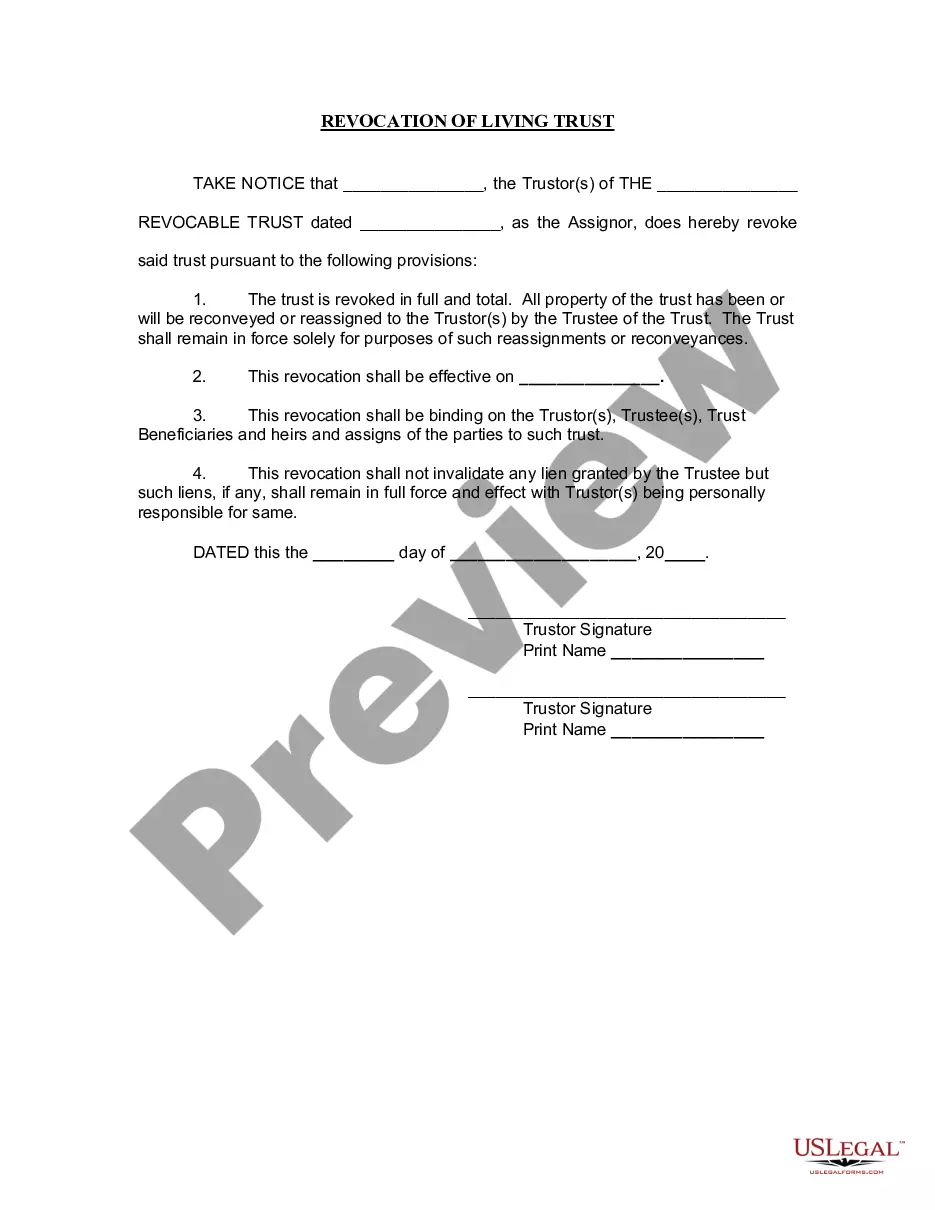

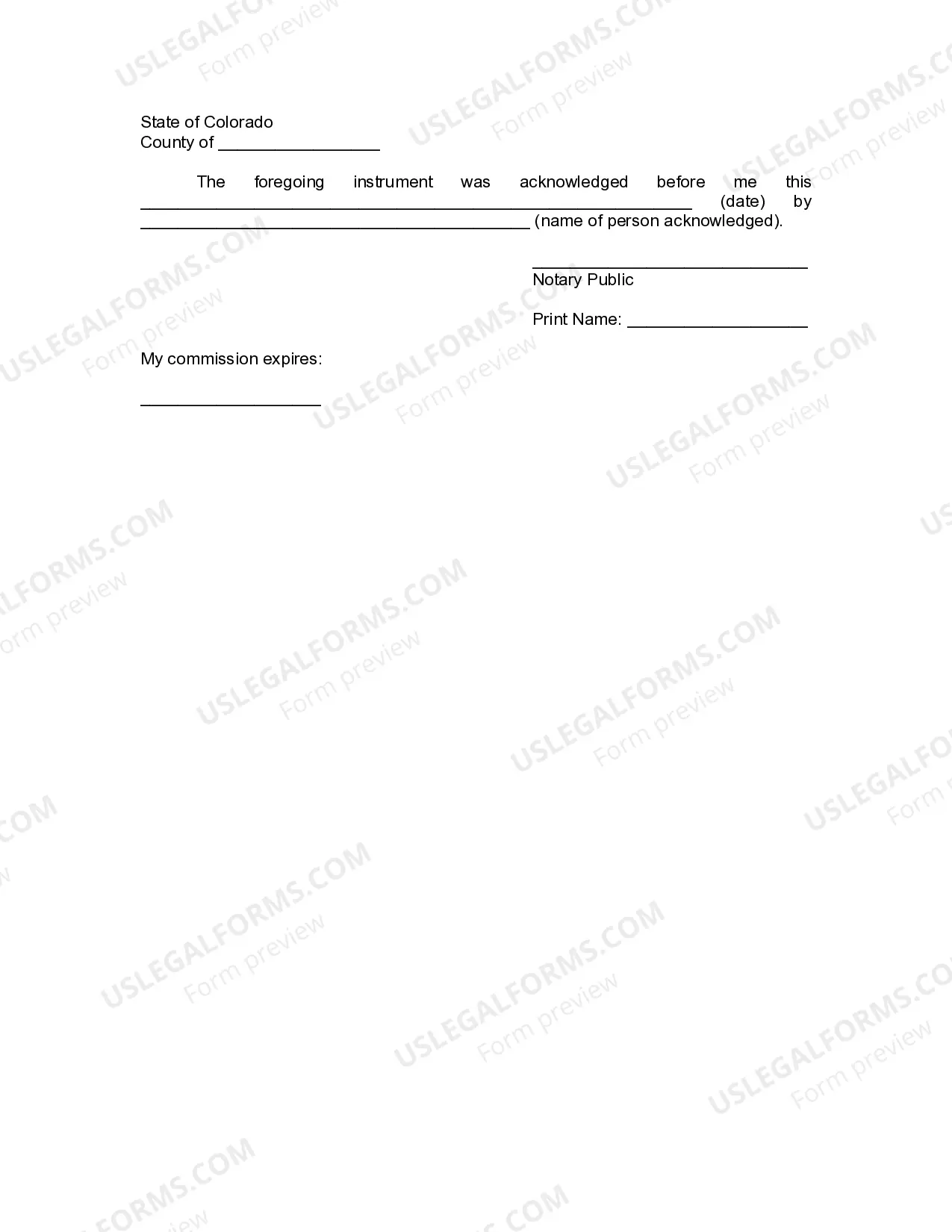

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Fort Collins Colorado Revocation of Living Trust

Description

How to fill out Colorado Revocation Of Living Trust?

If you are in search of a legitimate document, it’s exceptionally challenging to select a more suitable service than the US Legal Forms website – likely the most comprehensive online collections.

Here you can discover thousands of document examples for business and personal use by categories and regions, or by keywords.

With the superior search functionality, finding the latest Fort Collins Colorado Revocation of Living Trust is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Specify the file format and store it on your device.

- Furthermore, the relevance of each document is validated by a group of proficient attorneys who routinely verify the templates on our platform and update them in accordance with the latest state and county guidelines.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Fort Collins Colorado Revocation of Living Trust is to Log In to your account and select the Download option.

- If you're utilizing US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have selected the document you need. Review its description and utilize the Preview feature (if accessible) to examine its content. If it doesn’t meet your requirements, employ the Search function at the top of the screen to find the suitable file.

- Confirm your selection. Choose the Buy now option. After that, select your desired pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

Yes, trusts generally must file tax returns annually if they generate income. The specific requirements can depend on the type of trust established and its income level. For individuals managing a Fort Collins Colorado Revocation of Living Trust, it is crucial to be aware of the tax implications. Consulting with a tax advisor or an attorney can ensure that you comply with all necessary tax obligations while effectively managing your trust.

The 5-year rule for trusts refers to the period during which any transfers to a trust may be subject to scrutiny, particularly in Medicaid planning. Specifically, if assets are transferred into a trust within five years of applying for government assistance, those assets may be counted against eligibility. This rule helps prevent individuals from giving away assets to qualify for benefits. Understanding the implications of the 5-year rule is essential when considering the Fort Collins Colorado Revocation of Living Trust.

