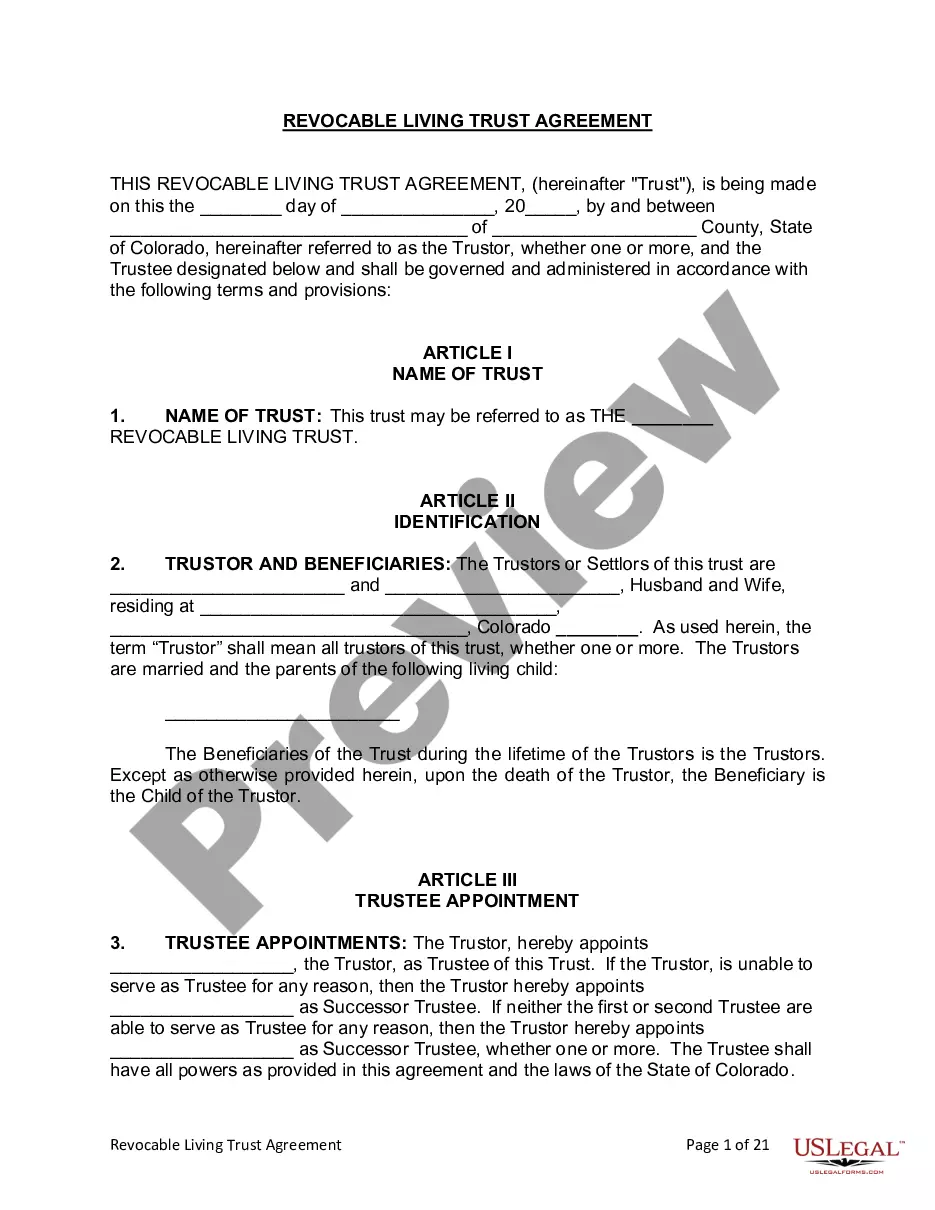

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A living trust is a legal document that allows individuals to manage and distribute their assets during their lifetime and after their passing. In Fort Collins, Colorado, a living trust for a husband and wife with one child is a popular estate planning tool. This type of trust provides numerous benefits such as avoiding probate, protecting assets, and ensuring the smooth transfer of wealth to the designated beneficiaries. Below, we delve into the various types of living trusts available in Fort Collins, Colorado for a husband and wife with one child: 1. Revocable Living Trust: A revocable living trust is the most common type of trust chosen by couples with one child in Fort Collins. This trust enables the individual(s) to make changes or revoke the trust at any point during their lifetime. It grants full control over assets, allowing easy management, modification, and withdrawal of the trust's assets during their lifetime. 2. Irrevocable Living Trust: An irrevocable living trust, in contrast to the revocable one, cannot be altered or revoked once established. By transferring ownership of assets into this trust, couples can protect their assets from estate taxes, lawsuits, and creditors. The principal advantage of this type of trust is the potential reduction of estate taxes, ensuring the preservation of wealth for the benefit of the surviving spouse and child. 3. Testamentary Living Trust: A testamentary living trust is created and put into effect upon the death of one or both spouses. It dictates the distribution of assets according to the couple's wishes. This type of trust is often used in conjunction with a will, ensuring that assets are distributed efficiently and in accordance with the specified instructions. 4. Special Needs Trust: If a couple has a child with special needs, a special needs trust provides a solution to secure their future. This trust allows parents to allocate assets specifically designated for the care and support of their child after they are gone. It ensures that the child continues to receive government benefits while also enhancing their quality of life. 5. Family Asset Protection Trust: A family asset protection trust is designed to shield a couple's assets from potential risks, such as lawsuits, claims, or divorces involving the child. By placing assets into this trust, couples can safeguard them for future generations, ensuring the intended beneficiaries receive the maximum benefit. In conclusion, Fort Collins, Colorado offers several living trust options for a husband and wife with one child. The choice of trust depends on the specific needs and goals of the couple, including asset management, estate taxes, asset protection, or special needs planning. Seeking advice from an experienced estate planning attorney in Fort Collins is crucial to ensure the trust is tailored to the family's