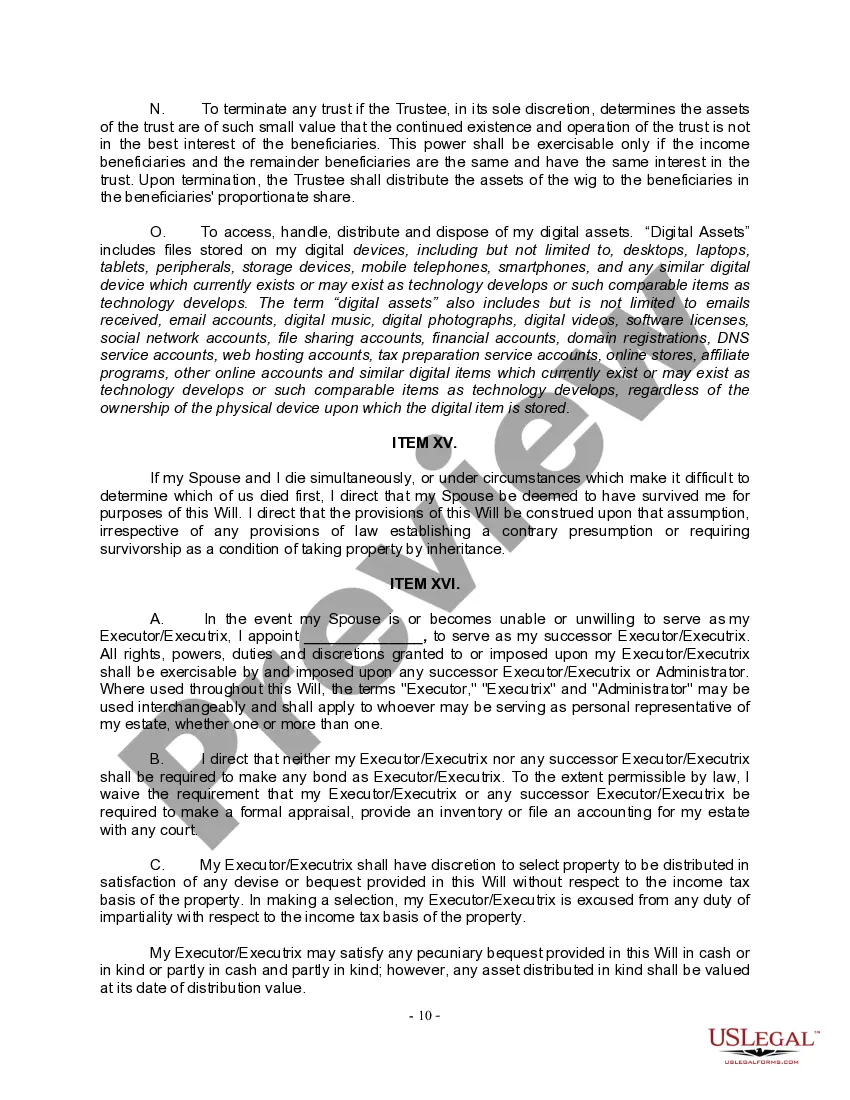

Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates is an estate planning tool designed to protect and preserve the assets of individuals with substantial estates. This complex will combine the advantages of a credit shelter trust and a marital trust, offering significant tax benefits and flexibility for estate distribution. The credit shelter trust, also known as a bypass or a family trust, is drafted to utilize an individual's estate tax exemption. By sheltering a portion of the estate from estate taxes, this trust ensures that the beneficiaries ultimately receive more of the estate's value. This type of trust is especially beneficial for married couples as it allows them to maximize their estate tax exemptions individually, effectively doubling the amount protected from taxation. The marital trust, often referred to as a TIP (Qualified Terminable Interest Property) trust, provides financial security for the surviving spouse while allowing the granter to maintain control over the ultimate distribution of assets. Unlike the credit shelter trust, the assets placed in the marital trust are included in the surviving spouse's estate, potentially increasing the overall estate tax liability. However, this trust ensures that the surviving spouse receives income distributions, has access to the principal, and is taken care of throughout their lifetime. By combining these two trusts within a Fort Collins Colorado Complex Will, individuals with large estates can create a comprehensive estate plan that strives to minimize estate taxes and provide for their loved ones. The complexity of such a will requires experienced estate planning attorneys well-versed in tax laws and regulations to ensure all intricacies are correctly addressed. The Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates offers several variations tailored to meet specific needs: 1. Testamentary Credit Shelter Marital Trust: This type of trust is established within the will, activated only upon the death of the granter. It provides the surviving spouse with income distributions and access to principal while maximizing estate tax exemptions. 2. Revocable Living Complex Will with Credit Shelter Marital Trust: This trust is created during the granter's lifetime and allows alteration or revocation if circumstances change. It provides flexibility while achieving the same objectives as the testamentary trust. 3. Irrevocable Complex Will with Credit Shelter Marital Trust: Unlike the revocable trust, the irrevocable version cannot be amended or revoked once established. This type of trust is often used to protect assets from potential creditors, preserve wealth, and reduce estate tax liability. In summary, the Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates is an estate planning strategy that integrates a credit shelter trust and a marital trust to protect assets, preserve wealth, and minimize estate taxes. It is essential for individuals with significant estates to consult with experienced estate planning attorneys to determine the most suitable option to meet their specific needs.

Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out Fort Collins Colorado Complex Will With Credit Shelter Marital Trust For Large Estates?

Take advantage of the US Legal Forms and gain immediate access to any form sample you require.

Our user-friendly website with a vast array of documents enables you to locate and acquire nearly any document sample you need.

You can download, complete, and endorse the Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates in a matter of minutes rather than spending hours searching online for a suitable template.

Utilizing our repository is a smart approach to enhance the security of your form submissions. Our experienced legal experts routinely assess all the documents to ensure that the templates are suitable for a specific state and adhere to current laws and regulations.

Download the file. Choose the format to receive the Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates and modify and complete, or endorse it as per your needs.

US Legal Forms is likely the most extensive and reliable form library available online. Our company is always prepared to assist you with any legal process, even if it's merely downloading the Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates. Feel free to maximize our form catalog and optimize your document experience!

- How can you obtain the Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates.

- If you already have a membership, simply Log In to your account. The Download option will be available for all the samples you view.

- Furthermore, you can access all previously saved documents in the My documents section.

- If you don't yet possess an account, adhere to the steps outlined below.

- Access the page containing the form you need. Ensure that it is the form you were seeking: check its title and description, and utilize the Preview option when available. Otherwise, utilize the Search field to find the necessary one.

- Initiate the downloading process. Choose Buy Now and select the pricing plan that fits you best. Then, create an account and complete your order with a credit card or PayPal.

Form popularity

FAQ

A credit trust and a marital trust function differently in estate planning. A credit trust is focused on minimizing estate taxes by maximizing exemptions, while a marital trust ensures that a surviving spouse has access to trust income. Both can be integral components of a Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates, and understanding their roles can help you make informed decisions.

One disadvantage of a credit shelter trust is that it may complicate estate management, as it requires separate tax returns and accounting. Additionally, if not structured correctly, it can lead to unintended tax implications. However, when used appropriately in a Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates, many of these challenges can be addressed with the help of a knowledgeable professional.

A GRAT (Grantor Retained Annuity Trust) and a CRT (Charitable Remainder Trust) serve distinct purposes in estate planning. A GRAT allows you to transfer assets while retaining annuity payments for a specified term, potentially reducing gift taxes. In contrast, a CRT involves donating assets to charity, providing income during your lifetime, and benefiting your heirs after. For those considering a Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates, it's important to weigh these options.

A credit trust, often referred to as a credit shelter trust, is designed to hold assets up to the exemption limit to minimize estate taxes. This type of trust allows the decedent's estate to take advantage of their exemption amounts, benefiting heirs while reducing overall tax liability. When considering estate planning, understanding a credit trust's role in a Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates is vital.

Another name for a marital trust is a Qualified Terminable Interest Property (QTIP) trust. This type of trust allows a surviving spouse to receive trust income during their lifetime, while ensuring that the principal ultimately goes to other beneficiaries. Knowing this term can be important when discussing your options in a Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates.

A credit shelter trust and a marital trust serve different purposes in estate planning. A credit shelter trust helps reduce estate taxes by utilizing the estate tax exemption for the deceased spouse, while a marital trust allows the surviving spouse to receive income from the trust assets. Understanding these differences is crucial when creating a Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates.

Yes, a credit shelter trust typically needs to file a tax return. This trust is considered a separate entity for tax purposes, which means it must report its income and expenses. It's essential to manage this process properly to ensure compliance with tax laws, especially when dealing with a Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates.

While trusts offer many benefits, they come with some disadvantages. Firstly, creating a trust involves legal costs and ongoing management responsibilities, which can be complex. Additionally, a credit shelter trust, as part of the Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates, may limit flexibility in accessing assets due to its irrevocable nature. Understanding these drawbacks is essential for informed planning.

Income generated from a credit shelter trust is generally taxed to the trust itself. This means the trust needs to file a tax return, paying taxes on any earnings before distribution. However, beneficiaries receiving distributions may also face taxes on that income. Planning within a Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates can clarify these tax implications and alleviate concerns.

A marital trust allows the surviving spouse to access income and principal during their lifetime, while a credit shelter trust, defined in the Fort Collins Colorado Complex Will with Credit Shelter Marital Trust for Large Estates, aims to minimize estate taxes for the deceased spouse's heirs. The credit shelter trust holds a portion of the estate outside the surviving spouse's estate, benefiting heirs without incurring additional taxes upon the second spouse's death. Understanding these differences helps ensure proper estate planning.