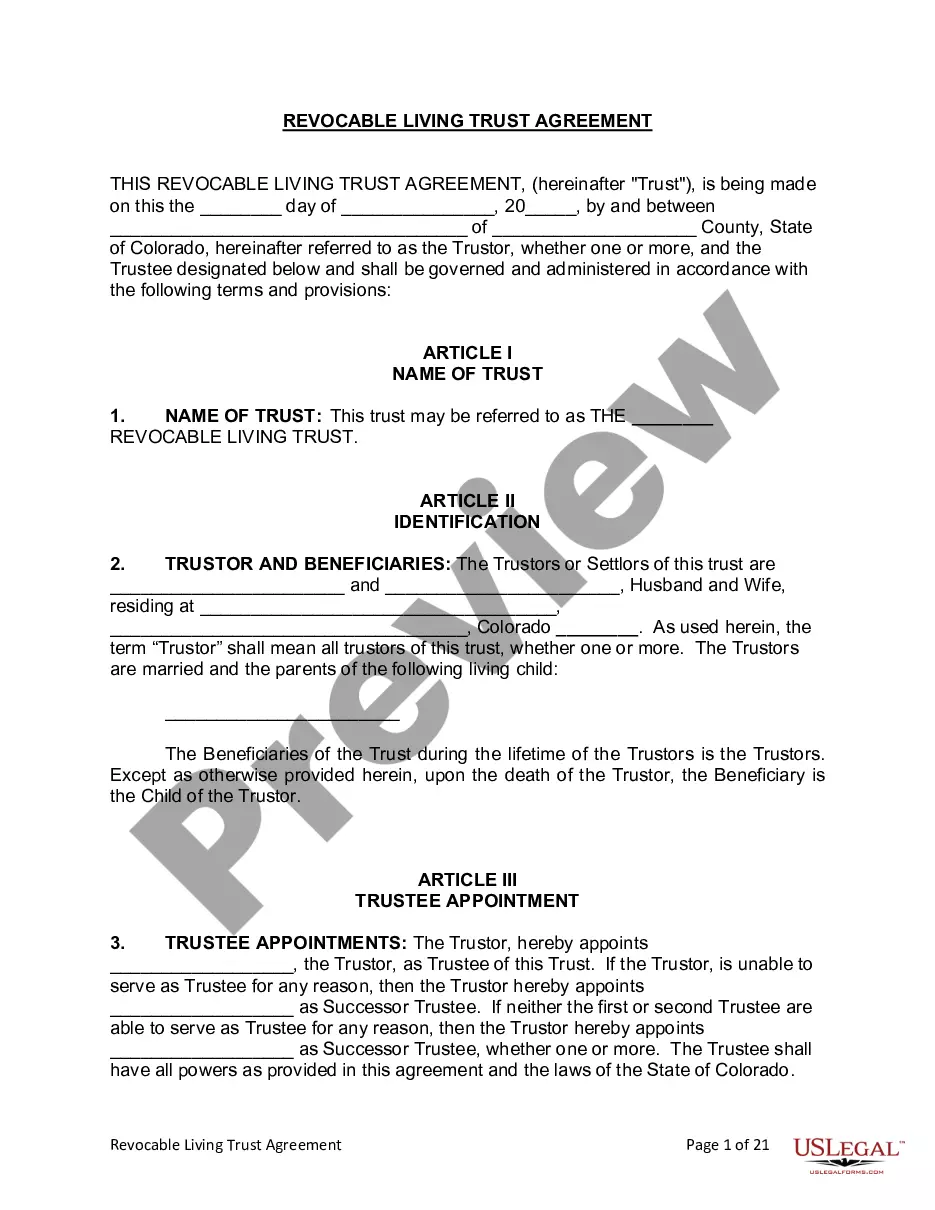

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Arvada, Colorado Living Trust for Husband and Wife with One Child: A living trust is a legal document that allows individuals, couples, or families to designate how their assets will be managed and distributed during their lifetime and after their death. For married couples with one child residing in Arvada, Colorado, a living trust can provide numerous benefits and protection. One common type of living trust for husband and wife with one child is a revocable living trust. This trust allows the couple to maintain complete control over their assets during their lifetime while avoiding probate upon their death. In the event of incapacity or death, the trust ensures a smooth transition of assets to the surviving spouse and then to the child. Key benefits of establishing an Arvada, Colorado Living Trust for Husband and Wife with One Child: 1. Probate Avoidance: By placing assets into a living trust, the couple can circumvent the costly and time-consuming probate process. This enables the surviving spouse and child to access and manage the assets promptly. 2. Asset Protection: A living trust shields assets from potential creditors, lawsuits, or legal judgments. This protection ensures that the assets are safeguarded for the benefit of the surviving spouse and child. 3. Privacy: Unlike a will, a living trust is a private document. It is not subject to public records, providing enhanced privacy and avoiding the publicity associated with probate proceedings. 4. Incapacity Planning: In the event that one spouse becomes incapacitated, a living trust allows for a seamless management of the couple's assets. The designated successor trustee will step in and ensure the financial affairs of the incapacitated spouse are handled according to their wishes. Types of Arvada, Colorado Living Trust for Husband and Wife with One Child: 1. Joint Living Trust: A joint living trust is the most common type for a married couple with one child. Both spouses will serve as co-trustees, maintaining control over the assets in the trust. After the death of one spouse, the surviving spouse becomes the sole trustee, providing continued access and management of the assets. 2. Testamentary Trust: This type of living trust goes into effect upon the death of the first spouse. The deceased spouse's assets are then transferred to a trust, managed by a designated trustee for the benefit of the surviving spouse and child. Testamentary trusts can be tailored to meet specific needs such as special needs or spendthrift provisions. 3. Irrevocable Trust: While less common in this scenario, an irrevocable living trust may be appropriate for couples seeking asset protection or estate tax planning. In this trust, the couple transfers assets irrevocably to the trust, relinquishing control but potentially gaining significant tax advantages. In conclusion, an Arvada, Colorado Living Trust for Husband and Wife with One Child is an effective estate planning tool that provides probate avoidance, asset protection, privacy, and incapacity planning. The most common types of trusts in this scenario are the revocable joint living trust and the testamentary trust. Depending on the couple's specific needs, an irrevocable trust may also be an option. Consultation with an experienced estate planning attorney is highly recommended creating a personalized trust that suits