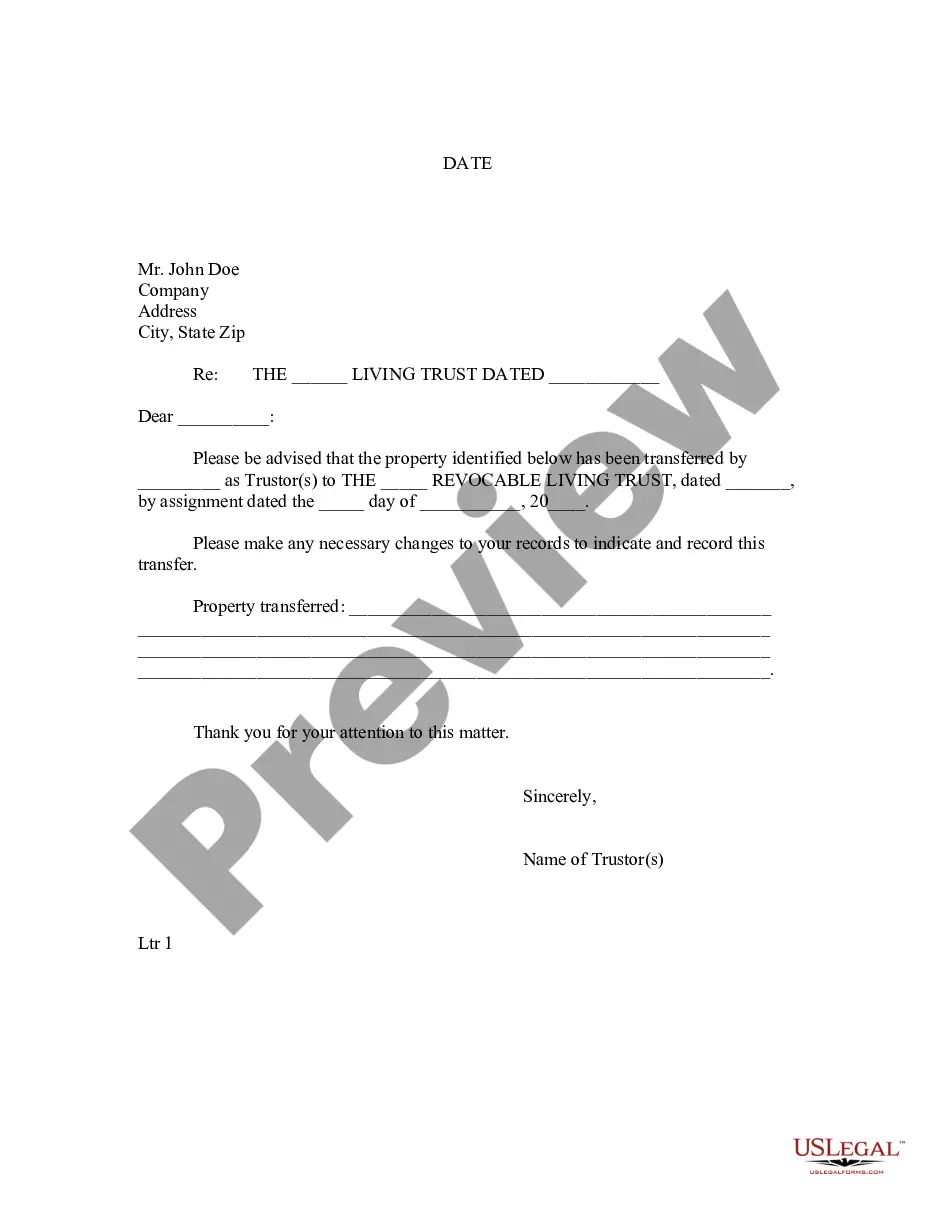

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

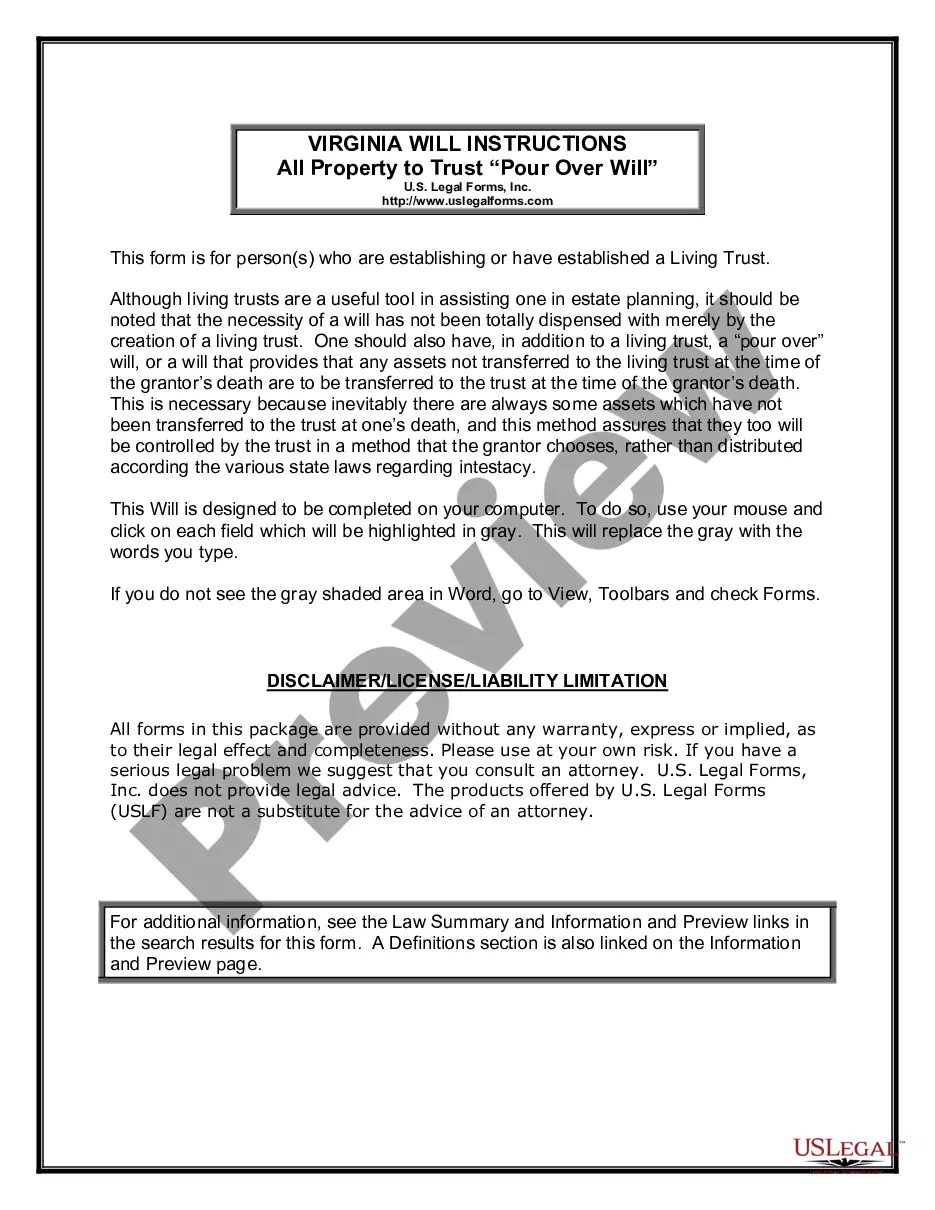

Title: Thornton Colorado Letter to Lien holder to Notify of Trust — A Comprehensive Guide Introduction: A Thornton Colorado letter to lien holder to notify of trust is a legal document used to inform a lien holder about the creation of a trust regarding a property or asset. By sending this letter, the trust creator notifies the lien holder about the transfer of ownership of the property to the trust. This article aims to provide a detailed description of this letter, its purpose, essential components, and variations based on different situations. Key Points: 1. Purpose and Importance of the Letter: — This letter serves as an official communication to keep the lien holder informed regarding the change in ownership due to the establishment of a trust. — It ensureAtheneesoldererer is aware of the trust's existence and will interact with the trustee rather than the trust creator, reducing potential misunderstandings and financial issues. 2. Essential Components of the Thornton Colorado Letter to Lien holder: a. The Identification Section: — This section includes the full legal name and contact details of both the trust creator (granter) and the lien holder. — Additionally, it should mention the details of the property or assets related to the lien holder's interest. b. Trust Establishment Details: — Precisely mention the date of trust creation and the name of the trust, if applicable. — Include any relevant information about the trust, such as its type (revocable or irrevocable) and the name(s) of the trustee(s) responsible for managing the trust. c. Lien holder's Role and Contact Information: — Outline the lien holder's responsibilities