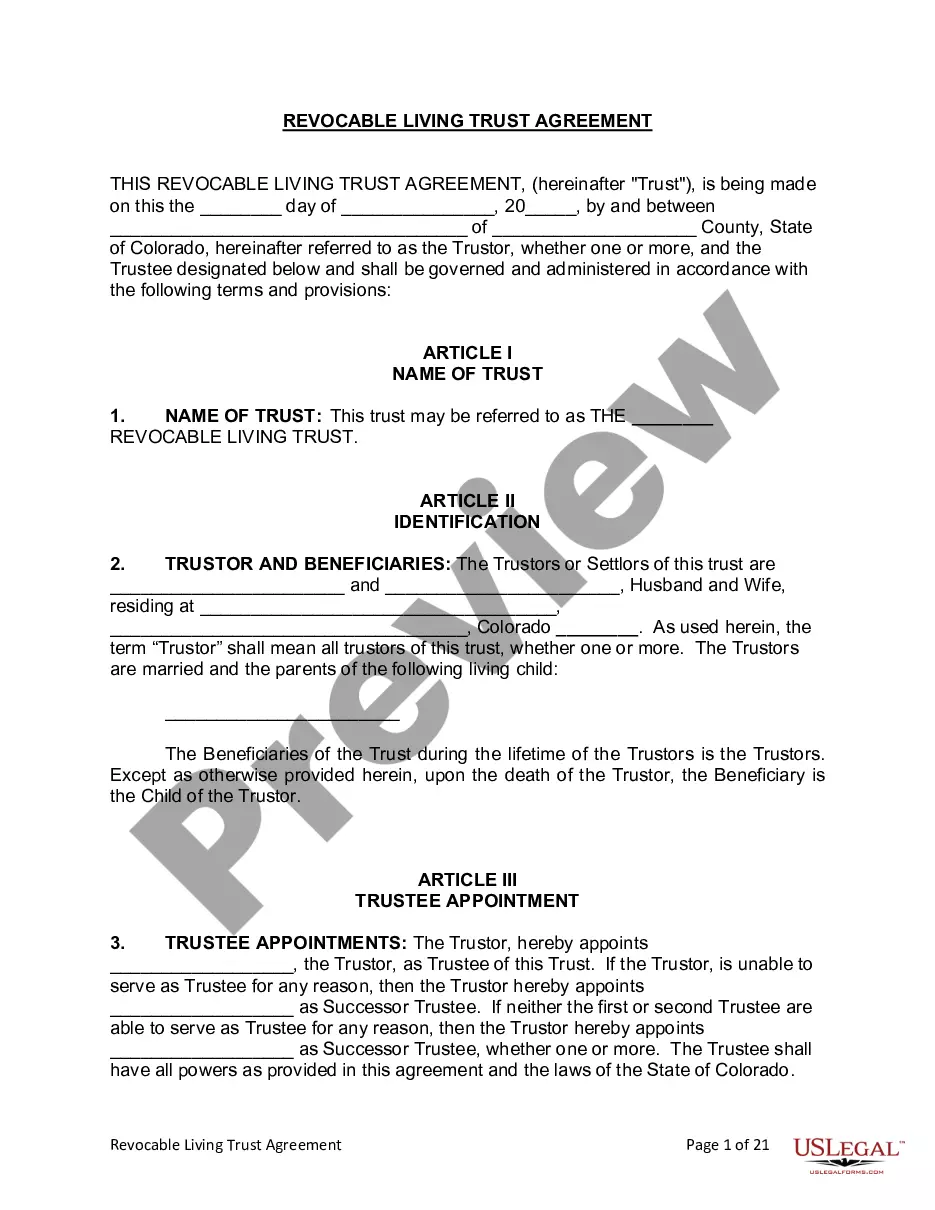

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Westminster Colorado Living Trust for Husband and Wife with One Child: A Comprehensive Guide Introduction: A Westminster Colorado Living Trust for Husband and Wife with One Child is a legal document designed to protect and distribute assets for married couples in Westminster, Colorado, who have a single child. This trust provides a multitude of benefits, including asset management, asset protection, minimizing estate taxes, and ensuring the seamless transfer of assets to the designated beneficiaries. Key Elements of a Westminster Colorado Living Trust for Husband and Wife with One Child: 1. Trustee Designation: The trust document allows the husband and wife to appoint a trustee, an individual or entity responsible for managing and distributing the trust assets according to the stipulations outlined in the trust agreement. The trustee must act in the best interests of the beneficiaries and ensure asset preservation and growth. 2. Asset Protection: One vital aspect of a Westminster Colorado Living Trust is asset protection. It shields the trust assets from potential creditors, lawsuits, or any other financial liabilities of the beneficiaries. This ensures the preservation of the intended distribution for the surviving spouse and the child. 3. Avoiding Probate: By creating a living trust, married couples can bypass the often protracted and costly probate process. Probate involves the court-supervised distribution of assets after someone's death, and it can be time-consuming and expensive. A living trust allows for the transfer of assets outside of probate, ensuring a smooth and efficient distribution process for the surviving spouse and child. 4. Estate Tax Benefits: Westminster Colorado Living Trusts can also minimize estate tax liabilities. With proper planning and expert guidance, couples can structure their trust in a way that maximizes estate tax exemptions, reduces tax burdens, and ensures that the intended beneficiaries receive the fullest benefit from their assets. Types of Westminster Colorado Living Trust for Husband and Wife with One Child: 1. Revocable Living Trust: This is the most common type of living trust. It allows the granters (husband and wife) to retain control over the trust assets during their lifetimes, modify or revoke the trust, and make changes to the beneficiaries or trustee if necessary. It provides flexibility and can be easily adjusted to meet changing circumstances. 2. Irrevocable Living Trust: An irrevocable living trust, as the name suggests, cannot be modified or revoked without the consent of the beneficiaries. This type of trust is often used for long-term asset protection or for tax planning purposes. It provides enhanced creditor protection and avoids estate tax liabilities but sacrifices some control over the assets. Conclusion: A Westminster Colorado Living Trust for Husband and Wife with One Child offers numerous advantages, ensuring the smooth transition of assets and protecting loved ones' financial well-being. By utilizing a living trust, married couples can avoid probate, protect their assets, minimize estate taxes, and tailor their financial plans to meet their specific needs. It is essential to consult with an experienced estate planning attorney to create a trust