the unique circumstances and goals of the family.Arvada, Colorado Living Trust for Husband and Wife with One Child: A living trust is a legal document that allows individuals, couples, or families to designate how their assets will be managed and distributed during their lifetime and after their death. For married couples with one child residing in Arvada, Colorado, a living trust can provide numerous benefits and protection. One common type of living trust for husband and wife with one child is a revocable living trust. This trust allows the couple to maintain complete control over their assets during their lifetime while avoiding probate upon their death. In the event of incapacity or death, the trust ensures a smooth transition of assets to the surviving spouse and then to the child. Key benefits of establishing an Arvada, Colorado Living Trust for Husband and Wife with One Child: 1. Probate Avoidance: By placing assets into a living trust, the couple can circumvent the costly and time-consuming probate process. This enables the surviving spouse and child to access and manage the assets promptly. 2. Asset Protection: A living trust shields assets from potential creditors, lawsuits, or legal judgments. This protection ensures that the assets are safeguarded for the benefit of the surviving spouse and child. 3. Privacy: Unlike a will, a living trust is a private document. It is not subject to public records, providing enhanced privacy and avoiding the publicity associated with probate proceedings. 4. Incapacity Planning: In the event that one spouse becomes incapacitated, a living trust allows for a seamless management of the couple's assets. The designated successor trustee will step in and ensure the financial affairs of the incapacitated spouse are handled according to their wishes. Types of Arvada, Colorado Living Trust for Husband and Wife with One Child: 1. Joint Living Trust: A joint living trust is the most common type for a married couple with one child. Both spouses will serve as co-trustees, maintaining control over the assets in the trust. After the death of one spouse, the surviving spouse becomes the sole trustee, providing continued access and management of the assets. 2. Testamentary Trust: This type of living trust goes into effect upon the death of the first spouse. The deceased spouse's assets are then transferred to a trust, managed by a designated trustee for the benefit of the surviving spouse and child. Testamentary trusts can be tailored to meet specific needs such as special needs or spendthrift provisions. 3. Irrevocable Trust: While less common in this scenario, an irrevocable living trust may be appropriate for couples seeking asset protection or estate tax planning. In this trust, the couple transfers assets irrevocably to the trust, relinquishing control but potentially gaining significant tax advantages. In conclusion, an Arvada, Colorado Living Trust for Husband and Wife with One Child is an effective estate planning tool that provides probate avoidance, asset protection, privacy, and incapacity planning. The most common types of trusts in this scenario are the revocable joint living trust and the testamentary trust. Depending on the couple's specific needs, an irrevocable trust may also be an option. Consultation with an experienced estate planning attorney is highly recommended creating a personalized trust that suits the unique circumstances and goals of the family.