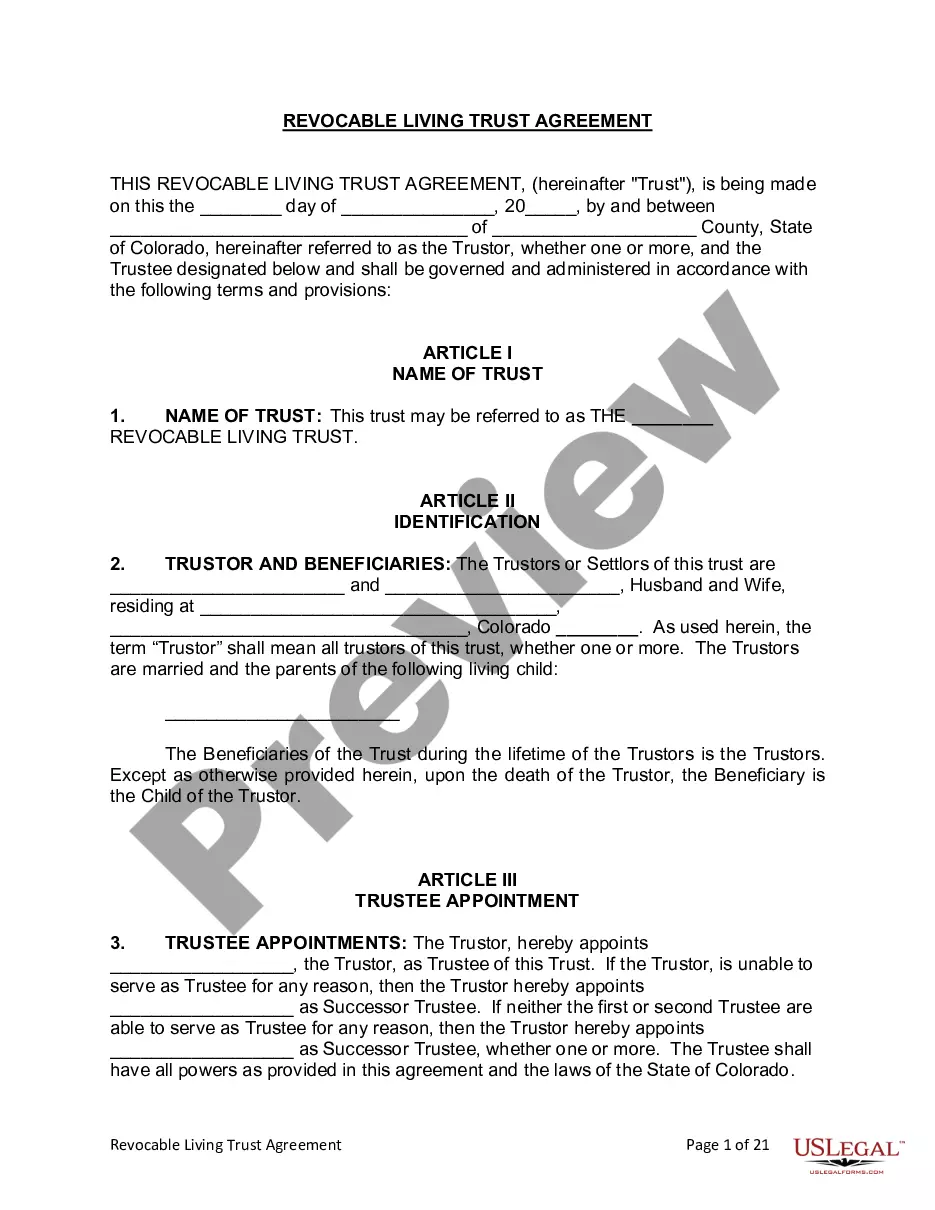

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Thornton Colorado Living Trust for Husband and Wife with One Child is an estate planning tool designed to protect and manage a couple's assets and ensure the smooth transfer of wealth to their sole child. This legally binding document outlines how the couple's assets will be distributed, managed, and cared for both during their lifetimes and after their passing. There are different types of Thornton Colorado Living Trusts for Husband and Wife with One Child, including revocable living trusts and irrevocable living trusts. A revocable living trust allows the couple to maintain control over their assets during their lifetime. They can amend, modify, or revoke the trust as they see fit. In this type of trust, both spouses act as trustees and can make decisions regarding the trust's assets. An irrevocable living trust, on the other hand, cannot be altered or revoked once established, except under limited circumstances. This type of trust offers certain tax benefits and asset protection advantages. The couple designates a trustee to manage the trust's assets, ensuring the child's inheritance is properly administered. Under a Thornton Colorado Living Trust for Husband and Wife with One Child, the couple can define how their assets should be managed in the event of their incapacity or death. They can specify how their assets will be distributed to their child, including timelines and conditions. This can be particularly important if the child is a minor or has special needs, as it ensures their care and financial future are secure. One of the primary benefits of establishing a living trust is avoiding the probate process. Probate can be time-consuming, expensive, and public. With a living trust, the assets can be transferred directly to the designated beneficiaries without court involvement, saving time and money. Additionally, a living trust provides privacy, as its details remain confidential and are not part of public records, unlike a will. By creating a Thornton Colorado Living Trust for Husband and Wife with One Child, individuals can have peace of mind knowing that their assets will be protected, managed, and distributed according to their wishes. It is recommended to consult with an experienced estate planning attorney to ensure that the trust is properly drafted and legally binding.A Thornton Colorado Living Trust for Husband and Wife with One Child is an estate planning tool designed to protect and manage a couple's assets and ensure the smooth transfer of wealth to their sole child. This legally binding document outlines how the couple's assets will be distributed, managed, and cared for both during their lifetimes and after their passing. There are different types of Thornton Colorado Living Trusts for Husband and Wife with One Child, including revocable living trusts and irrevocable living trusts. A revocable living trust allows the couple to maintain control over their assets during their lifetime. They can amend, modify, or revoke the trust as they see fit. In this type of trust, both spouses act as trustees and can make decisions regarding the trust's assets. An irrevocable living trust, on the other hand, cannot be altered or revoked once established, except under limited circumstances. This type of trust offers certain tax benefits and asset protection advantages. The couple designates a trustee to manage the trust's assets, ensuring the child's inheritance is properly administered. Under a Thornton Colorado Living Trust for Husband and Wife with One Child, the couple can define how their assets should be managed in the event of their incapacity or death. They can specify how their assets will be distributed to their child, including timelines and conditions. This can be particularly important if the child is a minor or has special needs, as it ensures their care and financial future are secure. One of the primary benefits of establishing a living trust is avoiding the probate process. Probate can be time-consuming, expensive, and public. With a living trust, the assets can be transferred directly to the designated beneficiaries without court involvement, saving time and money. Additionally, a living trust provides privacy, as its details remain confidential and are not part of public records, unlike a will. By creating a Thornton Colorado Living Trust for Husband and Wife with One Child, individuals can have peace of mind knowing that their assets will be protected, managed, and distributed according to their wishes. It is recommended to consult with an experienced estate planning attorney to ensure that the trust is properly drafted and legally binding.