that aligns with individual preferences and goals.Westminster Colorado Living Trust for Husband and Wife with One Child: A Comprehensive Guide Introduction: A Westminster Colorado Living Trust for Husband and Wife with One Child is a legal document designed to protect and distribute assets for married couples in Westminster, Colorado, who have a single child. This trust provides a multitude of benefits, including asset management, asset protection, minimizing estate taxes, and ensuring the seamless transfer of assets to the designated beneficiaries. Key Elements of a Westminster Colorado Living Trust for Husband and Wife with One Child: 1. Trustee Designation: The trust document allows the husband and wife to appoint a trustee, an individual or entity responsible for managing and distributing the trust assets according to the stipulations outlined in the trust agreement. The trustee must act in the best interests of the beneficiaries and ensure asset preservation and growth. 2. Asset Protection: One vital aspect of a Westminster Colorado Living Trust is asset protection. It shields the trust assets from potential creditors, lawsuits, or any other financial liabilities of the beneficiaries. This ensures the preservation of the intended distribution for the surviving spouse and the child. 3. Avoiding Probate: By creating a living trust, married couples can bypass the often protracted and costly probate process. Probate involves the court-supervised distribution of assets after someone's death, and it can be time-consuming and expensive. A living trust allows for the transfer of assets outside of probate, ensuring a smooth and efficient distribution process for the surviving spouse and child. 4. Estate Tax Benefits: Westminster Colorado Living Trusts can also minimize estate tax liabilities. With proper planning and expert guidance, couples can structure their trust in a way that maximizes estate tax exemptions, reduces tax burdens, and ensures that the intended beneficiaries receive the fullest benefit from their assets. Types of Westminster Colorado Living Trust for Husband and Wife with One Child: 1. Revocable Living Trust: This is the most common type of living trust. It allows the granters (husband and wife) to retain control over the trust assets during their lifetimes, modify or revoke the trust, and make changes to the beneficiaries or trustee if necessary. It provides flexibility and can be easily adjusted to meet changing circumstances. 2. Irrevocable Living Trust: An irrevocable living trust, as the name suggests, cannot be modified or revoked without the consent of the beneficiaries. This type of trust is often used for long-term asset protection or for tax planning purposes. It provides enhanced creditor protection and avoids estate tax liabilities but sacrifices some control over the assets. Conclusion: A Westminster Colorado Living Trust for Husband and Wife with One Child offers numerous advantages, ensuring the smooth transition of assets and protecting loved ones' financial well-being. By utilizing a living trust, married couples can avoid probate, protect their assets, minimize estate taxes, and tailor their financial plans to meet their specific needs. It is essential to consult with an experienced estate planning attorney to create a trust that aligns with individual preferences and goals.