The 5-year rule can affect certain trusts, especially regarding asset transfers. This rule often comes into play during Medicaid eligibility assessments. If assets are transferred into a trust within five years of applying for Medicaid, they may be considered available resources. It is important to consult with a knowledgeable attorney familiar with the Fort Collins Colorado Revocation of Living Trust to understand how this can impact your situation.

Filling out a revocable living trust involves providing detailed information about your assets, beneficiaries, and the terms under which the trust operates. It's vital to be thorough and precise to avoid any legal complications. Utilizing platforms like uslegalforms can streamline the process of creating your Fort Collins Colorado Revocation of Living Trust, ensuring that all necessary elements are correctly addressed.

Generally, a nursing home cannot take assets held in a revocable trust, as these assets are still considered part of the grantor's estate. However, Medicaid may require the trust to be evaluated during financial assessments, which can impact your eligibility. Consulting with an expert about your Fort Collins Colorado Revocation of Living Trust can help safeguard your assets.

A revocation of a living trust is a formal procedure where the grantor decides to cancel the trust's terms. This action nullifies the trust's effect, allowing the grantor to take back full control of the assets. Keeping your Fort Collins Colorado Revocation of Living Trust updated is essential to reflect your current wishes.

A trust can become null and void if it lacks the required elements, such as a competent trustee or a defined purpose. Additionally, if the trust is based on illegal conditions or fraud, it cannot stand. Understanding these principles is vital when establishing a Fort Collins Colorado Revocation of Living Trust to ensure its validity from the start.

To revoke a revocable trust in Colorado, you must provide a written statement expressing your intent to revoke it. It's important to ensure that all copies of the trust document are either destroyed or marked as revoked. Properly conducting the Fort Collins Colorado Revocation of Living Trust safeguards your intentions and helps prevent future legal issues.

Revoking a living trust means canceling the legal agreement that created it, thus returning control of the assets to the grantor. This process is crucial if your circumstances change or your wishes evolve. By knowing how to navigate the Fort Collins Colorado Revocation of Living Trust, you empower yourself to make necessary adjustments.

A trust can be terminated through revocation, expiration, or by the completion of its purpose. The Fort Collins Colorado Revocation of Living Trust allows individuals to decide to end the trust at any point, provided they follow legal procedures. Understanding these options can aid you in managing your trust effectively.