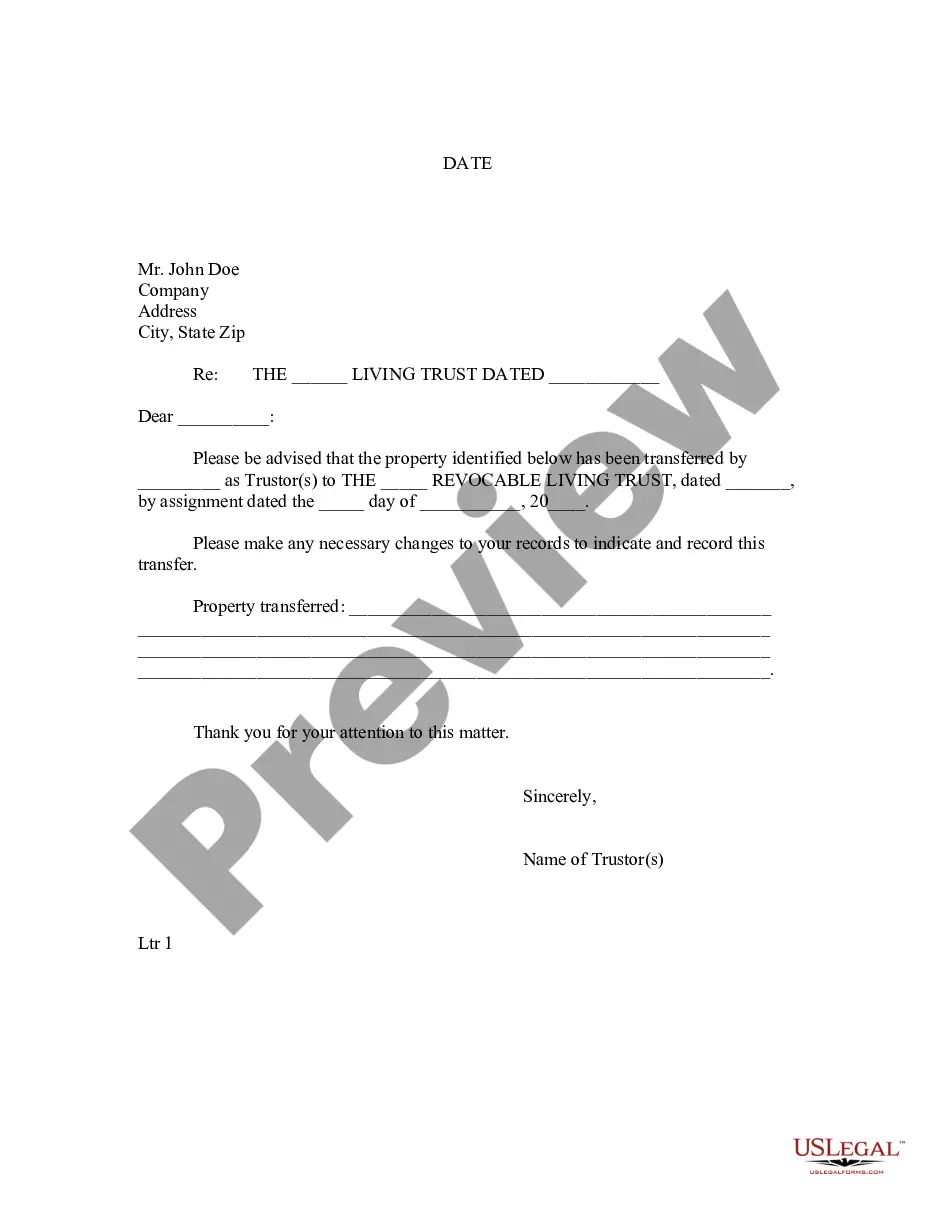

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

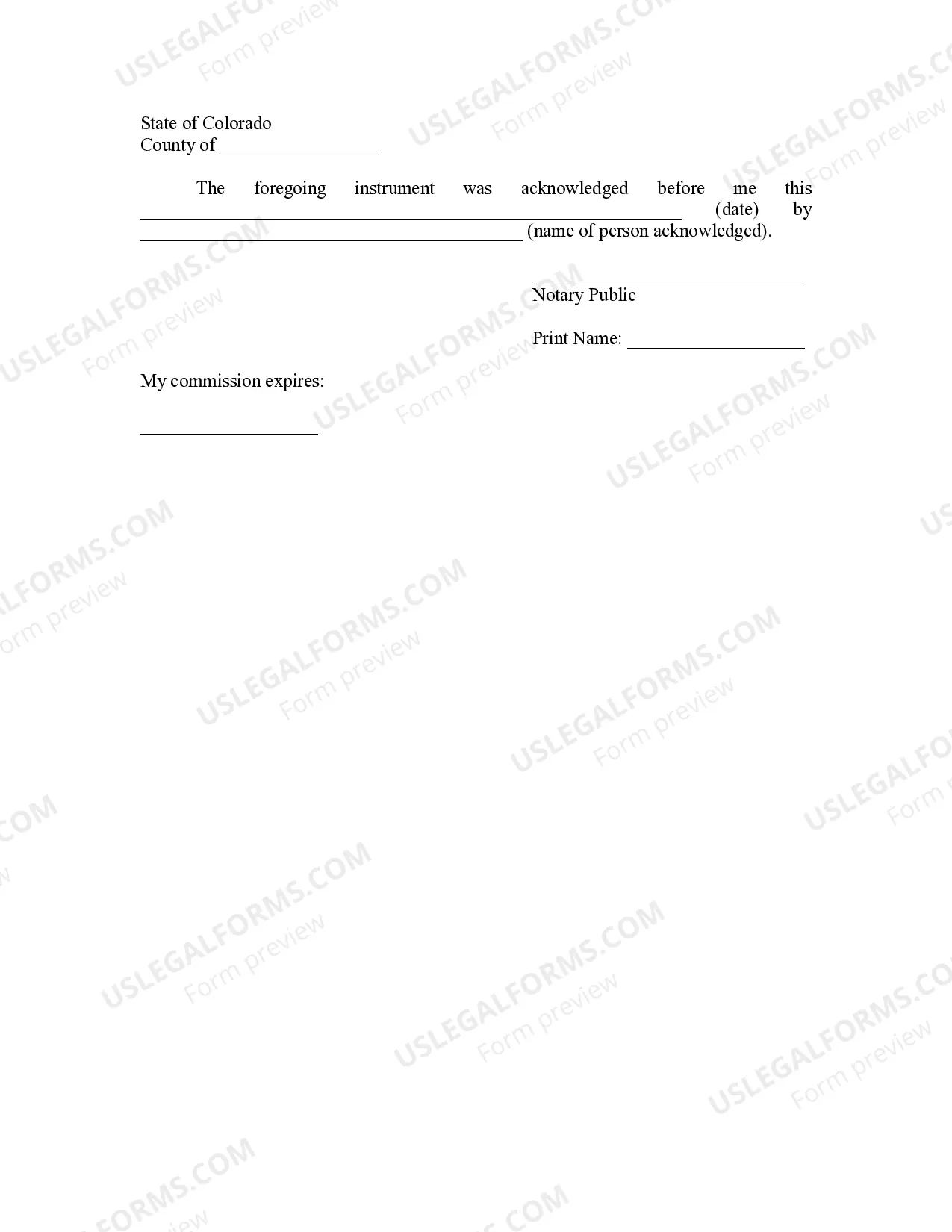

Fort Collins Colorado Letter to Lien holder to Notify of Trust: A Complete Guide In Fort Collins, Colorado, when a property owner establishes a trust agreement, it is important to notify the lien holder of this new arrangement. This notification is necessary to ensure that the lien holder is aware of the change in ownership rights and can appropriately update their records. The Fort Collins Colorado Letter to Lien holder to Notify of Trust serves as a formal means of communication between the property owner and the lien holder. This letter ensures that the lien holder receives vital information regarding the establishment of the trust and any subsequent changes that might occur. Key Elements of a Fort Collins Colorado Letter to Lien holder to Notify of Trust: 1. Introduction: The letter should begin with a formal salutation, addressing the lien holder by name and title. It is crucial to include the complete contact information of both the property owner and the lien holder, such as names, addresses, phone numbers, and email addresses. 2. Description of Trust: The letter should clearly state that a trust has been established and provide a brief overview of its purpose and terms. It is essential to include the date of trust establishment and any specific legal references or document numbers associated with it. 3. Property Details: The letter needs to provide accurate and detailed information about the property that is subject to the trust. This includes the property address, legal description, and any other specific details required to identify the property correctly. 4. Trustee Information: The letter should specify the identity and contact information of the trustee(s) responsible for managing the trust, including their full names, addresses, and any applicable professional affiliations. 