This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children

Description

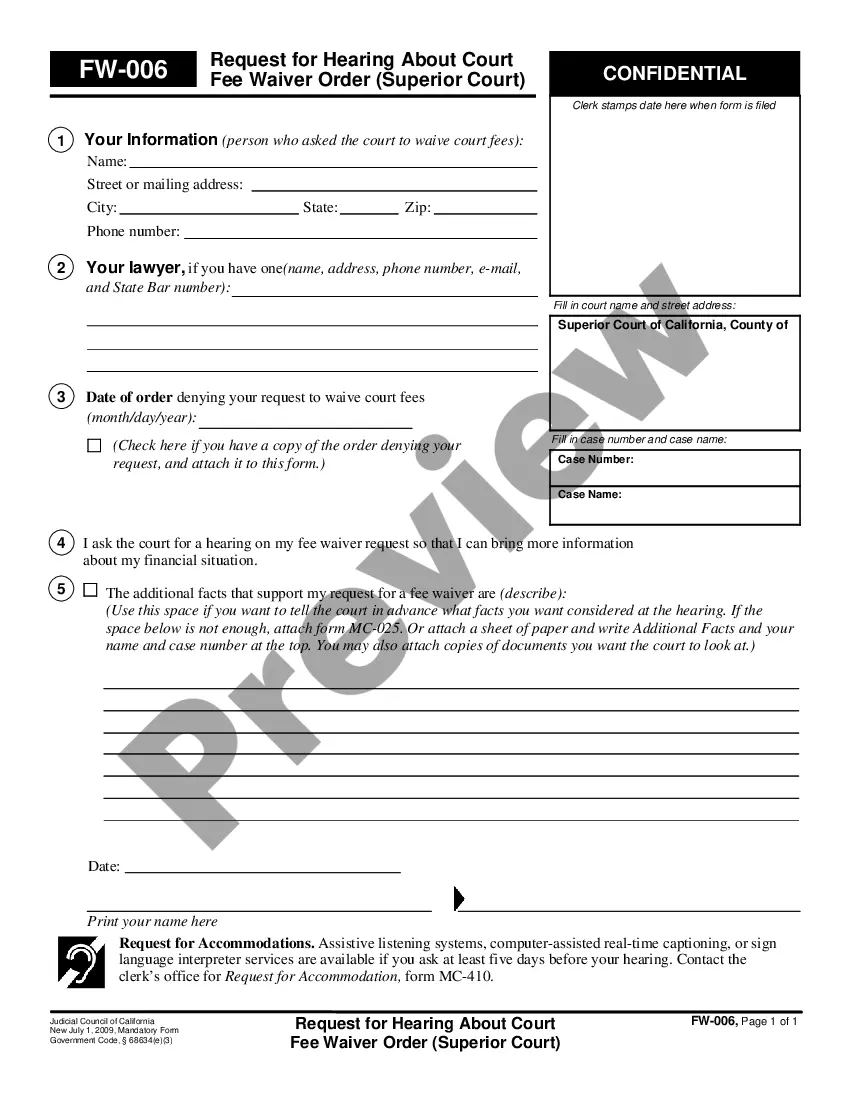

How to fill out Colorado Living Trust For Husband And Wife With Minor And Or Adult Children?

If you have previously availed yourself of our service, Log In to your account and store the Thornton Colorado Living Trust for Husband and Wife with Minor and/or Adult Children on your device by clicking the Download button. Confirm your subscription is active. If it's not, renew it as per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have uninterrupted access to every document you have acquired: you can find it in your profile within the My documents section whenever you need to use it again. Utilize the US Legal Forms service to effortlessly find and download any template for your personal or professional requirements!

- Ensure you’ve identified the appropriate document. Review the description and utilize the Preview feature, if available, to verify if it fulfills your needs. If it does not meet your expectations, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Establish an account and process a payment. Enter your credit card information or choose the PayPal option to finalize the transaction.

- Obtain your Thornton Colorado Living Trust for Husband and Wife with Minor and/or Adult Children. Select the file format for your document and download it to your device.

- Complete your form. Print it out or use professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

Yes, you can write your own trust in Colorado, but it is essential to ensure that it meets all legal requirements. A Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children allows you to specify how your assets will be managed and distributed. While writing your own trust can save costs, the process can be complex, and any mistakes may lead to unwanted consequences. Utilizing platforms like US Legal Forms can help simplify this process by providing templates that guide you in creating a valid trust.

Separate trusts can offer unique advantages to a husband and wife, especially when dealing with different assets or family dynamics. A Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children allows each spouse to maintain control over their individual properties while providing for shared interests. This arrangement can protect against liability issues and ensure that each spouse's wishes are honored. Each couple should evaluate their situation to decide if separate trusts are the right choice.

Suze Orman emphasizes the importance of having a living trust to protect assets and provide for loved ones. She advocates for a Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children, as it ensures that your family receives financial security. Orman encourages individuals to educate themselves about trusts to avoid probate, which can be time-consuming and costly. Trusts help streamline the process of asset distribution, making them a valuable estate planning tool.

Even if your children are adults, a living trust remains beneficial. A Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children can help manage and distribute assets according to your wishes, reducing potential conflicts among siblings. Additionally, trusts can provide financial guidance, ensuring your adult children handle inheritances wisely. Ultimately, having a trust gives you control over how your assets are passed on.

The ideal living trust for a married couple often includes a joint living trust that accommodates both partners' wishes and assets. A Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children can effectively outline how to manage and distribute assets, providing security for children regardless of their age. It simplifies the management of shared property and can minimize estate taxes. Consulting with an expert can ensure the trust meets your family's specific needs.

While it's common for couples to create joint living trusts, some may benefit from separate trusts. A Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children can be tailored to meet individual needs and protect assets separately. This approach can address specific financial concerns and provide unique benefits for each spouse. Ultimately, assessing your situation with a legal professional can guide you toward the best decision.

Yes, you can write your own living trust in Colorado. However, it requires careful attention to legal requirements to ensure validity. By using a user-friendly platform like UsLegalForms, you can access templates and guidance, simplifying the creation of your Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children while following state regulations.

To put everything in a living trust, begin by transferring ownership of your assets into the trust. This can include real estate, bank accounts, and investments. Clearly outline these assets in your trust documents, and consider working with UsLegalForms to simplify the process. Ultimately, this complete integration helps ensure your Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children effectively manages and protects your family's wealth.

A significant mistake parents often make is not updating their trust as family circumstances change. For instance, failing to adjust beneficiaries or assets can lead to confusion or unintended consequences. It’s vital to review the living trust periodically, especially after major life events, ensuring that your Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children remains relevant and effective.

Filling a living trust involves several essential steps. First, you need to gather all relevant information about your assets and beneficiaries. Afterward, use a reliable template or platform, like UsLegalForms, to draft the trust document accurately. Finally, ensure all parties involved understand the terms and sign the document to make it valid in accordance with a Thornton Colorado Living Trust for Husband and Wife with Minor and or Adult Children.