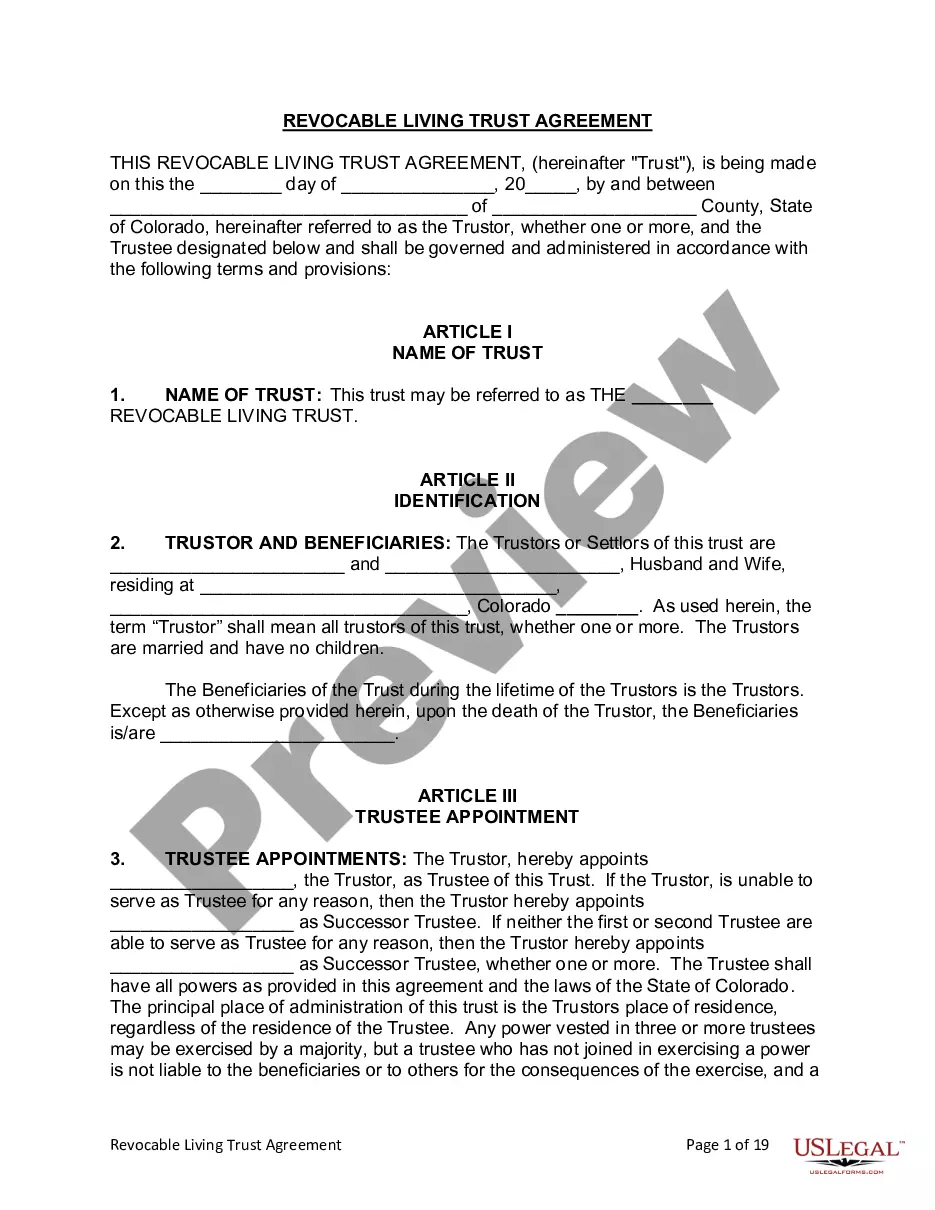

This Living Trust form is a living trust prepared for your state. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Colorado Springs living trust for a husband and wife with no children is a legal document that helps couples protect and distribute their assets during their lifetime and after their passing. It serves as an effective tool for managing and organizing their estate while minimizing probate costs and potentially reducing estate taxes. Here, we will explore the various types of living trusts that couples can establish in Colorado Springs, Colorado: 1. Revocable Living Trust: A revocable living trust is the most common type of living trust utilized by married couples without children in Colorado Springs. With this trust, couples can retain control of their assets during their lifetime while designating how those assets will be distributed upon their death. The trust can be modified or revoked as circumstances change, providing flexibility and control. A revocable living trust helps avoid probate and ensures privacy by keeping the estate out of public records. 2. Irrevocable Living Trust: While less commonly used, an irrevocable living trust can be beneficial in specific situations. Establishing an irrevocable living trust transfers ownership of assets to the trust, removing them from the couple's estate. By effectively giving up control over the assets, the couple may gain certain tax benefits or protect their assets from creditors or potential lawsuits. It's essential to consult an attorney before opting for an irrevocable trust due to its irreversible nature. 3. Joint Living Trust: A joint living trust is an option for couples who want to combine their assets and estate planning efforts. This type of trust allows spouses to create a single trust document to hold their assets jointly, simplifying the administration process. Joint living trusts typically become irrevocable upon the death of the first spouse, ensuring the wishes of the couple remain intact. 4. Qualified Personnel Residence Trust (PRT): For couples who want to protect their primary residence and potentially reduce estate taxes, a PRT may be an ideal option. With this trust, couples transfer ownership of their home into the trust while retaining the right to live in it for a set number of years. By doing so, they can remove the value of the home from their estate, potentially reducing taxes while still enjoying residence during the trust's term. In Colorado Springs, establishing a living trust for couples without children offers a range of benefits, including avoiding probate, maintaining privacy, and having more control over asset distribution. Whether opting for a revocable or irrevocable trust, or considering joint living trusts or a specialized PRT, it's crucial to consult an experienced attorney who specializes in trust and