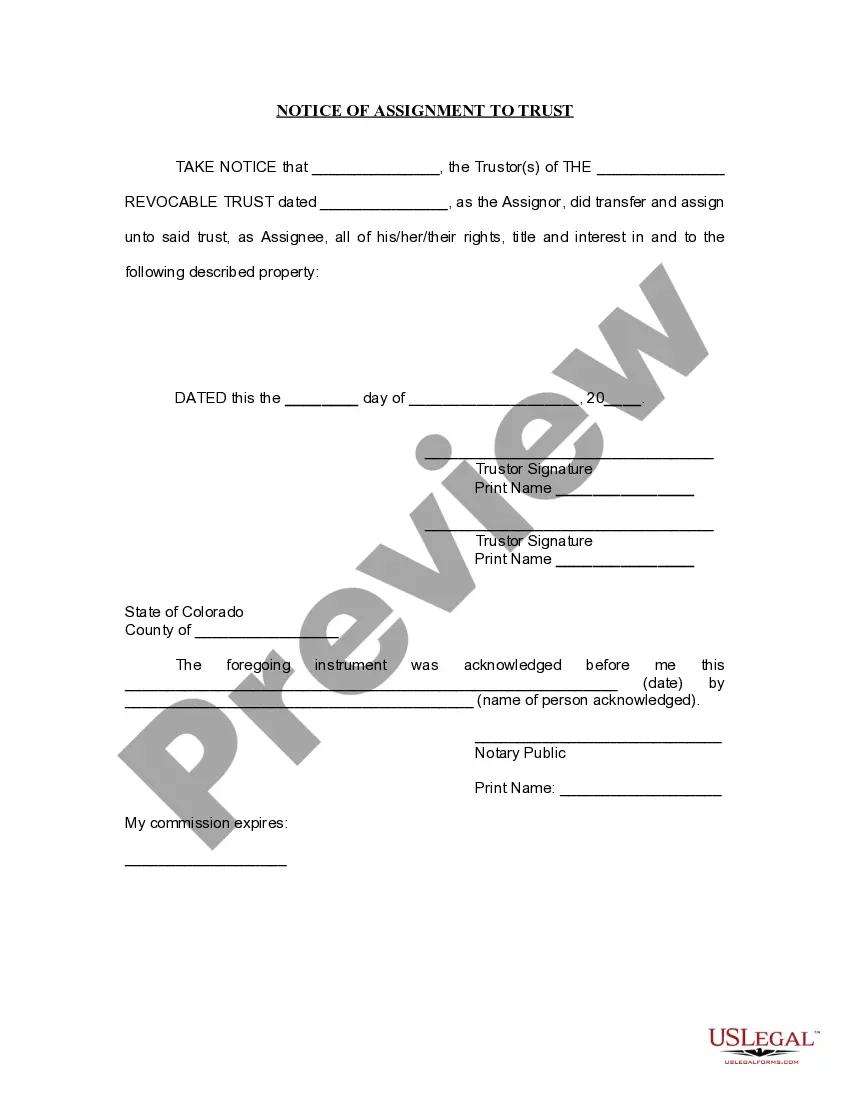

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

A Thornton Colorado Notice of Assignment to Living Trust is a legal document that outlines the transfer of assets from an individual or couple to a living trust based in Thornton, Colorado. This trust-based estate planning tool ensures efficient asset management, avoidance of probate, and ease of distribution upon death or incapacity. By transferring ownership of various properties, investments, and belongings, individuals can protect their assets, streamline the transfer process, and provide potential tax advantages. Different types of Thornton Colorado Notice of Assignment to Living Trust may include: 1. Real Estate Assignment: This type of notice specifically transfers ownership of real estate properties, such as residential homes, vacation properties, or commercial assets, into the living trust. By doing so, the trust then becomes the legal owner and effectively manages and distributes the property as per the trust's terms. 2. Financial Account Assignment: In this case, individuals assign ownership of various financial accounts, such as bank accounts, brokerage accounts, or retirement funds, to the living trust through a formal notice. This ensures seamless asset management and distribution, including investment decisions and tax planning strategies. 3. Personal Property Assignment: This type of assignment pertains to assets like vehicles, artwork, jewelry, antiques, or any other tangible personal property that holds significant value. The Thornton Colorado Notice of Assignment to Living Trust allows the trust to manage the administration and distribution of such personal belongings as per the granter's wishes. 4. Business Ownership Assignment: For business owners, this notice facilitates the transfer of ownership rights to their businesses, including shares, partnerships, or membership interests, into the living trust. This allows the trust to effectively manage, govern, and potentially transfer business assets upon the granter's incapacity or death. Ultimately, the Thornton Colorado Notice of Assignment to Living Trust offers flexibility, control, and convenience in managing one's assets during their lifetime and ensures the smooth and efficient administration of the trust estate upon their passing. It is recommended to consult with an attorney specializing in estate planning to navigate the legal requirements and draft a valid and thorough assignment notice tailored to individual circumstances and asset types.A Thornton Colorado Notice of Assignment to Living Trust is a legal document that outlines the transfer of assets from an individual or couple to a living trust based in Thornton, Colorado. This trust-based estate planning tool ensures efficient asset management, avoidance of probate, and ease of distribution upon death or incapacity. By transferring ownership of various properties, investments, and belongings, individuals can protect their assets, streamline the transfer process, and provide potential tax advantages. Different types of Thornton Colorado Notice of Assignment to Living Trust may include: 1. Real Estate Assignment: This type of notice specifically transfers ownership of real estate properties, such as residential homes, vacation properties, or commercial assets, into the living trust. By doing so, the trust then becomes the legal owner and effectively manages and distributes the property as per the trust's terms. 2. Financial Account Assignment: In this case, individuals assign ownership of various financial accounts, such as bank accounts, brokerage accounts, or retirement funds, to the living trust through a formal notice. This ensures seamless asset management and distribution, including investment decisions and tax planning strategies. 3. Personal Property Assignment: This type of assignment pertains to assets like vehicles, artwork, jewelry, antiques, or any other tangible personal property that holds significant value. The Thornton Colorado Notice of Assignment to Living Trust allows the trust to manage the administration and distribution of such personal belongings as per the granter's wishes. 4. Business Ownership Assignment: For business owners, this notice facilitates the transfer of ownership rights to their businesses, including shares, partnerships, or membership interests, into the living trust. This allows the trust to effectively manage, govern, and potentially transfer business assets upon the granter's incapacity or death. Ultimately, the Thornton Colorado Notice of Assignment to Living Trust offers flexibility, control, and convenience in managing one's assets during their lifetime and ensures the smooth and efficient administration of the trust estate upon their passing. It is recommended to consult with an attorney specializing in estate planning to navigate the legal requirements and draft a valid and thorough assignment notice tailored to individual circumstances and asset types.