unique circumstances and adhere to Colorado laws.A living trust is a legal document that allows individuals to manage and distribute their assets during their lifetime and after their passing. In Fort Collins, Colorado, a living trust for a husband and wife with one child is a popular estate planning tool. This type of trust provides numerous benefits such as avoiding probate, protecting assets, and ensuring the smooth transfer of wealth to the designated beneficiaries. Below, we delve into the various types of living trusts available in Fort Collins, Colorado for a husband and wife with one child: 1. Revocable Living Trust: A revocable living trust is the most common type of trust chosen by couples with one child in Fort Collins. This trust enables the individual(s) to make changes or revoke the trust at any point during their lifetime. It grants full control over assets, allowing easy management, modification, and withdrawal of the trust's assets during their lifetime. 2. Irrevocable Living Trust: An irrevocable living trust, in contrast to the revocable one, cannot be altered or revoked once established. By transferring ownership of assets into this trust, couples can protect their assets from estate taxes, lawsuits, and creditors. The principal advantage of this type of trust is the potential reduction of estate taxes, ensuring the preservation of wealth for the benefit of the surviving spouse and child. 3. Testamentary Living Trust: A testamentary living trust is created and put into effect upon the death of one or both spouses. It dictates the distribution of assets according to the couple's wishes. This type of trust is often used in conjunction with a will, ensuring that assets are distributed efficiently and in accordance with the specified instructions. 4. Special Needs Trust: If a couple has a child with special needs, a special needs trust provides a solution to secure their future. This trust allows parents to allocate assets specifically designated for the care and support of their child after they are gone. It ensures that the child continues to receive government benefits while also enhancing their quality of life. 5. Family Asset Protection Trust: A family asset protection trust is designed to shield a couple's assets from potential risks, such as lawsuits, claims, or divorces involving the child. By placing assets into this trust, couples can safeguard them for future generations, ensuring the intended beneficiaries receive the maximum benefit. In conclusion, Fort Collins, Colorado offers several living trust options for a husband and wife with one child. The choice of trust depends on the specific needs and goals of the couple, including asset management, estate taxes, asset protection, or special needs planning. Seeking advice from an experienced estate planning attorney in Fort Collins is crucial to ensure the trust is tailored to the family's unique circumstances and adhere to Colorado laws.