estate planning to ensure the trust aligns with your specific goals and needs.A Colorado Springs living trust for a husband and wife with no children is a legal document that helps couples protect and distribute their assets during their lifetime and after their passing. It serves as an effective tool for managing and organizing their estate while minimizing probate costs and potentially reducing estate taxes. Here, we will explore the various types of living trusts that couples can establish in Colorado Springs, Colorado: 1. Revocable Living Trust: A revocable living trust is the most common type of living trust utilized by married couples without children in Colorado Springs. With this trust, couples can retain control of their assets during their lifetime while designating how those assets will be distributed upon their death. The trust can be modified or revoked as circumstances change, providing flexibility and control. A revocable living trust helps avoid probate and ensures privacy by keeping the estate out of public records. 2. Irrevocable Living Trust: While less commonly used, an irrevocable living trust can be beneficial in specific situations. Establishing an irrevocable living trust transfers ownership of assets to the trust, removing them from the couple's estate. By effectively giving up control over the assets, the couple may gain certain tax benefits or protect their assets from creditors or potential lawsuits. It's essential to consult an attorney before opting for an irrevocable trust due to its irreversible nature. 3. Joint Living Trust: A joint living trust is an option for couples who want to combine their assets and estate planning efforts. This type of trust allows spouses to create a single trust document to hold their assets jointly, simplifying the administration process. Joint living trusts typically become irrevocable upon the death of the first spouse, ensuring the wishes of the couple remain intact. 4. Qualified Personnel Residence Trust (PRT): For couples who want to protect their primary residence and potentially reduce estate taxes, a PRT may be an ideal option. With this trust, couples transfer ownership of their home into the trust while retaining the right to live in it for a set number of years. By doing so, they can remove the value of the home from their estate, potentially reducing taxes while still enjoying residence during the trust's term. In Colorado Springs, establishing a living trust for couples without children offers a range of benefits, including avoiding probate, maintaining privacy, and having more control over asset distribution. Whether opting for a revocable or irrevocable trust, or considering joint living trusts or a specialized PRT, it's crucial to consult an experienced attorney who specializes in trust and estate planning to ensure the trust aligns with your specific goals and needs.