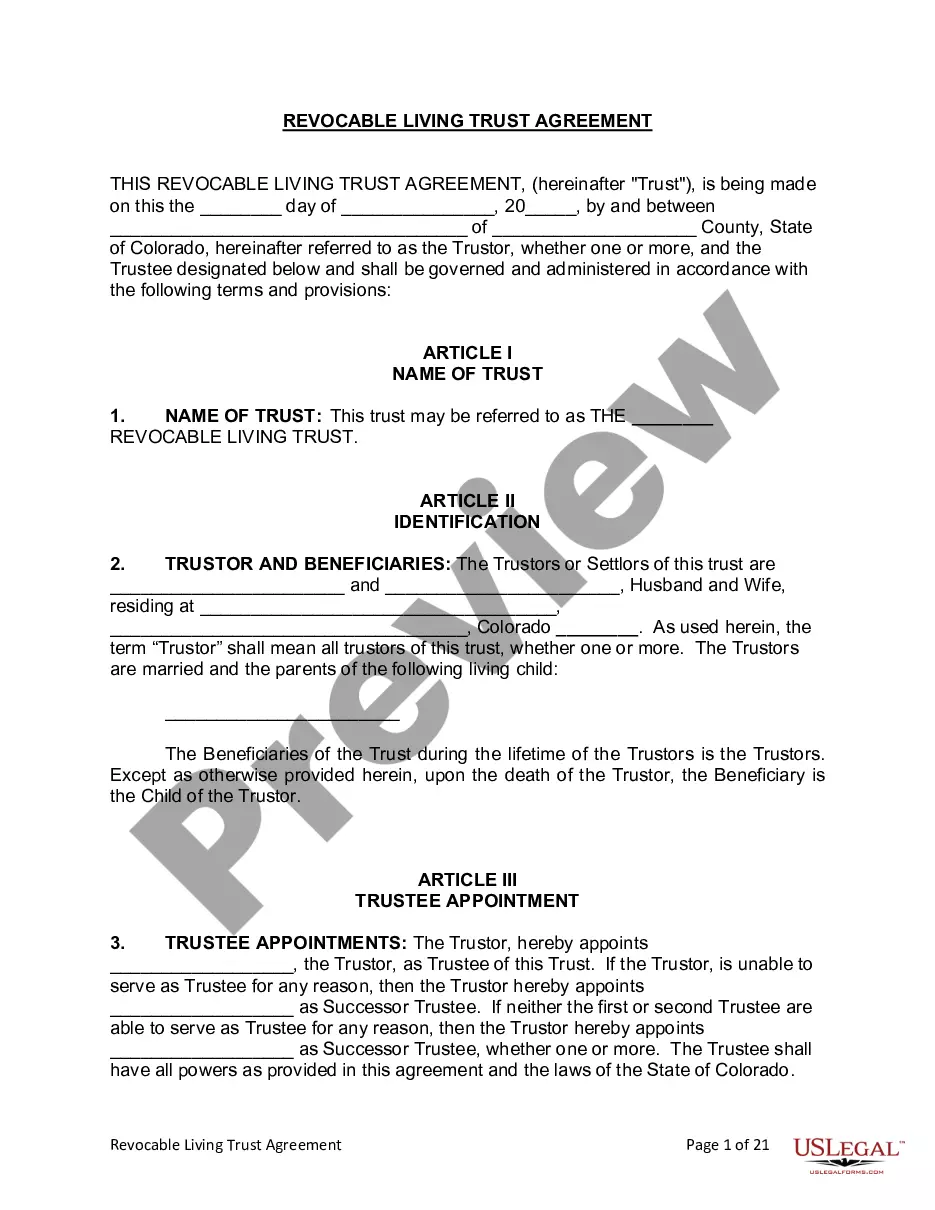

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Lakewood Colorado Living Trust for Husband and Wife with One Child: A Comprehensive Guide to Planning Your Family's Future Keywords: Lakewood Colorado, living trust, husband and wife, one child, estate planning, assets, beneficiaries, probate, legal protection, tax benefits, revocable trust Introduction: Creating a living trust is an integral part of estate planning, especially for married couples residing in Lakewood, Colorado, who have one child. A living trust provides a legal framework for managing and distributing assets while ensuring the financial security of your loved ones. This article will delve into the details of the Lakewood Colorado Living Trust for Husband and Wife with One Child, covering its importance, benefits, and possible variations. 1. Understanding the Living Trust: A living trust, also known as a revocable trust, is a legal document that allows individuals, in this case, a married couple, to transfer their assets into a trust during their lifetime. The trust becomes the legal owner of these assets, ensuring seamless management and distribution during incapacity or after their passing. 2. Importance of a Living Trust: By establishing a living trust specifically designed for married couples with one child in Lakewood, Colorado, you can enjoy several benefits, including: — Avoidance of probate: A properly drafted living trust allows your assets to bypass the lengthy and costly probate process. This ensures that your loved ones have quicker access to the assets and avoids unnecessary legal fees. — Protection of your child's inheritance: Creating a living trust allows you to set specific terms on how assets should be distributed to your child. This ensures that their inheritance is protected, allowing for a smooth transition and financial stability. — Flexibility and control: A living trust provides flexibility in managing your assets during your lifetime, allowing you to make changes or amendments as needed. You can also specify conditions or restrictions on the distribution of assets, providing long-term control over your wealth. — Privacy: Unlike a will, a living trust offers privacy by keeping your estate distribution out of public record, protecting your family's financial details from prying eyes. 3. Types of Living Trusts for Husband and Wife with One Child in Lakewood, Colorado: While the basic concept of a living trust remains the same, there are a few variations tailored to specific situations. Here are some common types: — Joint Living Trust: This type of trust allows both spouses to establish a single trust document. It provides flexibility and convenience, as both spouses have equal control and access to the trust's assets. — Survivor's Trust: In this variation, the trust is split into two parts: a survivor's trust and a decedent's trust. The survivor's trust continues to provide financial support to the surviving spouse while ensuring the child's inheritance remains intact for future generations. Conclusion: Creating a Lakewood Colorado Living Trust for Husband and Wife with One Child is a crucial step in securing your family's financial future. It offers numerous benefits, such as avoiding probate, protecting your child's inheritance, maintaining control, and ensuring privacy. By understanding the different types of living trusts available, you can tailor your estate plan to meet your specific needs. Seek the assistance of an estate planning attorney specializing in Colorado law to help you navigate the complexities and create a comprehensive