5. Lien holder's Rights and Responsibilities: The letter should clearly outline the lien holder's rights and responsibilities regarding the new trust arrangement. This may include information about receiving regular updates on trust-related matters and ensuring that all lien interests are adequately protected. 6. Request for Updated Documentation: It is crucial to request that the lien holder update their records and communicate any further contact details or procedural changes required due to the establishment of the trust. This may include providing copies of the trust agreement or other related documentation. 7. Closing: The letter should conclude with a polite closing, reiterating the property owner's appreciation for the lien holder's cooperation in updating their records. The property owner's signature and the date of the letter should be included below the closing. Types of Fort Collins Colorado Letters to Lien holder to Notify of Trust: 1. Notification of Living Trust Creation: This letter is used when a property owner establishes a living trust, which will become effective during their lifetime. The purpose of this trust may include maintaining control over the property and ensuring proper management and distribution of assets upon the owner's death or incapacitation. 2. Notification of Testamentary Trust Creation: This letter is used when a property owner creates a testamentary trust. Unlike a living trust, a testamentary trust only takes effect upon the property owner's death and is established through their will. This type of trust often includes specific instructions on how assets should be managed and distributed among beneficiaries. 3. Notification of Irrevocable Trust Creation: This letter is used when a property owner establishes an irrevocable trust, which cannot be altered or revoked without the consent of the beneficiaries or a court order. Irrevocable trusts are often used for estate planning purposes and can include various tax planning benefits. Remember, while these guidelines provide a framework for writing a Fort Collins Colorado Letter to Lien holder to Notify of Trust, it is always recommended consulting with legal professionals to ensure compliance with local laws and specific trust requirements.