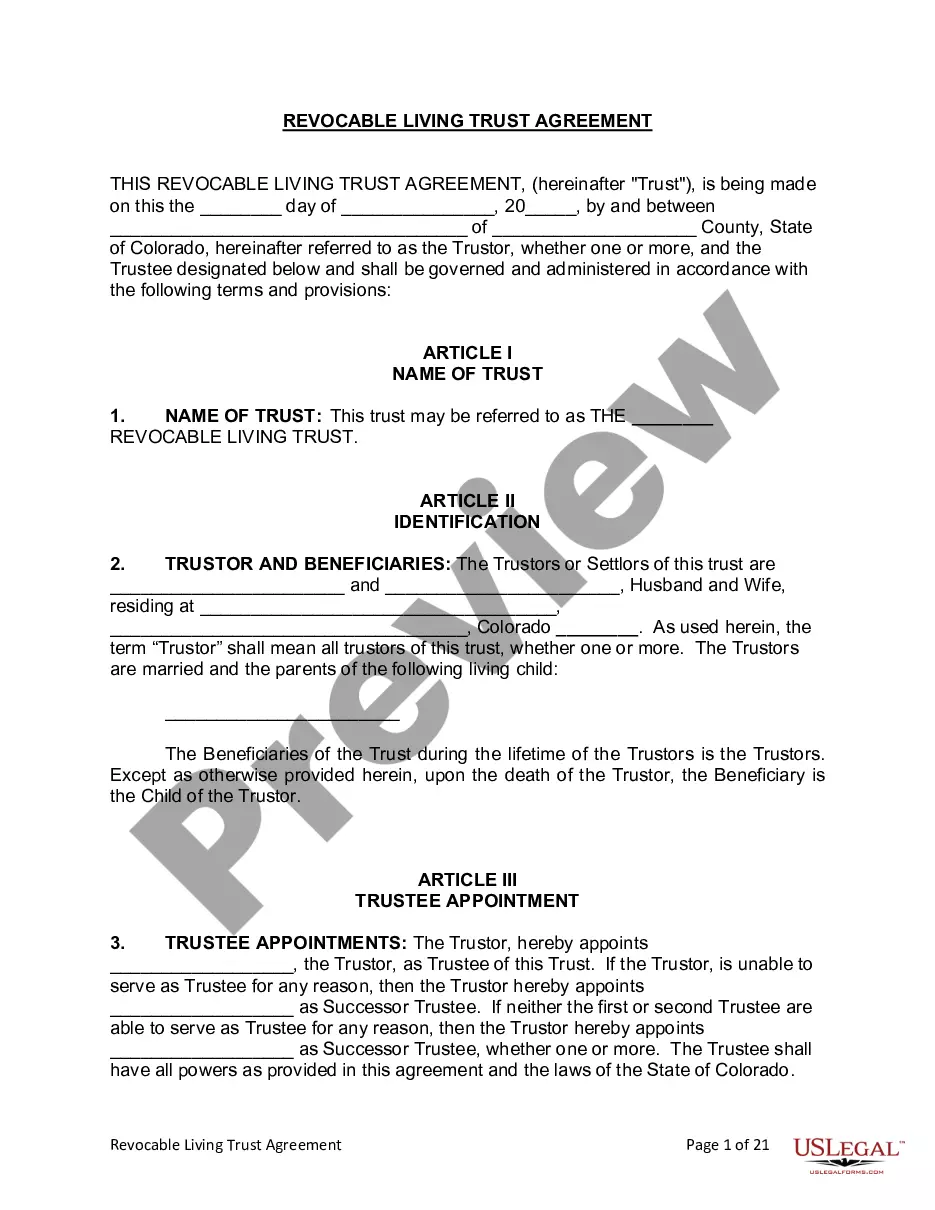

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Centennial Colorado Living Trust for Husband and Wife with One Child: A Centennial Colorado Living Trust for Husband and Wife with One Child is a legal document that allows a married couple residing in Centennial, Colorado, to protect and distribute their assets for the benefit of their family, specifically their child, while minimizing estate taxes and avoiding probate. This type of living trust is designed to ensure that the couple's assets are transferred seamlessly to their child upon their passing, without the need for court involvement or the lengthy and costly probate process. It is crucial to mention that there are different types of Centennial Colorado Living Trusts for Husband and Wife with One Child, including revocable and irrevocable trusts. A revocable living trust allows the couple to retain control of their assets during their lifetime while naming themselves as trustees. They have the flexibility to make changes, add or remove assets, or even revoke the trust if circumstances change. In the event of their passing, the designated successor trustee takes over the management and distribution of assets to the surviving spouse and eventually to their child, according to the instructions outlined in the trust document. On the other hand, an irrevocable living trust, once established, cannot be altered or revoked without the consent of the beneficiaries. This type of trust offers certain tax advantages, as the assets placed in it are no longer considered part of the individuals' taxable estate. It can be an effective strategy for estate planning purposes, particularly for families wanting to protect their assets and minimize tax obligations. Centennial Colorado Living Trusts for Husband and Wife with One Child are highly customizable according to the couple's specific needs and wishes. They can include provisions for early distribution of assets to the child, appoint guardians for minor children or beneficiaries with special needs, and even establish conditions or restrictions on how assets are managed and used. By implementing a living trust, families in Centennial, Colorado can ensure the seamless transfer of their assets, protect their loved ones' financial future, and potentially reduce estate taxes. It is advised to consult with a qualified estate planning attorney to determine the most suitable type of trust based on the family's unique circumstances and goals.