living trust that safeguards your family's wealth.Lakewood Colorado Living Trust for Husband and Wife with One Child: A Comprehensive Guide to Planning Your Family's Future Keywords: Lakewood Colorado, living trust, husband and wife, one child, estate planning, assets, beneficiaries, probate, legal protection, tax benefits, revocable trust Introduction: Creating a living trust is an integral part of estate planning, especially for married couples residing in Lakewood, Colorado, who have one child. A living trust provides a legal framework for managing and distributing assets while ensuring the financial security of your loved ones. This article will delve into the details of the Lakewood Colorado Living Trust for Husband and Wife with One Child, covering its importance, benefits, and possible variations. 1. Understanding the Living Trust: A living trust, also known as a revocable trust, is a legal document that allows individuals, in this case, a married couple, to transfer their assets into a trust during their lifetime. The trust becomes the legal owner of these assets, ensuring seamless management and distribution during incapacity or after their passing. 2. Importance of a Living Trust: By establishing a living trust specifically designed for married couples with one child in Lakewood, Colorado, you can enjoy several benefits, including: — Avoidance of probate: A properly drafted living trust allows your assets to bypass the lengthy and costly probate process. This ensures that your loved ones have quicker access to the assets and avoids unnecessary legal fees. — Protection of your child's inheritance: Creating a living trust allows you to set specific terms on how assets should be distributed to your child. This ensures that their inheritance is protected, allowing for a smooth transition and financial stability. — Flexibility and control: A living trust provides flexibility in managing your assets during your lifetime, allowing you to make changes or amendments as needed. You can also specify conditions or restrictions on the distribution of assets, providing long-term control over your wealth. — Privacy: Unlike a will, a living trust offers privacy by keeping your estate distribution out of public record, protecting your family's financial details from prying eyes. 3. Types of Living Trusts for Husband and Wife with One Child in Lakewood, Colorado: While the basic concept of a living trust remains the same, there are a few variations tailored to specific situations. Here are some common types: — Joint Living Trust: This type of trust allows both spouses to establish a single trust document. It provides flexibility and convenience, as both spouses have equal control and access to the trust's assets. — Survivor's Trust: In this variation, the trust is split into two parts: a survivor's trust and a decedent's trust. The survivor's trust continues to provide financial support to the surviving spouse while ensuring the child's inheritance remains intact for future generations. Conclusion: Creating a Lakewood Colorado Living Trust for Husband and Wife with One Child is a crucial step in securing your family's financial future. It offers numerous benefits, such as avoiding probate, protecting your child's inheritance, maintaining control, and ensuring privacy. By understanding the different types of living trusts available, you can tailor your estate plan to meet your specific needs. Seek the assistance of an estate planning attorney specializing in Colorado law to help you navigate the complexities and create a comprehensive living trust that safeguards your family's wealth.