in terms of ongoing communication and how they should direct any future inquiries to the trustee. — Provide accurate contact information of the trustee for future correspondence, redirecting the lien holder's communication channels appropriately. d. Notarization and Delivery: — Ensure the letter is notarized to add legal validity and authenticity. — Choose a secure delivery method, such as certified mail, return receipt requested, to confirm the lien holder's receipt of the notification. Types of Thornton Colorado Letter to Lien holder to Notify of Trust: 1. Thornton Colorado Letter to Lien holder for Real Estate Trust: — This specific letter notifies the lien holder, usually a mortgage lender, about the transfer of a property's ownership to a trust. — It is crucial to inforthenesoldererer to ensure their legal rights are protected and to avoid any mortgage default issues. 2. Thornton Colorado Letter to Lien holder for Vehicle Trust: — This variation applies in cases where the trust creator transfers the ownership of a vehicle or any other motorized asset to a trust. — The letter notifiethenesoldererer or the vehicle's financing institution, ensuring smooth interaction between the trustee and the lien holder for future dealings. Conclusion: The Thornton Colorado letter to lien holder to notify of trust is an essential document for trust creators to officially communicate with lien holders about the transfer of ownership. By following the provided guidelines and including key components, individuals can ensure the lien holder is aware of the trust's existence, vital for any future transactions, and to avoid potential conflicts. Whether it relates to real estate or vehicle trusts, this letter serves as a legal formality and promotes transparency between all parties involved.