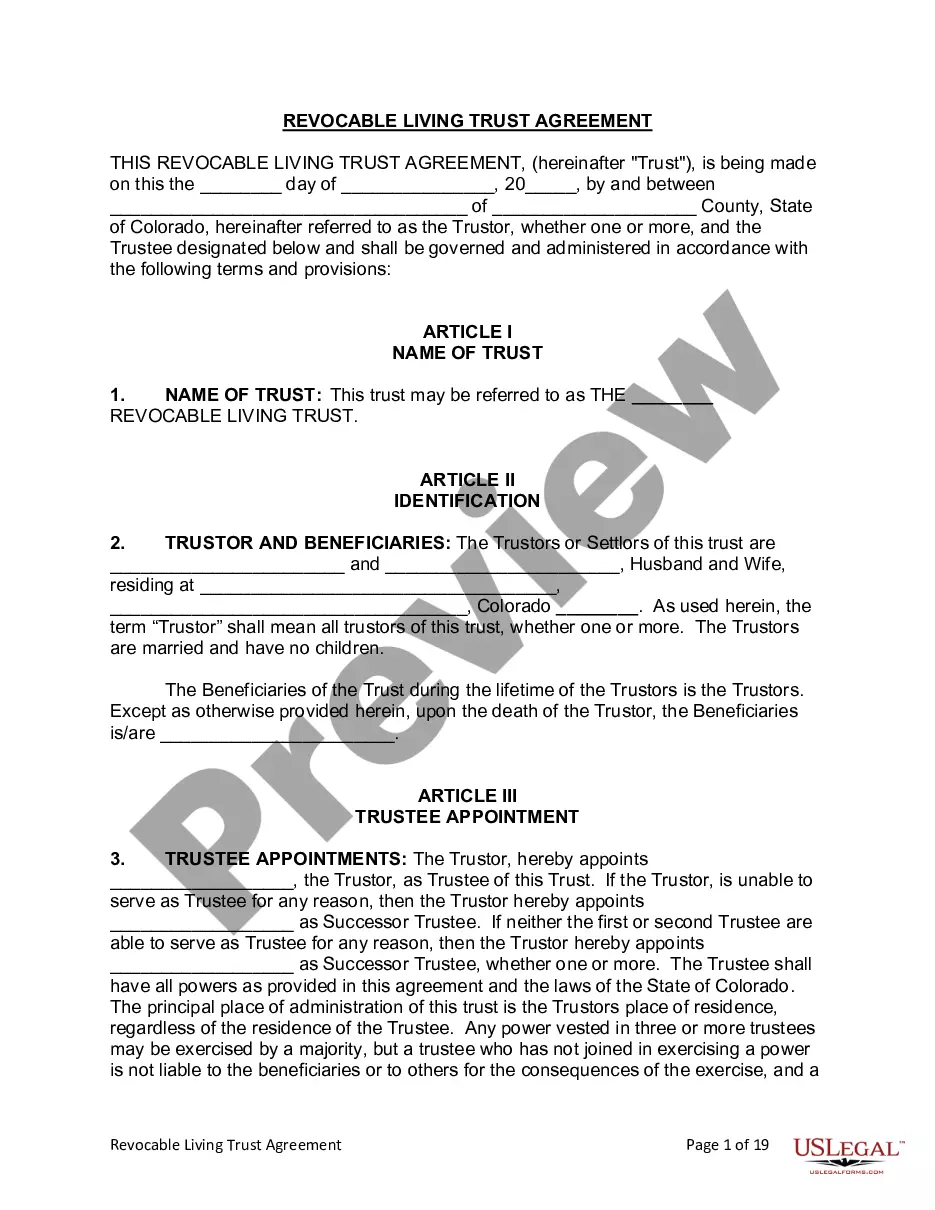

This Living Trust form is a living trust prepared for your state. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Westminster Colorado Living Trust for Husband and Wife with No Children is a legal arrangement designed to protect and manage the assets and property of a married couple with no children. This type of living trust ensures that the couple's wishes regarding their estate are followed, both during their lifetime and after their passing. By establishing a living trust, the couple can specify how their assets should be distributed, who will be responsible for managing the trust, and avoid probate court involvement. There are different types of living trusts available in Westminster, Colorado, specifically tailored for couples with no children. Some commonly used types include: 1. Revocable Living Trust: This type of living trust allows the couple to retain full control over their assets during their lifetime. They can amend, modify, or revoke the trust as they desire. It also provides flexibility in managing the trust's assets and provides a smooth transfer of assets to beneficiaries after their passing. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be easily changed or revoked once created. It offers some unique asset protection benefits, such as shielding the assets from creditors, reducing estate taxes, or qualifying for Medicaid benefits. 3. Joint Living Trust: A joint living trust is a single trust established by a married couple together. It allows them to combine their assets and make joint decisions regarding the trust's management. After the passing of one spouse, the surviving spouse has full control over the trust and its assets. 4. Single Living Trust with Mutual Powers: In some instances, a couple may choose to create separate living trusts while granting each other mutual powers. This type of trust allows both spouses to maintain control over their respective assets while providing flexibility in decision-making for the couple's shared assets. Regardless of the type of Westminster Colorado Living Trust for Husband and Wife with No Children, its primary purpose is to protect the couple's assets, ensure their wishes are respected, and simplify the estate settlement process. It is recommended to consult with an experienced estate planning attorney to establish the most suitable living trust based on individual circumstances and goals.A Westminster Colorado Living Trust for Husband and Wife with No Children is a legal arrangement designed to protect and manage the assets and property of a married couple with no children. This type of living trust ensures that the couple's wishes regarding their estate are followed, both during their lifetime and after their passing. By establishing a living trust, the couple can specify how their assets should be distributed, who will be responsible for managing the trust, and avoid probate court involvement. There are different types of living trusts available in Westminster, Colorado, specifically tailored for couples with no children. Some commonly used types include: 1. Revocable Living Trust: This type of living trust allows the couple to retain full control over their assets during their lifetime. They can amend, modify, or revoke the trust as they desire. It also provides flexibility in managing the trust's assets and provides a smooth transfer of assets to beneficiaries after their passing. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be easily changed or revoked once created. It offers some unique asset protection benefits, such as shielding the assets from creditors, reducing estate taxes, or qualifying for Medicaid benefits. 3. Joint Living Trust: A joint living trust is a single trust established by a married couple together. It allows them to combine their assets and make joint decisions regarding the trust's management. After the passing of one spouse, the surviving spouse has full control over the trust and its assets. 4. Single Living Trust with Mutual Powers: In some instances, a couple may choose to create separate living trusts while granting each other mutual powers. This type of trust allows both spouses to maintain control over their respective assets while providing flexibility in decision-making for the couple's shared assets. Regardless of the type of Westminster Colorado Living Trust for Husband and Wife with No Children, its primary purpose is to protect the couple's assets, ensure their wishes are respected, and simplify the estate settlement process. It is recommended to consult with an experienced estate planning attorney to establish the most suitable living trust based on individual circumstances and goals.